Finding the best insurance rates can feel like navigating a maze, but this guide simplifies the process. We’ll explore various insurance types, dissect the factors influencing rates, and provide practical strategies for securing the most competitive premiums.

From understanding different coverage options to utilizing comparison tools effectively, we’ll equip you with the knowledge to make informed decisions. This detailed look at insurance rates will help you confidently compare quotes and choose the best plan for your needs.

Factors Affecting Insurance Rates

Insurance premiums are not a fixed amount; they are dynamically adjusted based on a variety of factors. Understanding these influences allows individuals to make informed decisions about their coverage and potentially reduce costs. These factors vary significantly across different insurance types, reflecting the unique risks associated with each.Insurance companies meticulously analyze these factors to determine the appropriate risk level for each policyholder.

By evaluating these elements, they can assess the likelihood of claims and establish premiums that are both fair to policyholders and sustainable for the company.

Driving Record

A driver’s history significantly impacts auto insurance premiums. Traffic violations and accidents directly affect the risk assessment. Poor driving records are associated with a higher probability of future claims, which in turn necessitates higher premiums to compensate for the increased risk. This is a crucial factor for insurers to calculate the overall risk profile of a policyholder.

Vehicle Type

The type of vehicle also influences insurance costs. High-performance vehicles, particularly those with a high horsepower rating, are often associated with a higher risk of accidents and damage. Insurance companies adjust premiums based on the vehicle’s inherent characteristics and potential for claims. This reflects the fact that more expensive vehicles typically have a higher potential for loss and damage.

Vehicle Use

The intended use of a vehicle plays a vital role in insurance pricing. Commercial vehicles, used for business purposes, face a greater risk of accidents and damage compared to personal vehicles. Insurers often differentiate premiums based on the anticipated usage of the vehicle, reflecting the varied levels of risk associated with different operational contexts. This is often reflected in higher premiums for commercial use.

