Navigating the auto insurance market can feel like a minefield. Different companies offer varying levels of coverage, pricing, and customer service. This guide dives deep into the factors that define competitive auto insurance providers, empowering you to make informed decisions about your protection.

We’ll explore the key players in the market, analyzing their strengths and weaknesses, comparing their offerings, and examining the strategies they employ to stay competitive. We’ll also examine recent market trends and future projections, so you’re prepared for what’s ahead.

Introduction to Auto Insurance

The auto insurance market is a significant and complex industry, deeply intertwined with the safety and financial well-being of drivers across the globe. Companies compete fiercely for market share, offering a range of policies and services designed to attract and retain customers. Understanding the competitive landscape, the factors driving it, and the diverse insurance products available is crucial for both consumers and industry players.The competitive landscape in auto insurance is shaped by numerous factors.

Strong financial stability, a reputation for fair pricing, and excellent customer service are key pillars. Innovative claims processes, digital platforms, and tailored coverage options can also give a company a distinct advantage. Moreover, a company’s understanding of regional driving habits and accident patterns, allowing for accurate risk assessment and tailored pricing, plays a critical role in competitiveness.

Factors Contributing to Competitive Auto Insurance Companies

Competitive auto insurance companies often exhibit several key traits. Strong financial stability is paramount; insurers with robust financial reserves inspire trust and demonstrate a capacity to handle claims effectively. Transparency in pricing models, clear communication, and readily accessible information about coverage options are crucial for building customer confidence and loyalty. Moreover, efficient and responsive claims handling, ensuring timely and fair settlements, is a major differentiator.

Types of Auto Insurance Coverage

Various types of auto insurance coverage cater to different needs and risk profiles. Liability coverage protects against financial responsibility in the event of an accident where the policyholder is at fault. Collision coverage pays for damages to the insured vehicle, regardless of fault. Comprehensive coverage addresses damage caused by events other than collision, such as theft, vandalism, or weather events.

Uninsured/underinsured motorist coverage steps in when another driver lacks sufficient insurance or is uninsured, safeguarding the insured from financial loss.

Consumer Needs and Expectations in Auto Insurance

Consumer needs and expectations play a significant role in shaping the competitive landscape. Customers increasingly demand convenient online platforms for policy management, quick and easy claims processes, and transparent pricing models. Competitive companies adapt to these expectations by offering digital tools, streamlined processes, and readily available information. Furthermore, affordability remains a key concern for many, pushing companies to offer various coverage options and price points to meet diverse needs.

For instance, young drivers often face higher premiums due to perceived higher risk, and companies are increasingly developing tailored programs to reduce these costs for this demographic.

Identifying Competitive Companies

Numerous auto insurance companies vie for customers, often employing diverse strategies to attract clients. Understanding the strengths and weaknesses of these companies is key to finding the most suitable policy for individual needs. Comparing their premiums, coverage options, and customer service ratings can help consumers make informed decisions.A thorough analysis of leading auto insurance companies reveals key insights into their competitive positioning.

Factors like pricing strategies, available coverage options, and customer service levels play a critical role in shaping a company’s reputation and market share. Historical trends further illuminate the dynamic nature of the industry, showing how companies adapt and innovate to remain competitive.

