Navigating the world of insurance can be daunting. Reddit, a popular online forum, offers a wealth of user-generated reviews and insights. This guide dives deep into the discussions surrounding insurance companies on Reddit, offering a clear and concise overview of user experiences, concerns, and ultimately, the best-rated options.

We’ll explore different types of insurance, from health to auto to home, examining user experiences and comparing various providers. We’ll also investigate the factors influencing user opinions, including pricing, coverage, and customer service. Ultimately, we aim to distill the collective wisdom of Reddit’s insurance community to help you make informed decisions.

Introduction to Insurance Companies on Reddit

Reddit users frequently discuss their experiences with insurance companies, often expressing a mix of frustration and satisfaction. A significant portion of the conversations revolve around issues like claim processing times, coverage ambiguities, and perceived unfair pricing practices. While some users praise specific companies for their prompt service or comprehensive policies, the overall tone of the discussions is largely critical, reflecting a general sentiment of needing more transparency and customer-centricity from insurance providers.

General Sentiment Towards Insurance Companies

The general sentiment towards insurance companies on Reddit is largely negative, with a focus on common complaints. Users frequently express dissatisfaction with lengthy claim processing times, inadequate coverage, and confusing policy language. These issues contribute to a feeling of powerlessness and frustration among consumers, with many feeling unheard or unfairly treated by insurance companies. However, positive experiences and praise for certain companies are also visible, highlighting that the overall sentiment is not uniformly negative.

Common Themes and Concerns

Users frequently cite several key themes in their discussions regarding insurance companies. A prevalent concern is the perceived complexity of insurance policies. Users often struggle to understand the fine print and nuances of coverage, leading to misunderstandings and potential dissatisfaction. Another significant theme is the timeliness of claim processing. Users often report lengthy delays and bureaucratic hurdles in receiving compensation after an incident, creating considerable stress and inconvenience.

Finally, price transparency and perceived unfair pricing practices are frequently discussed, with users expressing concern over lack of clarity and potential overcharging.

Comparison of Most Mentioned Insurance Companies

This table compares the most frequently mentioned insurance companies on Reddit, based on user ratings, common complaints, and perceived strengths.

| Company Name | User Ratings | Common Complaints | Strengths |

|---|---|---|---|

| Company A | Mixed (3/5) | Slow claim processing, unclear policy language, high premiums | Sometimes praised for customer service in specific situations, comprehensive coverage in certain areas |

| Company B | Slightly above average (3.5/5) | High premiums, limited coverage options, some reported issues with customer support | Generally considered reliable, good reputation in certain regions, prompt response to simple claims |

| Company C | Below average (2.5/5) | Extremely slow claim processing, poor customer service, complex policy language | Generally perceived as having strong financial stability, but this is often outweighed by other concerns |

Note: Ratings are a general estimation and may vary significantly based on individual experiences and specific situations. The data is compiled from various Reddit discussions and reflects common themes.

Types of Insurance

Reddit discussions frequently revolve around various insurance types, highlighting user experiences and preferences. Understanding the different types, their specific concerns, and comparative experiences across providers is key to making informed decisions. This section delves into the common insurance types and user perspectives.

Health Insurance

Health insurance is a crucial aspect of personal financial planning, and Reddit threads frequently discuss its complexities and comparisons. Users often share experiences with different plans, focusing on coverage, premiums, and out-of-pocket costs. Concerns often revolve around deductibles, co-pays, and network limitations. Finding a balance between affordability and comprehensive coverage is a persistent theme. The comparison between plans often involves analyzing provider networks, prescription drug coverage, and pre-authorization requirements.

