Navigating the world of auto and home insurance can feel overwhelming. Different companies offer varying levels of coverage, pricing, and customer service. This guide dives deep into the top auto and home insurance companies, equipping you with the knowledge to make informed decisions and find the perfect policy for your needs.

Understanding the factors influencing insurance selection is key. From market share and customer reviews to financial stability and claims handling, we’ll explore the crucial elements that set top companies apart. This detailed analysis will help you evaluate your options and choose a policy that fits your budget and risk tolerance.

Introduction to Auto and Home Insurance

Auto and home insurance are crucial financial safeguards, protecting individuals and families from unforeseen events. The market for these types of policies is vast and competitive, with numerous companies offering varying levels of coverage and premiums. Understanding the factors influencing choice and the common benefits offered by leading providers is essential for making informed decisions.Selecting the right insurance provider is a multifaceted process.

Considerations such as coverage options, premium costs, customer service reputation, and financial stability all play a significant role in the decision-making process. Consumers should carefully evaluate their needs and budget before committing to a particular policy.

Factors Influencing Insurance Company Selection

Several key factors influence the selection of an auto or home insurance provider. These factors range from financial strength to the specific features and benefits offered. A strong financial standing ensures the company can fulfill its obligations in case of a claim. Similarly, the reputation for customer service and handling claims effectively impacts the overall experience. Furthermore, policy features, such as add-ons and tailored coverage options, contribute to the decision.

