Finding the best car insurance can feel like navigating a maze. Different policies, confusing jargon, and a plethora of options can leave you overwhelmed. This guide breaks down the most effective methods for comparing car insurance, equipping you with the knowledge to make informed decisions and save money.

From understanding various comparison approaches to evaluating insurance provider profiles, this comprehensive resource details crucial factors and practical strategies to help you get the most suitable coverage at the most competitive price. Whether you’re a seasoned driver or a new one, this guide will walk you through every step of the process, making the comparison process clear and straightforward.

Understanding Comparison Methods

Choosing the right car insurance policy can save you money and provide adequate coverage. A crucial aspect of this process is effectively comparing different policies to identify the best fit for your needs. This involves understanding various comparison approaches and evaluating their strengths and weaknesses.

Different Approaches to Comparing Policies

Different methods are available for comparing car insurance policies, each with its own advantages and disadvantages. These range from utilizing online comparison tools to directly contacting insurers and scrutinizing policy documents. Selecting the most suitable method depends on your individual needs and preferences.

Using Online Comparison Tools

Online comparison tools are a popular and convenient way to compare car insurance quotes. These tools typically gather data from multiple insurers, allowing you to quickly see various options. They often offer user-friendly interfaces, making it easy to input your details and receive tailored quotes.

- Strengths: Speed and convenience are key advantages. These tools provide quick comparisons of various quotes, saving significant time compared to contacting insurers individually. They often allow you to refine searches based on specific criteria like your driving history or vehicle type. The user-friendly interfaces are a considerable plus for those unfamiliar with insurance jargon.

- Weaknesses: Accuracy may be affected if the tool doesn’t properly gather all relevant information from insurers. These tools sometimes lack the personalized service that direct communication with insurers can offer. Hidden fees or additional charges might not be fully disclosed by the tools, leading to unexpected costs down the line.

Contacting Multiple Insurers Directly

Directly contacting multiple insurers can offer a more personalized approach to comparison. You can discuss your specific needs and circumstances with representatives, potentially leading to more tailored quotes and a better understanding of policy options.

- Strengths: Personalized service is a significant advantage. Representatives can address your specific concerns and provide detailed explanations of different policies, which is beneficial for complex situations. This method allows you to negotiate potential discounts and explore options not available through online tools.

- Weaknesses: This method is generally more time-consuming than using comparison tools. Gathering quotes from multiple insurers can be a significant undertaking, and you may need to follow up on several calls and emails.

Reviewing Policy Documents

Thoroughly reviewing policy documents is essential for ensuring a complete understanding of the coverage you’re purchasing. Policy documents Artikel the terms and conditions of the policy, including exclusions and limitations.

- Strengths: A comprehensive understanding of the policy’s terms is essential. Carefully reading the fine print helps you avoid misunderstandings and identify any potential issues down the road. You can fully evaluate the level of protection offered and ensure it aligns with your needs.

- Weaknesses: Insurance policies can be complex documents, making them potentially difficult to fully grasp for those unfamiliar with insurance terminology. The detailed review can take considerable time and effort, and may not always be sufficient in identifying every potential issue.

Comparison Table

| Comparison Method | Speed | Cost | Accuracy | Personalization |

|---|---|---|---|---|

| Online Comparison Tools | High | Low | Moderate | Low |

| Contacting Insurers Directly | Low | Moderate | High | High |

| Reviewing Policy Documents | Low | Low | High | Low |

Key Factors to Consider

Choosing the right car insurance policy involves careful consideration of various factors. Understanding these elements is crucial for securing the best possible coverage at a fair price. A thorough comparison of different policies is essential to identify the optimal fit for your needs and budget.

Coverage Types

Different coverage types offer varying levels of protection. A fundamental understanding of these types is essential when comparing policies. Liability coverage, for example, protects you from financial responsibility in the event of an accident where you are at fault. Collision coverage, on the other hand, covers damages to your vehicle regardless of who is at fault. Comprehensive coverage goes further, protecting your vehicle from perils like vandalism, theft, and weather events.

Each policy may offer varying levels of coverage, which should be meticulously compared to identify the most suitable option.

Deductibles

Deductibles are the amounts you pay out-of-pocket before your insurance company covers the rest of the claim. A lower deductible means you pay less upfront, but your premiums might increase. Conversely, a higher deductible results in lower premiums, but you’ll be responsible for a larger amount if an accident occurs. Choosing the right deductible involves weighing the trade-offs between premium cost and potential out-of-pocket expenses.

