Finding the cheapest home and auto insurance can feel like navigating a maze. Factors like your driving record, home security, and coverage choices all play a role. This comprehensive guide provides a roadmap to help you understand the process and find the best possible rates without sacrificing necessary protection.

We’ll explore reputable insurance providers, strategies for discounts, and how to compare coverage options. Understanding your needs and comparing quotes is key to securing the best deal, and we’ll equip you with the tools to do just that.

Introduction to Cheapest Home and Auto Insurance

Securing affordable home and auto insurance is crucial for financial security. It protects individuals and families from significant financial burdens in the event of unforeseen circumstances, such as accidents or property damage. A well-chosen policy can provide peace of mind, knowing that essential assets are protected.Understanding the factors influencing insurance costs is key to finding the most suitable and affordable coverage.

These factors can vary widely, impacting premiums in both the home and auto insurance markets. A comprehensive understanding of these influences empowers consumers to make informed decisions about their coverage options.

Factors Influencing Home Insurance Costs

Home insurance premiums are influenced by a variety of factors. Property characteristics, location, and risk assessments play a critical role. The value of the home, its construction materials, and its proximity to potential hazards like floods or wildfires directly affect the cost. Geographic location also significantly impacts rates, with areas prone to natural disasters experiencing higher premiums.

Insurance companies assess risk based on historical data and local conditions, making location a significant factor in premium calculation.

Factors Influencing Auto Insurance Costs

Auto insurance premiums are likewise influenced by several factors. Driving history, vehicle type, and location all play a significant role in determining the cost of coverage. A driver with a history of accidents or traffic violations will likely face higher premiums compared to a driver with a clean record. The type of vehicle, its value, and its features also contribute to the premium calculation.

Geographic location impacts rates as well, with areas with higher traffic density or higher accident rates often having higher premiums. Insurance companies assess risk based on statistical data and local conditions.

Common Misconceptions About Cheapest Insurance Options

There are several common misconceptions about the cheapest insurance options. One prevalent misconception is that the cheapest option always provides the least coverage. In reality, inadequate coverage can leave individuals vulnerable to significant financial losses in the event of a claim. Another common misconception is that discounts are always available. Discounts are often available, but they are not universally applicable and may vary significantly depending on the insurer and the policyholder’s profile.

Furthermore, consumers may mistakenly believe that purchasing insurance from a smaller, less-known company automatically translates to lower premiums, overlooking the potential risks of dealing with companies that lack financial stability.

Challenges Consumers Face in Finding Affordable Insurance

Consumers encounter various obstacles when seeking affordable insurance. One significant challenge is navigating the complexities of different coverage options and understanding the nuances of various policy provisions. Understanding the specific needs of one’s situation is crucial to choosing the appropriate coverage. Additionally, consumers may struggle to compare different insurance quotes from various providers. The sheer volume of options and the differences in policy terms can be overwhelming, making the comparison process difficult.

Finding a balance between coverage and affordability is a key challenge for many consumers.

Comparison of Different Insurance Coverage Types

| Coverage Type | Description | Potential Benefits | Potential Drawbacks |

|---|---|---|---|

| Basic Liability | Covers damages to others in the event of an accident. | Relatively low cost. | Provides limited protection for the policyholder’s assets. |

| Comprehensive | Covers damages to the insured’s property regardless of who is at fault. | Protects against a broader range of incidents, including theft, vandalism, and weather-related damage. | Can be more expensive than basic liability. |

| Collision | Covers damage to the insured’s vehicle in an accident, regardless of who is at fault. | Protects against damage to the insured’s vehicle. | Can be more expensive than liability-only coverage. |

This table illustrates the differences between various coverage types. Comparing the benefits and drawbacks allows for a more informed decision regarding the appropriate coverage needed. Each coverage type has its own set of considerations for policyholders.

Identifying Affordable Insurance Providers

Finding the most affordable home and auto insurance requires careful research and comparison. Different providers employ various strategies, and understanding these approaches is key to securing the best possible rates. This section will Artikel reputable insurance companies known for competitive pricing, analyze different provider models, and highlight factors influencing a company’s reputation. Ultimately, this knowledge empowers you to compare quotes effectively and make informed decisions.Identifying affordable insurance is a multi-faceted process that involves analyzing various factors beyond just price.

Reputable companies often demonstrate a commitment to customer satisfaction, financial stability, and transparent pricing. Understanding the different provider models and their strengths can also assist in the selection process.