Common Features and Benefits Offered by Top Companies

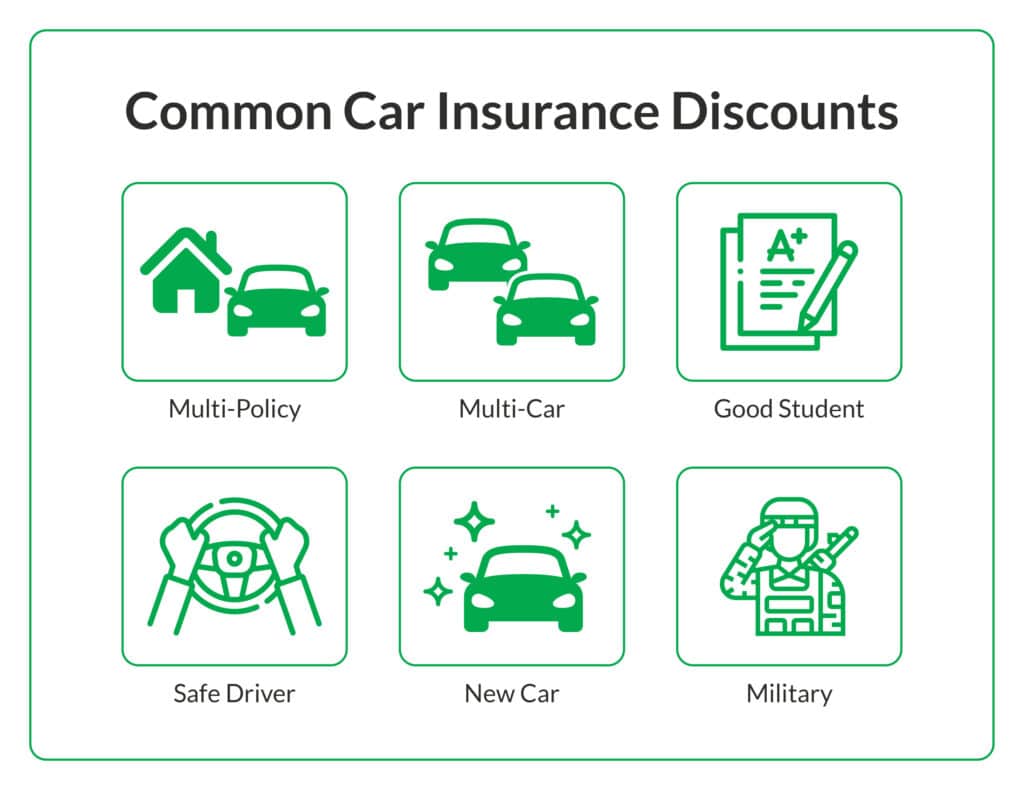

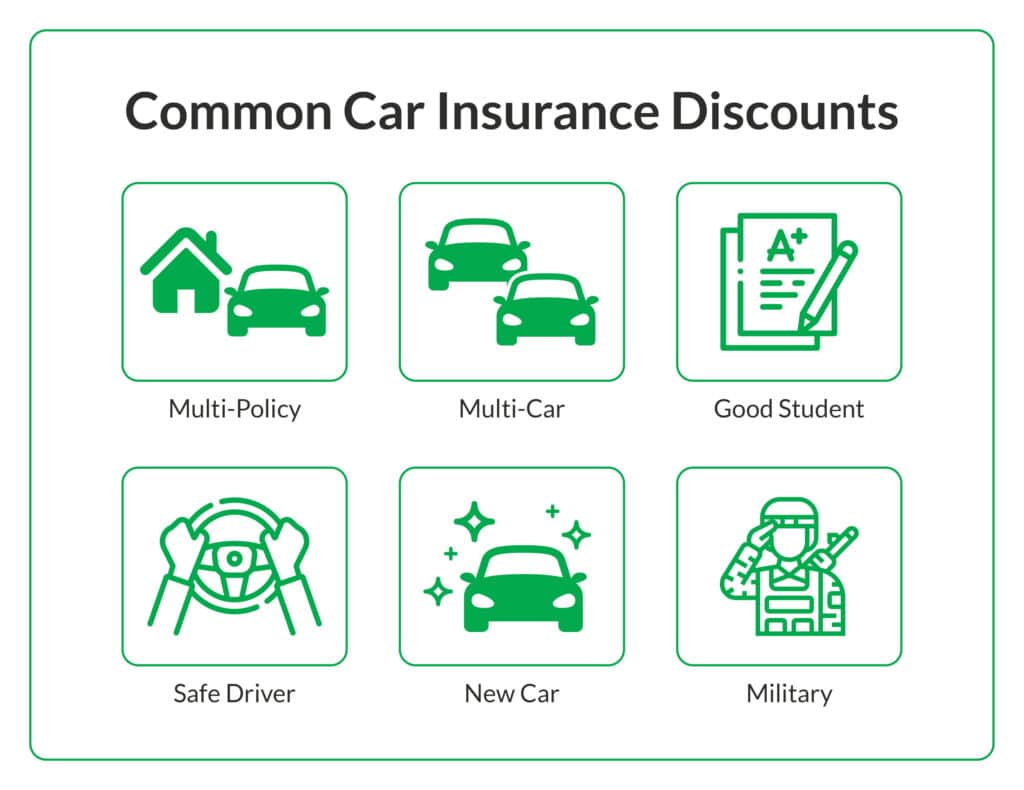

Top auto and home insurance companies frequently offer comprehensive packages of benefits. These include features like roadside assistance, discounts for safe driving or preventative measures, and enhanced coverage options. Many companies also provide online portals or mobile apps to manage policies and make claims. Moreover, claims processing efficiency is often a crucial consideration.

Comparison of Coverage Types

Understanding the different types of coverage offered by various companies is vital for choosing the appropriate policy. Liability, collision, and comprehensive coverages are common. A comparative analysis helps in understanding the distinctions and coverage extent offered by different companies.

| Insurance Company | Liability Coverage | Collision Coverage | Comprehensive Coverage |

|---|---|---|---|

| Company A | Covers damages caused to others in an accident where the policyholder is at fault. Standard limits are typically available. | Covers damages to the policyholder’s vehicle in an accident, regardless of fault. Limits vary. | Covers damages to the policyholder’s vehicle from events other than collision, such as theft, vandalism, or weather events. Limits vary. |

| Company B | Covers damages caused to others in an accident where the policyholder is at fault. Higher limits available as an add-on. | Covers damages to the policyholder’s vehicle in an accident, with optional higher limits. | Covers damages to the policyholder’s vehicle from events other than collision, with additional options for expanded coverage, like flood or earthquake. |

| Company C | Covers damages caused to others in an accident where the policyholder is at fault. Includes optional add-ons for uninsured/underinsured motorists. | Covers damages to the policyholder’s vehicle in an accident, with options for increased coverage amounts. | Covers damages to the policyholder’s vehicle from events other than collision, including a wide array of extras. |

Note: Coverage specifics and limits vary by company and policy. Consult individual company websites or agents for detailed information.