Premiums

Premiums represent the cost of your insurance policy. Several factors influence premium amounts, including your driving record, vehicle type, location, and age. A comparative analysis of premiums across different providers is vital to ensure you’re getting the best possible value for your money. Be sure to look beyond the base premium and consider any add-ons or discounts that may affect the final cost.

Add-ons

Many insurance providers offer optional add-ons like roadside assistance, rental car coverage, and more. These add-ons can provide extra benefits but will increase your premium. Evaluate if the added value justifies the increased cost. A comprehensive review of these extra features is essential in the comparison process.

Policy Exclusions and Limitations

Every insurance policy has exclusions and limitations. These define the circumstances under which the policy won’t provide coverage. Carefully review these clauses to avoid unpleasant surprises after an accident. Understand the specifics of the exclusions to make an informed decision about the policy’s suitability.

Key Factor Comparison Table

| Factor | Description | Significance in Comparison |

|---|---|---|

| Coverage Types | Liability, Collision, Comprehensive | Ensures adequate protection against various risks. |

| Deductibles | Amount paid out-of-pocket before coverage. | Balances premium costs with potential out-of-pocket expenses. |

| Premiums | Cost of the insurance policy. | Determines the overall financial burden of insurance. |

| Add-ons | Optional features like roadside assistance. | Adds value but increases premium; weigh benefits against costs. |

| Exclusions/Limitations | Circumstances not covered by the policy. | Avoids surprises; ensures clarity on policy scope. |

Utilizing Comparison Tools

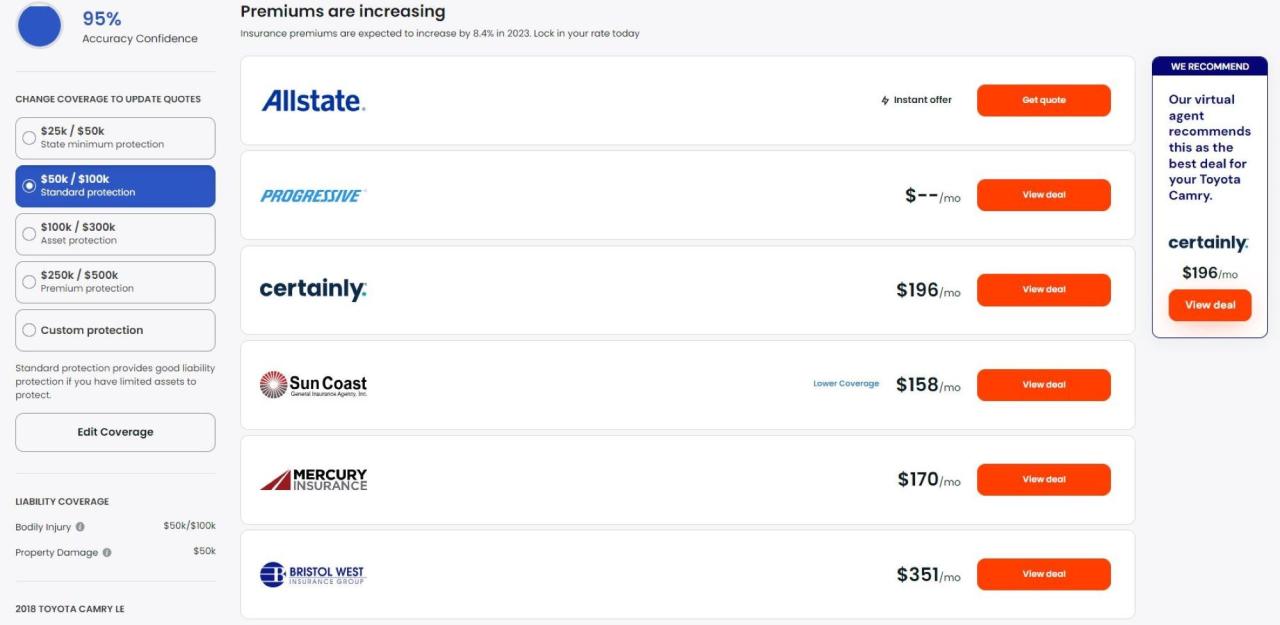

Finding the best car insurance often involves navigating numerous options. Online comparison tools streamline this process, allowing you to quickly compare quotes from various providers. These tools typically provide a comprehensive overview of available policies, enabling informed decisions based on tailored needs and budget constraints.Comparison websites act as intermediaries, collecting data from insurers and presenting it in a user-friendly format.

