Securing the best auto insurance prices is crucial for every driver. This comprehensive guide breaks down the key factors impacting rates and provides actionable strategies to help you find the most favorable deals. From understanding coverage options to negotiating with insurers, we’ll equip you with the knowledge to confidently manage your auto insurance.

Navigating the complexities of auto insurance can feel overwhelming. However, with a systematic approach and a keen understanding of your needs, finding the best insurance prices is achievable. This guide offers a practical approach to comparing policies, understanding the factors that influence costs, and ultimately, saving money.

Understanding Auto Insurance Needs

Navigating the world of auto insurance can feel overwhelming. Understanding the different types of coverage and how they apply to your specific needs is crucial for making informed decisions. This section will Artikel the essential aspects of auto insurance, helping you choose the right coverage for your situation and budget.Auto insurance protects you from financial losses arising from car accidents or damage to your vehicle.

It’s a complex system, but breaking down the different types of coverage, their benefits, and the factors that affect costs makes it more manageable.

Different Types of Auto Insurance Coverage

Auto insurance policies typically include various coverage options, each designed to address different risks. Understanding these different types is fundamental to securing appropriate protection.

- Liability Coverage: This is often the minimum required by law. It covers the financial responsibility for damages you cause to another person or their property in an accident where you are at fault. Liability insurance doesn’t cover your own vehicle’s damage or your medical expenses.

- Collision Coverage: This coverage pays for damage to your vehicle regardless of who is at fault in an accident. It’s beneficial if you’re involved in a collision, even if it’s your fault.

- Comprehensive Coverage: This protects your vehicle from damage caused by events other than collisions, such as vandalism, theft, fire, or hail. It’s an essential addition to your policy, as it provides comprehensive protection against unforeseen events.

Examples of Coverage Application

Consider these scenarios to illustrate how different coverage types apply:

- Scenario 1: You rear-end another car. Liability coverage will likely pay for the other driver’s vehicle repairs and potential medical expenses if they’re injured. Collision coverage would not apply since you were at fault. Comprehensive coverage wouldn’t be triggered in this situation either.

- Scenario 2: Your car is stolen. Comprehensive coverage would pay for the replacement of your vehicle. Liability and collision coverage would not apply in this instance.

- Scenario 3: A tree falls on your car during a storm. Comprehensive coverage would likely cover the damages to your vehicle.

Factors Influencing Auto Insurance Costs

Several factors influence the cost of your auto insurance premiums. Understanding these factors can help you proactively manage your insurance expenses.

- Driving Record: A clean driving record, free from accidents and violations, generally results in lower premiums. Accidents and speeding tickets, conversely, will increase your premium cost.

- Vehicle Type: The type of vehicle you drive plays a role. Sports cars, for example, tend to have higher insurance premiums than smaller, more economical cars, due to perceived risk and repair costs.

- Location: Insurance rates vary significantly by region. Areas with higher rates of accidents or theft tend to have more expensive premiums.

Deductibles and Premiums

Deductibles and premiums are key components of your insurance costs. Understanding how they affect your overall insurance expenses is essential for budgeting purposes.

- Deductibles: A deductible is the amount you pay out-of-pocket for covered damages before your insurance company begins paying. Higher deductibles typically lead to lower premiums, while lower deductibles result in higher premiums.

- Premiums: Premiums are the regular payments you make to maintain your insurance coverage. They’re influenced by factors like your driving record, vehicle type, and location. Lower premiums generally mean lower overall insurance costs.

Insurance Coverage Comparison

The table below summarizes different insurance coverages.

| Coverage Type | Description | Benefits | Example |

|---|---|---|---|

| Liability | Covers damage to others’ property or injuries to others in an accident where you are at fault. | Protects you legally from financial responsibility for accidents where you are liable. | You hit another car and are at fault. Liability covers their repairs and potential medical expenses. |

| Collision | Covers damage to your vehicle in an accident, regardless of who is at fault. | Protects your vehicle if you are involved in a collision, even if it’s your fault. | You collide with a parked car, and your vehicle is damaged. Collision coverage will cover your repairs. |

| Comprehensive | Covers damage to your vehicle from events other than collisions, like vandalism, theft, fire, or hail. | Protects your vehicle from unforeseen events that cause damage. | Your car is stolen. Comprehensive coverage will pay for its replacement. |

Finding the Best Prices

Securing the most competitive auto insurance rates is crucial for managing expenses. This involves a proactive approach that goes beyond simply selecting the first available quote. Understanding the various factors impacting pricing and utilizing effective comparison strategies is key to securing the best possible deal.

