Navigating the world of shop insurance can feel overwhelming. Fortunately, the internet provides a wealth of resources to compare shop insurance rates online, allowing you to find the best policy for your business. This guide explores the key factors to consider when searching for shop insurance quotes, from understanding the different types of coverage to comparing various providers and understanding the claim process.

Finding the right insurance coverage for your shop is crucial for protecting your investment and ensuring business continuity. This comprehensive guide walks you through the process of obtaining shop insurance quotes online, equipping you with the knowledge to make informed decisions.

Understanding Online Shop Insurance Rates

Navigating the complexities of online shop insurance can feel daunting. However, understanding the different types of coverage, the factors influencing premiums, and the nuances of policy exclusions empowers you to make informed decisions and secure appropriate protection for your business. This detailed guide will help you understand online shop insurance rates and choose the right policy for your needs.

Types of Shop Insurance

Online shops require specialized insurance coverage beyond basic business insurance. A comprehensive policy typically includes general liability insurance, protecting against customer injuries or property damage occurring on your premises or due to your business operations. Product liability insurance is critical, covering potential harm from defective products. Cybersecurity insurance safeguards against data breaches and online fraud. Business interruption insurance can compensate for lost revenue if your online store experiences a disruption.

Finally, professional liability insurance protects against claims of errors or omissions in your services.

Factors Affecting Shop Insurance Premiums

Several factors significantly impact your insurance premiums. The value of your inventory, the nature of your products (e.g., hazardous materials), and your online sales volume all influence the risk assessment. The location of your business and the security measures in place (e.g., fraud prevention systems) play a role in determining premiums. Your claims history, if any, is also a factor.

A clean record usually translates to lower premiums. A high-risk business operation, such as selling high-value items or operating in a high-crime area, will attract higher premiums.

Coverage Levels

Different coverage levels cater to various needs and budgets. Basic policies offer a minimal level of protection, while comprehensive policies provide extensive coverage against a wide range of potential risks. Consider the potential financial impact of different scenarios. For example, a small online retailer selling handmade crafts might need a lower coverage level than a large e-commerce business selling electronics.

It’s crucial to assess your specific needs and match them with the appropriate coverage.

Common Exclusions

Insurance policies often contain exclusions. These are specific circumstances or events that the policy doesn’t cover. War or acts of terrorism are often excluded. Certain types of intentional damage or criminal activity are usually excluded as well. Policies may also exclude damage from wear and tear, or from naturally occurring events such as floods or earthquakes.

It is crucial to review the fine print and understand these exclusions before purchasing a policy.

Obtaining Shop Insurance Quotes Online

The process of obtaining shop insurance quotes online is straightforward. Numerous online platforms provide a range of options. You typically need to input details about your business, such as the type of products sold, location, sales volume, and inventory value. Online quote comparison tools can streamline this process. Be sure to compare quotes from multiple providers to find the most competitive rates.

Don’t hesitate to ask questions to ensure you understand the coverage and exclusions in each policy.

Comparing Shop Insurance Providers

| Insurance Provider | Coverage Options | Premium Range (estimated) | Customer Reviews |

|---|---|---|---|

| Company A | Comprehensive coverage, including liability, product, and cyber | $500-$2,000 per year | Positive reviews on customer service and quick claim processing |

| Company B | Specialized coverage for online retailers, focusing on cyber security | $700-$3,000 per year | Positive feedback on proactive risk management |

| Company C | Basic liability coverage for smaller online businesses | $200-$1,000 per year | Mixed reviews, some concerns about claim handling |

Note: Premium ranges are estimates and can vary significantly based on individual circumstances. Always consult the specific provider for accurate pricing. Customer reviews are sourced from online review platforms.

Comparing Online Insurance Quotes

Shopping for online shop insurance can feel overwhelming. Understanding how to compare quotes effectively can save you money and ensure you’re protected. This process involves examining various insurance providers, evaluating their coverage, and analyzing the costs.Comparing quotes allows you to make informed decisions based on specific needs and budget constraints. This analysis is crucial for finding the optimal insurance package, ensuring your online business is adequately covered.

Features and Benefits of Different Providers

Different insurance providers offer varying features and benefits. Some might specialize in specific types of online businesses, such as e-commerce stores or digital marketing agencies. Others might have extensive coverage options, including liability protection, product recall, or business interruption. Analyzing these differences is crucial to finding a provider that aligns with your business model and risks. Factors like customer service, claim handling procedures, and the reputation of the provider should also be considered.