This eliminates the need for individual contact with each insurer, saving valuable time and effort. Crucially, these platforms often offer insights into policy features, coverage levels, and associated costs, helping you make a more informed choice.

Effective Use of Online Comparison Websites

Online comparison tools are designed to facilitate a straightforward comparison process. These platforms typically require you to provide personal information about your vehicle, driving history, and desired coverage. Accurate inputting of this data is crucial for obtaining precise and relevant quotes.

Inputting Relevant Data

To ensure accurate quotes, meticulously provide accurate details. This includes specifics about your vehicle (make, model, year, mileage, and any modifications), your driving record (number of accidents, traffic violations, and any prior insurance claims), and the level of coverage desired (liability, collision, comprehensive, and additional extras). The more accurate your input, the more precise the resulting quotes will be.

Avoid common mistakes like misremembering details or omitting essential data.

Interpreting Results

Comparison tools present results in various formats, often including tables or graphical representations. Understanding these representations is vital to making informed decisions. Carefully review the details of each quote, including premiums, deductibles, and coverage options. Analyze the features and benefits offered by different insurers to identify the best fit for your individual needs. Comparison websites often include helpful tools to clarify any uncertainties in the data presented.

Step-by-Step Navigation and Filtering

Comparison platforms typically offer intuitive navigation. Most sites have clear menus and filtering options, enabling users to narrow their search by criteria such as location, coverage type, or premium range. This step-by-step approach enables a focused search for the most appropriate car insurance option. By using these filtering options, you can tailor the results to your specific requirements and budget.

Examples of Comparison Tools and Their Features

Various online comparison platforms exist, each with unique features. Some prominent examples include [Example 1], [Example 2], and [Example 3]. These tools might offer features such as personalized recommendations, detailed breakdowns of quotes, and interactive maps displaying local providers. These features aid in identifying the most cost-effective and suitable insurance options. Consider evaluating different platforms based on their specific offerings and user reviews to find the best fit.

A key aspect of effective utilization involves familiarizing yourself with the particular layout and features of each platform.

Evaluating Insurance Provider Profiles

A crucial step in securing the best car insurance is thoroughly assessing the profiles of potential providers. This involves more than just comparing premiums; it’s about understanding the reputation, financial stability, and claims-paying history of the insurer. A strong provider profile often translates to a smoother claims process and greater peace of mind.Understanding a provider’s track record is vital.

A company with a history of prompt and fair claims handling can be a valuable asset in the event of an accident or other covered loss. Conversely, a company with a less-than-stellar reputation may lead to delays or disputes. This section will Artikel methods for researching insurance providers’ profiles to make informed decisions.

Researching Provider Reputation and Financial Stability

Insurance providers’ reputations and financial stability are key factors to consider when evaluating potential insurers. A reputable company with a solid financial foundation is likely to be able to meet its obligations in the event of a claim. Investigating this involves several avenues.

Examining Customer Reviews and Ratings

Customer reviews and ratings provide valuable insights into the experiences of previous policyholders. Online platforms often host aggregate ratings and reviews from policyholders, offering a snapshot of the insurer’s customer service and claims handling. This feedback can range from positive accounts of quick and straightforward claim processes to negative ones detailing delays or disputes. It is important to note that reviews, while informative, should be considered alongside other evaluation methods.

Verifying Claims-Paying History and Financial Strength

Beyond customer reviews, verifying an insurer’s claims-paying history and financial strength is critical. Insurers with a history of timely and fair claim settlements demonstrate a commitment to policyholders. This information can often be found on regulatory agency websites or financial rating services, such as AM Best or Standard & Poor’s. These sources provide objective assessments of the insurer’s financial standing, including solvency ratings and historical data on claim payouts.