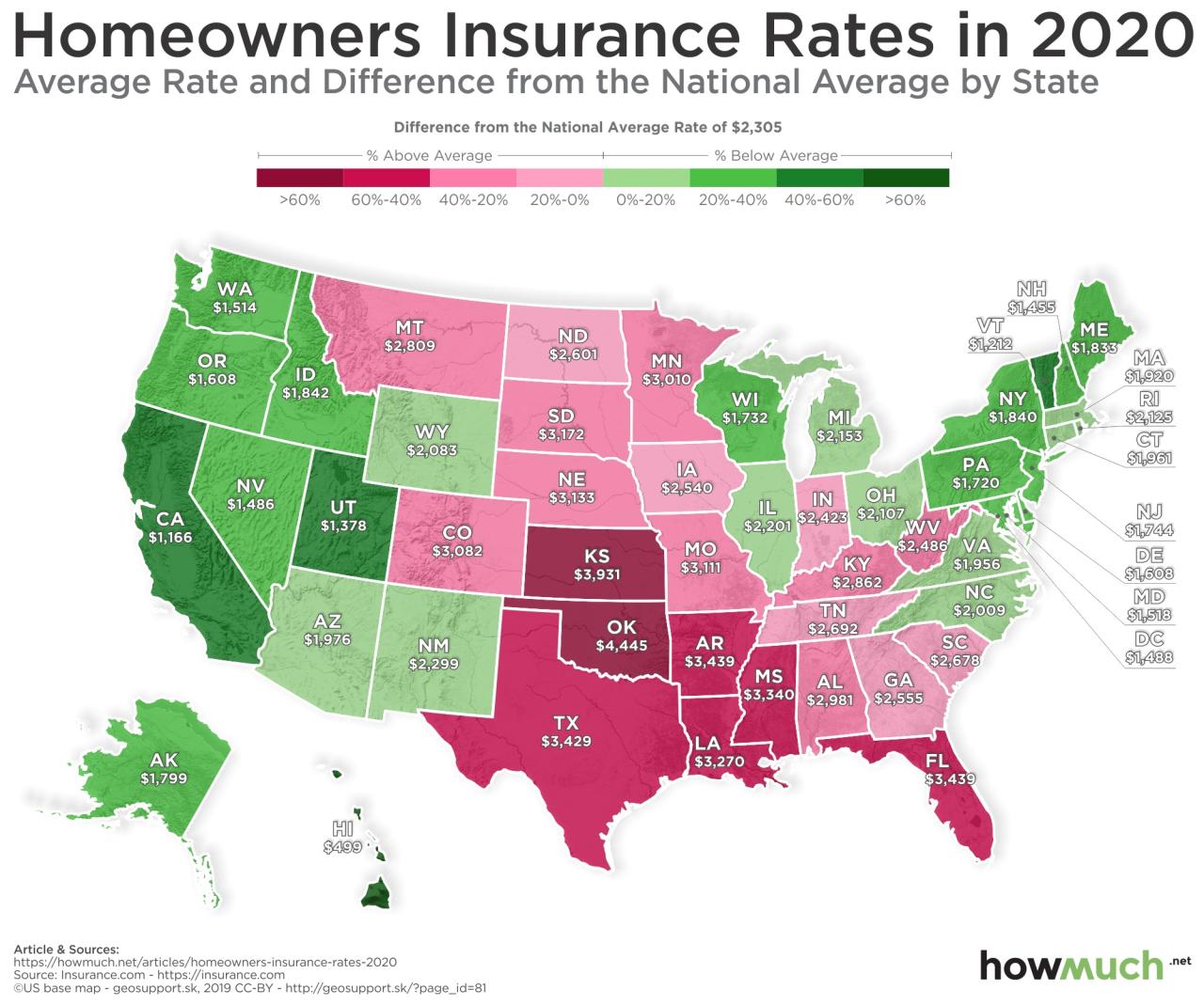

Location

Geographic location is another influential factor. Areas with higher crime rates or accident concentrations often have higher insurance premiums. Insurance companies assess these factors to determine the specific risks associated with a particular region. This directly correlates to the overall claim frequency and severity within a specific area.

Age and Gender

Insurers consider the age and gender of the driver when setting premiums. Statistical data indicates that certain demographics have higher claim frequencies. This is used to assess the risk profile of a driver and, accordingly, adjust the premiums. This data-driven approach allows for more equitable and accurate risk assessment.

Credit History

In some cases, credit history is considered when determining insurance premiums. Poor credit scores are sometimes associated with higher risk-taking behaviors. Insurance companies might view this as an indicator of a higher likelihood of making claims. This practice is not universally applied and can vary considerably depending on the insurance provider.

Age and Usage of the Car

The age and usage of the vehicle directly impact insurance rates. Newer, more advanced vehicles, while generally safer, may attract higher premiums initially due to higher replacement costs. Conversely, older vehicles, particularly those with known mechanical issues, could also lead to higher premiums.

Table: Impact of Factors on Auto Insurance Rates

| Factor | Description | Impact on Rate |

|---|---|---|

| Driving record | Traffic violations, accidents | Higher for poor records |

| Vehicle type | Performance, horsepower | Higher for high-performance vehicles |

| Vehicle use | Commercial vs. personal | Higher for commercial vehicles |

| Location | Crime rates, accident concentration | Higher in high-risk areas |

| Age and gender | Statistical data on claims | Premiums vary based on age and gender |

| Credit history | Financial responsibility | Potentially higher for poor credit scores |

| Vehicle age | Vehicle condition, replacement cost | Higher for older or high-risk vehicles |

| Usage frequency | Daily mileage, distance driven | Potentially higher for vehicles used extensively |

Finding Best Rates

Securing the most favorable insurance rates is a crucial aspect of responsible financial planning. Understanding various comparison methods empowers you to make informed decisions and potentially save money. This section details effective strategies for comparing insurance quotes, guiding you toward the most suitable coverage at the most competitive price.