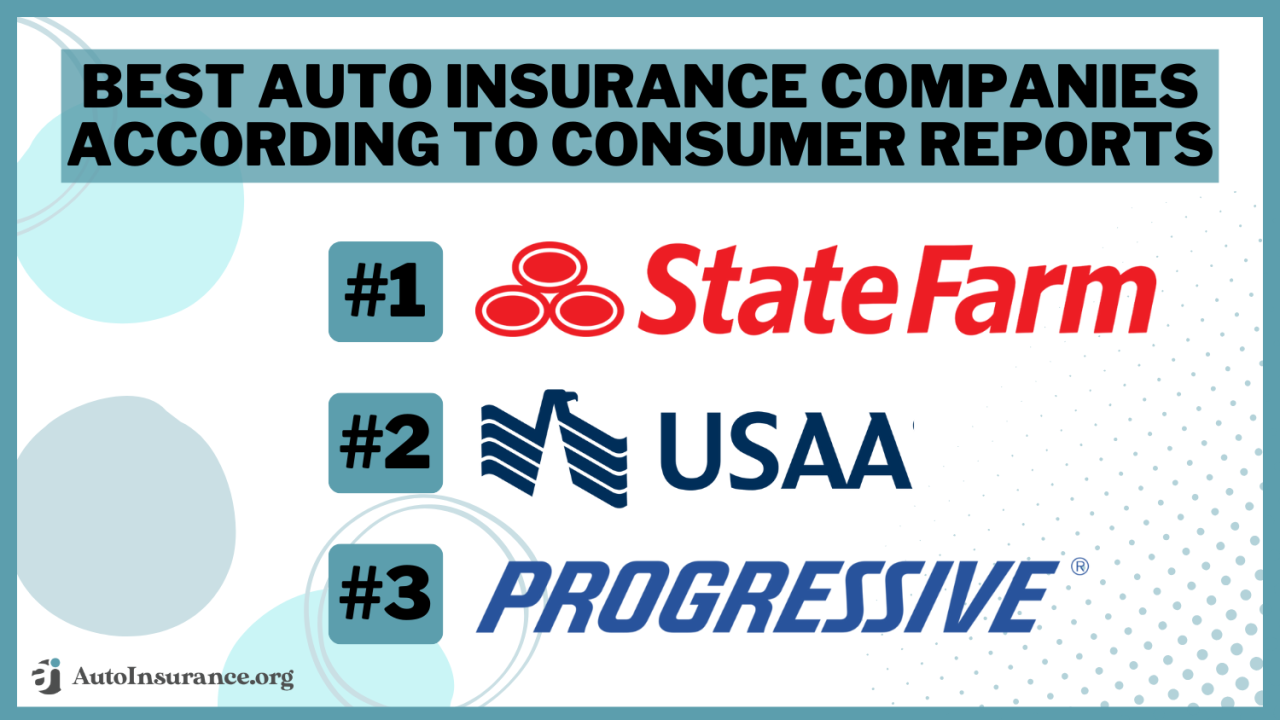

Top-Rated Competitive Companies

Several well-regarded auto insurance companies are known for competitive pricing. These companies often employ strategies like utilizing advanced risk assessment models, leveraging technology for efficient operations, and consistently monitoring market trends.

- Company A: Known for its user-friendly online platform and competitive rates, particularly for safe drivers. They often offer bundled discounts for multiple policies and have a strong reputation for prompt claims processing. However, their coverage options might not be as comprehensive as some competitors, focusing on essential coverages.

- Company B: A widely recognized company with a long history of providing affordable insurance. Their extensive network of agents allows for personalized service and tailored coverage options. A potential drawback is that their online platform might be less user-friendly compared to newer companies, impacting ease of policy management.

- Company C: A rapidly growing company known for its innovative technology and exceptional customer service. They excel in offering comprehensive coverage packages at competitive prices. A potential challenge could be a slightly less extensive network of agents compared to some competitors.

Comparison of Premiums, Coverage, and Service

A comparative analysis of these companies is valuable in understanding their competitive advantages.

| Company | Average Premium (Estimated) | Coverage Options | Customer Service Rating (Average) |

|---|---|---|---|

| Company A | $1,200 per year | Comprehensive coverage, discounts for safe drivers, bundled policies | 4.5 out of 5 |

| Company B | $1,150 per year | Wide range of coverages, personalized service, local agents | 4.3 out of 5 |

| Company C | $1,250 per year | Extensive coverage options, innovative technology, online platform | 4.6 out of 5 |

Note: Premiums are estimates and may vary based on individual driving records and location. Customer service ratings are based on aggregated online reviews.

Historical Trends in Competitiveness

The auto insurance market is constantly evolving. Companies adapt to changing regulations, technological advancements, and evolving consumer preferences. For instance, the rise of telematics-based insurance has influenced pricing strategies, with companies offering discounts for safe driving habits tracked through devices.