Factors to Consider in Assessing Provider Profiles

| Factor | Description |

|---|---|

| Customer Service Ratings | Average ratings from various online platforms reflect the quality of customer interactions and responsiveness to inquiries. |

| Complaint Records | Publicly available data on complaints filed against the insurer, which can highlight potential issues with handling claims or addressing customer concerns. This should be examined alongside other information. |

| Financial Strength Ratings | Ratings from independent agencies (e.g., AM Best) assess the insurer’s ability to meet its financial obligations, providing a crucial insight into its long-term stability. |

| Claims-Paying History | Data showing the insurer’s track record in settling claims promptly and fairly, reflecting its commitment to policyholders. |

| Regulatory Compliance | Reviewing the insurer’s record of compliance with relevant regulations ensures the company operates within established industry standards. |

Analyzing Policy Documents

Carefully reviewing your car insurance policy documents is crucial for understanding the specific terms and conditions of your coverage. This step ensures you are fully aware of what is and isn’t protected, minimizing surprises and potential disputes in the future. It’s not just about the price; it’s about understanding the details to avoid unpleasant surprises down the road.Thorough analysis of policy documents allows you to identify potential gaps in coverage and ensure the policy aligns with your needs and expectations.

This meticulous review helps you avoid unforeseen circumstances and protects your financial interests. It’s a proactive approach to managing your insurance, rather than simply reacting to a claim.

Interpreting Key Terms and Conditions

Policy documents contain a variety of terms and conditions. Understanding these is vital to knowing what your insurance covers and doesn’t. Identifying specific terms like “comprehensive coverage,” “collision coverage,” “deductible,” “liability limits,” and “uninsured/underinsured motorist coverage” is essential. Familiarizing yourself with these terms will help you make an informed decision.

Understanding Coverage Details

Insurance policies define the specific situations and circumstances under which your coverage applies. It’s crucial to examine the details of what is covered, such as damage to your vehicle, injury to others, or your own medical expenses. This includes understanding the specific types of incidents and situations covered. For example, does the policy cover damage from hail, theft, or accidents?

Are there any geographical limitations? The policy will detail these.

Identifying Exclusions and Limitations

Understanding what is excluded from coverage is just as important as knowing what is covered. Exclusions often pertain to specific circumstances or types of damage that aren’t protected. Limitations, on the other hand, might specify maximum payouts or conditions that affect coverage amounts. For example, certain types of vehicles might be excluded or there might be limits on coverage for specific types of damage or locations.

Pay close attention to what’s explicitly not covered.

Scrutinizing Policy Wording and Fine Print

The fine print of your policy document holds crucial information, often overlooked. It contains details on the specific conditions, exclusions, and limitations. Read this section with extreme care, as it can contain hidden clauses that can impact your coverage. It’s advisable to use a highlighter or pen to mark key phrases and conditions. Pay close attention to specific dates, time frames, and conditions that may apply.

Example Structured Policy Analysis

| Policy Section | Key Term/Condition | Interpretation |

|---|---|---|

| Coverage A (Collision) | “Damage to your vehicle caused by an accident” | This covers damage if your car is involved in a collision, regardless of fault. |

| Coverage B (Comprehensive) | “Damage to your vehicle not due to collision” | This covers damage from incidents like hail, fire, theft, or vandalism. |

| Exclusions | “Damage caused by wear and tear” | This means the policy doesn’t cover normal deterioration of the vehicle. |

| Limits | “Maximum payout of $5,000 for comprehensive claims” | This sets a cap on the amount the insurer will pay for a comprehensive claim. |

Addressing Specific Needs

Finding the best car insurance often involves tailoring your search to your unique circumstances. This involves understanding how different factors influence your premiums and coverage options. A standardized comparison method might not fully capture the specific needs of young drivers, high-risk drivers, or those with unique vehicles. This section provides a framework for adapting comparison methods to individual needs and circumstances.Adapting your comparison approach to align with personal factors is crucial for obtaining the most suitable coverage.

Prioritizing specific needs, such as driving habits, vehicle type, and location, will significantly impact your overall insurance costs and the available coverage options. Recognizing these factors allows you to target your comparison efforts more effectively.

Prioritizing Factors Based on Individual Needs

Different aspects of your driving habits, vehicle type, and location can drastically influence your insurance premiums. A careful evaluation of these factors will lead to a more informed decision.

- Driving Habits: Your driving record, including traffic violations, accidents, and claims history, is a significant factor in determining your insurance premium. A clean driving record will usually lead to lower premiums compared to a history of violations. Similarly, defensive driving courses or safety features on your vehicle can help reduce your risk and thus your premiums.

- Vehicle Type: The make, model, and year of your vehicle influence your insurance costs. More expensive or high-performance vehicles often come with higher insurance premiums due to the increased risk of theft or damage. Conversely, older or less expensive vehicles typically have lower premiums. Consider the vehicle’s features and potential for damage when evaluating different insurance options.

