Finding the best car insurance can feel like navigating a maze. Fortunately, online comparison tools make it much easier. These websites aggregate quotes from various providers, allowing you to quickly compare coverage and pricing. This exploration delves into the key factors, from website features to data security, to help you choose the ideal platform for your needs.

Choosing the right car insurance can save you money and ensure your protection. This guide helps you understand the process of comparing quotes online, the crucial factors to consider, and the best ways to leverage online comparison tools.

Introduction to Online Car Insurance Comparison

Online platforms have revolutionized the way people shop for car insurance. These tools streamline the process, allowing users to compare quotes from multiple insurers in a fraction of the time it would take to visit each company’s website individually. This ease of access empowers consumers to make informed decisions, potentially saving money and finding a policy that better suits their needs.These comparison websites act as a central hub, collecting data from various insurance providers and presenting it in a user-friendly format.

This eliminates the need for extensive research and allows for a more efficient comparison of different policies, coverage options, and pricing structures. By leveraging technology, these platforms offer a more comprehensive and transparent approach to finding the right car insurance.

How Online Platforms Compare Car Insurance Quotes

Online car insurance comparison websites utilize sophisticated algorithms to collect and process data from multiple insurance providers. This data includes factors like the driver’s age, location, driving history, vehicle type, and desired coverage levels. The websites then use this information to generate tailored quotes from various insurers, allowing users to compare options side-by-side. This automated process saves time and effort, providing a comprehensive overview of available policies.

Benefits of Using Online Tools for Finding the Best Car Insurance

Utilizing online comparison tools offers several significant advantages. Consumers can easily compare quotes from different insurers, saving time and effort. The ease of use and transparency of these platforms empower informed decision-making, potentially leading to substantial savings on premiums. By accessing multiple quotes simultaneously, individuals can discover policies tailored to their specific needs and preferences, such as various coverage options and premium amounts.