Reputable Insurance Companies

Several insurance companies consistently receive positive feedback for their competitive pricing and customer service. These include established players with proven track records and often offer various discounts for specific situations, such as bundling home and auto policies or for safe driving habits. Companies known for competitive pricing often have clear and concise online platforms to compare rates and tailor coverage options.

Insurance Provider Models

Insurance providers utilize diverse models to serve customers. Direct insurers often have their own sales channels and claim processes, potentially offering lower administrative costs and streamlined customer interactions. Agency models, on the other hand, leverage local agents to build relationships and provide personalized service. This approach can be beneficial for complex situations or needs. Understanding the differences in models is essential when assessing which approach best fits individual circumstances.

Factors to Consider in Evaluating Reputation

Evaluating an insurance company’s reputation goes beyond just price. Financial strength ratings from independent organizations, such as A.M. Best or Standard & Poor’s, provide insights into the company’s stability and ability to meet future obligations. Customer reviews and ratings on independent platforms offer valuable perspectives on past experiences. The company’s history and longevity in the insurance industry are also crucial considerations.

These factors, combined with the company’s pricing strategies, contribute to a comprehensive assessment of its reputation.

Insurance Provider Comparison Table

This table presents a concise overview of several insurance providers, highlighting their key services. This is not an exhaustive list, but it illustrates the type of information to seek when comparing different companies.

| Insurance Provider | Service Type | Coverage Options | Customer Ratings |

|---|---|---|---|

| Company A | Home, Auto | Comprehensive, Liability | 4.5 out of 5 stars |

| Company B | Auto, renters | Collision, liability | 4.2 out of 5 stars |

| Company C | Home, renters, commercial | Property, liability, workers’ compensation | 4.7 out of 5 stars |

Comparing Insurance Quotes

Obtaining quotes from multiple providers is crucial for achieving the most affordable coverage. This process involves providing the same information about your home and vehicle, including details about the vehicles, location, and desired coverage levels. Comparing quotes side-by-side enables a precise evaluation of different prices and coverage options. Using comparison websites or dedicated tools facilitates this process.

Gathering and comparing quotes from multiple providers is a fundamental aspect of finding affordable insurance.

Strategies for Obtaining Lower Rates

Securing affordable home and auto insurance hinges on proactive strategies to minimize premiums. Understanding the factors insurers consider and implementing methods to leverage discounts can significantly reduce your overall insurance costs. This section Artikels various techniques for achieving lower rates.

Discount Opportunities

Many insurers offer discounts for a variety of factors, ranging from safe driving habits to specific lifestyle choices. By understanding these discounts and meeting the necessary requirements, you can potentially save a substantial amount on your premiums.

- Safe Driving Records: Insurance companies often reward drivers with clean driving records, such as those with a low accident history or involvement in traffic violations. This demonstrates responsible driving behavior, which is a significant factor in determining premiums.

- Defensive Driving Courses: Completing a defensive driving course can lead to lower premiums. These courses teach safe driving techniques and strategies, potentially improving your driving record and reducing your likelihood of accidents.

- Multiple Policies: Bundling your home and auto insurance with the same provider often leads to discounts. This approach can significantly reduce your overall insurance costs.

- Anti-theft Devices: Installing anti-theft devices in your vehicles or home security systems can reduce your premiums. The presence of these devices indicates an enhanced security measure, decreasing the risk of theft or damage.

- Home Security Systems: Similar to anti-theft devices, home security systems often qualify for discounts. This is a direct reflection of your commitment to preventing property damage or theft.

- Good Credit Score: While not always a direct discount, a good credit score often correlates with a lower insurance rate. Insurance companies view this as a sign of responsible financial management.

- Vehicle Features: Some insurers offer discounts for vehicles equipped with specific safety features, such as anti-lock brakes (ABS), airbags, or electronic stability control (ESC). These features demonstrably improve safety and reduce accident risk.

Leveraging Promotions and Offers

Insurance providers frequently run promotions and offers that can result in immediate discounts. Staying informed about these opportunities can save you money.

- Promotional Periods: Be on the lookout for promotional periods, such as discounts offered during specific times of the year, such as holidays or special events. Monitoring the insurer’s website and promotional emails can help you capitalize on these offers.

- Loyalty Programs: Some insurers have loyalty programs that reward long-term customers with discounts. These programs provide an incentive for maintaining a relationship with the insurer.