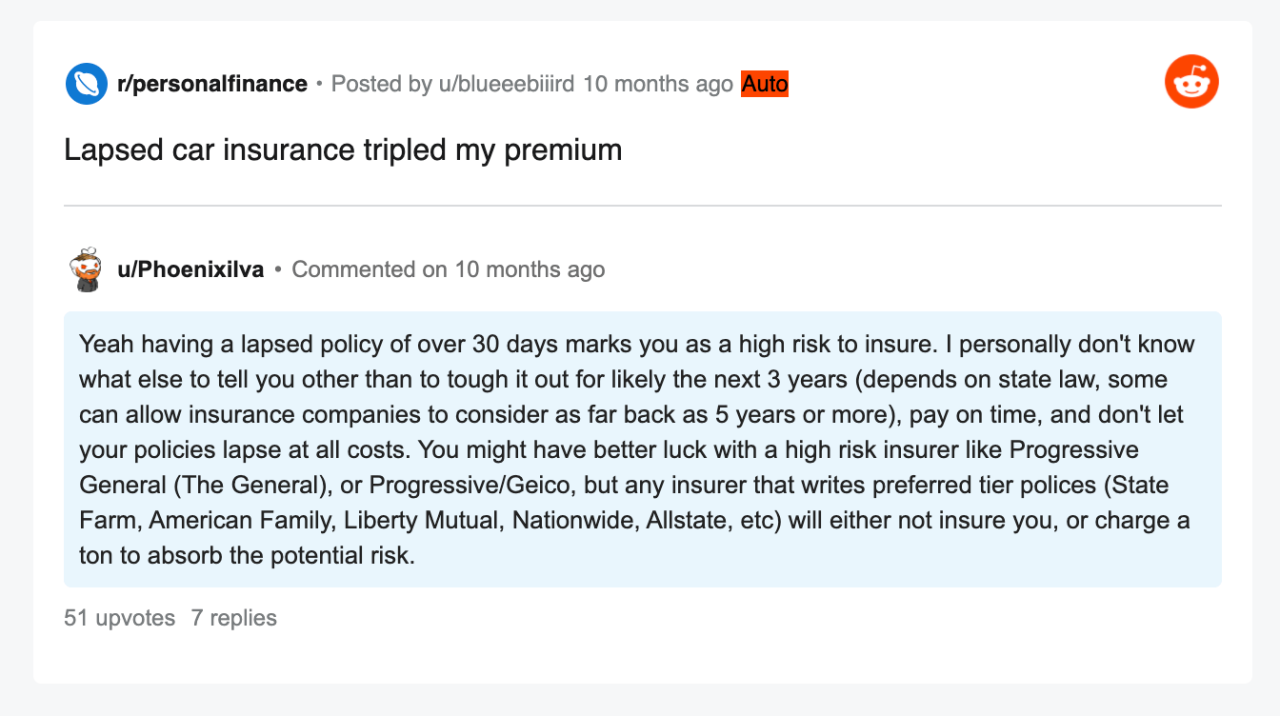

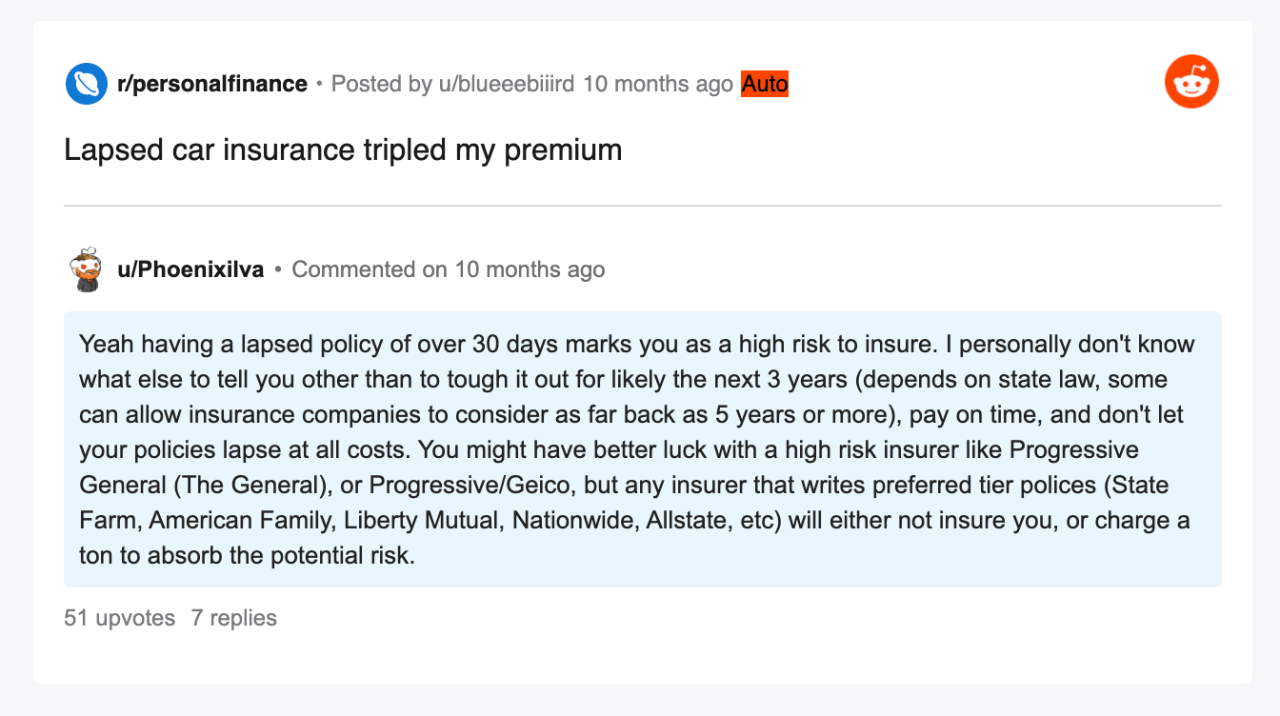

Auto Insurance

Auto insurance is a mandatory purchase in many jurisdictions, and Reddit discussions highlight the importance of finding affordable and reliable coverage. Users frequently compare premiums across different providers, emphasizing factors like driving history, vehicle type, and geographic location. Specific concerns include coverage limits, liability protection, and uninsured/underinsured motorist coverage. Reddit discussions frequently explore the impact of accident claims and the process of filing a claim with different insurance companies.

Homeowners Insurance

Homeowners insurance protects property from various perils, and Reddit discussions center on finding suitable coverage at competitive rates. Users compare policies based on coverage amounts, deductibles, and the types of perils included. Frequent concerns involve flood insurance, replacement cost coverage, and the impact of natural disasters. Discussions often include experiences with different providers and their claim handling procedures, emphasizing the importance of transparent communication and prompt responses.

Table of Insurance Types

| Insurance Type | Pros | Cons | Examples of Companies |

|---|---|---|---|

| Health Insurance | Access to necessary medical care, protection against high medical expenses, preventative care options. | Premiums can be substantial, coverage limitations may exist, deductibles and co-pays can be significant, and network limitations can restrict access to preferred doctors. | Blue Cross Blue Shield, UnitedHealthcare, Aetna, Humana |

| Auto Insurance | Protection against financial losses in the event of an accident, legal protection in case of liability, and peace of mind. | Premiums can vary significantly based on driving record, location, and vehicle type, coverage limits may need adjusting, and claim processes can be complex. | State Farm, Geico, Progressive, Allstate |

| Homeowners Insurance | Protection against damage or loss of a home, liability protection, and coverage for personal belongings. | Premiums can vary significantly based on location and the type of home, deductibles can be high, and claim processes can be lengthy and complex. | Allstate, Nationwide, Liberty Mutual, Farmers Insurance |

Factors Influencing User Opinions

Reddit users frequently discuss insurance companies, offering insights into their experiences and preferences. These discussions are often driven by a complex interplay of factors, including price, coverage details, and the quality of customer service. Understanding these factors is crucial for companies looking to improve their reputation and gain a competitive edge.User opinions on insurance companies are shaped by a variety of interconnected elements.