- Location: Geographic location plays a significant role in insurance costs. Areas with higher crime rates or accident-prone roads typically have higher insurance premiums. Consider your area’s specific circumstances when assessing insurance options.

Considerations for Specific Needs

Recognizing the specific needs of various driver profiles helps in focusing your comparison efforts.

- Young Drivers: Young drivers often face higher premiums due to their perceived higher risk profile. Insurance companies often view younger drivers as more prone to accidents. Strategies like defensive driving courses or adding a trusted driver on the policy can often help reduce these premiums. Insurance providers might offer specific discounts or programs for young drivers with clean driving records.

For example, some companies offer discounts for young drivers who maintain a perfect driving record.

- High-Risk Drivers: Drivers with a history of accidents or traffic violations often face significantly higher premiums. This reflects the increased risk associated with their driving history. Addressing these factors and taking steps to improve driving habits can positively impact the insurance cost. Exploring options like additional coverage or specialized high-risk programs might be necessary to obtain adequate coverage at a more manageable price.

- Unique Vehicles: Vehicles with specialized features or high values, such as classic cars or collector’s items, often have specific insurance needs. This necessitates tailored insurance options. For example, collectors of classic cars often find specialized insurance policies for their valuable vehicles.

Impact of Personal Factors on Insurance Costs and Coverage

| Personal Factor | Potential Impact on Costs | Potential Impact on Coverage |

|---|---|---|

| Clean driving record | Lower premiums | Standard coverage options |

| Accidents or violations | Higher premiums | Potentially limited coverage options or higher deductibles |

| High-value vehicle | Higher premiums | Higher coverage limits for potential damage |

| Young driver | Higher premiums | Potentially limited coverage options or higher deductibles |

| High-risk driver | Significantly higher premiums | Limited coverage options or specialized high-risk programs |

| Unique vehicle (e.g., classic car) | Higher premiums | Specialized coverage options for collector’s items or antique vehicles |

Data Interpretation

Interpreting car insurance quotes objectively is crucial for making informed decisions. A purely emotional or biased approach can lead to overlooking potentially better options. Understanding the nuances of different quote structures and policy options is key to effectively comparing offers.Accurate interpretation involves detaching from preconceived notions about specific providers or policies. Focus instead on the core elements of coverage and pricing.

A systematic approach, like the ones Artikeld below, ensures a thorough comparison and minimizes the risk of overlooking a suitable option.

Quote Structure Analysis

Different insurance providers employ various methods for presenting quotes. Understanding these structures is vital for accurate comparison. Some providers might present quotes in a tabular format, listing premiums for different coverages, while others may display a single overall premium figure. It’s important to look beyond the headline figures to understand the breakdown of coverages and deductibles.

Policy Option Comparison

Comparing various policy options necessitates a clear and concise methodology. A structured approach will aid in distinguishing between different options. Consider the following elements:

- Coverage levels: Analyze the extent of coverage offered in each policy. Compare the details of liability, collision, comprehensive, and any additional add-ons. Look for the limitations in each policy and the implications of such limitations.

- Deductibles: Understanding the deductible amount is essential. A higher deductible often translates to lower premiums, but you’ll have to pay a larger sum out-of-pocket if you file a claim. Consider your financial situation and the likelihood of needing to file a claim in the near future when evaluating deductibles.

- Premiums: Examine the overall premium cost and break it down by coverage. Compare the premium costs of different policy options from various providers.

- Add-ons: Assess any additional coverage options offered, such as roadside assistance, rental car coverage, or uninsured/underinsured motorist protection. Analyze the added cost of each add-on and determine if they are worth the expense for your specific needs.

Presenting Comparison Results

A structured format is vital for effectively presenting the results of your comparison. This format should highlight key differences and similarities between various policy options.

| Insurance Provider | Premium (Annual) | Coverage Level | Deductible | Add-ons |

|---|---|---|---|---|

| Company A | $1,500 | Comprehensive, Collision, Liability | $500 | Roadside Assistance, Rental Car |

| Company B | $1,200 | Comprehensive, Collision, Liability | $1,000 | Roadside Assistance |

| Company C | $1,350 | Comprehensive, Collision, Liability, Uninsured/Underinsured Motorist | $500 | Roadside Assistance, Rental Car, Emergency Medical |

This table provides a clear overview of the comparison. Visual aids, such as charts and graphs, can further enhance the presentation of the data, making it easier to spot key differences and similarities.

