Finding the best car insurance rates is a crucial step in managing your finances. This guide will take you through the essential aspects of the process, from understanding your needs to securing the most competitive quotes. It’s about more than just saving money; it’s about finding the right coverage for you and your circumstances.

We’ll delve into the factors influencing insurance premiums, explore various comparison methods, and provide practical tips for lowering your rates. Whether you’re a new driver, a seasoned veteran, or just looking to understand the nuances of car insurance, this resource is designed to empower you.

Understanding the Search Intent

People search for “find best car insurance rates” with a variety of motivations, primarily driven by a desire for affordability and protection. This search often reflects a need to manage costs effectively while ensuring adequate coverage in case of accidents or damage. Understanding the specific motivations behind these searches helps tailor the approach to provide useful and relevant information.

Typical Motivations and User Scenarios

Users searching for the “best” car insurance rates are often looking to save money on their premiums. This could be a result of a recent change in their driving record, a move to a new area, or simply a desire to compare options and find better value. For example, a young driver might be looking to reduce costs after receiving their license, while a homeowner might be searching for insurance that includes comprehensive coverage for their vehicle.

Furthermore, some users might be looking for specific types of coverage, like roadside assistance or rental car coverage, while others may be simply trying to find the best overall deal. Each user has their own particular circumstances and needs, which must be considered when providing assistance.

User Needs Associated with Affordable Car Insurance

Finding affordable car insurance is often a top priority for many users. This need can be particularly strong during economic hardship or when facing financial constraints. Budget-conscious individuals often prioritize low premiums, while others might prioritize comprehensive coverage. Users may have specific needs like insurance for a classic car or for a newly acquired vehicle, which affects their search criteria and desired policy features.

Different factors like the vehicle’s value, age, and model, as well as the driver’s history and location, all contribute to the premiums.

Types of Car Insurance Policies

Various types of car insurance policies exist, each with unique features and benefits. These policies can include liability insurance, which covers damages caused to others in an accident; collision insurance, which covers damages to the insured vehicle regardless of fault; comprehensive insurance, which covers damage to the insured vehicle from events other than collision (e.g., theft, vandalism, weather damage); and uninsured/underinsured motorist coverage, which protects against accidents caused by drivers without insurance or with insufficient coverage.

Understanding these different policy types helps users determine the most appropriate coverage for their needs.

Common Pain Points and Frustrations

Users often encounter difficulties navigating the complex world of car insurance comparisons. The sheer volume of options and the varying terminology used by different providers can be overwhelming. Finding a reliable comparison tool and understanding the nuances of different policies can be challenging. Users may also experience frustration due to a lack of transparency in pricing or difficulty in contacting customer service representatives.

These issues often lead to a less-than-optimal experience.

Factors Influencing Car Insurance Premiums

Several factors contribute to the cost of car insurance. These include the driver’s age, driving record, location, vehicle type, and claims history. For example, younger drivers often have higher premiums due to a higher risk profile. Geographic location also plays a significant role, as some areas have higher rates due to higher accident frequency or other factors.

The vehicle’s make, model, and value are also important determinants, with more expensive or high-performance vehicles typically having higher premiums. A clean driving record, on the other hand, often leads to lower premiums.

Online Tools and Resources for Comparing Quotes

Numerous online tools and resources are available to help compare car insurance quotes. These tools allow users to input their information and receive customized quotes from various providers. Some popular comparison websites provide detailed information on different policies and features, assisting users in making informed decisions. Using comparison websites can be a straightforward way to save money on car insurance.

These websites often allow for quick and efficient comparison of policies and rates.

Comparison Methods and Tools

Finding the best car insurance rates involves comparing quotes from various providers. This process can be streamlined by utilizing online comparison websites, which offer a convenient way to gather multiple quotes in a single search. This allows for a more informed decision-making process and potentially significant savings.

