Finding the best auto insurance quote can feel like navigating a maze. Factors like driving history, vehicle type, and even your location significantly impact premiums. This guide unravels the complexities, offering practical steps and insights to help you secure the most competitive rates.

From understanding your specific needs to comparing different insurance providers, we’ll cover everything you need to know. We’ll also highlight common pitfalls to avoid, helping you make informed decisions and ultimately save money.

Understanding the User Need

Seeking the best auto insurance quote reflects a desire for optimal value and protection. Consumers want to ensure they’re not overpaying for coverage while still having adequate protection against potential financial losses. This often stems from a combination of factors, including personal financial situations and risk profiles.Factors influencing the desire for the best auto insurance quote are multifaceted.

Financial responsibility, peace of mind, and the need for comprehensive protection all play crucial roles in this decision-making process. Individuals weigh the cost of coverage against the potential financial burden of an accident or damage, ultimately seeking the most suitable coverage without exceeding their budget.

Motivations Behind Seeking Optimal Insurance Coverage

Individuals seek optimal insurance coverage for various reasons, often balancing cost-effectiveness with comprehensive protection. A primary motivation is financial security. Understanding potential costs associated with accidents or damages is key in making informed decisions. Another key motivation is peace of mind, knowing that they are adequately protected against potential financial risks. Furthermore, many seek the best quote to avoid being overcharged for coverage.

This is particularly relevant for those who are new to the insurance market and need to compare different providers.

Common Pain Points Associated with the Auto Insurance Quote Process

Navigating the auto insurance quote process can be challenging. A common pain point is the sheer volume of options and providers, making it difficult to compare policies. Furthermore, the jargon used in insurance documents can be confusing and intimidating. Many users find it time-consuming to gather all the required information and input it into various online platforms.

This can lead to frustration and potentially inaccurate quotes.

Types of Users Searching for the Best Auto Insurance Quote

Different user profiles present unique needs and motivations when searching for the best auto insurance quote. New drivers, for example, often have limited driving experience and higher risk profiles, leading them to prioritize affordable and comprehensive coverage. Frequent travelers may require additional coverage for out-of-state or international travel. Similarly, individuals with high-risk vehicles, such as older or customized models, might seek tailored policies to reflect the increased potential for damage.

Comparison of Different Insurance Types

Understanding the different types of auto insurance coverage is crucial for making informed decisions. This table provides a concise overview of common types, their coverage, and typical considerations.

| Insurance Type | Coverage | Typical Considerations |

|---|---|---|

| Liability | Covers damages to others in an accident where you are at fault. | Basic coverage; often required by law; limited protection for your own vehicle. |

| Comprehensive | Covers damages to your vehicle from events not involving collision, such as vandalism, fire, or theft. | Provides protection beyond collision damage; important for peace of mind. |

| Collision | Covers damages to your vehicle in an accident, regardless of who is at fault. | Protects your vehicle’s repair costs in an accident; important for comprehensive coverage. |

Comparison of Insurance Providers

Insurance companies employ diverse strategies to set premiums and offer varying coverage packages. Understanding these differences is crucial for securing the best possible auto insurance deal. This section delves into the methods used by different insurers, providing a structured approach to comparing quotes and identifying optimal coverage options.Different insurers employ different approaches to pricing and coverage. Some prioritize comprehensive coverage with higher premiums, while others focus on lower premiums with less comprehensive coverage.

Factors like driving history, vehicle type, and location all influence the price and coverage options offered by each company.

Pricing Models and Coverage Approaches

Insurance companies utilize various pricing models, considering factors like risk assessment, historical claims data, and market conditions. Some companies may emphasize discounts for safe drivers, while others focus on providing comprehensive coverage at a higher cost. It is important to recognize that the most comprehensive coverage isn’t necessarily the most expensive. Carefully analyze the value each company offers in relation to your needs.

Comparing Insurance Quotes

A systematic approach to comparing quotes is essential. Begin by creating a detailed list of desired coverage options. Then, obtain quotes from several reputable insurance providers, considering both premiums and coverage details. Comparing quotes side-by-side allows for a more objective evaluation of the value proposition. Don’t simply focus on the lowest premium; consider the level of coverage included.

Evaluating Coverage Options

Different coverage options cater to various needs. Liability coverage protects against claims from others, while collision coverage protects your vehicle in an accident. Comprehensive coverage provides protection for damage not caused by collision. Consider the specific risks you face and select coverage accordingly. For example, a young driver might need higher liability coverage due to increased accident risk.