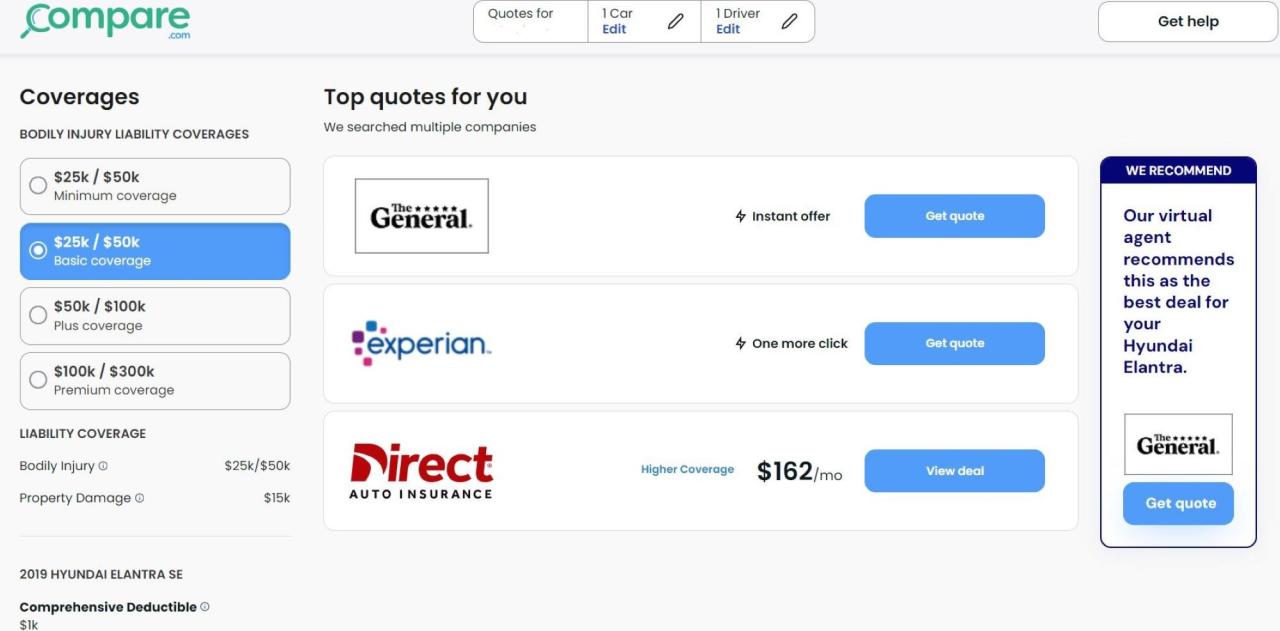

Typical Features and Functionalities of a Car Insurance Comparison Website

A typical car insurance comparison website offers a user-friendly interface for entering personal information and vehicle details. This information is crucial for generating accurate and relevant quotes. These websites typically present quotes in a clear and organized format, highlighting key features and differences between policies. Advanced features might include interactive tools for exploring different coverage options, detailed policy summaries, and the ability to save and compare quotes.

Furthermore, these websites often provide additional information regarding insurance regulations and terms, facilitating a better understanding of the insurance market.

Comparison of Different Car Insurance Comparison Websites

| Website Type | Features | Pricing Model | Target Audience |

|---|---|---|---|

| Large Aggregator | Extensive network of insurers, detailed policy comparisons, advanced search filters, comprehensive coverage options. | Often free to use, but may feature optional premium services or affiliate commissions. | Wide range of drivers, from young adults to experienced professionals, seeking competitive quotes and detailed policy comparisons. |

| Specialized Provider | Focuses on specific types of insurance or target audiences, like young drivers or specific vehicle types. May offer niche coverage options. | May charge a small fee for premium services, or operate on an affiliate model. | Drivers with particular needs, like young drivers, fleet owners, or drivers with specific vehicle requirements. |

| Direct Comparison Platform | Directly connects consumers with insurers, potentially offering better rates and faster processing times. | Often free to use, but some platforms might include a small fee for expedited services. | Drivers seeking the most competitive rates, focusing on direct interaction with insurance providers. |

Factors Influencing Car Insurance Premiums

Car insurance premiums aren’t a one-size-fits-all figure. Numerous factors play a role in determining the cost of your policy. Understanding these factors allows you to make informed decisions when comparing quotes and potentially lower your overall expenses. Comparison websites effectively utilize these factors to present tailored quotes.Comparison websites carefully consider various elements to calculate the most accurate premium for each individual driver.

They use sophisticated algorithms to evaluate numerous data points, ensuring that the displayed quotes are as precise as possible. These algorithms often use statistical models to correlate factors with risk levels.

Driving History

Driving history is a significant determinant of insurance premiums. A clean driving record, characterized by a lack of accidents or violations, generally translates to lower premiums. Conversely, drivers with a history of accidents or traffic violations face higher premiums. Insurance companies assess the frequency and severity of past incidents to establish the risk profile of a driver.

For instance, a driver with multiple speeding tickets might face a higher premium compared to a driver with no such infractions.

Vehicle Type

The type of vehicle significantly influences insurance premiums. Sports cars and high-performance vehicles are often associated with higher premiums due to their potential for more severe damage in accidents and the perceived higher risk of theft. Conversely, economical and smaller cars generally have lower premiums. Factors like the vehicle’s make, model, and year of manufacture play a crucial role in calculating the potential risk.

Location

Geographic location impacts car insurance costs. Areas with higher rates of theft, vandalism, or accidents typically have higher insurance premiums. For example, a driver in a city known for high-speed chases or frequent accidents might pay more than a driver in a rural area with a lower incidence of such incidents. Comparison websites take into account the local crime statistics and accident rates when providing quotes.

Insurance Coverage Options

The chosen insurance coverage options also influence premiums. Comprehensive coverage, which protects against damage caused by factors beyond accidents (such as vandalism or hail), typically results in higher premiums compared to policies with limited coverage. Similarly, the amount of liability coverage selected affects the premium. A higher liability limit often comes with a higher premium.

