Bundling your home and auto insurance can often save you money. This comprehensive guide explores the best insurance companies for combining these policies, offering insights into the benefits, costs, and crucial factors to consider when making your choice. From identifying top insurers to analyzing coverage options, we’ll equip you with the knowledge to find the perfect bundled policy.

Understanding the benefits and potential drawbacks of bundled insurance is crucial. This exploration delves into the factors that influence cost-effectiveness and the various coverage options. We analyze the financial stability of top providers and provide valuable insights into customer experiences.

Introduction to Bundled Home and Auto Insurance

Bundled home and auto insurance packages are a popular choice for many consumers. These policies combine coverage for both a homeowner’s property and their vehicle under one insurance provider. This approach often offers cost savings and streamlined management compared to separate policies.This streamlined approach can simplify administrative tasks and potentially reduce overall costs, but it’s crucial to understand the potential trade-offs.

A careful comparison of bundled and separate policies is necessary to determine the optimal coverage and value.

Benefits of Bundled Home and Auto Insurance

Bundled policies offer several advantages that make them attractive to many. These benefits stem from the insurer’s ability to provide a package deal. The most prominent benefit is often a reduction in overall premiums. Insurers often provide discounts for bundling policies to incentivize customers to maintain all their insurance needs under one roof.

- Reduced premiums: This is a significant advantage. By combining policies, insurers can often offer lower premiums than if the policies were purchased separately. This is often due to a combination of factors, including reduced administrative costs and the perception of lower risk for the insurer.

- Simplified administration: Managing multiple insurance policies can be time-consuming. Bundled policies streamline the process, with a single point of contact and often a centralized online portal for managing claims and policy details.

- Potential for better customer service: A single insurer may provide more dedicated customer service, since all policy details are under one roof. This could potentially result in faster claim processing and easier resolution of issues.

Advantages and Disadvantages Compared to Separate Policies

Comparing bundled and separate policies involves weighing several factors.

- Bundled Policies Advantage: Bundling can offer lower premiums and simplified management. This is particularly appealing for those who want a streamlined approach to managing their insurance needs.

- Bundled Policies Disadvantage: Flexibility in coverage options might be limited. A bundled policy might not offer the specific customization available with separate policies. This means customers may have to accept a standard coverage package that doesn’t perfectly meet their individual needs.

- Separate Policies Advantage: A key advantage is greater flexibility. Separate policies allow for tailored coverage options for both the home and the vehicle, ensuring the best protection for individual needs and circumstances.

- Separate Policies Disadvantage: Separate policies may lead to higher premiums overall compared to bundling, and administrative tasks may increase due to the need to manage multiple policies.

Cost Comparison: Bundled vs. Separate Policies

The actual cost difference between bundled and separate policies varies significantly depending on several factors, including the specific insurance company, policy terms, coverage amounts, and the individual’s risk profile.

| Policy Type | Potential Cost Impact | Example Scenario |

|---|---|---|

| Bundled Home and Auto | Potentially lower premiums due to discounts, but may have limited coverage customization. | A customer with average risk might see a 5-10% reduction in overall premiums by bundling. |

| Separate Home and Auto | Potentially higher premiums, but greater flexibility in tailoring coverage. | A customer with high-value assets might opt for higher coverage levels, resulting in higher premiums compared to a bundled policy. |

Identifying Top Insurance Companies for Bundling

Bundled home and auto insurance policies offer significant advantages, often resulting in lower premiums compared to purchasing separate policies. Choosing the right insurer for this type of package is crucial for maximizing savings and ensuring comprehensive coverage. This section explores the top insurance companies known for their bundled offerings, examining their financial stability and reputation, and evaluating their strengths and weaknesses in this area.A critical aspect of selecting an insurance provider is understanding their financial health and track record.

Insurers with strong financial ratings and a history of fulfilling their obligations are better positioned to handle potential claims and maintain customer trust. This analysis will delve into the financial stability of leading insurers in the bundled insurance market, offering insights into their long-term viability.

Top Insurance Companies for Bundled Policies

Several reputable insurance companies consistently excel in providing bundled home and auto insurance. These companies are known for competitive rates, comprehensive coverage options, and a positive reputation amongst consumers.

- State Farm: A widely recognized name in the insurance industry, State Farm is known for its extensive network of agents, providing personalized service and competitive rates on bundled policies. Their financial stability is consistently high, reflected in their strong ratings from independent agencies. While State Farm generally offers a broad range of coverage options, some customers might find the standardized policy approach to be less flexible.