Factors to Consider When Comparing Providers

| Factor | Description | Importance |

|---|---|---|

| Discounts | Companies offer various discounts, such as safe driver discounts, multi-policy discounts, and anti-theft device discounts. | Significant savings can be achieved with the right discounts. |

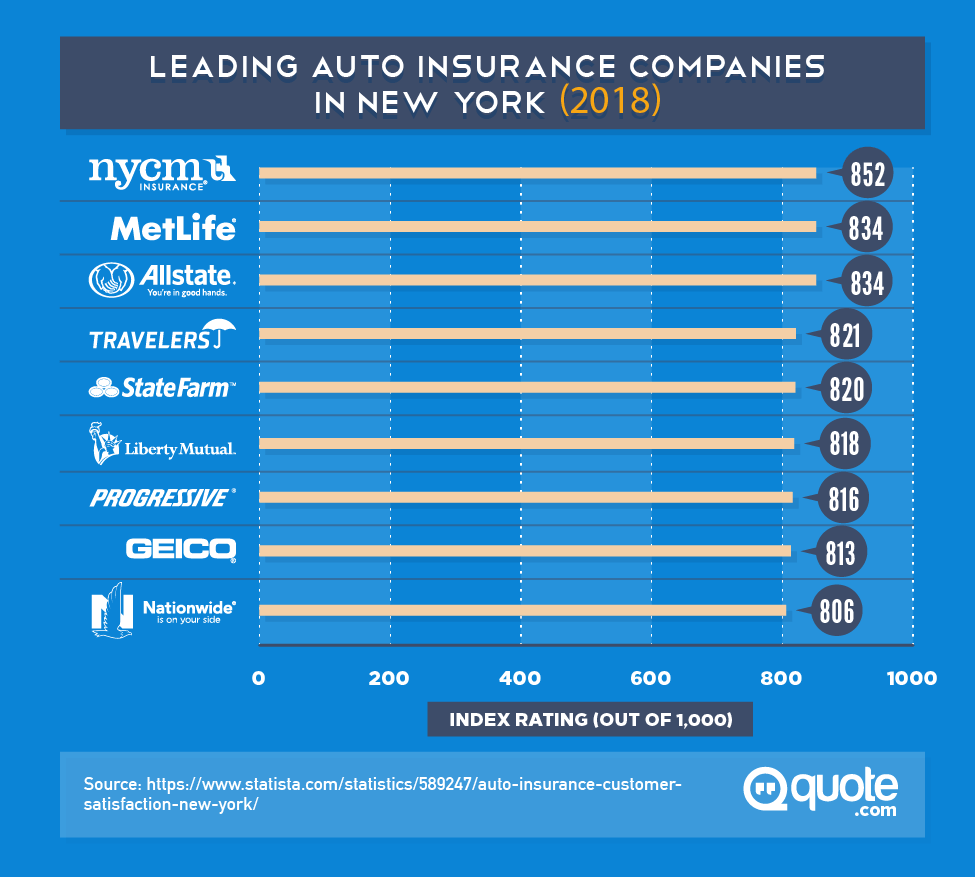

| Customer Service Ratings | Online reviews and ratings provide insights into the responsiveness and helpfulness of insurance representatives. | Positive ratings indicate potential for smoother claims processing and better customer support. |

| Claims Processing | Consider the efficiency and timeliness of claims processing. Companies with a reputation for quick and fair claims handling are preferable. | Avoid companies with a history of delays or complications in claim settlements. |

| Financial Strength | Assess the insurer’s financial stability, considering factors like their financial ratings and history. | A financially stable company is more likely to fulfill claims obligations. |

| Coverage Options | Compare the breadth and depth of coverage offered. | Thorough coverage protects your interests in various situations. |

Strategies for Finding Competitive Rates

Multiple strategies can help find competitive rates from multiple insurers. One strategy involves comparing quotes from various insurers online using dedicated comparison websites. These platforms allow you to input your details and receive instant quotes from multiple providers. Another strategy is to contact insurers directly, seeking quotes and discussing your specific needs. Bundling multiple policies, such as auto and home insurance, can often lead to discounted rates.

Negotiating with your current insurer for a better rate can also be a worthwhile strategy.

The Quote Process

Securing the best auto insurance quote involves a systematic approach. Understanding the process empowers you to make informed decisions and potentially save money. This section Artikels the key steps and methods for obtaining quotes, highlighting the importance of accurate information.The process of getting an auto insurance quote is straightforward, typically involving providing information about your vehicle, driving history, and personal details.

Different insurance providers employ various methods for obtaining quotes, allowing flexibility for customers. This detailed guide will help you navigate the quote process with confidence.

