Finding the best car insurance rates can feel like a daunting task, but online comparison tools make it significantly easier. This guide explores the crucial aspects of choosing the right platform for comparing car insurance policies, from evaluating key features to understanding the factors that influence premiums.

Navigating the complex world of car insurance can be challenging. Comparison websites streamline the process, allowing you to quickly and efficiently compare quotes from various providers. Understanding how these sites function and the elements that contribute to the best deals empowers you to make informed decisions about your coverage.

Introduction to Online Car Insurance Comparison

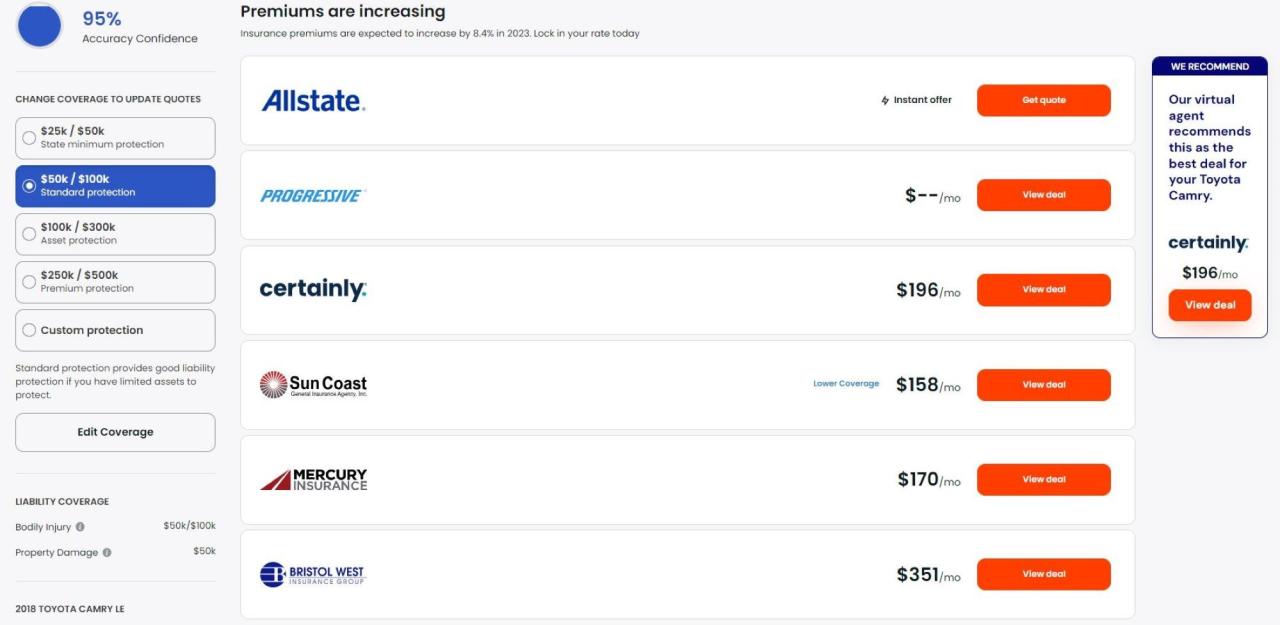

Online car insurance comparison tools have become a popular and efficient way for consumers to find the best possible rates. These platforms streamline the process of obtaining multiple quotes from various insurance providers, saving time and potentially significant money. By comparing different policies side-by-side, consumers can make informed decisions about their coverage and premiums.The benefits of using online comparison websites extend beyond cost savings.

They provide a comprehensive overview of available policies, allowing consumers to understand their options and choose the coverage that best suits their needs and budget. Moreover, these platforms often offer detailed explanations of different insurance terms and conditions, empowering consumers to make well-informed choices.

Factors Influencing Car Insurance Premiums

Numerous factors contribute to the cost of car insurance. These factors are evaluated by insurance companies to assess risk and determine premiums. A key element is driving history, including traffic violations, accidents, and claims filed. Higher risk profiles generally lead to higher premiums. Vehicle type and model also play a significant role, with certain vehicles considered more prone to damage or theft, resulting in higher insurance costs.

Location is another critical factor, as areas with higher crime rates or accident frequencies typically have higher premiums. The driver’s age and driving experience are also considered, with younger drivers often facing higher premiums due to their perceived higher risk. Finally, the desired coverage level and add-ons such as comprehensive or collision coverage influence the overall premium amount.

Common Misconceptions About Online Car Insurance Comparison Tools

Some consumers harbor misconceptions about online car insurance comparison tools. One common misconception is that these tools simply provide the lowest possible price without considering coverage quality. In reality, these tools present various policy options and allow consumers to compare them, enabling informed decisions that balance cost and coverage. Another misconception is that online comparisons are unreliable. In fact, reputable comparison sites employ secure systems to ensure data privacy and accuracy.