Practical Tips and Tricks

Savvy car insurance comparison involves more than just finding the lowest price. Strategic approaches and consistent monitoring are key to securing the best possible coverage at the most affordable rate. This section Artikels practical strategies to maximize savings and ensure your policy remains up-to-date with your evolving needs.Understanding that insurance costs fluctuate and discounts can vary, consistent comparison and vigilance are vital for securing optimal protection.

Maximizing Savings Through Comparison

Regular comparison shopping, coupled with a proactive approach to identifying and leveraging available discounts, can significantly reduce your insurance premiums. By consistently reviewing quotes and monitoring market trends, you can optimize your coverage while minimizing your out-of-pocket expenses.

- Review your policy regularly: Assess your current coverage and compare it to new quotes. Consider factors like driving history, vehicle type, and location to identify potential savings.

- Compare rates across multiple providers: Don’t limit your search to a single insurance company. Explore quotes from various providers to identify the best possible price and coverage package.

- Evaluate discounts: Many insurance providers offer discounts for safe driving, anti-theft devices, and bundled insurance policies. Take advantage of these discounts to reduce your premiums.

- Consider the cost of extras: Evaluate the need for optional extras like roadside assistance or rental car coverage. If these are not essential, consider foregoing them to reduce costs.

Leveraging Discounts and Promotions

Insurance providers often offer a range of discounts to incentivize customers. Understanding these opportunities and proactively seeking them can translate into substantial savings.

- Safe driver discounts: Many insurance companies reward safe driving habits with reduced premiums. Maintain a clean driving record to qualify for these discounts.

- Bundled insurance discounts: If you have multiple insurance policies (home, auto, etc.), look for bundled discounts offered by your insurer. Bundling policies can significantly reduce your overall insurance costs.

- Security device discounts: Installing anti-theft devices or alarm systems can qualify you for discounted premiums. These discounts reward responsible security measures.

- Student discounts: If applicable, student discounts can offer a significant reduction in your car insurance costs. Check if your insurer provides these.

Tracking Insurance Costs Over Time

Monitoring insurance costs over time provides valuable insights into trends and potential savings opportunities.

| Month | Insurance Premium | Notes |

|---|---|---|

| January 2024 | $150 | Initial quote |

| February 2024 | $145 | Secured a safe driving discount |

| March 2024 | $140 | Bundled policy with home insurance |

By maintaining a record of your insurance costs, you can identify patterns and make informed decisions about your coverage and savings.

- Create a spreadsheet or log: Document your monthly premiums, the date of the quote, and any discounts or promotions you leverage. Tracking your expenses in a spreadsheet or similar tool helps to identify cost trends over time.

- Compare quotes regularly: Compare your current policy to new quotes every six months or annually to ensure you’re getting the most competitive rate.

- Identify cost-saving opportunities: Use your records to identify periods where your insurance costs decreased. This may indicate areas where you can negotiate better terms with your insurer.

Final Wrap-Up

In conclusion, comparing car insurance effectively involves a multifaceted approach. Understanding the diverse comparison methods, key factors, and the importance of analyzing provider profiles and policy documents is crucial. By utilizing comparison tools, evaluating providers, analyzing policy documents, and addressing individual needs, you can make informed decisions. Remember to regularly review and update your information to maximize savings.

This guide provides a structured framework for a smooth and successful car insurance comparison experience.

FAQ Insights

How long does it typically take to compare car insurance quotes?

The time it takes to compare quotes varies depending on the methods used and the number of insurers considered. Using online comparison tools can provide quick quotes, while contacting multiple insurers directly may take longer. Generally, the process can be completed in a few hours to a few days.

What are some common discounts offered by insurance providers?

Insurance companies often offer discounts for various factors, including safe driving records, anti-theft devices, and bundling multiple policies. Discounts for good student status, anti-theft devices, and defensive driving courses are also common. Always check with your potential insurers for current offers.

What if I have a high-risk driving history?

High-risk drivers may face higher premiums. However, there are options available to mitigate costs, such as enrolling in defensive driving courses, improving your driving record, or exploring supplemental coverage options. Insurers have different policies regarding high-risk drivers, so it’s vital to contact several insurers for a comprehensive comparison.

Can I compare car insurance for different vehicle types?

Yes, you can compare car insurance for different vehicle types. Insurance premiums are often influenced by factors such as vehicle value, safety features, and model. Comparing quotes for various vehicles will help you understand how different types of vehicles affect your insurance costs.