Advantages and Disadvantages of Online Comparison Tools

Online comparison tools streamline the process of finding suitable insurance options. They provide a centralized platform to gather quotes from multiple providers, saving time and effort. However, these tools may not always display the full scope of coverage or hidden costs. It’s crucial to double-check the fine print and compare the actual policy documents before making a decision.

Another potential disadvantage is the lack of personalized service, which can be important for businesses with unique risk profiles.

Key Elements to Look for in Shop Insurance Quotes

When reviewing shop insurance quotes, pay close attention to the specific coverage limits. Review the types of risks covered, such as liability, property damage, and business interruption. Ensure the policy adequately addresses your specific business needs and online operations. The premium costs, deductibles, and any additional fees should be carefully assessed. A comprehensive review of the terms and conditions is critical to avoid any unexpected surprises.

Cost Comparison of Shop Insurance Quotes

A table showcasing cost comparisons from different providers is presented below. This comparison helps in evaluating the price differences between various insurance options.

| Insurance Provider | Premium (Annual) | Coverage Limits | Deductible | Additional Fees |

|---|---|---|---|---|

| SecureShop Insurance | $1,500 | $500,000 General Liability; $100,000 Product Liability | $500 | $50 per month for cybersecurity coverage |

| Reliable Retail Insurance | $1,200 | $300,000 General Liability; $50,000 Product Liability | $250 | None |

| Online Biz Protect | $1,800 | $1,000,000 General Liability; $250,000 Product Liability | $1,000 | $75 per month for fraud protection |

Step-by-Step Guide to Comparing Shop Insurance Rates Online

- Identify your specific insurance needs and risks.

- Use online comparison tools to gather quotes from multiple providers.

- Carefully review the coverage details of each quote, focusing on exclusions and limitations.

- Compare the premium costs, deductibles, and any additional fees.

- Contact the providers directly to clarify any uncertainties or ask for further details.

- Compare the terms and conditions of the different policies to ensure a good fit.

Importance of Reading the Fine Print

“Understanding the fine print of insurance policies is crucial for making an informed decision.”

Insurance policies often contain exclusions, limitations, and specific terms that can impact your coverage. Thoroughly reviewing these details ensures you understand the exact scope of protection you’re purchasing. This careful examination prevents any surprises or gaps in coverage that could be detrimental to your business. Pay particular attention to clauses relating to liability, property damage, and exclusions.

Factors Influencing Shop Insurance Costs

Understanding the factors that influence shop insurance rates is crucial for securing the most appropriate coverage at a competitive price. Insurance companies consider a multitude of variables when calculating premiums, and knowing these factors empowers you to make informed decisions about your business insurance. This includes assessing the specific risks associated with your location, type of business, security measures, and inventory value.Insurance premiums are not a one-size-fits-all calculation; they are highly personalized to the individual business.

The more information you provide to the insurance provider, the more accurate the quote will be. Factors like location, type of business, security measures, and inventory value all play a significant role in determining your shop’s insurance needs and cost.