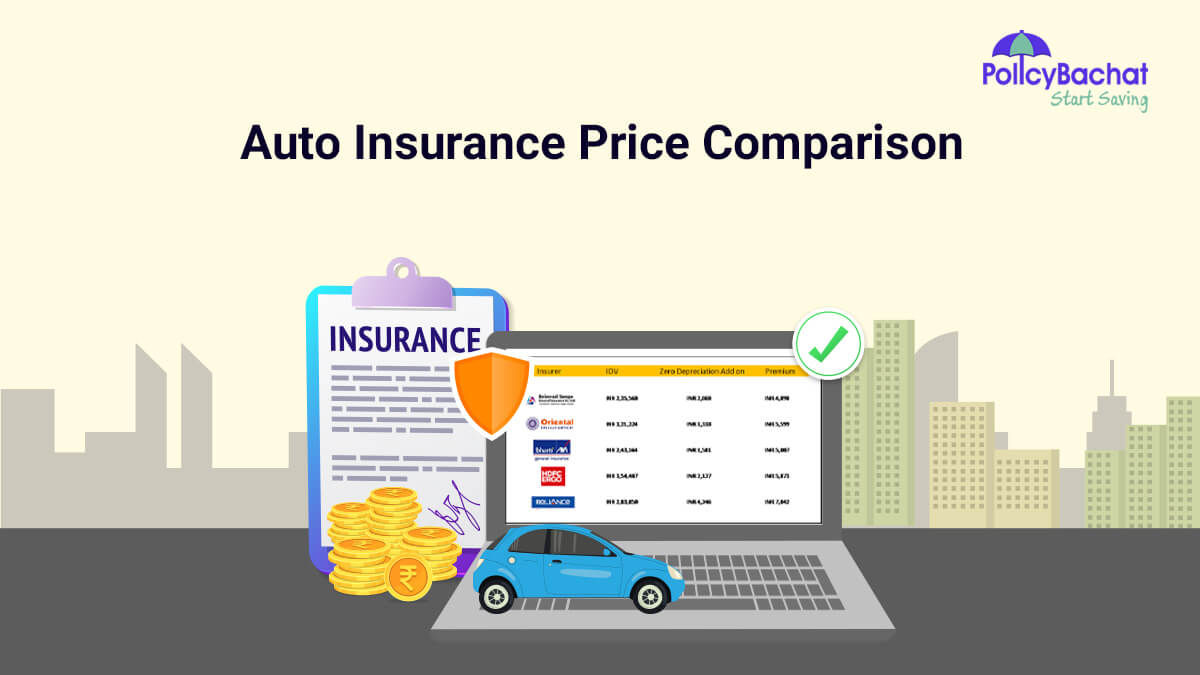

Comparing Auto Insurance Quotes

Various methods exist for comparing auto insurance quotes. Directly contacting insurers, often via phone or online portals, allows for personalized inquiries and tailored quotes. Utilizing online comparison tools is another efficient strategy. These tools aggregate quotes from multiple insurers, presenting a comprehensive overview of available options. This approach allows for quick and efficient comparison across different providers.

Importantly, consider the potential biases or limitations of these tools, as their algorithms and data sources can vary.

Online Insurance Comparison Tools

Online comparison tools streamline the process of finding competitive rates. They typically collect quotes from multiple insurers, offering a clear view of available options. Features often include filters to refine searches based on specific needs, such as vehicle type, location, and driving history. These tools often provide detailed breakdowns of coverage options and associated costs, helping consumers make informed decisions.

Users should be aware that different tools may prioritize different insurers or use varying data models, potentially leading to subtle discrepancies in displayed rates.

Importance of Considering Multiple Insurers

It is vital to solicit quotes from multiple insurers. Different companies employ varying pricing models and underwriting criteria. This means a policy that is competitive for one insurer may not be for another. Comparing quotes across multiple providers ensures a comprehensive view of available options, enabling the selection of the most suitable and cost-effective policy.

Impact of Discounts on Prices

Discounts can significantly reduce auto insurance premiums. These discounts often reflect favorable characteristics, such as a clean driving record, a safe driving habit, or enrollment in a good student program. Multi-car policies are another example of potential discounts.