Comparison Methods

Various methods are available for comparing insurance quotes. Directly contacting multiple insurers is a traditional approach, but it can be time-consuming. Alternatively, online comparison tools offer a streamlined way to assess various policies and rates from multiple providers simultaneously.

Online Comparison Tools

Online comparison tools are valuable resources for comparing insurance quotes. These platforms aggregate quotes from multiple insurers, enabling you to compare coverage options and rates conveniently.

- Insure.com: This site facilitates comprehensive comparisons across various insurance types, from auto to homeowners, allowing users to refine searches by location and specific needs. It provides a user-friendly interface for navigating and comparing options.

- Policygenius: This platform is known for its user-friendly interface and comprehensive policy options. It allows users to input their details to generate customized quotes from multiple insurance providers.

- NerdWallet: A popular personal finance website, NerdWallet also offers an insurance comparison tool. It provides detailed information about each policy and insurer, facilitating informed decision-making.

Using Comparison Tools Effectively

Utilizing comparison tools effectively involves a structured approach. A well-organized process ensures you receive the most pertinent information for your specific needs.

- Specify Your Needs: Define the type of insurance and desired coverage. Clearly outlining your requirements ensures you receive quotes that precisely match your needs, avoiding irrelevant or unsuitable options.

- Provide Accurate Information: Input accurate and complete details about your circumstances, including vehicle information (for auto insurance) or property characteristics (for homeowners insurance). Inaccurate information can lead to inaccurate quotes and ultimately less-than-optimal choices.

- Compare Multiple Quotes: Thoroughly review quotes from multiple insurers. Pay close attention to coverage details, premiums, and any associated fees. Comparing multiple quotes is crucial to identify the most favorable options.

- Review Fine Print: Carefully review the fine print of each policy before making a decision. Understanding the terms and conditions of the insurance policy is vital for making an informed choice.

- Contact Insurers Directly: If needed, contact insurers directly to clarify any uncertainties or obtain further information regarding specific aspects of the policies.

Step-by-Step Guide

The following steps detail a comprehensive approach to comparing insurance quotes.

- Identify Your Needs: Determine the types of insurance coverage you require (auto, homeowners, life, etc.). Consider your individual circumstances and potential risks.

- Gather Information: Compile necessary information, including your vehicle details, home address, and personal details.

- Use Comparison Tools: Utilize online comparison tools to obtain quotes from various insurers.

- Analyze Quotes: Carefully review the quotes, paying attention to premiums, coverage details, and additional fees.

- Contact Insurers: If necessary, contact insurers directly to clarify any aspects or obtain further information.

- Make Your Decision: Select the policy that best meets your needs and budget.

Strategies for Lower Rates

Reducing insurance premiums often involves a combination of proactive steps and informed choices. Understanding the factors that influence your rates is the first step. By implementing these strategies, individuals can potentially lower their insurance costs, making insurance more affordable and accessible.Insurance companies often consider various factors when setting premiums, including driving history, location, and the type of coverage selected.

These strategies focus on modifying these factors in ways that can lead to more favorable rates.

Improving Driving Records

Maintaining a clean driving record is crucial for securing lower auto insurance rates. This involves avoiding traffic violations and accidents. Insurance companies frequently reward safe driving habits, often through discounts for defensive driving courses, or for accident-free periods.

- Defensive Driving Courses: Completing a defensive driving course can demonstrate a commitment to safe driving practices, potentially leading to a reduction in premiums. These courses equip drivers with techniques to anticipate and avoid hazardous situations, contributing to safer driving habits and a reduced risk of accidents.

- Accident-Free Driving: A consistent history of accident-free driving is a strong indicator of responsible behavior. Insurance companies typically offer discounts for drivers with prolonged periods of safe driving, recognizing the reduced risk associated with such behavior.