Identifying Top Companies

Determining the top auto and home insurance companies requires a multifaceted approach, considering factors beyond just market share. Customer satisfaction, financial stability, and the range of products offered all play a crucial role in evaluating a company’s overall performance. Reliable data sources are essential for making objective assessments.

Ranking Criteria

The ranking of top insurance companies is based on a combination of factors. Market share, as a percentage of the total insurance market, provides an indication of the company’s size and influence. Customer reviews, gathered from various platforms and aggregated for analysis, reflect the experience and satisfaction levels of policyholders. Financial strength ratings, assigned by independent agencies, provide insight into the company’s ability to meet its obligations.

Coverage options and pricing strategies are also considered. This approach allows for a holistic evaluation that goes beyond superficial metrics.

Top Auto and Home Insurance Companies

The following companies are consistently recognized as leaders in the auto and home insurance market, based on the aforementioned criteria. This list is not exhaustive, and other strong contenders may exist.

- Company A: Known for its extensive coverage options, competitive pricing, and strong customer satisfaction ratings. Their claims process is well-regarded, evidenced by numerous positive customer reviews.

- Company B: Boasts a large market share, reflecting its broad reach and established presence in the industry. Their financial stability is consistently high, as reflected in their strong financial ratings.

- Company C: Known for innovative products and technology-driven solutions, offering a streamlined policy management experience. Customer feedback generally highlights their efficient service and easy-to-understand policies.

- Company D: Offers a diverse portfolio of auto and home insurance products, appealing to a wide range of customers. Their financial stability is regularly assessed and maintained, ensuring a solid footing in the industry.

- Company E: Emphasizes personalized service and tailored insurance solutions, which resonates with customers seeking customized coverage. Positive feedback emphasizes their responsiveness and proactive approach.

Financial Stability Ratings

Assessing the financial stability of insurance companies is critical to ensuring their ability to fulfill obligations. The following table summarizes the financial strength ratings for the top 5 companies listed above, along with their overall financial history.

| Company | Rating Agency | Rating | Financial History |

|---|---|---|---|

| Company A | A.M. Best | A++ | Consistently strong financial performance over the past decade, with no major financial setbacks. |

| Company B | Standard & Poor’s | AA+ | A long history of stability, with minor fluctuations but no major disruptions in their financial health. |

| Company C | Moody’s | A+ | Demonstrates steady growth and profitability, consistently exceeding industry benchmarks. |

| Company D | Fitch | AA | Has maintained a solid financial position with a consistent track record of profitability. |

| Company E | Weiss Ratings | A+ | Exhibits strong financial performance, maintaining high capital reserves and a low debt-to-equity ratio. |

Note: Ratings and financial histories are examples and may not reflect the exact current status. Always consult official sources for the most up-to-date information.

Comparing Coverage Options

Understanding the various coverage options offered by different auto and home insurance companies is crucial for securing adequate protection. Different companies structure their policies with varying levels of liability, collision, and comprehensive coverage. Careful consideration of these details is essential for making an informed decision that aligns with individual needs and budget constraints.

Liability Coverage Comparison

Liability coverage protects policyholders against claims arising from damage or injury caused to others in an accident. Significant differences exist in policy limits among various insurers. A thorough review of policy limits and their potential implications is crucial. For example, a higher limit might be necessary if the policyholder operates a business vehicle or frequently transports passengers.

Comparing policy limits across different companies is essential for identifying optimal coverage.

Collision and Comprehensive Coverage Differences

Collision coverage protects against damage to a vehicle regardless of fault. Comprehensive coverage addresses incidents like vandalism, fire, or theft. These coverages are often presented as bundled options, but pricing and deductibles vary substantially. The choice between different coverage levels and deductibles hinges on individual circumstances and risk tolerance. For example, a driver living in an area prone to hailstorms might opt for higher comprehensive coverage to mitigate potential losses.