Step-by-Step Guide to Obtaining a Quote

This guide provides a structured approach to obtaining a quote, ensuring you cover all necessary aspects. Follow these steps for a smooth and efficient process:

- Gather Necessary Information: Compile details about your vehicle (year, make, model, mileage), driving history (accident records, violations), and personal information (age, location, driving experience). Accuracy is paramount.

- Select Insurance Providers: Research and identify reputable insurance providers in your area. Compare their offerings and coverage options.

- Obtain Quotes: Utilize various methods, such as online portals, phone calls, or in-person visits, to request quotes from selected providers. Be prepared to provide the gathered information accurately.

- Compare Quotes: Evaluate the quotes received, considering factors like premiums, coverage options, and deductibles. Look for value and coverage that aligns with your needs.

- Choose the Best Option: Select the quote that best meets your needs and budget. Consider the level of coverage and the premium cost.

Methods for Obtaining Quotes

Several methods exist for obtaining auto insurance quotes, offering flexibility and convenience. Choose the method that best suits your needs and time constraints.

- Online Quotes: Many insurance companies offer online quote generators on their websites. This is a convenient and quick way to get a preliminary estimate.

- Phone Quotes: Contacting an insurance agent directly via phone allows for personalized assistance and clarification of any questions.

- In-Person Quotes: Visiting an insurance agency in person provides an opportunity for a detailed discussion and tailored coverage options.

Online Quote Input Fields

Online quote forms are common, often featuring a standardized set of input fields. This table demonstrates the typical fields required:

| Field | Description |

|---|---|

| Vehicle Information | Year, make, model, VIN, mileage, and other vehicle details. |

| Driver Information | Age, gender, driving history (e.g., accidents, violations), and driving experience. |

| Coverage Preferences | Desired coverage types (e.g., liability, collision, comprehensive), deductibles, and other specific coverage requirements. |

| Location | Residential address and geographic location. |

| Payment Information | Contact details for processing payments. |

Importance of Accurate and Complete Information

Accurate and complete information is crucial during the quote process. Inaccurate details can lead to incorrect quotes, potentially affecting your insurance coverage or premiums. It is vital to provide precise information to ensure you receive an accurate representation of your insurance needs.

Online Tools and Resources

Numerous online tools and resources can help you get auto insurance quotes. These resources can streamline the process and provide comparative analyses.

- Comparison Websites: Dedicated websites facilitate comparisons of quotes from multiple insurance providers, allowing for a comprehensive overview.

- Insurance Calculators: Online calculators provide estimates based on specific input parameters, enabling users to gauge different coverage options.

- Insurance Provider Websites: Insurance company websites often provide direct quote access, streamlining the process.

Factors Affecting Insurance Costs

Getting the best auto insurance quote involves understanding the factors that influence premiums. These factors are not arbitrary but are carefully considered by insurance companies to assess risk and set appropriate rates. Knowing these elements allows you to proactively manage your costs and potentially secure a more favorable insurance plan.

Driving History

A driver’s past driving record significantly impacts insurance premiums. Accidents, traffic violations, and claims all contribute to a higher risk assessment by insurance companies. A clean driving record, free from major infractions, typically results in lower premiums. For example, a driver with a history of speeding tickets or accidents will likely pay more than a driver with a spotless record.

Vehicle Type

The type of vehicle you drive plays a crucial role in determining your insurance cost. High-performance sports cars, for example, often have higher premiums than sedans due to their perceived risk of accidents and higher repair costs. Vehicles with advanced safety features, like airbags and anti-lock brakes, might qualify for discounts, lowering the overall premium.

Location

Geographic location significantly influences auto insurance rates. Areas with higher crime rates, more traffic accidents, or harsh weather conditions generally have higher premiums. This is because insurance companies assess the risk of claims in specific locations. For instance, a driver in a region prone to severe storms might pay more for coverage compared to someone living in a more stable climate.

Discounts

Insurance companies offer various discounts to incentivize good driving habits and responsible ownership. Maximizing these discounts can lead to substantial savings on your premiums. Understanding and leveraging these discounts is a crucial step in obtaining the best possible auto insurance rate.

Common Discounts

- Safe Driving Discounts: These discounts reward drivers with clean driving records, demonstrating a lower likelihood of accidents. Drivers with accident-free records can often qualify for significant discounts.

- Multi-Policy Discounts: Insuring multiple vehicles or other types of insurance (home, life, etc.) with the same company can result in a discount. This is because insuring multiple policies with one company reduces administrative costs for the insurance provider.

- Defensive Driving Courses: Completing a defensive driving course demonstrates commitment to safe driving practices and can often lead to a reduction in premiums.