Choosing the Right Coverage

Selecting the right coverage for your needs is essential for managing insurance costs. Comprehensive coverage might offer more protection, but it also comes with higher premiums. Careful consideration of your specific circumstances and needs can help you tailor your coverage to fit your budget and risk profile.

- Liability-Only Coverage: If your financial situation limits the need for extensive coverage, liability-only coverage might suffice. This coverage protects you from financial responsibility if you’re involved in an accident that leads to harm or property damage to others, but it does not provide protection for your own vehicle or possessions. This approach can significantly lower your premium.

- Deductibles: Higher deductibles can lead to lower premiums. A higher deductible means you’ll pay more out-of-pocket in the event of a claim, but it reduces the cost of the insurance itself. The appropriate deductible depends on your financial ability and risk tolerance.

Bundling Insurance Policies

Bundling multiple insurance policies, such as auto, homeowners, and renters insurance, with the same provider can sometimes lead to discounted rates. This strategy leverages the relationship between multiple insurance products and provides a bundled discount that can potentially lower overall insurance costs.

- Multiple Policies with One Provider: Consolidating your various insurance needs with a single provider often allows for bundled discounts, reducing the overall premium for all policies. This can be an effective way to save money on your insurance expenses.

Understanding Discounts

Many insurance companies offer discounts for various factors, including having a good credit score, installing safety features in your vehicle, or being a student. By taking advantage of these discounts, individuals can significantly reduce their insurance costs.

- Discounts for Safety Features: Vehicles equipped with safety features like anti-theft devices or airbags may qualify for discounts. These discounts are based on the reduced risk associated with these features, reflecting the enhanced protection for the vehicle and its occupants.

- Student Discounts: Insurance companies often provide student discounts, recognizing the lower risk profile associated with young drivers who are actively participating in educational pursuits. This is a common practice for auto insurance, specifically.

Comparing Insurance Quotes

Shopping around for quotes from different insurance providers is crucial. Comparing quotes from multiple companies allows you to identify the best possible rates. This process can help you find policies that meet your needs and fit your budget.

- Multiple Quotes from Different Providers: Obtaining quotes from various insurance providers provides a comprehensive comparison of rates and coverage options. This process enables individuals to identify the most favorable insurance package, potentially reducing their overall premium.

Insurance Quotes and Offers

Securing the best insurance rates involves more than just comparing prices. Understanding how quotes are generated and the various offers available is crucial for making an informed decision. This section will detail the process of obtaining accurate quotes, highlight common offers and discounts, and emphasize the importance of thorough policy review.

Obtaining Accurate Insurance Quotes

Insurance quotes are personalized estimations of the cost of coverage based on individual circumstances. Factors like driving record, vehicle type, location, and desired coverage levels all play a role. To obtain accurate quotes, prospective policyholders should provide complete and truthful information to the insurance provider. Using online quote comparison tools is a practical first step, but it’s important to verify the accuracy of the information presented and compare multiple quotes from different providers.

A phone call or visit to an insurance agent can offer further clarity and personalized recommendations, which may lead to a more tailored policy and better understanding of potential discounts. Remember, comparing quotes across different providers ensures you’re getting the best possible deal.

Common Insurance Offers and Discounts

Numerous offers and discounts are available to reduce insurance premiums. These incentives often target specific lifestyles or situations. Discounts are typically offered for safe driving habits, accident-free periods, or for bundling multiple policies. Insurance providers frequently advertise bundled discounts for combining auto, home, or life insurance policies. Furthermore, loyalty programs or discounts for students or seniors are also quite common.

Discounts for usage-based insurance programs based on driving behavior are becoming increasingly popular. These programs reward safe driving with lower premiums.

Reading Policy Details Carefully

A critical step in securing insurance is carefully reviewing the policy details. The policy document Artikels the specific coverage, exclusions, and terms and conditions. This careful review is essential for understanding the exact scope of coverage and avoiding surprises or misunderstandings in the event of a claim. Prospective policyholders should thoroughly examine all policy details, including limitations and exclusions.