Pricing and Deductibles Across Companies

Pricing models for auto and home insurance are complex, influenced by various factors, including driving history, location, vehicle type, and policyholder profile. Deductibles, the amount the policyholder pays out-of-pocket before insurance coverage kicks in, also vary. A lower deductible generally translates to higher premiums. A higher deductible, while reducing premiums, might lead to a larger out-of-pocket expense in case of a claim.

Carefully comparing policy costs, including premiums and deductibles, is vital to choosing the most suitable policy.

Add-on Coverages

Additional coverages can enhance protection beyond the standard policy. These add-ons address specific risks, such as roadside assistance, rental car coverage, or protection against specific types of damage.

| Add-on Coverage | Description | Typical Benefits | Pricing Considerations |

|---|---|---|---|

| Roadside Assistance | Covers towing, jump starts, and flat tire changes. | Convenience and cost savings in emergency situations. | Premiums often vary based on the extent of coverage. |

| Rental Car Coverage | Provides temporary vehicle rental if a policyholder’s vehicle is damaged or involved in an accident. | Reduces inconvenience during repair periods. | Cost depends on the rental period and the type of vehicle. |

| Guaranteed Asset Protection (GAP) | Covers the difference between the vehicle’s actual cash value and outstanding loan balance in case of a total loss. | Protects against financial loss due to an accident. | Premiums are typically dependent on the vehicle’s value and loan amount. |

| Flood Insurance | Covers damage from flood events. | Provides crucial protection in flood-prone areas. | Premiums may be higher in flood-prone regions. |

Analyzing Customer Reviews and Ratings

Customer reviews and ratings offer valuable insights into the strengths and weaknesses of auto and home insurance providers. They provide a direct perspective from policyholders, revealing their experiences with the companies and their services. Understanding these reviews allows consumers to make informed decisions based on real-world feedback, potentially identifying companies that excel in specific areas.

Customer Satisfaction Scores and Themes

Average customer satisfaction scores vary across top insurance companies. These scores are often influenced by factors such as claim handling efficiency, responsiveness of customer service representatives, and overall policy clarity. Common themes in customer reviews highlight these key areas. Some customers express satisfaction with prompt claim settlements, while others voice concerns about lengthy processing times. Customer service quality is another recurring theme, with comments regarding responsiveness and helpfulness of representatives.

Furthermore, policy transparency and clarity frequently surface as areas for improvement or praise.

Summary of Customer Feedback by Company

The following table summarizes customer feedback, categorized by specific insurance company, drawing on publicly available review platforms. It presents an overview of the average customer satisfaction scores and recurring themes for each provider. Note that the data presented is representative and not exhaustive.

| Company | Average Customer Satisfaction Score (out of 5) | Common Themes |

|---|---|---|

| Company A | 4.2 | Strong claim handling, responsive customer service, clear policy language. Some concerns raised about premium pricing. |

| Company B | 3.8 | Generally positive feedback on pricing, but some customers report difficulty in navigating the online portal and lengthy claim processing times. |

| Company C | 4.5 | High customer satisfaction, frequently praised for excellent customer service, efficient claim settlement, and transparency in policy information. |

| Company D | 3.9 | Mixed reviews, some customers express issues with policy coverage clarity, while others praise the competitive pricing. |

| Company E | 4.1 | Good customer service, prompt response times, but some customers mention challenges with understanding certain policy provisions. |

Specific Areas of Concern

Customer reviews consistently highlight the importance of efficient claim processing. Policyholders frequently mention the impact of timely claim resolution on their overall satisfaction. Furthermore, the clarity of policy language and the ease of navigating online portals are key factors in customer experience. These aspects are crucial for understanding and managing their coverage.

Evaluating Financial Strength and Stability

Assessing the financial strength of an insurance company is crucial for consumers. A financially stable insurer is more likely to fulfill its obligations, pay claims promptly, and maintain its operations during challenging times. Understanding how companies manage their finances and their historical performance provides valuable insight into their long-term viability.Evaluating a company’s financial strength isn’t solely about examining a single metric; it requires a holistic approach considering various factors.