- Online Quotes: Comparing online quotes from various insurers is often a simple and effective way to identify promotional offers. This approach allows for a broad comparison of rates and discounts.

Impact of Driving Record

A clean driving record is a key factor in obtaining favorable insurance rates. Consistent safe driving behavior directly translates to lower premiums.

A driver with a clean record demonstrates a reduced risk of accidents, leading to lower insurance costs.

Comparing Insurance Quotes

Comparing quotes for different vehicles is crucial for finding the most competitive rate. A systematic approach helps in making informed decisions.

- Quote Aggregation Tools: Utilize online quote aggregation tools to compare quotes from multiple insurers. These tools gather quotes from various providers, streamlining the comparison process and allowing for a quick overview of different options.

- Specific Vehicle Details: Ensure accurate vehicle details are provided when requesting quotes. Providing the year, make, model, and specific features of the vehicle is essential for insurers to accurately assess the risk profile.

Common Insurance Discounts

A clear understanding of common discounts and their requirements can help you maximize savings.

| Discount Type | Description | Requirements |

|---|---|---|

| Safe Driver Discount | Discounts for drivers with a clean driving record | Low accident and violation history |

| Bundled Policies Discount | Discounts for combining multiple insurance policies (e.g., home and auto) | Multiple policies with the same provider |

| Anti-theft Device Discount | Discounts for installing anti-theft devices | Proof of installation of an approved device |

| Defensive Driving Course Discount | Discounts for completing a defensive driving course | Completion certificate from an accredited course |

Understanding Coverage Options and Costs

Choosing the right home and auto insurance coverage is crucial for financial protection. Different levels of coverage translate to varying premiums, and understanding the nuances of add-on options and deductibles is key to securing the best possible value for your money. This section will delve into the specifics of coverage options, costs, and their impact on your overall insurance budget.

Comparing Coverage Levels for Home and Auto Insurance

Different coverage levels for home and auto insurance correspond to varying degrees of protection. A higher level of coverage usually comes with a higher premium, but it also provides more comprehensive financial safeguards in the event of a claim. For example, a homeowner’s policy with higher liability limits will protect you from greater financial responsibility in the event of a claim.

Similarly, an auto policy with comprehensive coverage will offer protection against damage from perils like hail or vandalism, even if not caused by another driver.

Identifying the Value of Add-on Coverages

Add-on coverages can significantly enhance your insurance protection, but they also impact your premiums. Consider the value proposition of each add-on coverage. For instance, a flood insurance add-on to your homeowner’s policy is essential in flood-prone areas, but it will increase your monthly premium. Similarly, an umbrella liability policy can broaden your protection against claims far exceeding your primary policy limits, but it also comes with a premium increase.