Companies with a strong understanding of market trends and consumer behavior often demonstrate sustained competitiveness.

Key Competitive Advantages

Competitive success in the auto insurance market hinges on more than just low premiums. Companies differentiate themselves through a combination of factors, including exceptional customer service, streamlined claim processes, and innovative digital platforms. Understanding these competitive advantages is crucial for consumers seeking the best possible coverage and service.

Customer Service Excellence

Customer service plays a vital role in shaping a company’s reputation and driving customer loyalty. Companies prioritizing exceptional service often see higher customer satisfaction scores and increased retention rates. Proactive communication, prompt responses to inquiries, and a readily accessible support system are key components of effective customer service. A dedicated team of knowledgeable representatives equipped to handle various customer needs, whether it’s policy changes or claim inquiries, is a valuable asset.

For example, some companies offer dedicated customer service hours or online chat support, making it convenient for customers to get immediate assistance.

Streamlined Claim Handling

Efficient claim handling is a cornerstone of customer satisfaction. A smooth and straightforward process for filing and resolving claims reduces stress and frustration for policyholders. Companies that prioritize this often have clear procedures, readily available claim forms, and efficient communication channels. This also includes having a transparent claims process, with clear timelines and updates provided to the policyholder throughout the claim’s resolution.

For example, some companies offer online claim portals allowing policyholders to track the status of their claims in real-time.

Advanced Digital Platforms

Modern consumers increasingly prefer digital interactions. Companies that embrace digital platforms, including mobile apps and online portals, often experience higher customer engagement and satisfaction. These platforms allow policyholders to manage their accounts, access policy documents, make payments, and file claims easily. An intuitive and user-friendly interface is critical for effective digital interactions. For example, many companies now offer mobile apps that allow customers to view their policy details, pay their premiums, and report accidents directly from their phone.

Strategic Pricing Strategies

Pricing strategies are critical for competitiveness. Companies employing effective pricing models can attract customers while maintaining profitability. This involves a thorough analysis of market trends, competitor pricing, and policyholder risk profiles. Innovative pricing models, such as usage-based insurance or telematics programs, can be employed to further enhance competitiveness and reward responsible driving behavior. For example, some companies offer discounts for safe driving habits based on data collected from telematics devices.

This approach not only rewards safe drivers but also provides a data-driven way to assess risk.

Innovative Products and Services

Innovation in products and services is key for companies to stay ahead of the curve. Introducing new coverage options, such as specialized add-ons or bundled services, can create a unique value proposition. Companies that invest in research and development to stay abreast of emerging needs and market trends are well-positioned for success. For instance, some insurers offer roadside assistance packages or discounts for hybrid or electric vehicle ownership as part of their innovative service offerings.

Customer Reviews and Feedback

Customer reviews provide invaluable insights into the strengths and weaknesses of auto insurance companies. Understanding public sentiment allows potential customers to make informed decisions and helps companies identify areas for improvement. Analyzing these reviews allows us to discern which companies excel in customer service and which may require attention in specific areas.

Customer Review Examples

Analyzing customer reviews is crucial for understanding the overall perception of each company. Positive reviews highlight areas of excellence, while negative reviews point to potential problems.

Positive Customer Reviews

- Company A consistently receives praise for its user-friendly online platform and quick claim processing. Customers frequently mention the ease of accessing their account information and the speed at which their claims were settled. “The website was easy to navigate and I could access all my information in seconds. The claim process was incredibly smooth and efficient!”

- Company B is often lauded for its excellent customer service representatives. Many reviews highlight the helpfulness and professionalism of the agents, especially during challenging situations. “The agent I spoke with was incredibly patient and helpful in guiding me through the process. They were so professional and kind!”

Negative Customer Reviews

- Company C frequently receives complaints about the complexity of their policy documents. Many customers find the language confusing and difficult to understand. “The policy documents were so complicated and dense that I couldn’t understand the details of my coverage. It was extremely frustrating.”