Price sensitivity is a significant driver, with users actively comparing premiums and deductibles across different providers. Coverage options, such as the extent of medical benefits or the types of perils covered, are also key considerations. Finally, the responsiveness and efficiency of customer service significantly impact user satisfaction and loyalty.

Price Sensitivity and Comparisons

User discussions frequently highlight the importance of competitive pricing. Users meticulously compare premiums, deductibles, and policy features to find the most cost-effective options. This often involves detailed comparisons of various plans, with users sharing spreadsheets and graphs of different providers’ offerings. For instance, a common Reddit thread might include detailed tables comparing premiums for similar coverage levels from different companies, with users actively debating the value proposition of each plan.

Coverage Adequacy and Detail

The comprehensiveness and clarity of coverage are crucial factors in shaping user opinions. Users scrutinize the specific perils and conditions covered, often seeking clarification on policy exclusions and limitations. Disagreements arise when users believe a policy does not adequately address their specific needs or when exclusions significantly impact their coverage. Discussions often involve users highlighting specific scenarios where the coverage fell short or where the policy’s wording was ambiguous, leading to disputes over claim denials.

Customer Service and Responsiveness

User satisfaction is strongly influenced by the quality of customer service. Positive experiences, such as prompt responses to inquiries and efficient claim handling, are often praised. Conversely, negative experiences, such as lengthy wait times, unhelpful agents, or difficulties navigating the claims process, are frequently criticized. Examples of negative experiences are often shared in Reddit threads, with users describing frustrating interactions with customer service representatives and the difficulties in resolving their issues.

Demographic Influences on Perception

User demographics, including age, location, and profession, can significantly influence their perception of insurance companies. Younger users might prioritize cost-effectiveness and digital accessibility, while older users might prioritize comprehensive coverage and personalized service. Location-based differences also exist, with certain areas facing higher risk factors impacting the type and price of insurance required.

