Finding the best auto insurance can feel like navigating a maze. This exploration delves into the critical factors consumers should consider when comparing quotes. From understanding user needs and evaluating comparison sites to analyzing influencing factors and content strategies, we’ll uncover the secrets to securing the most advantageous auto insurance policy.

The process of comparing auto insurance policies involves careful consideration of various factors, including pricing, coverage options, and the reputation of the provider. This analysis helps users make informed decisions and avoid potential pitfalls in the search for the best deal.

Understanding User Needs

Consumers seeking the “best place to compare auto insurance” are typically motivated by a desire to save money and find the most suitable coverage for their needs. They are often faced with a complex and confusing landscape of insurance options, making comparison tools crucial for navigating this process. The user’s primary pain point is the time-consuming and potentially frustrating task of manually researching various providers.

Their desired outcome is a simple, transparent, and efficient process to identify the most cost-effective and comprehensive auto insurance policy.

Typical User Profile

The typical user searching for auto insurance comparison tools is likely a digitally-savvy individual aged 25-55, with varying levels of financial expertise. They are likely preoccupied with managing their finances, balancing work and personal commitments, and desire a quick and easy solution for comparing policies. Their online behavior suggests they are comfortable using online comparison tools and are looking for user-friendly interfaces with clear pricing information.

They are motivated by potential savings and a desire to avoid being overcharged. The user’s digital comfort level can vary, ranging from those familiar with complex online tools to those who prefer straightforward interfaces.

Factors Influencing User Choice

Several factors significantly influence a user’s decision when selecting an auto insurance comparison site. Price is often the primary driver, but users also consider the breadth of coverage options offered. Reputable customer service is another critical aspect, as positive experiences and ease of claim processing are highly valued. A user-friendly interface, intuitive navigation, and clear presentation of data are vital for a positive user experience.

The speed and efficiency of the comparison process, along with the overall reliability of the site, contribute to the user’s choice. Furthermore, transparency in the comparison process, including clear explanations of various coverages and pricing models, is crucial for building trust and confidence.

Potential Problems and Frustrations

Users might encounter several problems when comparing auto insurance. Inaccurate or outdated information on the comparison site can lead to wrong estimations of premiums or unsuitable policy selections. Complex terminology or convoluted interfaces can make the comparison process frustrating and time-consuming. Hidden fees or unclear pricing models can make it challenging to accurately compare quotes. Furthermore, slow loading times or technical glitches on the site can create negative experiences.

The lack of personalized recommendations based on individual needs can also contribute to frustration. Users may also struggle to understand the nuances of different policy coverages and how they apply to their specific driving habits and car. Finally, a lack of transparency in the comparison process, including hidden fees or unclear pricing models, can lead to a negative experience.

User Persona

| Attribute | Description |

|---|---|

| Name | Sarah Miller |

| Age | 32 |

| Occupation | Software Engineer |

| Location | Suburban Area, California |

| Family Status | Married, with one child |

| Lifestyle | Active family lifestyle, enjoys outdoor activities and occasional travel. |

| Financial Situation | Comfortable but seeks to optimize spending |

| Online Behavior | Actively uses online tools and resources for research and comparisons; prefers clear and concise information. |

| Insurance Needs | Reliable and affordable auto insurance with comprehensive coverage, easy to understand policy options, and accessible customer support. |

Evaluating Comparison Sites

Comparing auto insurance quotes online is a convenient way to find the best rates. Reliable comparison sites can save you money by providing a clear overview of different insurance options. However, not all comparison sites are created equal. Understanding their features, pricing models, and reliability is crucial to making informed decisions.Evaluating the top comparison websites involves analyzing their strengths and weaknesses.

This includes examining their quote accuracy, available coverage types, customer service protocols, and pricing structures to ensure they meet your needs. Detailed analysis of these factors will enable you to choose the most appropriate platform for your specific requirements.

Top 5-10 Comparison Websites

A variety of websites provide auto insurance comparison services. Some of the most popular and well-regarded include: Insurify, Policygenius, Compare.com, and others. Each platform may have different strengths and weaknesses.

Features and Functionalities

Different comparison sites offer varying features and functionalities. Some may allow you to filter results by specific criteria like driving history, vehicle type, or location. Others might provide tools for calculating premium estimates based on various factors. A key factor is whether they provide an overview of coverage options. A comparison site’s features can significantly impact your experience and the accuracy of your quote.