Table of Factors and Their Influence on Premiums

| Factor | Influence on Premiums (High/Medium/Low) | Example Impact |

|---|---|---|

| Driving History (Accidents/Violations) | High | Multiple accidents or violations lead to significantly higher premiums. |

| Vehicle Type (High-performance/Luxury) | High | Sports cars and luxury vehicles often have higher premiums. |

| Location (High-crime Area) | High | Areas with high theft or accident rates have higher premiums. |

| Coverage Options (Comprehensive) | Medium | Comprehensive coverage, protecting against various damages, usually increases premiums. |

| Coverage Options (Liability Limit) | Medium | Higher liability limits typically result in higher premiums. |

Evaluating Website User Experience

A crucial aspect of choosing the best car insurance comparison website is its user experience. A well-designed interface simplifies the quote comparison process, saving users time and frustration. A positive user experience encourages repeat visits and fosters trust in the platform.A user-friendly website is more than just visually appealing; it requires intuitive navigation, clear information presentation, and efficient functionality.

This ensures that users can easily find the information they need, compare quotes effectively, and ultimately select the best insurance option.

Essential Features for a User-Friendly Interface

A user-friendly interface is paramount for a successful online car insurance comparison website. Key features that contribute to this include a clean and uncluttered design, easy-to-understand navigation, clear explanations of different coverage options, and the ability to save progress. Users should not be overwhelmed with excessive information or complicated processes. The design should prioritize clarity and simplicity, making the site enjoyable and straightforward to use.

Analyzing Website Navigation

A structured approach to analyzing website navigation is essential. This involves assessing the site’s architecture, identifying the logical flow of information, and evaluating the efficiency of the navigation system. A user should be able to quickly and easily find the desired information without getting lost in a maze of sub-pages. A well-structured website allows users to easily access relevant pages through clear menus and intuitive links.

Elements Contributing to a Positive User Experience

Several elements contribute to a positive user experience. A responsive design, which adapts to different devices, is critical for accessibility. Clear and concise language avoids jargon and ensures that users understand the terms and conditions. Fast loading speeds are paramount, as slow performance can frustrate users. Effective search functionality enables users to quickly find specific information or options.

Security and privacy assurances build trust, crucial for a website handling sensitive financial data.

Key Aspects of a User-Friendly Interface

Key aspects of a user-friendly interface include intuitive navigation, clear presentation of information, and the ability to easily save and retrieve progress. This includes visually appealing layouts, easily navigable menus, clear explanations of insurance terms, and a smooth user journey from start to finish. These features enhance user satisfaction and contribute to a positive experience.

Table of Essential Aspects of User Experience

| Aspect | Description | Example |

|---|---|---|

| Navigation | Clear and logical organization of website content, allowing users to easily find what they need. | A site with a well-structured menu system, allowing users to navigate between different insurance types (e.g., car, home, life) or to specific areas like comparison tools. |

| Information Clarity | Clear and concise presentation of information, avoiding jargon and ensuring users understand the content. | Using simple language and avoiding complex technical terms, and offering clear explanations of coverage options and exclusions. |

| Responsiveness | Adaptability to different devices (desktops, tablets, smartphones). | A website that adjusts its layout and functionality seamlessly across different screen sizes. |

| Performance | Fast loading times and efficient functionality. | A website that loads quickly, ensuring a smooth and seamless user experience, avoiding delays and frustrations. |

| Security | Assurance of data security and privacy, particularly when handling sensitive financial information. | A website displaying clear security measures, like HTTPS, and providing clear privacy policies. |

Comparing Website Features and Functionality

Different online car insurance comparison websites offer varying levels of functionality, impacting the ease and effectiveness of the quote comparison process. Understanding these features allows users to select the platform best suited to their needs and preferences. This section analyzes the key functionalities and their impact on the user experience.Websites offering comprehensive comparison tools generally outperform those with limited features.

Factors like the breadth of coverage options, ease of adjusting search criteria, and speed of quote generation directly affect the user experience. Thorough comparison tools empower users to make well-informed decisions.

Methods of Providing Quotes

Various methods are employed by comparison websites to generate quotes. Some sites leverage direct integrations with insurance providers, enabling rapid quote retrieval. Others utilize aggregator models, collecting data from multiple insurers to display a broader range of options. This difference in approach influences the time taken to receive quotes and the overall range of coverage choices. Direct integrations tend to be faster, while aggregator models offer more comprehensive comparisons.

Examples include instant quote generators on comparison websites, and quote forms filled out through insurance provider websites.