Common Auto Insurance Discounts

| Discount Type | Description | Eligibility | Example |

|---|---|---|---|

| Good Student Discount | Reduced premiums for students maintaining good grades. | Enrolled full-time student with a B average or higher. | A student with a 3.5 GPA and a good driving record could receive a 10-15% discount. |

| Multi-Car Discount | Reduced premiums for insuring multiple vehicles with the same company. | Owning multiple vehicles insured with the same provider. | Insuring a family vehicle and a personal vehicle with the same company could result in a 5-10% discount. |

| Defensive Driving Course Discount | Reduced premiums for completing a defensive driving course. | Completion of a recognized defensive driving course. | A driver successfully completing a defensive driving course might receive a 5% discount. |

| Safety Equipment Discount | Reduced premiums for installing safety equipment (e.g., anti-theft devices). | Installing approved safety equipment (e.g., alarm systems, anti-theft devices). | A driver installing a vehicle alarm system might receive a small percentage discount. |

These discounts can vary based on the specific insurer and the criteria they use.

Factors Affecting Auto Insurance Costs

Understanding the factors that influence auto insurance premiums is crucial for securing the best possible rates. These factors can vary significantly depending on the specific insurance provider and the individual circumstances of the policyholder. A thorough understanding allows informed decisions about coverage and potentially substantial savings.

Driving History Impact

Driving history is a significant determinant of auto insurance premiums. A clean driving record, devoid of accidents or traffic violations, typically results in lower premiums. Conversely, a history of accidents or violations leads to higher premiums. Insurance companies assess the risk associated with each driver based on their past driving behavior. This assessment often considers the severity and frequency of any incidents.

For example, a driver with multiple speeding tickets might face a substantially higher premium compared to a driver with a clean record. This is because insurers view a history of infractions as an indication of a higher likelihood of future claims.

Vehicle Type and Model Influence

The type and model of a vehicle significantly impact insurance costs. Certain vehicles, due to their design, safety features, and theft vulnerability, are more expensive to insure than others. Luxury vehicles, sports cars, and high-performance vehicles are often associated with higher premiums compared to standard models. Similarly, older models, particularly those without advanced safety features, can also attract higher premiums.

For instance, a sports car with a powerful engine might have a higher premium than a more basic vehicle due to the perceived higher risk of accidents or damage. Insurers assess the risk of damage or theft based on the vehicle’s characteristics and historical data.

Location and Geographic Factors

Location and geographic factors also play a substantial role in insurance costs. Areas with higher crime rates, higher accident rates, or more severe weather conditions generally have higher insurance premiums. This is because insurance companies must factor in the increased risk of claims in these locations. For example, a coastal area with frequent hurricanes might have significantly higher premiums compared to a rural area with a low incidence of accidents.

Insurance companies use statistical data on accidents and claims in various regions to determine the risk associated with insuring vehicles in specific locations.

Insurance Company Pricing Differences

Different insurance companies use varying criteria and models for determining insurance premiums. Factors like their internal risk assessments, profit margins, and the specific coverage options available influence the price of policies. Consequently, the same driver with the same vehicle and location might receive varying quotes from different insurers. For example, one company might prioritize a driver’s clean driving record more heavily than another company, leading to different premium amounts.

The level of competition within the insurance market also influences the prices charged by individual companies.

Risk Factors for Auto Insurance

| Risk Factor | Explanation | Impact on Pricing | Example |

|---|---|---|---|

| Driving History | Number and severity of accidents and violations | Higher violations lead to higher premiums | A driver with multiple speeding tickets will pay more. |

| Vehicle Type | Features, safety rating, and potential for theft | High-performance vehicles are often more expensive to insure | A luxury sports car has higher premiums compared to a compact car. |

| Location | Crime rates, accident rates, and weather conditions | High-risk areas usually have higher premiums | A city with high theft rates will have higher insurance premiums. |

| Age and Gender | Statistically, certain age groups and genders have higher claim rates | Younger drivers often face higher premiums | 18-year-old drivers often have higher premiums compared to older drivers. |

| Vehicle Usage | Frequency and distance of driving | High usage often leads to higher premiums | A driver who commutes long distances daily might pay more than a driver who drives less frequently. |

Strategies for Lowering Costs

Reducing your auto insurance premiums can save you a significant amount of money annually. By understanding the factors that influence your rates and implementing effective strategies, you can potentially lower your premiums. These strategies encompass improvements in driving habits, vehicle selection, coverage choices, and negotiation tactics.Implementing these strategies can yield substantial cost savings, allowing you to allocate those funds toward other financial goals or simply enjoy a more budget-friendly lifestyle.