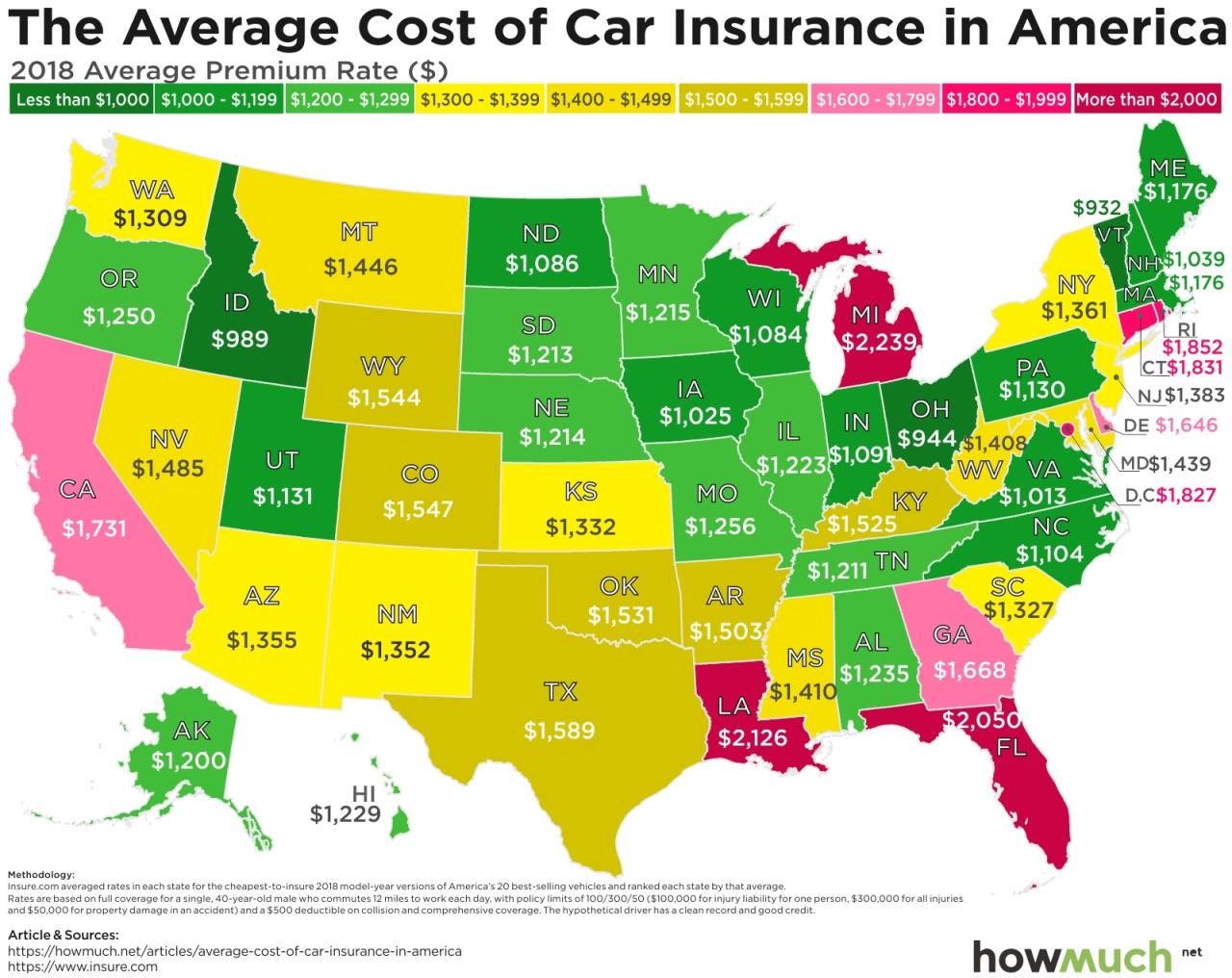

Location Impact on Insurance Rates

Shop location significantly impacts insurance premiums. Areas with higher crime rates, proximity to natural disaster zones, or increased risk of vandalism tend to have higher insurance costs. The specific location details influence the likelihood of certain events, directly affecting the risk assessment. For example, a shop in a high-crime neighborhood will likely incur higher premiums compared to a shop in a quieter, more secure area.

This is due to the increased potential for theft, vandalism, or other criminal activity in high-crime areas.

Business Type Impact on Insurance Premiums

The nature of the business directly influences the insurance premium. Businesses handling high-value items, like jewelry stores or electronics retailers, face higher insurance costs compared to shops selling less valuable goods. Furthermore, businesses operating in high-risk industries, such as those involving flammable materials or hazardous substances, also face higher insurance premiums. This reflects the increased potential for damage or loss associated with the specific business type.

High-Risk Factors Increasing Shop Insurance Costs

Certain factors significantly increase insurance costs. These include the presence of flammable materials, hazardous substances, or large quantities of cash. For example, a shop handling explosives or storing large sums of cash requires substantial security measures and higher premiums. Shops located in areas prone to flooding or earthquakes are also likely to face higher costs. The specific risks associated with the location and type of business are crucial to assess when calculating insurance costs.

Shop Security Measures and Insurance Costs

Robust security measures demonstrably lower insurance premiums. These measures include advanced alarm systems, surveillance cameras, and robust physical security features. The presence of security personnel and well-maintained security protocols also reduce the risk of loss or damage. Shops with comprehensive security measures show a lower likelihood of incidents, thus justifying lower insurance premiums.

Inventory Value Influence on Insurance Rates

The value of the inventory directly correlates with the insurance premium. Higher inventory values indicate a greater potential loss, resulting in higher insurance costs. For example, a shop selling high-end jewelry will have a higher insurance premium than a shop selling affordable clothing. Insurance providers consider the replacement cost of the inventory to determine the necessary coverage.