Comparing Online Car Insurance Comparison Websites

Online comparison websites are crucial for finding the best car insurance rates. Different websites cater to different needs and offer varying levels of features. Understanding their strengths and weaknesses is key to choosing the right platform.

| Website | Features | Pricing | Ease of Use | User Reviews |

|---|---|---|---|---|

| Insurify | Extensive coverage options, detailed policy breakdowns, and customer support. | Generally competitive, with potential for tailored discounts. | User-friendly interface, intuitive navigation. | Positive reviews highlight ease of use and transparency. |

| Policygenius | Wide range of insurance types, comprehensive comparison tools. | Often competitive, frequently updated pricing. | Straightforward navigation, clear presentation of options. | Good reviews focus on helpful customer service and clarity. |

| NerdWallet | Provides comprehensive financial advice and tools, alongside insurance comparisons. | Competitive rates, with a focus on transparency. | Easy-to-understand format, simple navigation. | Positive reviews appreciate the financial information combined with insurance comparisons. |

| QuoteWizard | Offers a large network of insurance providers, ensuring broad coverage options. | Competitive rates, often with quick quote generation. | Intuitive interface, user-friendly experience. | Positive reviews highlight the comprehensive selection and speed of the process. |

Factors to Consider When Selecting a Comparison Tool

Choosing the right comparison tool involves careful consideration of several key aspects. These factors ensure a seamless and efficient process for finding the most suitable car insurance plan.

- Coverage Options: Ensure the tool supports the specific coverage you require, including comprehensive, collision, liability, and other options. Some tools may not support specialized needs.

- Provider Network: Consider the breadth of insurance providers accessible through the tool. A wider network typically leads to more quotes and potentially better deals.

- Ease of Use: A user-friendly interface simplifies the process. Intuitive navigation and clear presentation of information are vital.

- User Reviews: Reading reviews from other users can provide valuable insights into the tool’s reliability and customer service.

Obtaining Multiple Quotes from Different Providers

Getting multiple quotes from various insurance providers is essential for finding the best possible rate. This involves utilizing online comparison websites or contacting providers directly.

To get the best rate, systematically compare quotes from multiple insurance providers. The comparison process should involve an in-depth analysis of each policy’s coverage and cost.

Using Comparison Websites Effectively

Effectively using comparison websites involves entering accurate information, including vehicle details, driving history, and personal information. Thoroughness and accuracy are crucial in getting precise and appropriate quotes.

Careful input of personal details, vehicle specifications, and driving history is key to obtaining accurate and suitable quotes.

Comparing Quotes Based on Specific Needs

Tailoring the comparison process to individual needs is crucial for obtaining the most suitable policy. Understanding specific requirements allows for a more focused and effective search.

- Young Drivers: Young drivers often face higher premiums. Look for discounts available to new drivers or those participating in driver education programs.

- Families: Families often require comprehensive coverage. Consider policies that provide adequate coverage for multiple drivers and potential liabilities.

- High-Risk Drivers: High-risk drivers may face higher premiums. Explore options such as defensive driving courses, which could potentially reduce premiums.

Online Tools and Resources

Various online tools and resources can aid in the process of finding the best car insurance rates. These tools offer convenience and support throughout the process.

- Insure.com: Provides comparisons and personalized recommendations.

- Policygenius: A comprehensive platform offering quotes and policy options.

- Insurify: Specializes in personalized quotes based on individual circumstances.

Factors Influencing Insurance Rates

Finding the best car insurance rates involves understanding the many factors that insurers consider. These factors are crucial for setting premiums, reflecting the risk associated with insuring different drivers and vehicles. Knowing these elements can help you shop more effectively and potentially secure a more favorable insurance policy.Insurance premiums are not static; they are influenced by a variety of factors, both controllable and uncontrollable.

Understanding these influences is essential to effectively manage your insurance costs. Factors such as driving history, vehicle type, location, and age all play significant roles in determining the cost of your policy.