This diligence will ensure the policy aligns with their needs and expectations.

Common Discounts and Promotions

| Discount Type | Description | Example |

|---|---|---|

| Bundling | Combining multiple policies (e.g., auto and home insurance) | Bundling auto and home insurance policies with the same provider can lead to substantial savings. |

| Safe Driving | Discounts for accident-free driving records | Insurance providers often reward drivers with clean records with lower premiums. |

| Usage-Based Insurance | Discounts based on driving behavior (e.g., telematics programs) | Usage-based programs, often using telematics, monitor driving habits to reward safe drivers with lower rates. |

| Loyalty Programs | Discounts for customers who have remained loyal to the insurance company | Long-term customers may qualify for loyalty discounts. |

| Student/Senior Discounts | Discounts for students or senior citizens | Students and seniors often qualify for discounts on insurance policies. |

Online Insurance Comparison Tools

Online comparison tools have revolutionized the insurance shopping experience, empowering consumers to easily evaluate different policies and find the best rates. These tools provide a centralized platform for comparing various insurance options, saving time and effort in a sometimes complex process.These tools streamline the process of finding suitable insurance coverage. They typically collect information from multiple insurers, allowing users to compare policies based on their specific needs and circumstances.

This aggregation of data enables users to make well-informed decisions, ultimately leading to potentially better financial outcomes.

Functionality of Comparison Tools

These tools function by collecting data from multiple insurance providers and presenting it in a user-friendly format. Users input their desired coverage details, such as location, vehicle type, or desired benefits, and the tool returns a comparative analysis of policies from different companies. This process is often automated, facilitating a quick and efficient comparison.

Features Offered by Comparison Tools

A comprehensive comparison tool typically offers several key features:

- Customizable Search Filters: Users can specify criteria such as location, coverage types, desired benefits, and specific policy details. This allows users to narrow their search to policies that align with their precise needs and preferences.

- Detailed Policy Comparison: Tools present a side-by-side comparison of policies, highlighting key aspects like premiums, deductibles, coverage limits, and additional benefits. This enables a direct comparison of various policy offerings.

- Multiple Insurance Providers: These tools typically aggregate data from a wide range of insurance providers, providing a broader perspective on available options. This ensures users aren’t limited to just a few companies, which would lead to a less comprehensive overview.

- Estimated Costs: The tools often calculate and display estimated premiums, helping users understand the potential financial impact of different policies. This allows users to quickly estimate the total cost and tailor their selection to fit their budget.

- User Profiles: Some tools allow users to create profiles, saving their preferences and search history for future use. This feature saves time by recalling previous searches, and allows users to revisit previous searches easily.

Visual Representation of a Comparison Tool

Imagine a user needing car insurance in California. They access an online comparison tool and enter their vehicle details, desired coverage, and location. The tool then retrieves policy options from multiple insurers, presenting them in a table format. The table displays each policy’s premium, deductible, coverage limits, and other relevant details. The user can sort and filter the results based on specific criteria, allowing them to quickly identify policies that best meet their needs.

| Insurance Company | Premium | Deductible | Coverage Limit |

|---|---|---|---|

| Company A | $1500 | $500 | $100,000 |

| Company B | $1200 | $1000 | $150,000 |

| Company C | $1800 | $250 | $50,000 |

Limitations of Online Tools

While online comparison tools are invaluable, relying solely on them has limitations:

- Hidden Costs: Some policies may include hidden fees or stipulations not immediately apparent in the comparison. These factors might only be clear after a detailed review of the full policy documents.

- Agent Expertise: A licensed insurance agent can offer personalized advice and provide a deeper understanding of specific policies. Tools can’t replicate the nuanced knowledge and experience of an expert.

- Policy Fine Print: Online tools might not completely capture the complexities of every policy’s fine print. The full details are essential for making informed decisions, and some aspects might not be easily accessible through the tools.