Accuracy and Reliability of Quotes

The accuracy and reliability of quotes from different comparison sites can vary. It is crucial to verify the accuracy of the information presented on the website by checking the data sources and reviewing independent ratings. Some sites might have more reliable data sources than others, which directly affects the accuracy of the quotes.

Pricing Structures and Hidden Fees

Comparison sites employ various pricing structures. Some may charge fees or commissions, while others may not. It is essential to examine the pricing model carefully to avoid any hidden costs. Some sites may also have limitations or exclusions in their pricing models.

Coverage Options

The range of coverage options available through different comparison sites varies. Some sites may only provide basic coverage, while others offer more comprehensive packages. Understanding the specific types of coverage available and their associated costs is essential for choosing the best option.

Customer Service Methodologies

Customer service methodologies differ between comparison sites. Some may offer 24/7 support, while others may have limited hours. The efficiency and responsiveness of customer service are key factors to consider.

Comparison Table

| Site Name | Pricing Model | Coverage Types | Customer Service |

|---|---|---|---|

| Insurify | Commission-based; may vary by state | Comprehensive, liability, collision, etc. | Online chat, phone support |

| Policygenius | Commission-based; may vary by state | Comprehensive, liability, collision, etc. | Online chat, phone support |

| Compare.com | Commission-based; may vary by state | Comprehensive, liability, collision, etc. | Online chat, phone support |

| Progressive | Direct pricing model; no commission | Comprehensive, liability, collision, etc. | Online chat, phone support |

| State Farm | Direct pricing model; no commission | Comprehensive, liability, collision, etc. | Online chat, phone support |

Factors Influencing Choice

Choosing the right auto insurance comparison site is crucial for securing the most competitive rates. Users often navigate a plethora of options, each with unique features and benefits. Understanding the factors influencing their decisions can help you tailor your site to better meet their needs.The user’s journey often involves a careful evaluation of different aspects of the comparison site, ranging from the ease of use to the accuracy of the quotes.

Factors such as speed, ease of navigation, and clarity of presented information play a significant role in the decision-making process. Understanding these influencing factors empowers you to design a user-friendly and informative comparison platform.

Top Criteria for Selecting a Comparison Site

Several key criteria drive users’ selections. These criteria include the comprehensiveness of the data provided, the accuracy of the quotes generated, and the overall user experience. These aspects are essential to the user’s confidence and satisfaction with the chosen site.

- Accuracy and Reliability of Quotes: Users prioritize the accuracy and reliability of the insurance quotes. Inaccurate quotes can lead to unsuitable or potentially misleading insurance options, and users may choose a site that delivers quotes from multiple insurers. Users need to be assured of the correctness and relevance of the data to their specific needs and situation. For instance, a user with a recent speeding ticket might see vastly different quotes from different providers on different comparison sites.