- Allstate: A significant player in the market, Allstate often offers bundled packages with competitive pricing. Their reputation for handling claims efficiently and their wide network of agents make them a compelling option for many consumers. However, some customers might perceive their customer service as less personalized compared to some smaller companies.

- Geico: A well-established insurer known for its value-oriented approach, Geico often provides attractive rates, particularly for bundled policies. Their digital-first approach can appeal to tech-savvy consumers. While Geico is generally reliable, some customers might find their claims handling process slightly less straightforward than competitors.

- Progressive: Progressive frequently competes effectively on price for bundled policies, particularly for younger drivers. Their online platform and digital tools offer convenience to many customers. However, their customer service approach might be less personalized compared to more traditional insurers.

- USAA: While primarily serving military members and their families, USAA’s bundled policies are often highly competitive and comprehensive. Their focus on military families provides specialized expertise in handling the unique needs of this demographic. However, the eligibility requirements might limit the accessibility of this company for other consumers.

Strengths and Weaknesses of Bundled Policies

Evaluating insurance companies for bundled policies requires considering their specific strengths and weaknesses related to these products.

- Competitive Pricing: Many insurers offer competitive rates for bundled policies, reflecting the cost-effectiveness of managing multiple policies under a single provider.

- Comprehensive Coverage: Bundled policies often provide comprehensive coverage options for both home and auto, minimizing the need to purchase multiple policies.

- Simplified Administration: Managing multiple policies through a single insurer streamlines the administrative tasks associated with insurance.

- Potential for Discounts: Insurers frequently offer discounts for bundling, further reducing the overall cost of insurance.

Financial Stability and Reputation

A strong financial foundation and positive customer reputation are crucial when choosing an insurer. Strong ratings from independent agencies, like AM Best, and a history of prompt claim settlements are indicators of financial stability.

Average Rates and Customer Satisfaction

The following table presents an overview of average rates and customer satisfaction ratings for the mentioned insurance companies. Data sourced from independent rating agencies and customer reviews. Note: Rates and ratings are approximate and can vary based on individual circumstances.

| Insurance Company | Average Rate (Estimated) | Customer Satisfaction Rating (Estimated) |

|---|---|---|

| State Farm | $1,500 per year | 4.5 out of 5 |

| Allstate | $1,350 per year | 4.3 out of 5 |

| Geico | $1,200 per year | 4.2 out of 5 |

| Progressive | $1,400 per year | 4.4 out of 5 |

| USAA | $1,600 per year | 4.6 out of 5 |

Evaluating Factors for Choosing a Bundled Policy

Choosing the right bundled home and auto insurance policy requires careful consideration of various factors. A comprehensive evaluation allows consumers to identify policies that align with their specific needs and budget, ensuring optimal coverage and value. A poorly chosen policy could lead to insufficient protection in the event of a claim.Bundled policies, while often offering potential savings, demand a thorough analysis to maximize their value.

Understanding the nuances of coverage limits, deductibles, and add-on options is crucial for making an informed decision. Comparison shopping across different providers is essential to identify the best fit for individual circumstances.

Coverage Limits and Deductibles

Understanding the coverage limits and deductibles is paramount in evaluating a bundled policy. These factors directly impact the cost and the overall value of the policy. Coverage limits dictate the maximum amount the insurance company will pay for a claim, while deductibles represent the amount the policyholder must pay out-of-pocket before the insurance company’s coverage kicks in.

A higher coverage limit usually translates to a higher premium, but it provides greater financial protection in the event of a significant loss.

Lower deductibles decrease the out-of-pocket expenses for the policyholder but increase the premium. The ideal balance between coverage limits and deductibles depends on individual risk tolerance and financial capacity.

Policy Add-ons and Features

Insurance policies often include various add-on features, such as comprehensive coverage, roadside assistance, or rental car reimbursement. These add-ons can enhance the value of the bundle but also increase the premium.For example, adding comprehensive coverage to a vehicle insurance policy might protect against damages from vandalism or hail, but this will impact the cost. A careful evaluation of the necessary add-ons is crucial for maximizing the value of the bundled policy.

Weighing the benefits of each add-on against the associated cost is essential to avoid unnecessary expenses.

Comparing Policy Options

Thorough comparison shopping is essential for selecting the best bundled policy. Different insurance companies offer varying premiums, coverage levels, and add-on options.