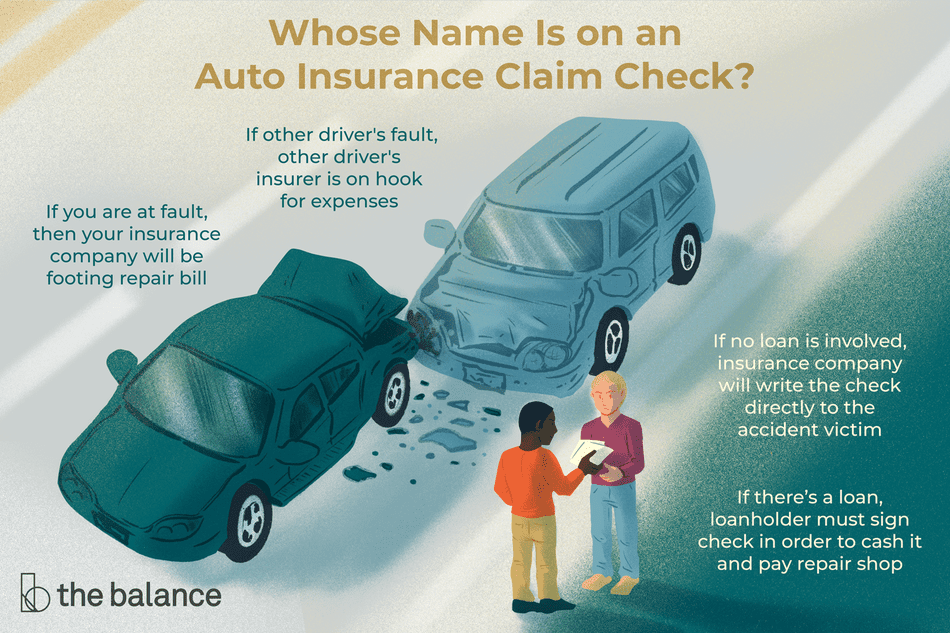

Comprehensive and Collision Coverage for Vehicles

Comprehensive and collision coverage are vital add-ons for your vehicle insurance. Comprehensive coverage protects against damage from perils like fire, vandalism, or theft, even if not caused by an accident. Collision coverage, on the other hand, covers damage to your vehicle resulting from an accident, regardless of who is at fault. Both are important to consider, as they can substantially reduce out-of-pocket expenses in the event of an accident or unforeseen damage.

Significance of Deductibles in Affecting the Final Cost

Deductibles play a significant role in determining the final cost of your insurance policy. A higher deductible will result in lower premiums, as the insurance company is assuming a larger portion of the risk. However, you will be responsible for paying the deductible amount if a claim is made. For example, a $1,000 deductible on a car insurance policy will mean you pay $1,000 upfront if you have an accident, but your premium will likely be lower than a policy with a $500 deductible.

Table of Coverage Options and Costs

| Coverage Option | Description | Typical Cost Impact (Example) |

|---|---|---|

| Homeowners Basic Liability | Covers legal liability for injuries or damages to others | Lower premium |

| Homeowners Comprehensive | Covers damages from perils like fire, hail, or vandalism | Higher premium |

| Auto Liability | Covers legal liability for injuries or damages to others in an accident | Lower premium |

| Auto Collision | Covers damage to your vehicle in an accident, regardless of fault | Higher premium |

| Auto Comprehensive | Covers damage to your vehicle from perils like fire, vandalism, or theft | Higher premium |

| Flood Insurance (Home) | Covers damages from flooding | Significant premium increase in flood-prone areas |

Analyzing Consumer Reviews and Testimonials

Consumer reviews and testimonials provide valuable insights into the experiences of policyholders with different insurance providers. Understanding these perspectives can significantly aid in making informed decisions, helping consumers choose the most suitable insurance plan for their needs. Reviews often highlight strengths and weaknesses of various companies, offering a glimpse into the quality of service and claims handling.Understanding customer experiences, as expressed through reviews, is crucial when evaluating insurance providers.

These reviews, often freely shared online, offer a direct window into the practical application of insurance policies, beyond the abstract terms and conditions. They provide firsthand accounts of the company’s responsiveness, transparency, and overall customer service.

Evaluating Credibility of Online Reviews

Reviews should not be taken at face value. Assessing the credibility of online reviews is paramount to making informed decisions. Look for reviews that include specific details, not just general praise or complaints. Genuine reviews tend to offer context, like the reason for the claim, the timeline of the process, and the specific staff member involved. Avoid reviews with overly exaggerated language or those lacking supporting evidence.

Checking for the reviewer’s history on other platforms, and looking for patterns in their feedback, can also help in determining the review’s credibility. A review from a verified customer, or one with a clear history of interaction with the company, carries more weight.

Organizing Customer Reviews into Categories

Categorizing reviews allows for a more structured analysis. Grouping reviews by aspect (e.g., customer service, claims handling, policy clarity, pricing) allows for a more focused understanding of the provider’s strengths and weaknesses. This structured approach aids in identifying trends and patterns in customer feedback. For example, consistently positive feedback in the “claims handling” category suggests a strong performance in this area.

- Customer Service: This category focuses on the responsiveness, helpfulness, and overall attitude of the insurance company’s representatives. Examples include prompt replies to inquiries, clear communication, and professional handling of concerns.

- Claims Handling: This category examines the efficiency and fairness of the claims process. It covers aspects like claim submission procedures, processing time, and the overall satisfaction with the resolution.

- Policy Clarity: This category addresses the comprehensibility and clarity of the insurance policies. Examples include easy-to-understand policy documents, clear explanations of coverage, and adequate communication about policy changes.

- Pricing: This category evaluates the affordability and competitiveness of the insurance premiums. It considers the value proposition of the policy in relation to the coverage offered.