Driving History

A clean driving record is a significant factor in securing lower insurance premiums. Accidents, traffic violations, and claims all contribute to a higher risk assessment by insurers. This is because a history of accidents or violations indicates a higher likelihood of future claims. A driver with a history of speeding tickets, for instance, may face higher premiums than a driver with a clean record.

Conversely, a driver with a consistently safe driving record can often secure a more competitive rate.

Vehicle Type

The type of vehicle you drive plays a crucial role in determining your insurance premium. Certain makes and models are statistically more prone to accidents or theft. High-performance sports cars, for example, often have higher premiums due to their perceived higher risk. Similarly, older vehicles might have higher premiums due to the potential for mechanical failures or lower safety features.

Conversely, smaller, economical cars are typically associated with lower premiums.

Location

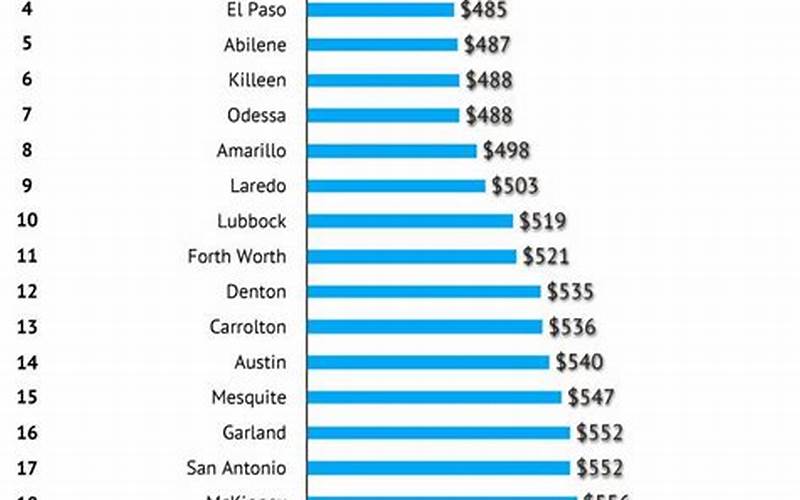

Geographic location significantly impacts insurance rates. Areas with higher crime rates or accident densities typically have higher premiums. This reflects the insurer’s assessment of the risk associated with insuring vehicles in those regions. Areas with more severe weather conditions, like areas prone to hurricanes or flooding, might also see increased premiums due to the potential for damages.

Conversely, areas with lower crime rates and fewer accidents often have lower premiums.

Age

A driver’s age is a critical factor in insurance rates. Younger drivers are often considered a higher risk due to inexperience and potentially higher accident rates. This leads to higher premiums for younger drivers compared to those with more experience. Conversely, older drivers with a long and safe driving history may see more favorable premiums. Insurers use statistical data to assess the risk associated with different age groups.

Driving Behaviors

Various driving behaviors directly impact insurance costs. Aggressive driving, such as speeding or reckless maneuvers, increases the risk of accidents, leading to higher premiums. Similarly, drivers who frequently use their vehicles for commercial purposes or for extended distances are often assessed as higher risks, and thus have higher premiums. Safe and responsible driving habits, on the other hand, can result in lower insurance premiums.

Car Makes and Models

Insurance rates vary across different car makes and models. Some vehicles are more prone to accidents or theft than others. Insurers use statistical data on accident rates, repair costs, and theft reports to establish premiums for different models. For example, a certain make and model of sports car might have a higher premium due to the higher likelihood of collisions or higher repair costs compared to a more compact vehicle.

Claims History

A claims history significantly affects insurance rates. Drivers with a history of filing claims for accidents or damages will likely face higher premiums. This is because insurers view a history of claims as a sign of a higher risk of future claims. This factor is crucial in assessing the risk associated with insuring a particular driver. Conversely, a driver with a clean claims history is likely to secure a lower premium.