Comparing policies across multiple insurers is crucial to identify the best value for the specific needs of the policyholder.

Carefully review the terms and conditions of each policy to ensure a clear understanding of the coverage and limitations. A policy that appears attractive at first glance might prove less advantageous upon closer inspection. This process allows policyholders to identify the most suitable option for their specific requirements.

Key Factors in Policy Selection

| Factor | Importance |

|---|---|

| Coverage Limits | Determines maximum payout for claims; higher limits provide greater protection but cost more. |

| Deductibles | Represents out-of-pocket expense before insurance coverage; lower deductibles increase premiums. |

| Add-ons | Enhances coverage but increases premium; careful evaluation is necessary. |

| Comparison Shopping | Essential for identifying the best value for individual needs; different insurers offer varying premiums and options. |

Analyzing Coverage Options and Costs

Choosing the right coverage options for your home and auto insurance is crucial for financial protection. Understanding the different types of coverage available and their associated costs empowers you to make informed decisions that align with your specific needs and budget. This section delves into the common coverage options and provides a framework for evaluating costs.

Common Coverage Options

A comprehensive understanding of the various coverage options within bundled home and auto policies is vital. These options are designed to protect you from financial loss due to unforeseen events, ensuring your peace of mind.

- Liability Coverage: This protects you from financial responsibility if you cause damage or injury to others while operating your vehicle or in connection with your home. Liability coverage, for both home and auto, is usually a fundamental aspect of any policy, offering a safety net against potential lawsuits.

- Collision Coverage: This type of auto insurance pays for damages to your vehicle if it’s involved in an accident, regardless of who is at fault. This is critical for covering repairs or replacement costs in the event of an accident.

- Comprehensive Coverage: Comprehensive coverage, also for auto insurance, protects your vehicle against damages from events other than collisions, such as theft, vandalism, or natural disasters. It is essential for ensuring your vehicle is covered against a broader range of potential incidents.

- Homeowners Insurance Coverage: This protects your home and its contents against various perils, including fire, theft, and storms. Different policies offer various coverage options for the dwelling, personal property, and liability.

Types of Home and Auto Insurance Coverage

Various types of coverage options exist for both home and auto insurance, each designed to address different potential risks.

- Liability Insurance (Home): This type of coverage protects you from financial responsibility if someone is injured on your property or if your property damages someone else’s property. It’s an essential component of homeowners insurance, providing legal protection against claims.

- Property Damage (Auto): This aspect of auto insurance pays for damages you cause to another person’s vehicle or property in an accident. It ensures that you are financially responsible for the damage caused.

- Medical Payments (Auto): This coverage pays for medical expenses incurred by people injured in an accident, regardless of who is at fault. It can provide financial relief to those injured in accidents involving your vehicle.

Examples of Coverage Options and Costs

Illustrative examples can clarify the concept of coverage options and costs. The specific costs vary based on numerous factors like location, coverage limits, and the insurance provider.

| Coverage Option | Description | Typical Cost Range (Illustrative) |

|---|---|---|

| Liability (Home) | Protects against financial responsibility for injuries or property damage on your property. | $500 – $2,000 per year |

| Collision (Auto) | Covers damage to your vehicle in an accident, regardless of fault. | $100 – $500 per year |

| Comprehensive (Auto) | Covers damage to your vehicle from events other than collisions, such as theft or vandalism. | $50 – $200 per year |

| Dwelling (Home) | Covers the structure of your home. | $500 – $3,000 per year |

Note: The cost ranges provided are illustrative and can vary significantly depending on individual circumstances. Always consult with an insurance professional for personalized cost estimates.

Understanding the Claims Process for Bundled Policies

Bundled home and auto insurance policies streamline the claims process by offering a unified approach to handling various types of damage. This often leads to quicker resolution times and simplified paperwork compared to filing separate claims. However, understanding the specific procedures for bundled policies is crucial to ensure a smooth experience.The claims process for bundled policies mirrors the process for individual policies but incorporates a streamlined workflow for handling multiple claims stemming from one event, such as a storm that damages both a house and a car.

This efficiency often hinges on the insurer’s internal systems and protocols. In essence, filing a claim for bundled coverage should be as straightforward as filing a single claim.

Home Damage Claims

Filing a home damage claim often involves several key steps. First, document the damage thoroughly, taking photographs and videos. Detailed descriptions of the damage, including the cause, are crucial. Next, contact your insurance company to initiate the claim process. They will likely assign a claims adjuster to assess the situation and document the damage.