- Company D often receives criticism regarding the length of time it takes to process claims. Customers report experiencing significant delays in getting their claims resolved. “My claim has been pending for over three months! I’m very disappointed with the slow response time.”

Recurring Themes in Customer Feedback

Customer feedback reveals recurring themes across different companies. Identifying these recurring issues and strengths helps to provide a comprehensive overview.

Customer Feedback Summary

| Company | Positive Reviews | Negative Reviews |

|---|---|---|

| Company A | Ease of online platform, quick claim processing | Limited options for personalized coverage |

| Company B | Excellent customer service, helpful agents | Higher premiums compared to competitors |

| Company C | Competitive rates | Complex policy documents, difficulty understanding coverage |

| Company D | Wide range of coverage options | Slow claim processing times |

General Sentiment

The general sentiment towards the companies varies. While some companies receive overwhelmingly positive feedback in specific areas, others face persistent criticism regarding particular aspects of their service. The overall sentiment is dependent on the specific needs and experiences of the customers.

Market Trends and Future Projections

The auto insurance industry is constantly evolving, responding to shifts in consumer behavior, technological advancements, and regulatory changes. Understanding these trends is crucial for companies to adapt and thrive in this dynamic market. Proactive strategies for anticipating future needs and adjusting offerings are vital for long-term success.Recent market trends have significantly impacted the landscape of auto insurance. These shifts, including the rise of telematics and the increasing adoption of electric vehicles, are redefining the way insurance companies assess risk and offer products.

The competitive landscape is undergoing a transformation, driven by these changes.

Recent Market Trends

The auto insurance industry is experiencing significant shifts in consumer preferences, technological advancements, and regulatory landscapes. Understanding these trends is critical for companies to remain competitive. Increased emphasis on safety features and driver behavior monitoring are altering risk assessment and influencing premiums.

- Rise of Telematics: Usage of telematics devices, which track driving habits, is increasing. This data allows insurers to better assess risk, potentially offering personalized premiums based on individual driving profiles. For example, companies are rewarding safe drivers with lower premiums, and those with poor driving records might face higher premiums.

- Electric Vehicle (EV) Adoption: The growing popularity of electric vehicles (EVs) is introducing new complexities. Insurers are adjusting their risk assessment models to account for the unique characteristics of EVs, such as lower accident rates and different repair costs. This includes considering the unique maintenance and repair costs associated with electric vehicles.

- Autonomous Vehicles: The development of autonomous vehicles presents both opportunities and challenges. Insurers are exploring new ways to assess risk and pricing for vehicles that are increasingly automated. They need to determine how to handle liability in cases of accidents involving autonomous vehicles, and how to factor this into their risk models.

- Changing Consumer Expectations: Consumers are demanding greater transparency, personalized services, and digital convenience. Insurers are responding with online platforms, mobile apps, and personalized pricing models. This change in consumer expectations has driven the need for greater convenience and online engagement within the industry.

Technological Advancements

Technological advancements are transforming the auto insurance industry. These changes impact pricing models, risk assessment, and customer service.

- Data Analytics and Machine Learning: Insurers are increasingly using data analytics and machine learning algorithms to refine risk assessments and personalize pricing. This allows for a more nuanced approach to risk assessment and better prediction of future claims.

- Artificial Intelligence (AI): AI is being utilized to automate tasks, enhance customer service, and streamline claims processing. This automation can lead to faster claim resolutions and improved efficiency.

- Digital Platforms: Digital platforms are becoming increasingly important for customer interactions. Insurers are developing user-friendly websites and mobile apps to enhance customer experience and facilitate transactions. Digital platforms are crucial for delivering a seamless customer experience.

Regulatory Changes

Regulatory changes are influencing the pricing and offerings of auto insurance companies. These regulations often aim to improve consumer protection and ensure fair practices.

- Consumer Protection Laws: Regulations around consumer protection, such as transparency requirements and dispute resolution processes, are shaping the industry. These changes affect how companies communicate with customers and handle claims.