They aggregate quotes from licensed insurance providers, providing consumers with a trustworthy comparison.

Key Features to Look for in an Online Car Insurance Comparison Site

Choosing the right online car insurance comparison site is crucial for obtaining the best possible rates and coverage. A well-designed platform simplifies the process and offers comprehensive information. The following table highlights key features that consumers should prioritize when evaluating comparison sites:

| Feature | Description | Importance | Example |

|---|---|---|---|

| User Interface | Ease of navigation and clarity of information | High | Intuitive menu structure, clear labels, and well-organized policy displays. |

| Coverage Options | Variety of coverages offered | High | Comprehensive, collision, liability, uninsured/underinsured motorist, and other relevant options should be presented. |

| Customer Support | Availability of help and assistance | High | Prompt and helpful responses to inquiries, and readily accessible contact information. |

| Privacy and Security | Protection of personal information | Critical | Secure platform, clear privacy policies, and verifiable security measures. |

| Insurance Provider Selection | Range of insurance providers | High | Access to a variety of reputable and licensed insurance providers. |

Key Features of Effective Comparison Sites

Finding the best car insurance rates can feel like a daunting task. Fortunately, online comparison sites simplify the process, offering a valuable resource for savvy consumers. These sites streamline the search, enabling users to compare policies from multiple providers, saving time and potentially money.Effective comparison sites excel by focusing on specific features that enhance the user experience and ensure accurate results.

A well-designed platform should provide a clear and straightforward process for users to find the ideal policy that meets their needs and budget.

Accuracy and Up-to-Date Information

Reliable car insurance comparison sites maintain precise and current data. This ensures that policy quotes reflect the most recent rates and available discounts offered by insurance companies. Constantly updated information is crucial, as insurance premiums and discounts fluctuate frequently. Users can trust that the comparisons presented are accurate and reflect the real-time market conditions.

User-Friendly Interfaces and Intuitive Navigation

A user-friendly interface is essential for a positive and productive experience. Clear navigation, simple layouts, and straightforward input fields make the comparison process effortless. Intuitive design allows users to quickly identify the options that best match their requirements, fostering a positive user experience. Sites with poor navigation can frustrate users and lead to inaccurate or incomplete comparisons.

Multiple Insurance Provider Participation

The inclusion of multiple insurance providers is critical for a comprehensive comparison. A broader range of options allows users to compare quotes from various companies, ensuring they access the widest possible range of rates and coverage options. This competitive environment is beneficial to consumers, offering diverse choices and potentially lower premiums.

Comparing Coverage Options and Pricing

Effective comparison tools facilitate the comparison of various coverage options and associated premiums. This includes features like deductibles, coverage limits, and add-ons. Users can easily analyze these details and tailor their policies to fit their needs and financial situation. The ability to pinpoint specific coverage needs and the associated costs is crucial for informed decision-making.

Methods of Filtering and Sorting

Comparison tools employ various filtering and sorting mechanisms to streamline the search. These mechanisms allow users to refine their searches by factors like location, vehicle type, driving history, and desired coverage levels. Sorting options, like price, coverage type, or provider, provide an easy way to organize the results and quickly identify the best-suited policy. A well-organized approach is essential to help users navigate a large number of options.

Car Insurance Discounts

| Discount Type | Description | Example |

|---|---|---|

| Safe Driving | Incentives for safe driving records | Accident-free driving history, low speeding tickets |

| Multi-Policy | Discounts for having multiple policies with the same company | Insuring multiple vehicles or homes with the same insurer |

| Bundled Services | Discounts for combining multiple services with the same provider | Combining home insurance with car insurance |

| Student Discounts | Discounts for student drivers | Dependent student drivers |

| Loyalty Programs | Discounts for being a long-time customer | Long-term customers with good records |

Factors Influencing Insurance Costs

Understanding the factors that drive car insurance premiums is crucial for making informed decisions about your coverage. A comprehensive understanding allows you to shop strategically and potentially secure more affordable rates. Insurance companies use a variety of metrics to assess risk and calculate premiums, impacting the final cost of your policy.

Vehicle Type

Different types of vehicles present varying levels of risk to insurers. Factors like vehicle size, engine power, and safety features all play a role in determining the associated risk. Sports cars and trucks, for instance, often have higher premiums compared to smaller, more economical vehicles due to their perceived higher accident risk and potential for greater damage.