- Unreliable Information: The accuracy of the information presented depends on the reliability of the data provided by the insurance companies. Inaccurate information can lead to flawed comparisons and potentially suboptimal choices.

Insurance Coverage Options

Insurance policies offer varying degrees of protection, and understanding the available coverage options is crucial for making informed decisions. Choosing the right coverage level ensures you’re adequately protected while avoiding unnecessary premiums. Different policies cater to unique needs, and the appropriate level of coverage often depends on factors like your assets, risk tolerance, and financial situation.

Types of Home Insurance Coverage

Understanding the different types of coverage available for your home is essential for comprehensive protection. Various options exist to safeguard your property against various risks. Each coverage type offers a unique set of benefits and drawbacks.

- Basic Coverage: This option typically covers the structure of your home, including the walls, roof, and foundation. It provides the most fundamental level of protection against perils like fire, windstorms, and hail. It’s often the most affordable option, but the protection it offers is limited. It might not cover all damages, especially those stemming from unforeseen circumstances.

- Broad Form Coverage: Expanding on basic coverage, broad form policies typically include additional perils like vandalism, theft, and falling objects. This option provides a wider range of protection compared to basic coverage, but costs more. The increased coverage may still have limitations, depending on the specific policy.

- Comprehensive Coverage: This is the most extensive form of home insurance. It covers a broad spectrum of perils, including not only those in basic and broad form coverage, but also more unusual or unforeseen events like water damage from burst pipes, or damage from tree branches falling on your home. While it offers the most protection, it also comes with the highest premiums.

Consider your specific needs and risks when deciding on this level of coverage.

Comparing Coverage Options for Home Insurance

The choice of coverage depends heavily on individual needs and circumstances. The table below highlights the advantages and disadvantages of each option, allowing for a comparative analysis.

| Coverage Option | Description | Pros | Cons |

|---|---|---|---|

| Basic | Covers the structure of the dwelling against fire, wind, and hail. | Affordable; Provides fundamental protection. | Limited protection; Doesn’t cover many perils like theft, vandalism, or water damage. |

| Broad Form | Expands on basic coverage to include additional perils like vandalism, theft, and falling objects. | Provides more comprehensive protection than basic coverage. | Might still have limitations; Costs more than basic coverage. |

| Comprehensive | Covers a wide range of perils, including damage from unforeseen events, and extends protection beyond typical hazards. | Offers the most extensive protection; Covers a broader spectrum of risks. | Highest premiums; Might not cover every possible scenario. |

Factors to Consider When Choosing Coverage

Your personal situation and risk tolerance are crucial when selecting the appropriate coverage. Factors like your location (prone to certain disasters?), home value, and the presence of valuable items (jewelry, art) influence the optimal coverage level. A professional assessment can guide you toward a suitable policy.

Closing Notes

In conclusion, securing the best insurance rates involves understanding the nuances of different policies, evaluating various factors, and strategically leveraging available resources. This guide has provided a comprehensive overview of the process, enabling you to confidently navigate the world of insurance and find the most suitable coverage.

By understanding the factors influencing your rates and employing comparison tools effectively, you can significantly reduce your insurance costs and safeguard your financial well-being.

FAQ Explained

What are some common discounts available on insurance policies?

Bundling multiple policies (e.g., auto and home), having a good driving record, or installing safety features in your vehicle can often lead to discounts.

How can I effectively use online comparison tools?

Provide accurate information about your needs and preferences when using comparison tools. Compare quotes from multiple providers, carefully reviewing policy details before making a decision.

What are the limitations of relying solely on online comparison tools?

Online tools might not capture all the nuances of individual policies. It’s essential to contact insurance providers directly to fully understand the specifics of their offerings.

How do pre-existing medical conditions affect health insurance rates?

Pre-existing conditions can impact health insurance rates. Factors such as the nature and severity of the condition can influence premiums. Consult with an insurance provider for a personalized assessment.