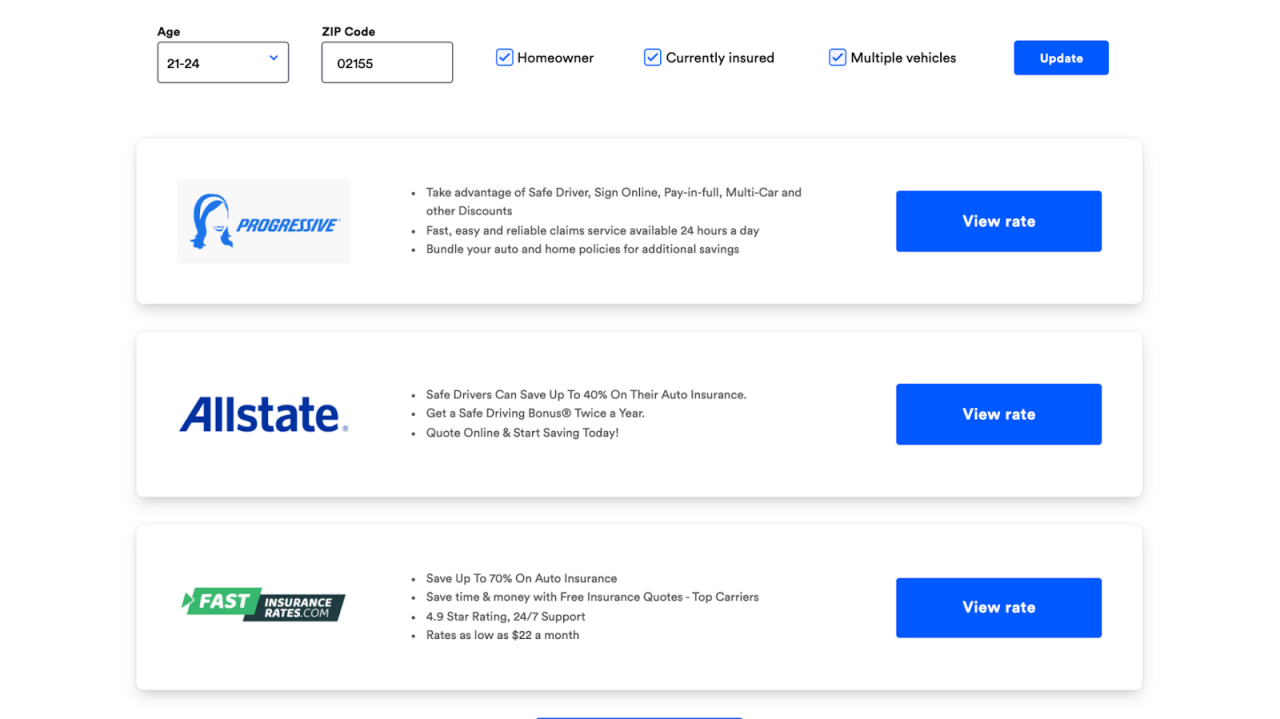

- Ease of Use and Navigation: A user-friendly interface and intuitive navigation are essential. A well-organized site, with clear categorization of insurance options and easy-to-understand information, enhances the user experience. A site that is easy to navigate will save the user time and allow them to compare different policies effectively. The layout of the site and the clarity of the information presented should enable a seamless and efficient comparison process.

- Comprehensive Coverage Options: Users appreciate sites that provide a wide range of insurance options. The comparison should include different coverage levels, deductibles, and add-ons, allowing users to find the perfect fit for their needs. Users will need to compare options based on factors such as their vehicle type, driving history, and desired level of coverage.

- Transparency and Clarity of Information: Users value sites that clearly present insurance quotes. The information should be easily digestible and understandable, with explanations of any associated fees or charges. Transparency builds trust and allows users to make informed decisions.

Potential Trade-offs in Prioritization

Users may prioritize different criteria based on their individual needs and circumstances. For example, a user might prioritize accuracy over speed if they are concerned about potential errors in the quotes. Alternatively, a user might choose speed over comprehensiveness if they are in a hurry to get a quick estimate. These choices often involve a trade-off between factors.

- Prioritizing accuracy might mean sacrificing speed, as more thorough verification of quotes takes time. Conversely, prioritizing speed may result in less comprehensive coverage options or potentially less accurate quotes.

Importance of Transparency and Clarity

Transparency and clarity are crucial for building user trust. Clearly presented quotes, with explanations of fees and coverage details, enhance user confidence in the comparison process. Users need to understand exactly what they are paying for. Unclear or confusing presentations can lead to mistrust and may discourage users from engaging further with the comparison site.

Comparison of User Interface and Experience

The user interface (UI) and user experience (UX) of different comparison sites vary significantly. Some sites excel in intuitive navigation, while others might struggle with clarity and efficiency. Some sites may provide more detailed explanations and comparisons, whereas others may focus on a more streamlined presentation. These differences significantly affect user satisfaction.

Relative Importance of Criteria

| Criteria | High | Medium | Low |

|---|---|---|---|

| Accuracy and Reliability of Quotes | ■ | ||

| Ease of Use and Navigation | ■ | ||

| Comprehensive Coverage Options | ■ | ||

| Transparency and Clarity of Information | ■ |

Note: This table provides a general representation and individual user priorities may vary.

Content Strategies for Auto Insurance Comparison Sites

Attracting and retaining customers in the competitive auto insurance market requires a multifaceted approach. Effective content strategies are crucial for building trust, educating users, and ultimately driving conversions. Comparison sites must go beyond simply listing policies; they need to provide value and establish themselves as trusted resources.

Potential Content Strategies

Content strategies should be tailored to address user needs and concerns, promoting a comprehensive understanding of auto insurance products. Sites can create a valuable resource by offering in-depth information, expert advice, and user-friendly tools. This includes educating users on policy specifics, helping them compare various options, and offering guidance on making informed decisions.

- Educational Articles and Guides: These provide detailed explanations of insurance terms, coverage options, and different types of policies. Examples include articles on “Understanding Collision Coverage” or “How to Choose the Right Liability Insurance.” These articles build trust and demonstrate expertise.