Comparison of Coverage Options

The methods used to display coverage options significantly affect the user experience. Some sites present options in a user-friendly format, allowing users to easily filter and compare different coverages. Others might present a more complex structure, requiring users to navigate multiple pages to access specific coverage details. Effective comparison tools clearly differentiate coverage options, ensuring the user understands the specifics of each policy.

This clarity facilitates better understanding of different policy features and allows for easier selection of the most appropriate coverage.

Ease of Use and Comprehensiveness of the Comparison Process

The user experience directly correlates with the ease and comprehensiveness of the comparison process. Intuitive interfaces, clear navigation, and well-organized displays contribute to a smooth user journey. Conversely, complex layouts, hidden features, and unclear information hinder the comparison process. Sites with intuitive interfaces facilitate comparison and allow users to quickly assess various factors. For instance, the ability to sort results by price or coverage type is essential.

User Preferences and Results

User preferences influence the outcomes of the comparison process. Users seeking the lowest possible premium might prioritize price over other factors, such as specific coverage options. Conversely, drivers with high-risk factors might prioritize comprehensive coverage, regardless of price. The comparison tools on the site should allow users to adjust their search criteria to match their priorities.

Customization of Search Criteria

A wide array of customizable search criteria is crucial for a comprehensive comparison. Users should be able to specify factors like vehicle type, location, driving history, and desired coverage levels. Detailed search filters enable users to precisely tailor their search, resulting in more accurate and relevant results. These tools should be readily available and easily navigable.

Website Features and Functionality Table

| Feature | Description | Example |

|---|---|---|

| Quote Generation Method | Direct integration with insurers or aggregator models. | Instant quote through direct integration, or comparison of quotes from multiple providers. |

| Coverage Options Display | User-friendly format for filtering and comparing coverage options. | Clear breakdown of coverage options with specific details and pricing. |

| Ease of Use | Intuitive interface, clear navigation, and well-organized displays. | Easy-to-navigate menus and clear explanations of features. |

| Customization Options | Ability to adjust search criteria for vehicle, location, driving history, and desired coverage. | Options to specify car make/model, location, and desired coverage amounts. |

Data Security and Privacy Concerns

Protecting user data is paramount for any online car insurance comparison website. Transparency and robust security measures build trust and maintain user confidence. Customers entrust these platforms with sensitive financial and personal information, making it crucial for providers to implement comprehensive safeguards.Ensuring data security goes beyond simply having a secure website; it involves a multifaceted approach to protecting user information from unauthorized access, use, or disclosure.

The methods employed must be demonstrably effective and regularly reviewed to maintain their efficacy against evolving threats. This includes safeguarding against breaches, maintaining data integrity, and adhering to relevant privacy regulations.

Importance of Data Security

Data breaches on comparison websites can have severe consequences for users. Compromised personal information can lead to identity theft, financial fraud, and reputational damage. This can result in significant financial losses for individuals and potentially tarnish the reputation of the insurance comparison platform. Moreover, data breaches can lead to legal liabilities and regulatory scrutiny.

Methods of Protecting User Data

Protecting user data requires a multi-layered approach. Strong encryption protocols, especially for transmitting sensitive information, are essential. Implementing multi-factor authentication adds an extra layer of security. Regular security audits and vulnerability assessments are crucial for identifying and addressing potential weaknesses.

Potential Privacy Risks and Mitigation

Potential privacy risks include unauthorized access to user data by hackers or malicious actors. Phishing scams or malware can compromise user accounts and expose sensitive information. Data breaches can also occur due to insufficient data encryption or inadequate security protocols. Implementing strong firewalls, intrusion detection systems, and regularly updating security software are crucial in mitigating these risks.

Data anonymization and pseudonymization can further limit the risk of identification and data exploitation.

Legal and Ethical Considerations

Compliance with data protection regulations, such as GDPR (General Data Protection Regulation) and CCPA (California Consumer Privacy Act), is essential. Transparency about data collection practices, including what data is collected, how it is used, and who it is shared with, is crucial for building trust. Websites should obtain explicit consent from users before collecting and using their data.

Ethical considerations include minimizing data collection to only what is necessary and securely disposing of data when no longer required.