Insurance Coverage Options

Different coverage options influence premiums. Comprehensive coverage, which protects against damages other than accidents, typically comes with a higher premium than liability-only coverage. Collision coverage, which protects against damages from accidents, is another factor that affects premiums. The more coverage included in a policy, the higher the premium is likely to be.

| Coverage Type | Description | Impact on Premium |

|---|---|---|

| Liability | Covers damages to others in an accident. | Generally lower premium |

| Collision | Covers damages to your vehicle in an accident. | Generally higher premium |

| Comprehensive | Covers damages to your vehicle from events other than accidents, such as theft or vandalism. | Generally higher premium |

| Uninsured/Underinsured Motorist | Covers damages if you are in an accident with an uninsured or underinsured driver. | Generally higher premium |

Tips and Strategies for Saving Money

Finding the best car insurance rates involves more than just comparing quotes. Implementing smart strategies can significantly reduce your premiums, saving you money in the long run. Understanding the factors influencing your rates, and taking proactive steps to manage them, is key to securing favorable terms.

Actionable Tips for Lowering Premiums

Various factors contribute to your car insurance premium, and you have control over some of them. Implementing the following tips can lead to substantial savings.

- Review your coverage needs: Ensure your current policy adequately covers your needs and assets. Unnecessary coverage can inflate premiums. A thorough review of your vehicle, personal circumstances, and lifestyle is recommended.

- Shop around regularly: Insurance rates fluctuate. Regularly comparing quotes from different providers can unearth substantial savings. Don’t be afraid to contact multiple insurers to secure the most competitive rates.

- Maintain a good driving record: Accidents and violations significantly impact premiums. Safe driving habits are paramount to maintaining low rates. Avoid speeding, reckless driving, and other risky behaviors.

- Increase your deductible: A higher deductible means a lower premium. Consider increasing your deductible if you’re comfortable with the financial responsibility. This can result in substantial savings on your monthly premiums.

Strategies for Negotiating Lower Rates

Insurance providers are often willing to negotiate. Proactive communication and a well-informed approach can lead to lower rates.

- Communicate with your insurer: Reach out to your insurance provider to discuss potential discounts or rate reductions. Highlight any positive changes in your driving record or lifestyle that might qualify you for a lower premium.

- Ask about discounts: Many insurers offer discounts for various reasons, such as bundling policies, safe driving programs, or anti-theft devices. Inquire about all applicable discounts to potentially lower your rates.

- Be prepared to provide documentation: Having documentation supporting any claims or changes to your driving record can strengthen your negotiation position. If you’ve recently completed a defensive driving course, provide the certificate to your insurance agent.

Importance of Bundling Insurance Policies

Bundling your insurance policies with the same provider can lead to significant savings.

Bundling your auto, homeowners, and life insurance with one company can often result in discounts.

- Reduced administrative costs: Insurance providers can reduce administrative overhead by handling multiple policies under one account.

- Customer loyalty incentives: Insurers often reward loyal customers with bundled policy discounts.

- Simplified management: Managing multiple policies with a single provider can streamline the process.

Maintaining a Good Driving Record

A clean driving record is crucial for securing favorable car insurance rates.

- Avoid traffic violations: Speeding tickets, reckless driving, and other traffic violations can significantly increase your insurance premiums.

- Practice safe driving habits: Adhering to traffic laws and practicing safe driving habits can help you maintain a clean driving record.

- Take defensive driving courses: Defensive driving courses can improve your driving skills and potentially reduce your insurance premiums.

Benefits of Using Available Discounts

Various programs offer discounts that can lower your car insurance premiums.

- Student discounts: Students with good academic records may qualify for student discounts.

- Safe driver programs: Participation in safe driving programs can earn discounts and potentially lower premiums.

- Anti-theft devices: Installing anti-theft devices on your vehicle can earn you discounts.

Monitoring and Comparing Insurance Rates Over Time

Regular monitoring and comparison of insurance rates are essential for securing the best possible deals.