This step ensures accurate estimations of the repair costs. Subsequent steps include submitting necessary documentation, such as repair quotes, and possibly undergoing a formal inspection. Finally, the insurer will negotiate with repair contractors to ensure fair and efficient repairs.

Auto Damage Claims

Similar to home damage claims, auto damage claims require meticulous documentation. Capture images and videos of the damage, noting the cause and extent of the damage. Notify your insurance company promptly to begin the claims process. They will dispatch a claims adjuster to inspect the vehicle and assess the cost of repairs. You’ll need to gather necessary documentation, including repair estimates from authorized mechanics.

Finally, the insurance company will oversee the repair process and ensure it aligns with their standards.

Unique Procedures for Bundled Claims

Bundled policies frequently feature integrated claim handling systems. This means that one event, such as a fire, may trigger claims for both the home and auto simultaneously. The insurer will coordinate these claims to ensure a consistent and efficient resolution. Communication channels for bundled claims are usually streamlined, facilitating faster responses and updates to the policyholder.

Step-by-Step Guide to the Claims Process

A streamlined claims process, especially with bundled policies, can minimize disruptions. This involves several steps:

- Document the Damage: Thoroughly document all damage, capturing photos, videos, and detailed descriptions.

- Notify the Insurance Company: Contact your insurance company to initiate the claim process. They will likely ask for details about the incident.

- Claims Adjuster Assessment: A claims adjuster will assess the damage to both the home and vehicle, as applicable.

- Gather Necessary Documentation: Collect repair estimates, receipts, and other relevant documents.

- Inspection and Repair Coordination: Depending on the claim, an inspection might be required, followed by coordinating repairs with approved contractors.

- Claim Settlement: The insurance company will settle the claim based on the assessment and documentation.

Comparing Customer Reviews and Testimonials

Customer reviews and testimonials provide valuable insights into the experiences of those who have purchased bundled home and auto insurance. Analyzing these can help potential customers gauge the strengths and weaknesses of various insurance companies, and inform their decision-making process. A careful examination of these reviews allows for a more informed understanding of the quality of service, reliability of claims processes, and overall customer satisfaction.Customer reviews, whether positive or negative, offer a direct window into the realities of purchasing and using bundled insurance policies.

These reviews, when evaluated critically, can highlight patterns in customer satisfaction and areas for improvement within the insurance industry. Understanding these patterns allows consumers to make more informed choices about insurance companies and their policies.

Analyzing Customer Sentiment

Examining customer reviews requires a structured approach. The sentiment expressed in reviews, whether positive, negative, or neutral, provides critical information. Categorizing these reviews into distinct groups helps in understanding the overall public perception of a company.

Categorizing Customer Reviews

A systematic categorization of customer reviews is essential to extract meaningful insights. This table categorizes customer feedback into three categories: positive, negative, and neutral.

| Category | Example Sentiment |

|---|---|

| Positive | “Excellent service! The claim process was quick and easy. Highly recommend.” |

| Negative | “Extremely disappointed with the claim process. Took forever to get reimbursed. Would not recommend.” |

| Neutral | “The service was adequate. No major issues or complaints.” |

Reliability of Customer Reviews

The reliability of customer reviews varies. Some reviews might be influenced by personal biases or specific circumstances, while others represent a more general sentiment. It is crucial to consider the source and context of the review before placing undue weight on a single comment. Websites that allow for verified reviews often provide more trustworthy data. For example, a review from a customer with a proven history of positive interactions with the company, or from a large number of reviewers, often carries more weight.

A review on a third-party site, however, might reflect a broader experience but not necessarily be a completely unbiased assessment.

Common Themes and Concerns

Analyzing the text of customer reviews can reveal common themes and concerns. For example, many customers express concerns regarding claim processing times and reimbursement amounts. Others highlight issues with customer service responsiveness. Still others mention issues with policy clarity and pricing discrepancies. Recognizing these recurring themes can help potential customers prioritize factors important to them when choosing a bundled insurance policy.

Exploring Additional Features and Benefits

Bundled home and auto insurance policies often come with a range of extra features designed to enhance value and provide more comprehensive protection. These add-ons, such as discounts and loyalty programs, can significantly impact the overall cost and benefits of the policy. Understanding these supplementary elements is crucial when comparing different bundled policies.