Key Security Measures

Implementing robust security measures is critical to protecting user data.

| Security Measure | Description | Effectiveness |

|---|---|---|

| Strong Encryption | Utilizing strong encryption protocols for data transmission and storage. | High – Protects data from unauthorized interception. |

| Multi-Factor Authentication | Requiring multiple forms of verification to access accounts. | High – Adds a layer of security against unauthorized access. |

| Regular Security Audits | Conducting periodic assessments to identify and address vulnerabilities. | High – Proactively identifies and fixes potential weaknesses. |

| Data Anonymization/Pseudonymization | Transforming data to protect user identity and reduce potential for re-identification. | Medium-High – Reduces the risk of direct identification but may not eliminate all risk. |

| Compliance with Data Protection Regulations | Adhering to relevant regulations like GDPR and CCPA. | High – Demonstrates commitment to user data protection. |

User Reviews and Ratings

Online reviews are a crucial element in evaluating any website, especially one dedicated to comparing car insurance quotes. User feedback provides valuable insights into the website’s performance, features, and overall user experience, allowing potential customers to make informed decisions. A robust review system, coupled with transparent rating mechanisms, can significantly impact a website’s credibility and attract more users.

Significance of User Reviews

User reviews offer a diverse perspective on the website’s strengths and weaknesses. They provide a direct account of the user experience, covering aspects such as ease of navigation, accuracy of information, speed of quote generation, and customer service interactions. Positive reviews often highlight the website’s helpfulness and efficiency, while negative reviews may point to areas needing improvement, such as slow loading times or confusing navigation.

These diverse opinions are invaluable for assessing the website’s effectiveness and reliability.

Impact on Website Credibility

User reviews significantly impact a website’s perceived credibility. A high volume of positive reviews, accompanied by consistent positive ratings, instills confidence in potential users. Conversely, a significant number of negative reviews, particularly those detailing recurring issues or problems, can damage the website’s reputation and deter potential customers. Websites with a strong track record of positive user feedback are generally viewed as more trustworthy and reliable.

Informed Consumer Decisions

User reviews empower consumers to make informed decisions by providing firsthand accounts of the website’s functionality. Consumers can gain valuable insights into the website’s strengths and weaknesses from the experiences of others. They can identify potential pitfalls, such as inaccurate quote comparisons or difficulties accessing support, and understand how the website operates in real-world scenarios. This transparency helps consumers make more informed decisions and avoid potential issues.

Limitations of Relying Solely on User Feedback

While user reviews are valuable, relying solely on them for evaluating a car insurance comparison website has limitations. Reviews can be subjective and influenced by individual user experiences. One person’s negative experience with a particular feature might not be representative of the overall user experience. Additionally, reviews might not always reflect the most recent updates or improvements made to the website.

A comprehensive evaluation requires considering multiple factors, including website features, data security, and user experience.

Examples of Positive and Negative User Reviews

The following table illustrates examples of positive and negative user reviews, categorized by their impact.

| Review Type | Example | Impact |

|---|---|---|

| Positive | “I found the website very easy to use. The comparison tool was straightforward, and I got multiple quotes in minutes. Highly recommend!” | Positive user experience, highlights ease of use and speed. |

| Positive | “The customer service was exceptional. I had a question about coverage, and they responded promptly and thoroughly. Very helpful!” | Excellent customer service, addressing a key concern. |

| Negative | “The website kept crashing during the quote comparison process. Extremely frustrating!” | Highlights potential technical issues, impacting user experience. |

| Negative | “The quote comparisons were inaccurate. The final policy I received had a significantly higher premium than what was displayed on the website.” | Indicates potential inaccuracies in the data presented, which is a major concern. |

Practical Tips for Using Comparison Sites Effectively

Getting the best car insurance rates involves more than just browsing through options. Savvy consumers utilize comparison websites strategically to secure the most competitive premiums. This guide provides practical steps and insights to maximize your savings potential.

Maximizing Search Refinements

Comparison websites empower users to tailor their searches. By utilizing filters, you can significantly narrow your search results to match your specific needs and circumstances. This process helps you pinpoint insurance plans that align with your desired coverage levels, vehicle type, and driving history.

- Vehicle Details: Specify the make, model, and year of your vehicle accurately. Incorrect information can lead to inaccurate quotes. Furthermore, consider your vehicle’s usage. A daily commute to work requires different coverage than a weekend car for leisure activities. A high-performance sports car will typically command higher premiums.