Driver Age

A significant factor influencing car insurance costs is the driver’s age. Younger drivers, particularly teenagers and new drivers, are typically assigned higher premiums. This is largely due to their statistically higher accident rates compared to more experienced drivers. Insurance companies consider this increased risk when setting premiums for younger drivers.

Driver History

A driver’s history of accidents and traffic violations is a critical factor in determining insurance premiums. Accidents and violations reflect a higher probability of future claims, leading to increased premiums. A clean driving record, free of accidents and violations, generally results in lower insurance costs.

Location

Location significantly impacts car insurance premiums. Areas with higher crime rates, more traffic congestion, or a higher frequency of accidents often result in higher premiums. This is because insurers consider the overall risk of accidents and claims in different geographic regions.

Vehicle Usage

The frequency and nature of vehicle usage can also affect insurance premiums. Commuters, for example, may face lower premiums than those who use their vehicles frequently for longer distances or in high-risk situations, such as driving in rural areas or using the vehicle for professional work involving heavy traffic.

| Factor | Impact on Premium | Example |

|---|---|---|

| Vehicle Type | Higher for sports cars, trucks, and those with fewer safety features | Sports cars, SUVs, and older model vehicles |

| Driver Age | Younger drivers typically pay more due to higher accident rates | Teen drivers, new drivers |

| Driver History | Accidents and violations increase premiums | DUIs, speeding tickets, accidents |

| Location | Areas with high accident rates and crime may have higher premiums | Urban areas, high-traffic zones |

| Vehicle Usage | Frequent or high-risk use can increase premiums | Long-distance commuters, frequent driving in rural areas |

Importance of Comprehensive Understanding

A thorough understanding of these factors is crucial for making well-informed decisions about car insurance. By recognizing how these elements influence premium costs, individuals can compare policies more effectively and choose the most suitable coverage at the best possible rate. For instance, a driver with a clean driving record and a modest vehicle can expect lower premiums compared to a younger driver with a history of violations and a high-performance sports car.

Tips for Finding the Best Deal

Securing the most advantageous car insurance rates involves a strategic approach, combining careful comparison and understanding of policy specifics. This section provides practical guidance to help you navigate the process effectively and obtain the best possible coverage.Finding the right car insurance often feels like a maze, but systematic comparison can illuminate the path to a good deal. This section details how to navigate comparison websites, compare quotes, choose the best coverage, and understand policy terms.

Navigating Comparison Websites Effectively

Comparison websites are powerful tools for evaluating various insurance options. A well-structured website will present clear and concise information, allowing for easy comparison across different providers. To maximize efficiency, use filters to narrow your search by factors like vehicle type, location, and desired coverage. Understanding the site’s search criteria is crucial for precise results. Many sites offer user-friendly interfaces with intuitive navigation features, enabling efficient comparisons.

Comparing Quotes from Multiple Insurers

A key step in obtaining the best deal is comparing quotes from multiple insurers. This ensures you aren’t missing out on potential savings. Remember to enter the same details into each quote request to maintain accuracy and comparability. Don’t hesitate to request quotes from insurers not initially suggested by the comparison website, as some might offer more favorable rates.

Identifying the Best Coverage Options for Your Needs

Insurance policies offer a range of coverage options, and the best choice depends on your individual circumstances. Carefully consider the types of coverage you need, like liability, collision, comprehensive, and uninsured/underinsured motorist protection. Avoid selecting unnecessary add-ons. Comprehensive coverage protects your vehicle against damage from perils like vandalism or fire, while collision coverage covers damage resulting from accidents.

Liability insurance protects you from financial responsibility if you cause an accident. Uninsured/underinsured motorist coverage is critical if you’re involved in an accident with a driver who lacks sufficient insurance.

Reviewing Policy Terms and Conditions

Thorough review of policy terms and conditions is crucial. Avoid overlooking fine print. Understanding policy limitations and exclusions is essential for making an informed decision. Carefully examine clauses related to deductibles, coverage limits, and exclusions. A detailed understanding of these terms can prevent future disputes and ensure the policy meets your specific requirements.

Step-by-Step Guide to Obtaining a Car Insurance Quote Online

This structured approach streamlines the quote process:

- Gather Information: Collect details about your vehicle, driving history, and desired coverage.

- Choose a Comparison Website: Select a reputable and user-friendly comparison site.

- Enter Vehicle Details: Provide accurate information about your vehicle, including make, model, year, and mileage.

- Specify Desired Coverage: Select the coverage options that meet your needs and risk tolerance.

- Review Quotes: Compare quotes from different insurers, considering premiums, coverage details, and additional benefits.

- Understand Policy Terms: Thoroughly review the terms and conditions of each policy.