Improving Driving Record

Maintaining a clean driving record is crucial for obtaining favorable insurance rates. Consistent safe driving practices are key to achieving this. Avoiding traffic violations, such as speeding tickets and accidents, is paramount. By practicing defensive driving techniques, you can significantly reduce the likelihood of incidents. Regularly reviewing traffic laws and regulations, and adhering to speed limits, are proactive measures that can contribute to a positive driving record.

Furthermore, defensive driving courses can enhance your awareness and skills, leading to safer driving practices and fewer accidents.

Selecting a Safe Vehicle

Vehicle safety features play a significant role in determining insurance premiums. Vehicles equipped with advanced safety technologies, such as airbags, anti-lock brakes, and electronic stability control, generally command lower insurance rates. The model year of the vehicle also impacts rates, with newer models often incorporating the latest safety features. Consider the safety ratings of different vehicle models.

Organizations like the Insurance Institute for Highway Safety (IIHS) and the National Highway Traffic Safety Administration (NHTSA) provide valuable information on vehicle safety ratings. Choosing a vehicle with a proven safety track record can lead to lower premiums.

Comparing Insurance Coverage Options

Understanding different coverage options is crucial for selecting the appropriate insurance plan. Comprehensive coverage provides protection against damage from events like vandalism, theft, or natural disasters. Collision coverage safeguards against damage to your vehicle in an accident, regardless of who is at fault. Liability coverage, on the other hand, protects you if you’re responsible for an accident and are legally obligated to compensate the other party.

Carefully evaluating the costs and benefits of each coverage type is essential to ensure that you’re adequately protected without paying for unnecessary coverage. For example, if you have a very old car with low market value, you might consider reducing or eliminating comprehensive and collision coverage.

Negotiating Insurance Premiums

Negotiating with your insurance provider can sometimes lead to lower premiums. Reviewing your current policy, especially if there are any changes in your circumstances, such as a change in employment status, or if you have made significant improvements in your driving record, can be beneficial. Contacting your insurer directly and requesting a quote review is an important step in this process.

In some cases, bundling your auto insurance with other policies, such as home insurance, can result in discounted rates.

Tips for Lowering Auto Insurance Costs

| Tip | Description | Expected Impact | Example |

|---|---|---|---|

| Maintain a clean driving record | Avoid traffic violations, accidents, and maintain safe driving practices. | Lower premiums due to lower risk profile. | Avoiding speeding tickets and maintaining a consistent driving record can result in significant savings. |

| Select a safe vehicle | Choose a vehicle with advanced safety features and a proven safety record. | Potentially lower premiums based on the vehicle’s safety rating. | A newer car with numerous safety features like airbags and anti-lock brakes will likely have a lower premium than an older model with fewer safety features. |

| Evaluate and adjust coverage options | Ensure that your coverage aligns with your needs and budget. | Potential savings by avoiding unnecessary coverage. | Reducing comprehensive and collision coverage if your vehicle is older and has low market value can lower your premium. |

| Negotiate with your insurer | Review your policy, communicate your improvements in driving record, and request a quote review. | Potential for lower premiums through negotiations. | Requesting a review of your policy after improving your driving record can lead to a lower premium. |

Insurance Company Comparisons

Choosing the right auto insurance company involves more than just price. Factors like reputation, financial stability, and customer service play a crucial role in ensuring a positive experience. Understanding these aspects allows drivers to make informed decisions that protect their interests and financial well-being.

Reputation and Financial Stability

Insurance companies’ financial strength directly impacts their ability to pay claims. Strong financial ratings from reputable agencies like A.M. Best, Standard & Poor’s, or Moody’s indicate a company’s stability. A financially stable insurer is less likely to face insolvency, guaranteeing the timely settlement of claims. Historical data on claims handling and promptness provide further insight into a company’s reliability.

Companies with strong track records in fulfilling their obligations demonstrate a commitment to their policyholders.

Customer Service

Customer service is a critical component of the insurance experience. A company’s responsiveness, helpfulness, and efficiency in handling inquiries and claims significantly impact customer satisfaction. Customer service ratings, often found on independent review platforms, offer a valuable benchmark. Positive customer reviews, addressing issues like claim processing and communication, can provide insight into the quality of service. Online chat support, phone assistance, and email responses can all be indicators of a company’s commitment to prompt and effective customer interaction.