- Anti-theft Devices: Installing anti-theft devices in your vehicle can often qualify you for a discount, as these devices reduce the risk of theft.

- Good Student Discounts: Students with a good academic record often qualify for discounts. This reflects the insurance company’s assumption of a lower accident risk among responsible students.

Calculating Total Cost

Calculating the total cost of auto insurance involves understanding the different components of the premium. The base rate is calculated based on factors like driving history and vehicle type. Discounts, if applicable, are subtracted from the base rate. Additional coverage options, like comprehensive and collision, will add to the total cost. Deductibles also play a role, with higher deductibles often leading to lower premiums.

Total Cost = Base Rate – Discounts + Additional Coverages + Deductibles

For example, a driver with a clean record and a standard sedan in a low-accident area might pay a lower base rate, potentially receiving several discounts, resulting in a lower overall premium. On the other hand, a driver with a history of violations and a high-performance vehicle in a high-accident area would likely pay a significantly higher premium.

Additional Considerations

Securing the best auto insurance involves more than just comparing quotes. Understanding the nuances of your policy and responsible driving practices are crucial for long-term financial security and peace of mind. Thorough review of policy documents, knowledge of potential pitfalls, and proactive claim management are all vital components of a successful insurance strategy.A well-rounded approach to auto insurance involves proactive measures beyond simply selecting the lowest quote.

By understanding your policy’s specifics, you can anticipate potential issues and proactively mitigate risks. This proactive approach ensures you’re adequately prepared for unforeseen circumstances.

Understanding Policy Documents

Policy documents are the legal contract between you and your insurance provider. Carefully reviewing these documents is essential to ensure you understand the coverage, exclusions, and limitations. This will prevent surprises and ensure you’re fully protected under your chosen policy. A comprehensive understanding of your policy prevents misunderstandings and potential disputes later.

Key Elements to Look For in an Auto Insurance Policy

A thorough review of your auto insurance policy involves scrutinizing key elements. This includes examining the types of coverage included (liability, collision, comprehensive), deductibles, and policy limits. These factors directly impact your financial responsibilities and the extent of coverage. Understanding these aspects ensures your policy meets your specific needs and risk tolerance.

- Coverage Types: Liability coverage protects you from financial responsibility if you cause an accident. Collision coverage pays for damage to your vehicle regardless of who caused the accident. Comprehensive coverage handles damage caused by non-collision incidents (e.g., vandalism, theft, weather events). Thorough understanding of each coverage type is crucial.

- Deductibles: The deductible is the amount you pay out-of-pocket before your insurance kicks in. A higher deductible typically means lower premiums, but you’ll need to be prepared to pay more in the event of a claim.

- Policy Limits: These limits specify the maximum amount your insurance company will pay out for a claim. Understanding these limits helps ensure you’re adequately protected.

- Exclusions: Carefully review exclusions, as these are circumstances where your insurance may not apply. Understanding these exclusions prevents misunderstandings.

Common Pitfalls to Avoid

Navigating the auto insurance market involves avoiding certain pitfalls. These pitfalls can lead to unexpected financial burdens or inadequate coverage. Proactive research and a critical approach are key to avoiding these common traps.

- Ignoring Exclusions: Many policies exclude certain types of damage or situations, such as pre-existing conditions on a vehicle or specific types of activities. Failure to understand these exclusions could lead to denied claims.

- Failing to Read the Fine Print: Thorough review of the policy document is critical. Failing to do so can lead to gaps in coverage or hidden fees.

- Choosing the Cheapest Policy Without Considering Coverage: Focusing solely on the lowest premium without assessing the coverage provided can lead to inadequate protection.

Claim Filing and Dispute Resolution

Filing a claim and resolving disputes efficiently requires a systematic approach. Understanding the claim process and steps for resolving disputes is crucial. A clear understanding of the claim process and steps for resolving disputes can save you time and stress.

- Document Everything: Gather all relevant documentation, such as accident reports, witness statements, and repair estimates. This documentation is critical to a smooth claim process.

- Communicate with Your Insurance Company: Follow the procedures Artikeld by your insurance company for filing a claim. Prompt and clear communication is essential throughout the process.

- Seek Professional Assistance if Necessary: If you encounter difficulties in resolving a dispute, consider seeking assistance from a legal professional.

Maintaining a Good Driving Record

Maintaining a good driving record is essential for keeping your auto insurance rates low. Safe driving practices and a clean driving history are directly linked to lower insurance premiums. A clean driving record directly correlates with lower premiums.

- Avoid Accidents and Traffic Violations: Responsible driving practices are essential to maintain a clean driving record and avoid costly insurance premiums.