- Choose the Best Option: Select the policy that offers the best value for your needs.

- Complete the Application: Fill out the online application for the selected policy.

- Finalize and Submit: Review the policy documents and submit the application for approval.

User Experience and Site Navigation

A seamless user experience is paramount for a car insurance comparison website. Users should be able to easily find the information they need and complete their comparison quickly and intuitively. A well-designed site not only saves users time but also builds trust and encourages conversions.A positive user experience is driven by several key elements, including site speed, mobile responsiveness, clear navigation, and intuitive search functionality.

These aspects contribute significantly to the overall effectiveness of the site and ultimately determine user satisfaction.

Importance of a Smooth User Experience

A smooth user experience is crucial for driving conversions. Users who find the site easy to navigate and understand are more likely to complete the comparison process and select the best insurance option. Conversely, a frustrating user experience can deter users and lead them to competitors.

Features Contributing to a Positive User Experience

Several features contribute to a positive user experience. These include:

- Fast loading speeds: A site that loads quickly minimizes user frustration. Users expect immediate results and a slow-loading site can lead to abandonment.

- Mobile responsiveness: A website that adapts to different screen sizes ensures a positive experience for users on all devices, from desktops to smartphones.

- Clear and concise information: Users should easily understand the information presented. Complex language or confusing layouts will deter them.

- Intuitive navigation: Users should be able to easily find the information they need. A well-organized site structure makes the process simple.

- User-friendly search functionality: A powerful search function allows users to quickly find the insurance plans they’re interested in.

Importance of Intuitive Site Navigation

Intuitive site navigation is vital for effective use. Users should be able to find what they need without difficulty. A well-designed navigation system guides users through the comparison process, minimizing the time spent searching and maximizing the likelihood of a successful outcome. This efficient navigation enhances the overall user experience and strengthens user confidence in the website.

Examples of Well-Designed Navigation Structures

Effective navigation structures often use a clear hierarchy, employing menus, drop-downs, and search bars. A site that presents a logical and organized structure makes it easier for users to quickly find the specific information they need. A well-structured site helps users find the desired information in a minimum number of steps. Examples include:

- Homepage with clear calls to action: The homepage should clearly guide users toward the desired comparison process.

- Logical menu structure: Categories and subcategories should be well-defined, enabling users to easily locate specific types of coverage.

- Search bar accessibility: A prominent search bar allows users to directly input their criteria and find the insurance plans matching their needs.

Elements of a Poor User Experience

Conversely, a poor user experience can arise from various elements:

- Slow loading times: A slow-loading website significantly impacts user satisfaction.

- Complex navigation: Users will abandon a site with confusing or illogical navigation.

- Lack of mobile optimization: A website not designed for mobile devices will lose potential customers.

- Poorly designed search functionality: Ineffective search tools will deter users from finding what they need.

- Confusing layout and design: A poorly structured site makes it difficult for users to navigate and locate the information they seek.

Usability of the Website

The table below Artikels elements that impact the usability of a website.

| Element | Impact on Usability | Example |

|---|---|---|

| Website Speed | Slow loading times negatively affect user experience. Users are more likely to abandon a site that takes a long time to load. | Site loads in under 2 seconds. |

| Mobile Responsiveness | Mobile-friendly design is essential. Users expect a website to adapt to different screen sizes, ensuring a seamless experience on smartphones and tablets. | Website adjusts to different screen sizes, displaying correctly on various devices. |

| Clear Information Presentation | Clear and concise information is essential for easy understanding. Complex or ambiguous information will deter users. | Information is presented in an easily understandable format with clear language. |

Final Conclusion

In conclusion, choosing the best site to compare car insurance rates is a critical step in securing the most advantageous coverage. By considering factors like user interface, coverage options, and accuracy of information, you can make a well-informed decision. Ultimately, comparing quotes from multiple insurers, understanding the influencing factors, and carefully reviewing policy details are key to securing the best possible deal.

FAQ Summary

What’s the most important factor to consider when choosing a comparison site?

Accuracy and up-to-date information are paramount. A reliable site ensures the quotes you see are current and reflect the most accurate pricing from various insurers.

How can I ensure I’m comparing apples to apples when comparing quotes?

Carefully review the specific coverage options offered by each insurer. Ensure the coverage details align with your needs, and compare the exact details of the policy terms, not just the price.

Are there any hidden costs associated with using online car insurance comparison sites?

Generally, no. These sites typically operate on a commission basis from the insurance providers, but the user does not incur any direct cost.

What is the best way to save money on car insurance?

Beyond using comparison tools, consider factors such as safe driving habits, bundling policies, and maintaining a good driving record. These often lead to significant discounts.