- Coverage Needs: Carefully review the coverage options offered. Comprehensive, collision, and liability are fundamental. Consider adding extras like roadside assistance or uninsured/underinsured motorist coverage if appropriate for your situation. The coverage selected will directly impact the final premium amount.

- Driver Profile: Enter your driving history, including your age, location, and driving record. Accurately reflecting your driving record is essential for a precise quote. A clean driving record is generally associated with lower premiums.

- Payment Preferences: Specify how you prefer to pay your premiums. Some sites may offer discounts for automatic payments.

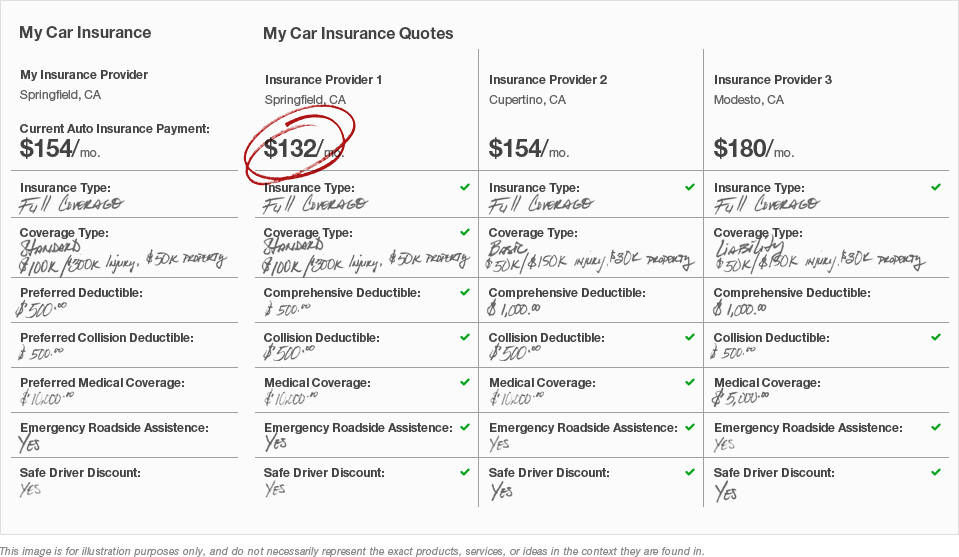

Comparing Quotes Effectively

Carefully evaluating quotes from multiple providers is crucial for securing the best rate. Look beyond the initial quote; compare the total cost of coverage over a specified period.

- Review the Details: Compare the coverage limits, deductibles, and other specifics offered by different providers. Read the fine print of each policy to avoid hidden fees.

- Calculate Total Costs: Consider the total premium for the policy duration. Avoid solely focusing on the monthly payment. The total cost over a year or several years could reveal a substantial difference between seemingly similar quotes.

- Consider Discounts: Most providers offer discounts for various factors like good driving records, anti-theft devices, or bundled insurance products. Take advantage of discounts whenever applicable to potentially lower your premiums.

- Check for Hidden Fees: Thoroughly review the policy document for any additional charges or fees not immediately apparent. This diligence can save you from costly surprises down the line.

Tips for Obtaining Competitive Rates

Obtaining the most competitive rates involves more than just using comparison tools.

- Shop Around Regularly: Insurance rates can fluctuate based on market conditions and your personal circumstances. Regularly reviewing quotes ensures you’re always getting the best possible deal.

- Maintain a Clean Driving Record: A clean driving record is one of the most significant factors affecting insurance premiums. Avoiding accidents and traffic violations is crucial for maintaining a low premium.

- Consider Bundling Insurance: Bundling your auto, home, and other insurance policies with the same provider can often lead to discounted rates.

- Negotiate with Insurers: If possible, contact the insurer directly to negotiate terms and conditions. A well-structured negotiation can often result in lower premiums.

Illustrative Case Studies (Hypothetical Examples)

Comparing car insurance quotes online can save you money, but navigating the process can be daunting. Illustrative case studies, showcasing real-world scenarios, can provide valuable insights into the effectiveness and practical application of online comparison tools. These examples highlight the steps involved and the potential outcomes.Understanding the experiences of others, through hypothetical yet relatable situations, can significantly enhance your understanding of the process.