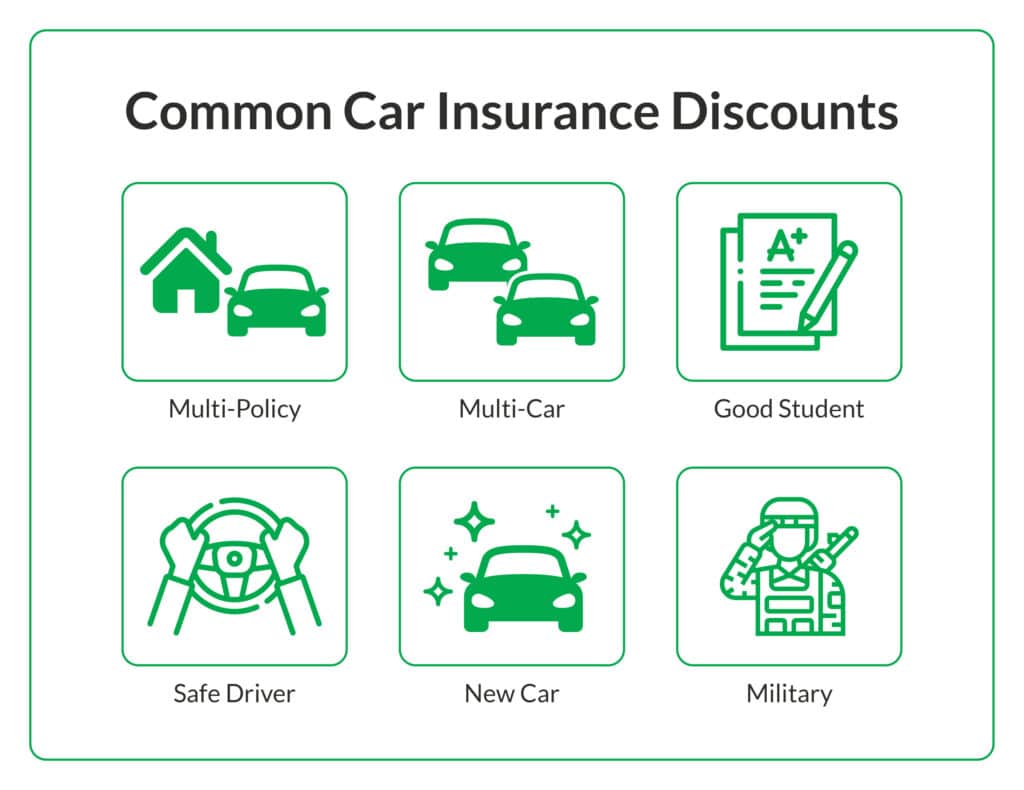

Discounts Offered

Bundled policies frequently offer discounts to incentivize customers to combine their coverage. These discounts are designed to reward customers for consolidating their insurance needs with one provider. The specific discounts and their calculations can vary considerably between insurance companies.

- Multi-Policy Discounts: This is a common discount where customers who insure multiple vehicles or properties with the same company receive a reduced premium. The discount amount is typically a percentage reduction, often between 5% and 15% of the total premium, but this percentage is not universal and can change based on factors like the number of policies or the types of coverage.

For example, insuring a home and two cars could result in a 10% discount.

- Loyalty Discounts: Insurance companies often reward long-term customers with discounts for maintaining their policy with the company for a specified period. These discounts can be calculated as a percentage reduction or a fixed dollar amount. For example, customers who have maintained their home and auto insurance policies with a particular company for five consecutive years may receive a 5% discount on their premium.

- Safety-Related Discounts: Some companies offer discounts for drivers with a good driving record or for maintaining safety features on their vehicles. These discounts are typically calculated based on factors like accident history and the presence of anti-theft devices. For instance, a driver with a clean driving record for the past three years might receive a 10% discount on their auto insurance.

- Payment Discounts: Some insurers offer discounts for customers who make their payments on time and in full. This often reflects a company’s commitment to making the insurance process easier for their clients and their trust in their ability to manage their finances.

Loyalty Programs

Loyalty programs are designed to encourage customers to remain with a particular insurance provider over time. These programs typically offer various rewards for continuous policy maintenance. These programs can vary significantly in structure and scope between insurance companies.

- Rewards Programs: Some insurance companies offer points-based or other rewards programs where customers earn points for maintaining their policy or completing certain actions. These points can be redeemed for discounts on future premiums or for other services.