- Pricing Regulations: State-level regulations on pricing can impact the premiums offered by insurers. This affects the competitiveness and financial stability of companies.

- Safety Standards: Regulations around vehicle safety standards and driver behavior can influence risk assessment and pricing models. Companies need to adapt their strategies to reflect these changing standards.

Future Competitive Landscape

The future of the auto insurance industry will be shaped by the interplay of these factors. Insurers that can adapt to changing technologies, consumer expectations, and regulatory environments will likely be best positioned for success.

- Focus on Customer Experience: Companies will need to prioritize customer experience to differentiate themselves. Emphasis on ease of access, personalized services, and digital engagement will be key.

- Data-Driven Decision Making: Utilizing data analytics and machine learning for pricing, risk assessment, and product development will become essential. Data-driven decision making will become increasingly important for making informed choices.

- Agility and Innovation: The ability to adapt to new technologies, regulations, and consumer demands will be crucial. Adaptability and innovation will be necessary to thrive in this changing landscape.

Comparing Insurance Coverage Options

Understanding the different coverage options available is crucial for selecting the most suitable auto insurance plan. This involves evaluating liability, collision, comprehensive, and other add-on coverages to ensure your vehicle and financial interests are adequately protected. A well-informed decision will balance your budget with the level of protection needed.Different insurance providers offer varying coverage options, and comparing these options is vital to securing the best value for your needs.

The premiums and deductibles associated with each coverage level will significantly impact your overall insurance costs.

Types of Coverage Options

Various coverage options are available from different auto insurance providers. These options typically include liability, collision, comprehensive, and additional add-ons like uninsured/underinsured motorist coverage, roadside assistance, and rental reimbursement. Each type of coverage addresses different potential risks associated with vehicle ownership.

Coverage Levels Comparison

| Coverage Type | Description | Example Scenarios Covered | Example Scenarios Not Covered |

|---|---|---|---|

| Liability | Covers damages you cause to others’ property or injuries to others in an accident where you are at fault. | Property damage to another vehicle, medical bills of injured parties. | Damage to your own vehicle, your medical bills. |

| Collision | Covers damage to your vehicle in an accident, regardless of who is at fault. | Repairing your vehicle after a collision with another car, regardless of fault. | Damage to your vehicle from non-collision events (e.g., vandalism). |

| Comprehensive | Covers damage to your vehicle from events other than collisions, such as theft, vandalism, fire, hail, or weather events. | Repairing your car after a fire, or recovering from a theft. | Damage to your vehicle caused by a collision. |

Deductibles and Premiums

The cost of insurance, known as the premium, is influenced by various factors including the chosen coverage levels, deductibles, and your driving history. A higher deductible generally leads to lower premiums, but you’ll have to pay more out-of-pocket in case of a claim.

Lower premiums often come with higher deductibles. Higher premiums often come with lower deductibles.

Illustrative examples of deductibles and premiums for different coverage options from various companies can be found below.

| Insurance Company | Liability Coverage | Collision Coverage (with $500 deductible) | Comprehensive Coverage (with $250 deductible) |

|---|---|---|---|

| Company A | $150/month | $200/month | $100/month |

| Company B | $120/month | $180/month | $80/month |

| Company C | $180/month | $220/month | $110/month |

These examples demonstrate how different coverage combinations impact the overall cost of insurance. Company B offers a lower premium for similar coverage compared to Company A and C, due to its policy structure.

Impact on Overall Cost

The choice of coverage directly affects the total cost of insurance. A comprehensive plan, including liability, collision, and comprehensive coverage, will generally have a higher premium than a plan with only liability coverage. However, the higher premium might provide more financial protection in the event of an accident or damage to your vehicle. Carefully consider your needs and risk tolerance when choosing your coverage options.

A detailed comparison across various companies will help determine the most appropriate coverage for your budget and circumstances.