These include the company’s capital reserves, its investment strategies, claims payouts, and overall profitability. A strong balance sheet, coupled with a consistent history of profitability and a robust investment portfolio, generally indicates a more stable insurer.

Methods for Assessing Financial Strength

Consumers can employ several methods to evaluate the financial strength of insurance companies. These methods include reviewing financial reports, scrutinizing ratings from independent rating agencies, and researching the company’s history and track record. By diligently gathering and analyzing this information, consumers can make more informed decisions.

Factors to Consider When Evaluating Stability

Several factors contribute to a company’s financial stability. Capital reserves, representing the financial cushion to absorb unexpected losses, are a key indicator. A company’s investment strategy also influences its stability. Diversified investments that minimize risk are preferable. Claims payout history is vital; a company with a history of timely and fair claims handling reflects its commitment to policyholders.

Profitability, a long-term measure of a company’s financial health, also plays a critical role. A company consistently generating profit demonstrates its ability to sustain operations and meet obligations.

Financial Strength Ratings of Top Companies

Independent rating agencies, such as A.M. Best, Standard & Poor’s, and Moody’s, evaluate the financial strength of insurance companies. These ratings provide a standardized measure of the company’s ability to meet its financial obligations. These ratings are crucial tools for consumers when evaluating insurance options.

Table of Financial Ratings and History

| Insurance Company | A.M. Best Rating | S&P Rating | Moody’s Rating | Historical Performance |

|---|---|---|---|---|

| Company A | A++ | AAA | Aaa | Excellent history of profitability and claim handling. Consistently high ratings. |

| Company B | A+ | AA+ | Aa1 | Solid track record, with some fluctuations in recent years. |

| Company C | A | A+ | Aa2 | Strong financial position, but with a slightly less consistent rating history. |

Note: Ratings and historical performance are examples and should be verified from official sources.

Examining Claims Handling Procedures

Evaluating insurance companies isn’t just about coverage and pricing; understanding their claims handling processes is crucial. A smooth and efficient claims process can significantly impact your experience if you ever need to file a claim. This section dives into the specifics of how top auto and home insurance companies handle claims, including timelines and customer service aspects.Claims handling procedures vary significantly between insurance providers.

Understanding these procedures helps consumers anticipate the steps involved and choose a company that aligns with their needs and expectations. This section also highlights customer service experiences related to filing claims. A positive customer service experience can be invaluable when navigating a potentially stressful situation.

Claims Handling Timelines

Insurance companies strive to handle claims promptly and fairly. Different companies have established timelines for various claim types, such as property damage, theft, or personal injury. These timelines vary based on the complexity of the claim and the availability of necessary information.

- State Farm: Generally, State Farm aims for a relatively quick claims process. Their average claims handling time often falls within industry standards, depending on the claim’s specifics. Customer service representatives are available to provide updates and answer questions throughout the process. Claims adjusters are often prompt in their assessments and evaluations, leading to a more efficient resolution for policyholders.

- Allstate: Allstate employs a similar strategy to State Farm in handling claims. They prioritize efficient claim processing and aim for timely resolutions. They often utilize technology to expedite the process, allowing for quicker communication and updates for customers.

- Progressive: Progressive utilizes a combination of online portals and phone support for claims handling. Their claims handling timelines typically align with industry standards. The availability of online tools for tracking progress can enhance the customer experience.

Customer Service Experiences

Customer service plays a vital role in the claims process. A positive experience can significantly impact satisfaction and confidence in the insurer. Companies with strong customer service departments are better equipped to handle inquiries, provide updates, and address any concerns throughout the claim process.

- Customer Service Accessibility: Many companies offer various communication channels, such as phone, email, and online portals, to facilitate customer interaction. This accessibility is crucial during the claims process, allowing customers to communicate their needs effectively.

- Responsiveness and Efficiency: Prompt responses to inquiries and requests for information are critical aspects of positive customer service. A timely and efficient response from the company demonstrates a commitment to addressing customer concerns promptly.