Correlation Between Shop Features and Insurance Costs

| Shop Feature | Correlation with Insurance Costs |

|---|---|

| High-crime location | Higher insurance costs |

| High-value inventory | Higher insurance costs |

| Flammable/hazardous materials | Higher insurance costs |

| Comprehensive security measures | Lower insurance costs |

| Well-maintained security protocols | Lower insurance costs |

| Strong physical security features | Lower insurance costs |

Navigating Online Shop Insurance Platforms

Finding the right shop insurance can feel like navigating a maze online. Fortunately, with a structured approach, you can efficiently compare quotes and select a suitable policy. This section will guide you through the process, from identifying reputable providers to tracking your policy details.

Identifying Reputable Shop Insurance Providers

Locating trustworthy online insurance providers is crucial. Begin by researching providers with a strong online presence and positive customer reviews. Check for industry accreditations, which can provide a degree of confidence in the company’s reliability and financial stability. Verify their licensing and insurance status to ensure they are legally authorized to operate in your area. Look for providers with clear and transparent pricing structures, detailed policy descriptions, and readily available customer support.

Completing Online Shop Insurance Applications

Completing online shop insurance applications is typically straightforward. Gather all the necessary information about your shop, including its location, inventory details, and any special circumstances (e.g., high-value items, unique risks). Provide accurate and complete information, as inaccuracies can affect the policy’s terms and coverage. Pay close attention to the specific details requested by the provider, and double-check your entries for accuracy before submitting the application.

Online Payment Methods

Most online shop insurance providers accept a range of payment methods, including credit cards (Visa, Mastercard, American Express), debit cards, and electronic bank transfers. Some may also offer installment plans or other payment options. Check the payment options available on the provider’s website before proceeding.

Examples of Online Insurance Platforms and Their Features

Several platforms offer comprehensive shop insurance solutions. Insurify, for example, provides a comparison tool to quickly compare quotes from various insurers. Policygenius allows users to customize their insurance coverage based on specific needs. Insureon often features detailed policy explanations and interactive maps for risk assessment.

Tracking Shop Insurance Policy Details

Many platforms offer online portals for managing your shop insurance policy. These portals allow you to view policy details, make payments, and report claims. They also typically provide access to important documents, such as certificates of insurance. Familiarize yourself with the platform’s interface and features to effectively manage your policy.

Online Insurance Platform Comparison

| Platform | Pros | Cons |

|---|---|---|

| Insurify | Quick quote comparison, user-friendly interface. | Limited policy customization options, may not offer the most comprehensive coverage for specialized risks. |

| Policygenius | Extensive coverage options, allows for customization, transparent pricing. | Processing time may be longer, features may be more complex. |

| Insureon | Detailed policy explanations, interactive risk assessment, robust customer support. | Interface may not be as intuitive as other platforms, higher cost in some cases. |

Coverage Options and Exclusions

Understanding the coverage options and exclusions in your shop insurance policy is crucial for adequate protection. A comprehensive policy safeguards your business assets and liabilities, but knowing what’s included and excluded is vital for informed decision-making. Different policies cater to various needs, so tailoring your coverage to your specific circumstances is paramount.

Typical Coverage Options

Shop insurance policies typically offer a range of coverages designed to protect your business from various risks. These options commonly include property damage coverage, liability protection, and business interruption coverage. Property damage coverage typically protects your physical shop from perils like fire, vandalism, or storms. Liability coverage safeguards your business from claims arising from customer injuries or property damage on your premises.

Business interruption coverage compensates for lost revenue if your business is temporarily unable to operate due to covered events.

Common Exclusions

Insurance policies often contain exclusions to define what isn’t covered. Understanding these exclusions is essential to avoid any surprises or disputes in case of a claim. Common exclusions may include wear and tear, gradual deterioration, and intentional damage. Natural wear and tear on equipment is generally not covered. Specific exclusions often vary depending on the insurer and policy terms.

Policy exclusions may also cover events like damage from faulty equipment, if not properly maintained, or losses caused by a business’s own negligence.

Understanding Coverage Limits

Coverage limits define the maximum amount an insurer will pay for a covered loss. These limits are crucial as they dictate the extent of financial protection. Exceeding these limits means the insurer will not fully compensate for the damages. For example, a business with a low coverage limit for property damage might not be fully compensated for a significant fire that destroys their entire inventory.

Examples of Limited or Excluded Coverage

Certain situations may lead to limited or excluded coverage. If a shop’s property damage coverage has a low limit, a major storm might not be fully compensated. If a business owner intentionally damages their property, the claim might be denied. Damage resulting from a faulty product or equipment not maintained properly, falls outside the scope of a standard policy.