This section explores successful strategies and common challenges, allowing for a deeper comprehension of how online comparison tools can assist in securing favorable insurance policies.

A Consumer Successfully Using a Comparison Website

A young professional, Sarah, needed to renew her car insurance. She was dissatisfied with her current provider’s quote and wanted to explore options for better coverage and lower premiums. She decided to utilize a popular online car insurance comparison website.Sarah began by providing basic information about her vehicle and driving history. The site presented quotes from various insurers, clearly outlining the different coverages and premiums.

She carefully reviewed the details of each quote, comparing coverage options, deductibles, and premiums.Sarah selected the policy offering the best balance of coverage and cost. This involved a detailed analysis of each insurance company’s offerings and a comparison of their respective rates. By following the guided process on the website, she secured a policy with a 15% lower premium compared to her previous insurer.

The comparison website helped her save money while maintaining her desired level of coverage.

Comparison of Car Insurance Quotes from Multiple Providers

Imagine a family of four, the Smiths, needing to insure their two vehicles. Their current policies are expiring, and they want to ensure they are getting the best possible coverage at a reasonable price.Using an online comparison website, the Smiths entered details for both vehicles, including their age, mileage, and use (primarily commuting). The website displayed quotes from various insurance providers, highlighting differences in coverage options and pricing.

The Smiths meticulously compared the different policies, considering factors like liability coverage, comprehensive coverage, and collision coverage.The website’s user-friendly interface allowed them to easily compare the policies side-by-side. The Smiths chose a policy that offered comprehensive coverage for both vehicles while keeping their premium costs competitive. This policy offered a good balance between coverage and cost, avoiding overly expensive premiums or insufficient coverage.

Decision-Making Process

The Smiths’ decision-making process involved a careful evaluation of the various policies. They meticulously compared the coverage details of each policy, noting the differences in liability limits, deductibles, and additional benefits. Their priority was to ensure sufficient protection for their family and vehicles while minimizing their insurance costs.Crucially, the Smiths reviewed the financial stability of each insurance company, recognizing that a reputable company is essential for long-term policy reliability.

They also assessed the ease of claim filing processes and the availability of customer support, considering factors such as 24/7 customer service and quick claim processing times.

Benefits and Drawbacks of the Chosen Solution

The Smiths’ chosen policy offered significant benefits, including a lower premium compared to their previous policies. It provided the coverage they needed for both vehicles, safeguarding their financial interests in case of accidents.A drawback of the chosen policy was a slightly higher deductible compared to some other options. However, this was a manageable trade-off given the substantial savings in premiums.

They considered the balance between the cost savings and the potential cost of a claim.

Conclusive Thoughts

In conclusion, effectively utilizing online car insurance comparison websites empowers you to make informed decisions and potentially save money. By considering website features, data security, user reviews, and practical tips, you can confidently find the best insurance plan for your needs. Remember, comparison websites are just tools – careful evaluation and research are key to securing the most competitive rate.

Answers to Common Questions

What are the common pricing models for car insurance comparison websites?

Different websites employ various pricing models. Some may charge a small fee for their service, while others may have a commission-based structure where they earn a percentage from the insurance provider for successful placements. Some are free to use. Ultimately, transparency about the pricing model is essential for consumers.

How can I ensure the security of my data when using these comparison websites?

Look for websites with robust security measures, like HTTPS encryption. Check their privacy policies for details on how they handle user data. Reliable sites will be transparent about their security practices and data protection protocols.

What factors influence the user experience of a car insurance comparison website?

A user-friendly interface, clear navigation, and easy-to-understand comparison tools are crucial. The ability to filter search criteria, compare multiple quotes, and quickly access relevant information greatly enhances the user experience. Website speed and responsiveness also contribute significantly to a positive experience.

What are some practical tips for effectively using comparison websites?

Thoroughly review your coverage needs, input accurate information during the quote process, compare different providers and features, and read reviews. Comparing quotes from various companies, adjusting search parameters, and checking for hidden fees are all crucial to finding the most competitive rates.