- Use comparison websites: Dedicated websites allow you to compare quotes from multiple insurers.

- Track your rates: Monitor your rates over time to identify any changes or potential savings opportunities.

- Review your policy regularly: Ensure your policy remains suitable for your current needs and driving record.

Illustrative Examples and Scenarios

Understanding the factors that influence car insurance rates is crucial for finding the best possible deal. This section provides real-world examples to illustrate how various factors interact and impact premium costs. We’ll explore successful savings strategies, highlight the importance of policy review, and demonstrate when seeking a second opinion is worthwhile.

Impact of Different Factors on Insurance Costs

Various factors significantly affect car insurance premiums. Consider a hypothetical scenario involving two drivers, Sarah and David. Both live in the same city and drive similar vehicles, but their driving habits and profiles differ, leading to distinct insurance costs.Sarah, a young, recently licensed driver with a clean driving record, drives a small sedan. She lives in a low-crime area and has a comprehensive policy.

David, a middle-aged driver with a clean record, owns a larger SUV. He resides in a high-crime area and opted for a basic policy.

| Factor | Sarah’s Impact | David’s Impact |

|---|---|---|

| Age | Lower premium due to her age | Higher premium due to his age |

| Vehicle Type | Lower premium for the smaller sedan | Higher premium for the larger SUV |

| Driving Record | Lower premium due to a clean record | Lower premium due to a clean record |

| Location | Lower premium due to low crime rate | Higher premium due to high crime rate |

| Policy Type | Higher premium for comprehensive coverage | Lower premium for basic coverage |

The table demonstrates how different factors combine to create substantial cost variations. Sarah’s profile results in a significantly lower premium than David’s. The interplay of these elements underlines the complexity of car insurance pricing.

Case Study: Successful Premium Reduction

A user, Emily, successfully reduced her car insurance premiums by 15% through proactive steps. She reviewed her policy regularly and identified unnecessary add-ons. She also upgraded her vehicle’s anti-theft features and updated her profile to reflect a safer driving record.

Scenarios for Different Driver Profiles

Different driver profiles require tailored approaches to finding the best insurance rates.

- New Drivers: New drivers often face higher premiums due to their inexperience. They can benefit from discounts offered for defensive driving courses or by bundling their insurance with other policies. Consider adding an experienced driver to your policy.

- High-Risk Drivers: Drivers with a history of accidents or traffic violations will typically face higher premiums. Addressing the root cause of the high-risk profile, such as improving driving habits, may help. Considering a safety-focused driving course and installing safety equipment could help lower premiums.

- Young Drivers: Young drivers often face higher premiums due to perceived higher risk. This can be mitigated through defensive driving courses and maintaining a clean driving record. Adding a supervising driver to the policy can also be a way to lower premiums.

Importance of Policy Document Review

A crucial step in securing the best car insurance is reviewing policy documents carefully. Reading the fine print, understanding coverage limits, and recognizing any exclusions is paramount. Policies may include exclusions for specific situations or vehicles. Misunderstandings can lead to significant financial implications.

Policy Adjustment Scenarios

Policy adjustments are necessary when circumstances change.

- Moving to a new location: Insurance rates vary based on location. A change in location may necessitate a policy adjustment.

- Adding or removing drivers: Changes in the number of drivers covered by the policy can impact the premium. Removing a driver can reduce costs, while adding a driver can increase premiums.

- Vehicle upgrades: Modifying a vehicle, such as installing safety features or changing its model, might impact the premium. Safety features often correlate with lower insurance rates.

Obtaining a Second Opinion

Seeking a second opinion on insurance quotes is beneficial when considering significant changes to your policy or coverage. Comparing quotes from multiple providers can help you identify potential savings.