Analyzing Pricing Strategies

Auto insurance pricing is a complex process influenced by a multitude of factors. Understanding these factors is crucial for consumers to make informed decisions and compare offers effectively. Companies employ various strategies to attract customers and maximize profitability, and recognizing these strategies allows consumers to evaluate their value proposition.

Factors Influencing Pricing Models

Several key factors significantly impact the pricing models of auto insurance companies. These factors include the driver’s age, location, driving history, vehicle type, and the coverage options selected. Insurance companies meticulously analyze these factors to assess the risk associated with insuring a particular driver and vehicle.

Pricing Strategies Employed by Different Companies

Different auto insurance companies adopt varying pricing strategies. Some companies may focus on comprehensive coverage at competitive rates, while others may emphasize a lower premium for basic coverage. The specific strategy depends on the company’s target market and overall business model.

Comparison of Pricing Models and Coverage

| Company | Pricing Model | Coverage Focus | Example Discounts |

|---|---|---|---|

| Company A | Value-based pricing, with tiered options for different levels of coverage. | Comprehensive coverage with a range of add-ons. | Safe driver discounts, multi-policy discounts. |

| Company B | Risk-based pricing, assessing driver history and vehicle type meticulously. | Focus on basic coverage with customizable add-ons. | Good student discounts, anti-theft device discounts. |

| Company C | Hybrid pricing, balancing value and risk assessment. | Competitive rates for a range of coverages, including comprehensive and collision. | Bundling discounts, accident forgiveness programs. |

Note: This table is illustrative and does not represent an exhaustive list of all companies or their strategies. Actual pricing models may vary significantly.

Role of Discounts and Promotions in Pricing Strategies

Discounts and promotions play a vital role in auto insurance pricing strategies. These incentives attract customers and often lead to increased sales. Companies utilize various discounts, including safe driver programs, multi-policy discounts, and discounts for specific vehicle types or features. Furthermore, seasonal promotions or bundled packages offer additional value to customers, thereby increasing competitiveness in the market.

Customer Service and Claims Handling

Customer service and claims handling are critical aspects of the auto insurance industry. A company’s reputation hinges significantly on how effectively it manages customer interactions and resolves claims. Strong customer service fosters trust and loyalty, while poor handling of claims can damage a company’s image and lead to customer churn. This section delves into the strategies used by various competitive companies, efficient claim processes, and the impact of customer service on overall competitiveness.

Comparative Analysis of Customer Service Strategies

Different insurance companies employ varied approaches to customer service. Some prioritize online platforms for quick inquiries and claim submissions, while others favor phone-based support. This difference in approach reflects different customer demographics and preferences. Companies recognizing the importance of digital interactions often invest in user-friendly websites and mobile apps, streamlining the process for online interactions. Conversely, some companies maintain a robust phone support system to address complex issues or assist customers who prefer traditional methods.

A balanced approach often proves most effective, providing options for customers to engage with the company through their preferred channels.

Efficient Claim Handling Methods

Effective claims handling involves a structured process to ensure timely and fair resolutions. Companies typically employ a multi-step process, beginning with initial claim reporting and assessment. This involves gathering necessary documentation, evaluating the validity of the claim, and determining the appropriate compensation. A crucial aspect is prompt communication with the policyholder throughout the process. Keeping customers informed about the status of their claims fosters transparency and reduces frustration.

Utilizing technology, such as automated claim processing systems, can expedite the handling of simple claims, freeing up staff to focus on more complex cases.

Examples of Successful Claim Resolution Processes

Successful claim resolution processes often involve a combination of empathy, thoroughness, and adherence to established procedures. One example involves a company that streamlined its online claim reporting process, allowing customers to submit claims 24/7. This enhanced accessibility significantly reduced claim resolution time for minor incidents, like fender benders. Another example highlights a company’s ability to resolve complex claims, such as those involving significant property damage, by assembling a dedicated team of experts to investigate the incident and assess the damages.