Local vs. National Companies

Local insurance companies often have a deeper understanding of the specific risks and driving patterns in their area. This knowledge allows them to tailor coverage options and pricing to local needs. National companies, however, may offer broader coverage options and a wider range of products due to their nationwide presence. The choice between a local or national company depends on individual needs and priorities.

Company History and Experience

Insurance companies with a long history and substantial experience in the industry typically have a proven track record of handling claims and managing risks. Their accumulated knowledge can provide a significant advantage in handling complex cases and maintaining a smooth customer experience. Examining a company’s history, including the evolution of their services and policies, offers a perspective on their adaptability and responsiveness to changing market conditions.

Insurance Company Comparison Table

| Company Name | Reputation | Customer Service Rating | Coverage Options |

|---|---|---|---|

| State Farm | Excellent; consistently high financial ratings | Generally high; known for extensive support channels | Comprehensive coverage options, including various add-ons and discounts |

| Progressive | Strong; often among top-rated companies | Good; frequently praised for online tools and ease of use | Competitive coverage packages, offering various policy customizations |

| Allstate | Very good; solid financial standing | Moderate; customer service can vary based on location and claims | Wide range of products and tailored solutions, but may have higher premiums in some areas |

| Geico | Good; well-established presence in the market | Generally good; known for convenient online services and digital platforms | Competitive options with a focus on affordability and ease of access |

| Nationwide | Excellent; consistently high financial ratings | Good; recognized for prompt and efficient claims processing | Comprehensive packages, tailored for various driving needs and preferences |

Negotiating and Obtaining Quotes

Securing the best auto insurance rates involves a strategic approach to obtaining and comparing quotes. Understanding the process empowers you to make informed decisions and potentially save money on your premiums. This section details the steps to effectively navigate the quote process and negotiate favorable terms.

Obtaining Multiple Quotes

Obtaining multiple quotes from different insurance providers is crucial for comparison. This broadens your options and allows you to identify the most competitive rates. Shopping around can uncover significant savings, often exceeding anticipated amounts.

Comparing Quotes Effectively

Comparing quotes requires a methodical approach. Don’t just focus on the premium; examine the complete coverage package. Evaluate the deductibles, policy limits, and specific coverages. Consider any additional benefits or services offered by each insurer. Compare the total cost of the policy, including any administrative fees or add-ons.

A comprehensive comparison, rather than a superficial one, ensures you select the most suitable policy.

Understanding Policy Terms and Conditions

Carefully reviewing policy terms and conditions is essential. Pay close attention to the fine print, which often details exclusions, limitations, and specific situations. A clear understanding of your rights and responsibilities under the policy is paramount. Ensure you comprehend the specific language used, as some terms might have implications that aren’t immediately obvious.

Negotiating Favorable Insurance Rates

Negotiation isn’t always about haggling, but rather about presenting a compelling case. Highlight any factors that might qualify you for a lower rate, such as a safe driving record or a comprehensive safety package on your vehicle. Demonstrate your understanding of the market rates and insurance policies.

Steps for Obtaining Auto Insurance Quotes

| Step | Description | Example | Result |

|---|---|---|---|

| 1 | Gather relevant information | Vehicle details (make, model, year, mileage), driving history (accidents, violations), personal details (age, location). | Provides a solid foundation for quoting. |

| 2 | Identify potential insurance providers | Contact local agents, online comparison websites, and insurers directly. | Provides a range of quotes from various sources. |

| 3 | Complete online quotes or contact providers | Fill out online forms or speak with an agent, providing accurate information. | Insurers generate quotes based on provided details. |

| 4 | Compare quotes based on coverage, premium, and additional features. | Analyze the policy terms, deductibles, coverage limits, and any add-ons. | Identify the most favorable options. |

| 5 | Review policy terms and conditions thoroughly. | Scrutinize all clauses, exclusions, and limitations. | Ensures clarity and understanding of the policy’s stipulations. |

| 6 | Negotiate if applicable, based on personal circumstances. | Highlight any safe driving history or discounts to potentially influence the rate. | Potentially achieve a lower premium or better terms. |

| 7 | Select the most suitable policy and sign the contract. | Choose the policy that best meets your needs and budget, ensuring you understand all terms. | Secures the best auto insurance coverage. |

Analyzing Coverage Options

Carefully reviewing your auto insurance coverage options is crucial for ensuring adequate protection and avoiding costly surprises. Understanding the different levels of coverage and the potential add-ons can significantly impact your premium and the overall value of your policy. Choosing the right coverage can save you money in the long run while providing peace of mind.Thorough analysis of coverage options is essential to aligning your policy with your specific needs and risk tolerance.