Pros and Cons of Different Providers Based on Customer Feedback

A table summarizing the pros and cons of different insurance providers based on customer feedback can be extremely helpful. Such a table, organized by provider, highlights the key strengths and weaknesses based on compiled customer reviews, and assists in comparing different providers objectively.

| Insurance Provider | Pros (Based on Reviews) | Cons (Based on Reviews) |

|---|---|---|

| Company A | Excellent customer service, quick claim processing, transparent communication | Slightly higher premiums compared to competitors, some issues with policy clarity |

| Company B | Competitive pricing, user-friendly online platform | Slow claim processing, inconsistent customer service, complex policy documents |

| Company C | Wide range of coverage options, comprehensive policy details | Less responsive customer service, long wait times for claim resolution |

Keeping Insurance Costs Down Over Time

Maintaining affordable home and auto insurance premiums requires proactive measures over time. Consistent responsible behavior and strategic adjustments to coverage can significantly reduce your long-term insurance costs. This involves understanding the factors influencing premiums and adapting your approach accordingly.Effective strategies for long-term affordability encompass responsible driving habits, proactive home maintenance, adjusting coverage levels, and managing risk. By understanding these components, you can achieve and maintain lower insurance premiums over time.

Responsible Driving Practices

Driving safely and avoiding accidents is crucial for reducing auto insurance premiums. A clean driving record demonstrates responsible behavior, which insurance companies often reward with lower rates. This involves adhering to traffic laws, maintaining a safe following distance, and avoiding distractions like cell phone use while driving. Regular vehicle maintenance also contributes to accident prevention. Maintaining proper tire pressure and ensuring your vehicle is in good working order minimizes the risk of mechanical failures.

Home Maintenance and Security

Regular home maintenance and security measures can lower homeowners insurance premiums. Protecting your home from potential damage reduces the likelihood of claims. This includes routine inspections and repairs, maintaining a functional alarm system, and installing security measures. Keeping your roof in good condition, and promptly addressing any plumbing or electrical issues can all contribute to reducing your risk of costly repairs or damage.

Adjusting Coverage Levels

Insurance coverage should be tailored to your specific needs and circumstances. Over-insuring can lead to unnecessary premium payments. Reviewing your coverage needs periodically, and adjusting your coverage levels accordingly is essential for optimizing costs. This involves assessing your assets, evaluating potential risks, and ensuring you are not paying for unnecessary protection. Consider factors such as your home’s value, the contents within, and the likelihood of specific risks.

Managing Risk to Lower Premiums

Managing risk effectively plays a vital role in maintaining low insurance premiums. Identifying and mitigating potential risks in both your home and driving habits can result in substantial savings. Examples of risk management strategies include installing smoke detectors, maintaining good home security, and taking defensive driving courses. By implementing preventive measures, you actively decrease the chance of claims and maintain lower insurance costs.

Table of Actions for Maintaining Affordable Insurance

| Action | Benefit |

|---|---|

| Maintain a clean driving record | Lower auto insurance premiums |

| Regular vehicle maintenance | Reduced risk of mechanical failures and accidents |

| Regular home maintenance | Reduced risk of damage and lower claims frequency |

| Install and maintain a functional alarm system | Enhanced home security, potentially lower premiums |

| Review and adjust coverage levels periodically | Avoid over-insurance and optimize costs |

| Take defensive driving courses | Improve driving skills and potentially reduce auto insurance premiums |

| Manage potential risks in your daily life | Reduces the possibility of claims and maintain lower insurance costs |

End of Discussion

In conclusion, securing affordable home and auto insurance involves careful research, understanding your needs, and leveraging available discounts. By comparing quotes, evaluating provider reputations, and adjusting your coverage as necessary, you can significantly reduce your insurance costs while maintaining adequate protection. This guide has provided a structured approach to help you navigate this process, empowering you to make informed decisions that save you money.

Q&A

What are some common misconceptions about cheap insurance?

A common misconception is that cheaper insurance automatically means lower coverage. Often, lower premiums come with reduced coverage options. It’s crucial to weigh the coverage levels against your needs to avoid gaps in protection.

How can I compare quotes effectively from multiple providers?

Use online comparison tools. Enter your details, and the sites will provide quotes from various providers. Compare not just the premiums but also the coverage details and any associated fees.

What are some simple ways to lower my auto insurance rates?

Maintaining a good driving record is crucial. Consider defensive driving courses and explore any discounts offered by your insurer for good driving history. Also, consider the vehicle you drive.

What is the best way to handle a dispute with an insurance company?

Document everything thoroughly. Keep records of all communications, and if necessary, involve a third-party mediator or seek legal counsel. Maintain clear and organized records.