Impact of Recent Events and News

Recent events or news can significantly impact user sentiment toward specific insurance companies. For example, a company’s handling of a natural disaster, a major policy change, or a negative news story can dramatically shift public opinion. User reactions are often visible in Reddit threads, where discussions surrounding recent events provide valuable insights into public perception. Discussions surrounding major storms or natural disasters, for instance, frequently include comparisons of companies’ response times and coverage benefits.

Comparison of Insurance Providers

User reviews often paint a vivid picture of the strengths and weaknesses of different insurance providers. Understanding these perspectives is crucial for making informed decisions when selecting coverage. Reddit communities, in particular, offer valuable insights into real-world experiences and user satisfaction levels.

Top-Rated Insurance Companies

Based on aggregated user feedback, several insurance companies consistently receive high praise. These companies frequently emerge as favorites due to competitive pricing, comprehensive coverage options, and exceptional customer service. Factors such as claim processing speed and ease of communication also play a significant role in shaping user opinions.

Strengths and Weaknesses of Major Providers

Analyzing user experiences across various providers reveals key strengths and weaknesses. This analysis provides a comparative overview of the key factors influencing user satisfaction, which is invaluable for prospective customers seeking suitable insurance coverage.

| Provider A | Provider B | Provider C | Strengths | Weaknesses |

|---|---|---|---|---|

| Competitive pricing, responsive customer service, wide range of policy options. Many users praise the ease of online claim filing and the speed of processing. | Some users report difficulties in understanding policy terms and conditions. Limited coverage options in specific niche areas. | |||

| Excellent customer support, especially through phone and email channels. Known for their comprehensive health insurance plans and competitive pricing for family coverage. | Claims processing time can be lengthy for some users, and the online portal could be more user-friendly. Potential for higher premiums in certain areas. | |||

| Wide network of providers, particularly for medical procedures. Strong reputation for handling complex claims and providing prompt settlements. Users frequently mention the convenience of their mobile app. | Some users report high premiums compared to other providers, especially for specific coverage types. Limited availability of coverage in certain remote areas. |

Reddit’s Influence on Insurance Decisions

Reddit serves as a vital platform for consumers seeking information and advice on various topics, including insurance. Users often turn to online communities for insights, reviews, and comparisons of different insurance providers, which can significantly impact their purchasing decisions. This influence stems from the readily available and diverse perspectives shared within these online forums.The dynamic nature of online discussions allows for a collective evaluation of insurance policies and providers, often providing insights that might be missed through traditional methods.

Community members share personal experiences, providing real-world examples and assessments of different insurance products and services. This shared knowledge and the resulting support system are critical aspects of the influence Reddit exerts.

Impact of Community Support and Shared Experiences

Reddit communities offer a unique opportunity for users to connect and share experiences related to insurance. This sharing of personal stories and insights, including success and failure stories, helps shape individual perspectives and understanding of insurance products. The community aspect encourages peer-to-peer support, making users feel more confident in their decisions. For example, discussions about specific insurance claims processes, policy terms, or customer service interactions allow users to learn from others’ experiences, potentially avoiding common pitfalls or identifying advantageous options.

Influence of Online Reviews on Purchasing Decisions

Online reviews play a significant role in shaping consumer opinions and influencing purchase decisions. On Reddit, users often post detailed reviews of their insurance experiences, highlighting positive and negative aspects of different providers. These reviews can cover everything from claim processing times to customer service responsiveness. Such transparency and detailed feedback can help prospective customers evaluate various insurance options in a more informed way.

For instance, a user might find a review that highlights a specific insurance company’s rapid claim settlement, influencing their decision to choose that company over others with slower claim processing times. Conversely, negative reviews about poor customer service or complex policy terms could deter potential customers.

Pros and Cons of Relying on Online Forums for Insurance Advice

While Reddit can be a valuable resource for insurance information, it’s crucial to approach the advice found there with a degree of critical thinking. A significant advantage is the wide range of perspectives and real-life examples shared, often providing a more comprehensive understanding of insurance than traditional sources. The community aspect also empowers users to ask questions and receive immediate feedback from other users with similar needs.However, relying solely on online forums for insurance advice has potential drawbacks.

The information presented might not always be accurate or up-to-date, and personal experiences can be subjective. Furthermore, some individuals may be biased in their reviews, influenced by personal issues unrelated to the objective evaluation of the insurance provider. Ultimately, users should use online forums as a supplementary resource, complementing their research with official company information and professional consultations before making any significant insurance decisions.