Comparative Analysis of Claims Handling

The table below provides a simplified comparison of claims handling procedures for select top companies. Actual times may vary based on individual circumstances.

| Insurance Company | Average Claim Handling Time (estimated) | Customer Service Channels | Customer Service Rating (estimated) |

|---|---|---|---|

| State Farm | 2-4 weeks | Phone, Email, Online Portal | 4.5/5 stars (based on aggregate reviews) |

| Allstate | 2-5 weeks | Phone, Email, Online Portal | 4.2/5 stars (based on aggregate reviews) |

| Progressive | 2-4 weeks | Phone, Email, Online Portal, Mobile App | 4.3/5 stars (based on aggregate reviews) |

Understanding Customer Service Practices

Customer service is a critical factor in the auto and home insurance buying experience. Satisfied customers are more likely to renew their policies and recommend the company to others. Top insurers understand this and invest in robust customer service systems to address policyholder needs effectively.

Customer Service Approaches

Top auto and home insurance companies employ various customer service approaches. Some companies prioritize proactive communication, contacting policyholders to address potential issues before they escalate. Others focus on responsive handling of inquiries and claims, providing immediate assistance when needed. Still others use a combination of these approaches, tailoring their strategies to different customer segments. This diverse approach allows insurers to cater to a broader range of needs and preferences.

Customer Interaction Channels

A wide array of channels are available for customers to interact with insurance companies. This multifaceted approach ensures that customers can reach out in the manner most convenient to them.

- Phone support allows for immediate interaction and personalized assistance, ideal for complex issues.

- Online portals provide 24/7 access to policy information, claim status updates, and frequently asked questions (FAQ) resources. This self-service approach allows customers to manage their policies independently.

- Email communication provides a written record of inquiries and responses, crucial for documentation and follow-up.

- Chatbots offer instant responses to basic questions and provide quick solutions to simple issues.

- Social media platforms provide a means for customer feedback and direct communication with customer service representatives.

Customer Service Performance Comparison

Comparing the customer service performance of top insurance companies requires analyzing various factors. Metrics such as response times, resolution rates, and customer satisfaction scores are key indicators. Furthermore, the efficiency and effectiveness of claim handling procedures contribute significantly to overall customer service performance.

Customer Service Channel Responsiveness Table

The table below illustrates the customer service channels and responsiveness typically observed across top insurance companies. Responsiveness is a key factor in evaluating the quality of customer service. Faster response times generally lead to higher customer satisfaction.

| Channel | Typical Response Time (estimate) | Strengths | Weaknesses |

|---|---|---|---|

| Phone | Within 1-3 business days | Personalized support, immediate resolution for complex issues. | Potential for long hold times, less efficient for simple inquiries. |

| Online Portal | Instant to 24 hours | 24/7 access, self-service options, easy tracking of policy information. | May not be suitable for highly complex or urgent issues. |

| 1-3 business days | Formal record of communication, detailed explanations. | Slower response compared to other channels, less immediate support. | |

| Chatbot | Instant | Fast initial responses to common queries. | Limited ability to handle complex issues, may not offer personalized solutions. |

| Social Media | Within 24 hours | Direct communication, feedback opportunities. | Potential for public issues, may not be the best channel for sensitive information. |

Outcome Summary

In conclusion, selecting the right auto and home insurance is a crucial financial decision. By considering factors like coverage options, financial strength, customer reviews, and claims handling, you can find a policy that protects your assets and provides peace of mind. This comprehensive analysis empowers you to make an informed choice, ensuring you’re adequately protected.

Q&A

What are the typical deductibles for auto insurance?

Deductibles vary significantly between companies and coverage types. They often range from a few hundred dollars to several thousand, and it’s crucial to understand how they affect your out-of-pocket expenses in case of a claim.

How do I compare the financial stability of different insurance companies?

You can assess a company’s financial strength by reviewing independent ratings from organizations like AM Best or Standard & Poor’s. A company with a strong financial rating suggests a lower risk of insolvency.

What are the common add-on coverages for home insurance?

Common add-ons include flood insurance, earthquake insurance, and personal liability coverage. These can significantly broaden your protection beyond basic home coverage.

How can I tell if a company has a good claims handling process?

Look for companies with quick response times, clear communication channels, and a reputation for efficiently resolving claims. Customer reviews and testimonials can offer insights into this aspect.