- Interactive Tools and Calculators: Tools that allow users to estimate their premiums, compare coverage options, and calculate savings can significantly enhance the user experience. For instance, a tool that calculates the impact of adding a teenage driver to a policy or a calculator that estimates the cost of different add-ons.

- Expert Insights and Interviews: Guest articles or interviews with insurance professionals or industry experts can add credibility and showcase the site’s commitment to providing accurate and reliable information. This could involve interviews on emerging trends in auto insurance or expert advice on navigating policy complexities.

- Blog Posts on Current Events: News, articles, and updates on relevant topics like accident statistics, changes in insurance regulations, and driver safety tips can position the site as a trusted resource for up-to-date information. For example, blog posts on “The Impact of Distracted Driving on Insurance Premiums” or “How New Safety Regulations Affect Policy Costs.”

Content Formats for Education

Various formats can effectively communicate complex insurance information.

- Infographics: Visual representations of complex data, like the breakdown of different types of insurance coverage or the cost comparison of various policy options, can help users quickly grasp key concepts. An infographic on “How to Save Money on Auto Insurance” would clearly show different methods and their potential savings.

- Videos: Short, engaging videos can explain insurance concepts in a clear and concise manner. A video demonstrating how to file a claim or explaining the difference between comprehensive and collision coverage can be very helpful.

- Checklists: Creating checklists to help users compare policies, gather necessary documents, or prepare for an accident can improve efficiency and provide actionable steps.

- Q&A Sections: Addressing common user questions directly can proactively answer concerns and build trust. A dedicated section on “Frequently Asked Questions about Auto Insurance” will benefit many users.

Testimonials and Case Studies

Testimonials and case studies are powerful tools for building trust and demonstrating the site’s value.

- User Testimonials: Positive feedback from satisfied customers can influence potential users. A compelling testimonial could showcase how a user saved money or had a positive experience filing a claim.

- Case Studies: Real-life examples of how the site helped users find the best policy can demonstrate its value. For example, a case study showing how a user saved thousands of dollars by switching policies through the site.

“I was so relieved to find this site. I saved a significant amount on my insurance, and the process was incredibly easy. Highly recommend!”

User Reviews and Ratings

User reviews and ratings provide valuable social proof and influence customer decisions.

- Importance of Reviews: Customer reviews and ratings provide social proof, helping potential customers gauge the site’s reliability and credibility. High ratings and positive reviews can encourage trust and increase conversion rates.

- Management of Reviews: Managing reviews effectively is crucial. Responding to both positive and negative feedback can build trust and demonstrate a commitment to customer service. Addressing concerns promptly shows users the site cares about their experience.

Visual Aids for Complex Concepts

Visual aids can enhance understanding and engagement.