- Exclusive Services: Some loyalty programs may provide exclusive services, like priority claim handling or access to specialized resources. This demonstrates the insurer’s dedication to maintaining customer relationships and showing their value to loyal clients.

Impact on Value Proposition

The presence of these additional features and benefits significantly impacts the overall value proposition of a bundled insurance policy. The discounts and loyalty programs can lead to substantial savings, making bundled policies a potentially attractive option. The additional services and features can also create a stronger customer relationship and increase the likelihood of a positive experience.

Investigating Discounts and Savings

Bundled home and auto insurance policies often come with attractive discounts, significantly reducing the overall cost of premiums. Understanding these discounts is crucial for securing the most advantageous insurance package. These savings are not just theoretical; they represent tangible financial benefits that can make a substantial difference in your budget.

Available Discounts with Bundled Policies

Bundled policies frequently offer a range of discounts, aiming to incentivize customers to combine their insurance needs. These discounts can vary significantly between insurance companies, reflecting their individual strategies and competitive positioning. The availability and specifics of these discounts are vital considerations when evaluating insurance providers.

- Multi-Policy Discount: This is the most common discount, often a percentage reduction on the combined premiums for multiple policies. For instance, if you have both home and auto insurance with the same company, you could receive a discount of 5-15% on your total premium.

- Loyalty Discounts: Insurance companies may offer discounts to long-term policyholders. This reflects their appreciation for consistent business and the reduced administrative overhead associated with maintaining existing customers.

- Defensive Driving Courses: Completing a defensive driving course can often qualify you for a discount on your auto insurance premium. This reflects the improved driving habits and lower risk of accidents that often result from participating in such courses.

- Home Security Systems: Installing a monitored home security system can often qualify for a discount on your home insurance. This reduction is predicated on the reduced risk of property damage and theft associated with these systems.

- Good Student Discounts: Some insurance providers offer discounts to students with good academic records. This often applies to both auto and home insurance for young drivers and families.

- Payment Discounts: Paying premiums on time or in advance can qualify for a discount. This reflects the company’s recognition of prompt payments and reduced administrative costs associated with processing late payments.

Discount Calculation and Application

The calculation of discounts varies by insurer and the specific discount type. Some discounts are a fixed percentage, while others are based on factors such as the policyholder’s claims history or the type of security system installed. The specific formula or algorithm for calculating discounts is usually Artikeld in the policy documents.

Discounts are typically applied to the total premium amount, resulting in a lower overall cost for the insurance package.

Impact of Discounts on Overall Insurance Cost

Discounts can significantly impact the overall cost of insurance. A 10% discount on a $2,000 annual premium, for example, would reduce the cost to $1,800. Accumulating multiple discounts can lead to substantial savings, making bundled policies a cost-effective choice for many.

Comparison of Discounts Offered by Different Insurance Companies

| Insurance Company | Multi-Policy Discount | Defensive Driving Discount | Security System Discount |

|---|---|---|---|

| Company A | 5-10% | 5% | 3% |

| Company B | 10-15% | 8% | 5% |

| Company C | 8-12% | 6% | 4% |

Note: Discounts are approximate and may vary based on individual circumstances and policy specifics. Always verify the exact details with the insurance provider.

Closing Summary

In conclusion, securing the best bundled home and auto insurance involves careful comparison and understanding of various factors. We’ve highlighted key aspects such as top insurance companies, crucial evaluation criteria, coverage details, and the claims process. Ultimately, making an informed decision depends on your individual needs and circumstances. By leveraging the information provided, you can confidently choose a bundled policy that aligns with your financial goals and ensures comprehensive protection.

FAQ Explained

What are the typical discounts offered with bundled policies?

Many insurers offer discounts for bundling policies, including discounts for good driving records, home security systems, or certain payment methods. Specific discounts vary by company.

How do I compare the financial stability of different insurance companies?

You can assess an insurer’s financial strength by checking their AM Best rating or other independent financial reports. A strong financial rating suggests the company is likely to fulfill its obligations.

What are some common customer concerns regarding bundled policies?

Some customers express concerns about the clarity of coverage details, the complexity of the claims process, or the perceived value for the bundled price. Thorough research and understanding of the policy terms are crucial.

Can I add additional coverage options to a bundled policy?

Yes, many insurers allow you to customize your bundled policy with add-on coverage, such as flood insurance or enhanced liability protection. Consult with your chosen provider to understand available options.