The potential risks and benefits of different coverage levels, coupled with various add-ons, will determine the appropriate level of protection. Understanding the policy language is key to making informed decisions about coverage. This ensures that you comprehend the scope of protection and limitations associated with your policy.

Importance of Reviewing Coverage Options

A thorough review of coverage options allows you to tailor your policy to match your driving habits, vehicle type, and financial situation. This personalized approach helps to avoid unnecessary expenses and ensures that you are adequately protected against potential risks. Failing to evaluate different options could lead to gaps in coverage, leaving you vulnerable to financial burdens in the event of an accident or damage.

Potential Risks and Benefits of Different Coverage Levels

Different coverage levels offer varying degrees of protection. Higher coverage levels usually translate to higher premiums, but they also provide greater financial security in case of an accident or damage. Lower coverage levels may save you money, but they also come with a higher risk of financial loss if a claim arises. It’s crucial to weigh the potential costs against the potential benefits to choose the right coverage level for your individual circumstances.

For instance, a young driver with limited assets might benefit from lower coverage levels to manage their premiums, but should also consider the potential financial impact of an accident if their assets are not sufficient to cover the damage.

Impact of Add-ons on the Final Cost

Add-ons to your basic coverage, such as roadside assistance, rental car reimbursement, or comprehensive coverage, can increase your premiums. However, these add-ons provide additional protection and peace of mind. The decision to include add-ons should be based on your individual needs and risk tolerance. A person frequently traveling long distances might find roadside assistance invaluable, whereas someone who is a careful driver and has substantial assets might not require comprehensive coverage, which can significantly increase the premium.

Significance of Understanding Policy Language

Understanding the policy language is vital to avoid misunderstandings and ensure you fully grasp the terms and conditions. Vague or unclear language can lead to disputes or rejection of claims. It’s essential to read the policy carefully and seek clarification on any sections you don’t fully comprehend. Ambiguity can create problems when making claims.

Table of Different Coverage Options

| Coverage Type | Description | Cost | Example |

|---|---|---|---|

| Liability Coverage | Covers damages you cause to other people or their property in an accident. | Variable | Pays for damages to another vehicle or injuries to others if you are at fault. |

| Collision Coverage | Covers damage to your vehicle regardless of who is at fault. | Variable | Covers repairs or replacement if your car is damaged in an accident, regardless of who caused the accident. |

| Comprehensive Coverage | Covers damage to your vehicle from events other than collisions, such as theft, vandalism, or weather events. | Variable | Covers damage caused by a fire, hail, or theft. |

| Uninsured/Underinsured Motorist Coverage | Protects you if you are involved in an accident with an uninsured or underinsured driver. | Variable | Pays for your injuries or damages if you are hit by a driver without insurance or with insufficient insurance. |

Closing Notes

In conclusion, obtaining the best auto insurance prices requires a proactive and informed approach. By understanding your coverage needs, comparing quotes from multiple providers, and implementing strategies to lower costs, you can significantly reduce your insurance expenses. Remember, a well-researched and strategically planned approach is key to securing the best possible deal.

FAQ Overview

How can I improve my driving record?

Maintaining a safe driving record is the most significant factor influencing insurance premiums. Avoid speeding, distracted driving, and aggressive maneuvers. Consider defensive driving courses to enhance your skills and knowledge.

What discounts are available for auto insurance?

Many insurers offer discounts for various factors. These include good student discounts, multi-car discounts, and discounts for safe driving habits. Contact your insurance provider to see which discounts may be available to you.

How do I compare auto insurance quotes effectively?

Use online comparison tools to gather quotes from multiple insurers. Compare policy features, coverage options, and premiums carefully. Be sure to consider the overall value, not just the lowest price.

What is the role of location in auto insurance costs?

Location significantly impacts auto insurance costs. Areas with higher crime rates, accident frequency, or severe weather patterns tend to have higher premiums. Your specific location within a region can also play a role.