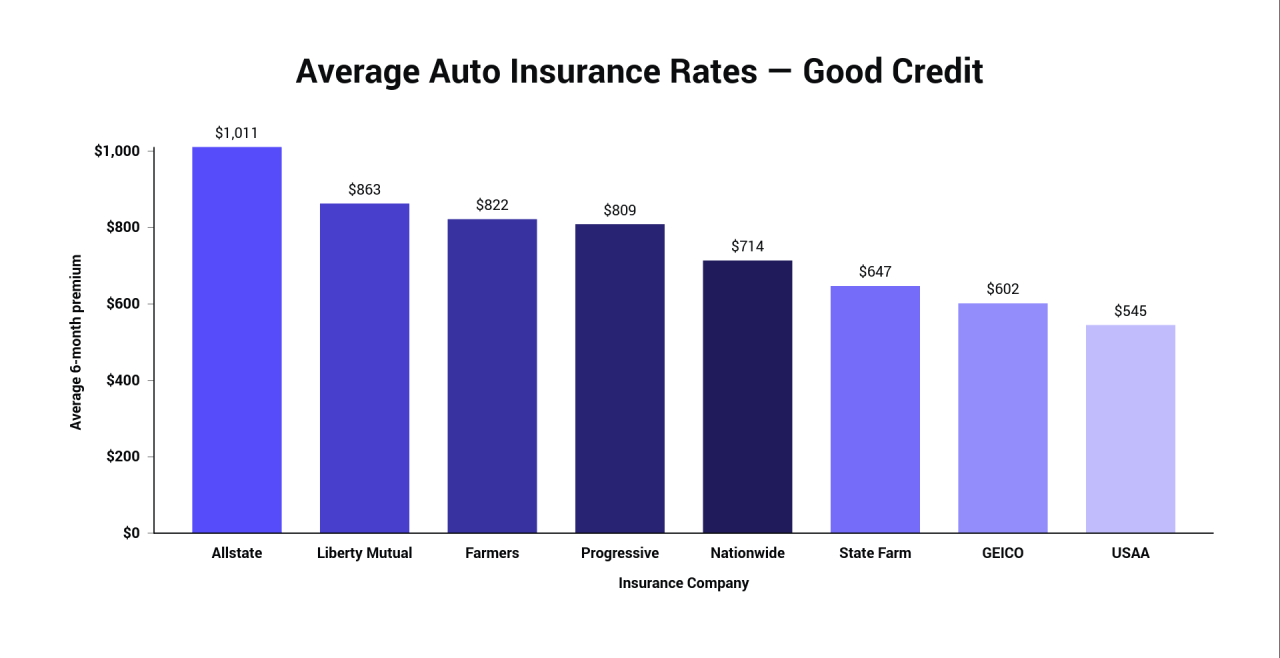

- Infographics and Charts: Using infographics and charts to represent data can make complex insurance concepts easier to understand. For instance, a chart comparing the costs of different coverage options for various vehicles or an infographic showing the breakdown of accident claims by type of vehicle.

- Interactive Maps: Using maps to illustrate how location influences insurance premiums can be very useful for consumers. A map displaying the average cost of insurance across different states or cities can help illustrate this.

Content Type Effectiveness

| Content Type | Description | Effectiveness |

|---|---|---|

| Educational Articles | In-depth explanations of insurance concepts | High |

| Interactive Tools | Tools for calculating premiums and comparing policies | High |

| Testimonials | Positive feedback from satisfied users | Moderate to High |

| User Reviews | Customer ratings and feedback | High |

| Visual Aids (Infographics) | Visual representations of data | High |

Illustrative Examples and Case Studies

Auto insurance comparison sites leverage various strategies to attract and retain customers. Understanding successful marketing campaigns and the strategies behind them provides valuable insights for creating effective content. Successful sites use data-driven approaches to tailor their content to user needs and preferences. This approach yields higher engagement and conversion rates.Effective auto insurance comparison sites go beyond simply listing policies; they actively engage users through targeted content and intuitive interfaces.

This approach demonstrates a keen understanding of the customer journey and the factors that influence their decisions.

Successful Marketing Campaigns

Several auto insurance comparison sites have implemented successful marketing campaigns. A key component of these campaigns is the emphasis on user experience, tailored content, and effective promotional methods. For instance, a site might focus on highlighting specific savings opportunities for particular demographics or drivers. Another site might leverage testimonials and social proof to build trust and credibility. By targeting specific customer segments and showcasing real-world benefits, these campaigns effectively communicate value and resonate with potential customers.

Promotional Methods

Comparison sites employ various promotional methods to drive traffic and conversions. These methods range from targeted advertising campaigns on social media and search engines to partnerships with other organizations. Some sites use special discounts and coupons, while others offer referral programs to encourage user engagement. The selection of promotional methods depends on the site’s specific goals and target audience.

For instance, a site might use email marketing campaigns to nurture leads, while others might focus on paid search advertising to capture users actively searching for insurance.

Mobile Optimization and User Experience

Mobile optimization is crucial for auto insurance comparison sites. The increasing use of mobile devices necessitates a seamless and intuitive mobile experience. This involves a responsive design that adapts to different screen sizes and ensures quick loading times. User experience (UX) plays a vital role in guiding users through the comparison process efficiently. For example, a site might use clear and concise language, well-organized navigation, and intuitive search filters to facilitate quick policy comparisons.

A well-optimized mobile site allows users to access information and make comparisons on the go, ultimately enhancing the user experience.

Case Study: Impact of Content Strategy

A comparison site focusing on “young drivers” saw a significant increase in user engagement and conversion rates after implementing a new content strategy. This strategy emphasized educational content about safe driving practices, tips for maintaining a good driving record, and the benefits of insurance for young drivers. The site also highlighted the affordability and accessibility of insurance options for this demographic.

The result was a 25% increase in user engagement and a 15% increase in conversion rates within three months. This outcome demonstrates the positive impact of a well-defined and tailored content strategy on user behavior.