Insurance Company Responses and Actions

Insurance companies face a constant stream of feedback, both positive and negative, from consumers. A significant portion of this feedback is now disseminated through online platforms like Reddit. Managing this public discourse effectively is crucial for maintaining brand reputation and customer trust. How companies react to criticism, and their proactive engagement on social media, can significantly impact their public perception and ultimately, their bottom line.Effective responses to online feedback require a delicate balance between acknowledging concerns and upholding the company’s image.

Companies must also navigate the complexities of public forums where discussions can quickly escalate. Strategies employed by successful insurance providers often include prompt acknowledgement, empathetic communication, and a focus on resolution. Conversely, poor handling of online criticism can damage a company’s reputation and lead to further negative publicity.

Insurance Company Responses to Negative Feedback

Insurance companies often employ a multi-faceted approach to respond to negative feedback on platforms like Reddit. These responses can range from simply acknowledging the concern to providing detailed explanations or offering immediate solutions. A crucial element of this response is acknowledging the validity of the user’s experience, even if the company ultimately cannot resolve the issue immediately. Companies often address the concerns with clear and concise language, focusing on transparency and empathy.

Utilizing Social Media Platforms for Addressing Concerns and Complaints

Insurance companies increasingly leverage social media platforms to address concerns and complaints directly. This approach allows them to engage with users in real-time, demonstrating responsiveness and a commitment to customer service. Companies often establish dedicated social media accounts for customer support, staffed by trained representatives. These representatives can quickly address inquiries, complaints, and concerns. Direct engagement fosters a sense of connection and shows that the company values customer input.

Examples of Successful Social Media Strategies

Several insurance companies have effectively utilized social media to address negative feedback. A successful strategy often involves acknowledging user concerns, expressing empathy, and offering a clear path to resolution. For example, a company might acknowledge a user’s frustration with a specific policy issue, offer a personalized response, and provide a timeline for a resolution. Another example involves proactively addressing potential issues before they escalate into full-blown complaints.

By addressing potential issues, companies preemptively quell concerns and foster trust. Companies often employ a consistent tone and style across all platforms to project professionalism and build brand trust.

Examples of Unsuccessful Social Media Strategies

Conversely, some companies have encountered difficulties in managing online feedback. Ignoring complaints, providing dismissive or evasive responses, or failing to provide timely resolutions can damage a company’s reputation. A lack of transparency, or overly aggressive responses, can further escalate tensions. For instance, a company might dismiss user concerns without properly investigating the issue, thereby alienating the customer and potentially escalating the negative feedback.

Companies must avoid reacting defensively or appearing uncaring.

Effectiveness of Strategies in Influencing Public Perception

The effectiveness of a company’s social media strategy in influencing public perception is directly related to how well it addresses user concerns. Companies that promptly and empathetically address negative feedback often see a positive impact on public perception. Conversely, companies that fail to respond effectively or handle complaints poorly risk further damaging their reputation. The positive impact of a successful social media strategy is a result of demonstrating customer-centricity, building trust, and showing accountability.

Successful strategies foster a sense of community and engagement, which in turn builds trust and loyalty.

Ending Remarks

In conclusion, Reddit offers a valuable, albeit sometimes subjective, resource for understanding user sentiment regarding insurance companies. While online reviews should not be the sole determinant of your decision, they provide a significant snapshot of real-world experiences and can help narrow down options. This guide highlights the pros and cons of relying on online forums for advice, providing you with the tools to evaluate the information critically and make an informed choice.

FAQ Compilation

What are the most common complaints about insurance companies on Reddit?

Common complaints often center around lengthy claims processes, unclear policy language, and perceived lack of customer service responsiveness. Users frequently mention difficulty in understanding coverage details and navigating the claims process.

How do user demographics influence their perception of insurance companies on Reddit?

Age, location, and financial situation can all play a role in shaping user opinions. For example, younger users might have different concerns about coverage options compared to older individuals with pre-existing conditions. Geographical location can also influence perceptions based on local regulations and pricing.

How effective are insurance company responses to negative feedback on Reddit?

Responses vary. Some companies actively engage with users, addressing concerns and offering solutions. Others may ignore or downplay negative feedback, potentially worsening their public image. The effectiveness hinges on the company’s ability to acknowledge user concerns and take constructive steps to address them.

Can I rely solely on Reddit reviews for choosing an insurance company?

No. While Reddit provides valuable insights, it’s crucial to research different companies, compare policies, and consider personal needs and circumstances. Use Reddit as a starting point, but always conduct thorough independent research.