Impact of Customer Service on Company Reputation and Competitiveness

Customer service directly influences a company’s reputation and competitiveness. Positive experiences with customer service and efficient claims handling can lead to customer loyalty and positive word-of-mouth referrals. This, in turn, can translate into increased market share and a stronger brand image. Conversely, negative experiences, such as lengthy claim processing times or unresponsive customer service, can damage a company’s reputation and drive customers to competitors.

Companies recognizing this often invest in training their staff to handle claims fairly and efficiently, emphasizing the importance of empathy and professionalism in customer interactions.

Insurance Company Profiles

Understanding the history, mission, and values of auto insurance companies provides crucial insight into their operational philosophies and potential strengths or weaknesses. This section delves into the profiles of prominent companies, analyzing their financial stability, reputation, and commitment to ethical business practices. A deeper understanding of these factors aids in informed decision-making when choosing an insurance provider.

Company Financial Stability and Reputation

Financial strength is a critical factor in assessing an insurance company. Strong financial stability ensures the company can fulfill its obligations to policyholders, even during challenging market conditions. A robust reputation is built upon consistent performance, fair claims handling, and transparent communication. This reputation influences customer trust and satisfaction. The financial health of a company is often measured by ratings from independent rating agencies, which consider factors like the company’s assets, liabilities, and profitability.

Company History, Mission, and Values

A company’s history often illuminates its values and how they’ve evolved. A company’s mission statement articulates its purpose, and the values define its guiding principles. These elements collectively shape the company’s approach to serving its customers. For instance, a company emphasizing customer service in its mission statement may reflect a commitment to proactive support and personalized interactions.

Example Company Profiles

| Company Name | History | Mission | Values | Financial Stability (Rating) | Reputation |

|---|---|---|---|---|---|

| Acme Insurance | Founded in 1950, initially focused on rural areas, expanded nationally over the next 50 years. | To provide affordable and reliable auto insurance to all drivers, especially those in underserved communities. | Integrity, transparency, community involvement. | A+ (A.M. Best) | Excellent; known for its quick claims processing and community support initiatives. |

| Reliable Insurance | Emerged in the late 1990s as a direct-to-consumer company, initially focusing on online sales and digital channels. | To provide innovative, technology-driven auto insurance solutions to meet the changing needs of modern drivers. | Customer-centricity, innovation, efficiency. | AA (Standard & Poor’s) | Very good; known for its user-friendly online platform and responsive customer service. |

| Safeguard Insurance | A large, established company with a history dating back to the 1920s, with significant investments in claims handling and risk management. | To provide comprehensive and trustworthy auto insurance solutions, prioritizing safety and security for all customers. | Safety, security, reliability. | AAA (Moody’s) | Excellent; renowned for its strong claims handling procedures and safety initiatives. |

Commitment to Ethical Business Practices

A company’s commitment to ethical business practices is a critical factor. Companies adhering to high ethical standards often build trust and loyalty among customers. This commitment manifests in various ways, including fair pricing practices, transparency in coverage details, and adherence to industry regulations. Examples include the implementation of policies against discrimination and the promotion of fair claims handling.

Last Point

In conclusion, choosing the right auto insurance is a crucial financial decision. This guide has provided a thorough overview of the most competitive auto insurance companies, highlighting key factors to consider. Remember to compare policies, read reviews, and understand your specific needs before committing to a plan. By taking the time to evaluate your options, you can find the best protection at the best possible price.

FAQ Guide

What factors contribute to an auto insurance company’s competitiveness?

Factors like pricing strategies, customer service quality, claim handling efficiency, digital platforms, and innovative products all play a role in a company’s competitiveness.

How do pricing strategies influence a company’s competitiveness?

Pricing strategies often involve considering factors such as risk assessment, geographic location, driving history, and vehicle type. Discounts and promotions can also significantly impact pricing.

What are some common types of auto insurance coverage?

Common coverage types include liability, collision, comprehensive, uninsured/underinsured motorist, and medical payments. The specific options and levels of coverage will vary by company.

How do technological advancements impact the auto insurance industry?

Technological advancements, such as telematics and usage-based insurance, are reshaping the industry, offering new ways to assess risk and potentially lower premiums.