Visual Elements and User Experience

Visual elements significantly impact the user experience on auto insurance comparison sites. Color schemes, typography, and imagery should be consistent and aligned with the brand identity. For example, a site using a calming blue color palette and clean fonts might convey a sense of trust and reliability. Images of happy customers or successful insurance claims can reinforce the site’s value proposition.

Effective use of visuals can enhance user engagement and improve the overall user experience. Visual elements should be easily accessible and provide clear information. For instance, the placement of buttons and links should be intuitive and logical, reducing the need for users to search for necessary information.

User-Friendly Interfaces

User-friendly interfaces are critical for successful auto insurance comparison sites. The following examples illustrate key elements:

- Clear Navigation: A prominent menu bar with easily accessible sections for different insurance types, coverage options, and comparison tools ensures easy navigation. Using clear labels and icons for each section helps users quickly locate the desired information.

- Intuitive Search Filters: Users should be able to quickly narrow down their search results using relevant filters such as location, coverage type, vehicle details, and driver profiles. This allows for focused comparisons and ensures that the presented options match the user’s specific needs.

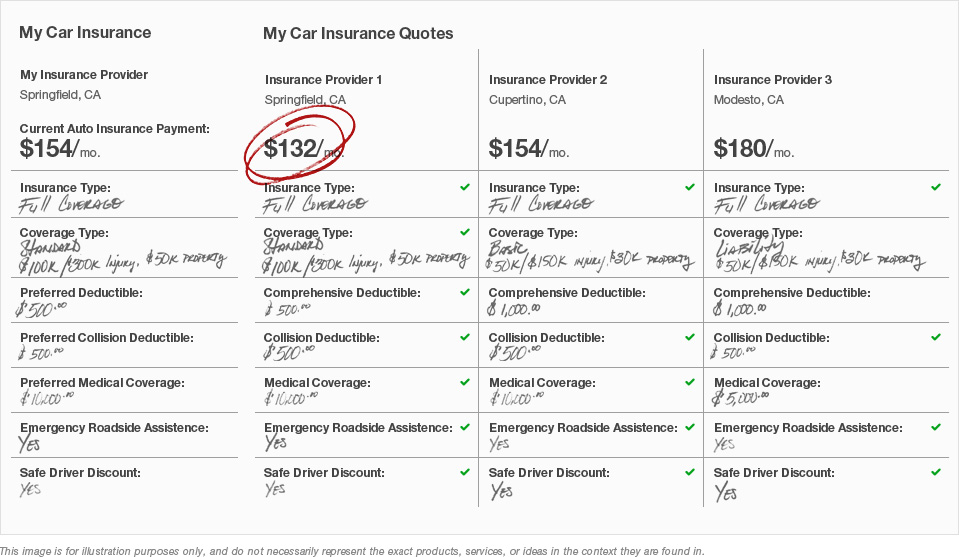

- Easy-to-Understand Comparisons: Comparison tables should be easily readable with clear headings, highlighting key features and pricing differences. Visual cues like color-coding or icons should enhance the comparison process.

- Concise Information: Information presented on each policy should be clear and concise, avoiding unnecessary jargon or technical terms. Using bullet points and short paragraphs makes the information easily digestible.

- Contact Options: Multiple contact options, such as live chat, email, and phone numbers, allow users to quickly get answers to their questions and concerns.

Last Word

In conclusion, comparing auto insurance policies effectively requires a comprehensive understanding of user needs, careful evaluation of comparison sites, and an awareness of influencing factors. By considering these aspects, consumers can confidently choose the best auto insurance plan tailored to their individual requirements. Ultimately, the best comparison site will provide a user-friendly experience, transparent pricing, and a variety of coverage options.

General Inquiries

What are some common problems users face when comparing auto insurance?

Users often encounter difficulties navigating complex policy terms, comparing quotes across multiple providers, and understanding the intricacies of different coverage options. In addition, issues with customer service and hidden fees can lead to frustration.

How do I choose the right auto insurance comparison website?

Factors to consider include accuracy of quotes, reliability of the website, ease of use, and the reputation of the comparison site. Reviewing user reviews and comparing pricing models are crucial steps in this process.

What types of coverage options are typically available through comparison sites?

Standard coverage options include liability, collision, comprehensive, and uninsured/underinsured motorist coverage. Some sites might offer additional coverage options such as roadside assistance or rental car reimbursement.

How can I determine if a quote is accurate?

Comparing quotes from different sites is crucial. Look for discrepancies in pricing. Check if the quotes are based on the same details and assumptions. Verify the provider’s reputation for accuracy.