- Report All Accidents and Violations Immediately: Prompt reporting is essential for accurate record-keeping.

- Review Your Driving History Regularly: Regularly review your driving record to ensure accuracy and identify any potential issues.

Illustrative Examples

Getting the best auto insurance quote involves more than just finding the lowest price. Understanding the factors influencing costs and comparing quotes from various providers is crucial for making an informed decision. This section provides practical examples to help you navigate the process.

A User’s Journey

A young professional, Sarah, needs to renew her auto insurance policy. She currently pays $150 per month but wants to find a better deal. She starts by researching online and gathers quotes from different companies. After comparing policies and considering factors like her driving record and vehicle type, she selects a policy that offers similar coverage at a lower monthly premium.

This illustrates the proactive approach necessary to get the best possible deal.

Comparing Quotes

Comparing quotes from different insurance providers is essential to finding the best value. A table clearly displays the key aspects of each policy.

| Insurance Provider | Monthly Premium | Coverage Details | Deductibles |

|---|---|---|---|

| Acme Insurance | $125 | Comprehensive, collision, liability | $500 |

| Best Choice Insurance | $130 | Comprehensive, collision, liability, uninsured/underinsured | $1000 |

| Reliable Insurance | $115 | Comprehensive, collision, liability, roadside assistance | $500 |

This table showcases a simplified comparison. Actual quotes will vary based on individual circumstances. Note that coverage details, deductibles, and other aspects can influence the final cost.

Comprehensive Policy Example

A sample auto insurance policy Artikels the coverage, exclusions, and terms and conditions. This document clarifies the extent of protection and responsibilities for both the insurer and the policyholder.

Sample Policy Excerpt:”This policy provides liability coverage for bodily injury and property damage caused by an accident involving the insured vehicle. Comprehensive coverage protects against damage from perils like vandalism or fire. Exclusions include intentional acts of the insured. The policyholder is responsible for a deductible of $500 in case of a covered claim.”

This excerpt highlights key elements of a comprehensive policy. Full policy documents are legally binding contracts and should be reviewed carefully.

Calculating Total Cost

To calculate the total annual cost, consider the monthly premium. For example, if the monthly premium is $125, the annual cost is $125 x 12 = $1500. This calculation simplifies the process. Additional fees or taxes may be added to the premium.

Factors Influencing Cost

Various factors influence the total cost of an auto insurance policy. Driving record, vehicle type, location, and coverage options are key factors. For instance, a driver with a clean driving record will likely pay less than a driver with a history of accidents. A high-performance sports car may have a higher premium than a basic sedan.

- Driving Record: A clean driving record demonstrates responsible driving behavior, potentially resulting in lower premiums. A history of accidents or violations may lead to higher premiums.

- Vehicle Type: High-performance vehicles, luxury cars, and older vehicles are often associated with higher insurance premiums. This is because of factors like the potential for higher repair costs and the perceived risk.

- Location: Areas with higher rates of accidents or theft may have higher insurance premiums. The geographic location of the driver’s residence is a key factor.

- Coverage Options: Adding comprehensive or collision coverage will typically increase the premium. This extra protection is often necessary to cover damages not covered by liability insurance.

Ultimate Conclusion

In conclusion, securing the best auto insurance quote is a journey of informed decision-making. By understanding your needs, comparing providers, and utilizing available resources, you can confidently navigate the process. Remember, accurate information and careful consideration are key to achieving the best possible deal. Don’t hesitate to explore the FAQs below for further clarity on common issues.

Question & Answer Hub

What are the common pain points associated with the auto insurance quote process?

Many users find the quote process confusing due to the vast number of providers and options. Comparing quotes and understanding coverage details can be overwhelming, and the fear of making the wrong choice often leads to inaction. Inaccurate information provided during the quote process can also result in incorrect pricing or coverage gaps.

How can I find hidden discounts on auto insurance?

Many insurance providers offer hidden discounts for things like bundling policies or maintaining a good driving record. Actively researching and contacting providers directly, rather than relying solely on comparison websites, can uncover these opportunities. Review your policy documents carefully to identify any potential discounts.

What is the significance of a good driving record in auto insurance?

A clean driving record is often a significant factor in determining insurance premiums. Accidents and violations directly impact your rates. Maintaining a good record demonstrates responsible driving habits, which insurers often reward with lower premiums.

How do I calculate the total cost of auto insurance?

Calculating the total cost involves considering the base premium, deductibles, and any applicable discounts. Review your policy documents and use online calculators to obtain a precise estimate of the overall cost. Don’t forget to factor in any potential increases or decreases due to factors like location changes or vehicle modifications.