Policy Information and Structure

Understanding the specifics of your car insurance policy is crucial for making informed decisions and ensuring adequate protection. This section delves into the various types of policies, coverage options, add-ons, and the language used in these contracts. Knowing how different claims affect rates and how to interpret policy documents will empower you to manage your insurance effectively.

Types of Car Insurance Policies

Car insurance policies typically cover liability, collision, and comprehensive damage. Liability coverage protects you if you cause damage to another person’s vehicle or property. Collision coverage pays for damages to your vehicle regardless of who is at fault. Comprehensive coverage, on the other hand, compensates for damages resulting from events other than collisions, such as theft, vandalism, or natural disasters.

Different states have varying requirements for minimum liability coverage, so it’s essential to understand your state’s regulations.

Coverage Options

- Liability Coverage: This protects you if you’re responsible for harming someone else or their property while driving. It usually comes in bodily injury and property damage liability. Bodily injury covers medical expenses and lost wages for those injured in an accident you cause. Property damage covers repairs or replacements for damaged property.

- Collision Coverage: This covers damage to your vehicle if it’s involved in a collision, regardless of who’s at fault. It pays for repairs or replacement of your vehicle.

- Comprehensive Coverage: This covers damages to your vehicle from events other than collisions, such as vandalism, theft, fire, hail, or weather-related damage.

- Uninsured/Underinsured Motorist Coverage: This provides protection if you’re involved in an accident with a driver who doesn’t have insurance or whose insurance coverage is insufficient to cover the damages.

Add-ons and Extras

- Rental Reimbursement: Covers the cost of a rental vehicle if your car is damaged or totaled and unavailable for use.

- Towing and Labor Costs: Covers expenses associated with getting your vehicle towed to a repair shop.

- Roadside Assistance: Provides assistance for issues like flat tires, dead batteries, or lockout situations.

- Gap Insurance: Pays the difference between the actual cash value of your vehicle and the outstanding loan balance if your car is totaled.

Insurance Policy Terminology

- Deductible: The amount you pay out-of-pocket before your insurance company starts paying.

- Premium: The monthly or annual fee you pay for your insurance coverage.

- Claims Adjuster: The person who investigates and evaluates claims filed against your policy.

- Policy Period: The duration for which your insurance coverage is valid.

Types of Claims and Rate Impacts

- Minor Accidents: Often have minimal impact on insurance rates, as long as they don’t result in frequent claims.

- Major Accidents: Can significantly increase insurance premiums due to higher payouts and the potential for a negative driving record.

- Theft Claims: Can result in higher premiums depending on the frequency of theft in the area and the value of the stolen vehicle.

Interpreting Policy Documents

Carefully reviewing your policy documents is essential. Understanding the terms and conditions, coverage limits, and exclusions is crucial. Look for details on deductibles, premiums, and any add-on options. Contact your insurance provider if you have any questions or require clarification.

Closing Summary

In conclusion, finding the best car insurance rates involves careful consideration of your needs, a thorough comparison of quotes, and proactive measures to manage your premiums. This guide has equipped you with the knowledge and tools to navigate this process successfully. Remember to prioritize your needs and seek professional advice when necessary.

FAQ Summary

How can I find reputable car insurance comparison websites?

Look for websites with clear information about their methodology, user reviews, and transparency regarding fees. Check for industry accreditation or awards as well.

What are some common discounts offered by insurance providers?

Discounts often include those for safe driving records, bundling policies (like home and auto), anti-theft devices, and certain driver safety courses.

How does my driving history affect my insurance rates?

A clean driving record with no accidents or traffic violations typically results in lower premiums. However, even minor infractions can significantly impact your rate.

What if I have a high-risk driving profile?

High-risk drivers, such as those with a history of accidents or traffic violations, may find higher premiums. However, exploring options like specialized insurance providers can be beneficial.

How do I interpret car insurance policy documents?

If you’re unsure about a policy’s terms or conditions, seeking guidance from an insurance agent or professional can help in interpreting the details clearly.