A policy might not cover losses caused by business errors or negligence.

Adding Specific Coverage Options

Adding specific coverage options to your base policy can strengthen your protection. These might include flood insurance, equipment breakdown coverage, or cyber liability insurance. Flood insurance is often a crucial addition for businesses located in flood-prone areas. Equipment breakdown coverage is valuable for protecting costly machinery. Cyber liability insurance safeguards against data breaches and online fraud.

The addition of these specific coverages often comes at an additional cost.

Shop Insurance Coverage Options and Limits

| Coverage Option | Description | Example Limit |

|---|---|---|

| Property Damage | Protects physical shop from covered perils | $50,000 |

| Liability | Covers claims for customer injuries/property damage | $1,000,000 |

| Business Interruption | Covers lost revenue due to covered event | $10,000 per month |

| Flood Insurance | Covers damage from floods | $250,000 |

| Equipment Breakdown | Covers damage to equipment due to malfunctions | $20,000 per item |

Shop Insurance Claim Procedures

Filing a shop insurance claim is a crucial process for recovering financial losses due to unforeseen events. Understanding the steps involved can ease the stress of a claim and ensure a smooth resolution. This section details the claim procedure, common scenarios requiring claims, and the necessary documentation.

Online Claim Filing Process

The online claim filing process typically involves submitting a detailed report, attaching supporting documentation, and waiting for a response. Most insurance providers have user-friendly online portals that guide users through each step.

Examples of Claim Situations

Several scenarios can trigger a shop insurance claim. Examples include damage from a fire, theft of inventory, or vandalism to the premises. A water leak causing extensive damage to stock or equipment also necessitates a claim. Natural disasters like floods or severe storms often lead to claims for structural damage or property loss.

Required Documentation

A shop insurance claim requires specific documentation to substantiate the loss. Essential documents include the police report (if applicable), photos or videos of the damage, receipts for damaged or stolen goods, and any relevant contracts or agreements. Proof of business ownership and insurance policy details are also often required.

Submitting a Claim Through an Online Portal

The claim process is usually straightforward. Insurance providers often have dedicated online portals for filing claims. Instructions are usually clearly Artikeld, guiding users through the necessary steps. Claims are typically submitted through an online form, with a detailed description of the incident, supporting photos, and the required documentation attached.

Claim Processing Timeframe

The time taken to process a shop insurance claim varies based on the complexity of the claim and the insurance provider’s procedures. Some claims might be processed within a few days, while others may take several weeks. Factors such as the severity of the damage, the need for appraisals, and the availability of necessary documentation can influence the timeframe.

Steps Involved in Filing a Shop Insurance Claim Online

| Step | Description |

|---|---|

| 1. Assess the Damage | Thoroughly inspect the damage and gather all necessary information and documentation. |

| 2. Access the Online Portal | Log in to the insurance provider’s online claim portal. |

| 3. Complete the Claim Form | Accurately complete the online claim form, providing details about the incident, damage, and losses. |

| 4. Attach Supporting Documents | Upload all required documents, including photos, videos, police reports, and receipts. |

| 5. Submit the Claim | Submit the completed claim form and supporting documents for review. |

| 6. Await Acknowledgment | Expect an acknowledgment from the insurance provider regarding receipt of the claim. |

| 7. Follow-up | If needed, follow up with the insurance provider to inquire about the claim status. |

Final Review

In conclusion, securing the appropriate shop insurance is vital for safeguarding your business. This guide has provided a detailed overview of the process, from comparing quotes to understanding coverage options and claim procedures. By leveraging online resources and understanding the key factors influencing rates, you can confidently choose the best shop insurance policy tailored to your specific needs. Armed with this knowledge, you’re well-positioned to protect your business and have peace of mind.

FAQ Compilation

What are the common types of shop insurance?

Common shop insurance types include property insurance, liability insurance, and business interruption insurance. Each type covers different aspects of your business operations.

How does the location of my shop affect insurance rates?

Shop location can significantly impact insurance rates. Areas with higher crime rates or a greater risk of natural disasters often have higher premiums.

What are some high-risk factors that increase shop insurance costs?

High-risk factors include the presence of flammable materials, proximity to high-traffic areas, and inadequate security measures.

How can I find reputable shop insurance providers online?

Use reputable online comparison tools and review online reviews and ratings to find trustworthy insurance providers. Look for companies with strong financial ratings.

What documentation is needed for a shop insurance claim?

Documentation may include proof of loss, police reports (if applicable), and any supporting documentation relevant to the claim.