Best home and auto bundle packages are becoming increasingly popular, offering significant financial and administrative benefits. This comprehensive guide delves into the intricacies of these bundled insurance products, exploring their advantages, potential limitations, and crucial considerations for consumers.

We’ll explore various bundle offerings, highlighting the key features, coverage levels, and pricing models. Understanding the market trends and customer considerations is paramount in choosing the optimal bundle tailored to individual needs. From cost savings to administrative efficiency, we’ll examine the multifaceted advantages of bundling home and auto insurance.

Defining the Bundle

A home and auto bundle is a package deal offered by insurance providers that combines home and car insurance policies into a single contract. This approach often provides cost savings and streamlined management for customers. The core benefit lies in the potential for reduced premiums compared to purchasing policies separately.Bundling policies allows insurance companies to offer bundled discounts and potentially provide better customer service through a single point of contact.

This simplification can save time and reduce administrative burdens for customers.

Types of Home and Auto Bundle Offerings

Bundled home and auto insurance offerings often come in various forms. Some providers offer basic bundles that include only the fundamental coverage components. Others provide more extensive packages with additional options like roadside assistance, rental car coverage, or enhanced liability limits.

Common Features and Benefits

The most common features in home and auto bundles include:

- Reduced Premiums: Bundling frequently results in lower premiums compared to purchasing separate policies, due to the reduced administrative costs and potential for discounts.

- Simplified Management: A single contract simplifies the payment process, claim procedures, and overall insurance management.

- Enhanced Customer Service: Many providers offer dedicated customer service representatives for bundled policyholders, streamlining communication and assistance.

- Potential Discounts: Bundled policies often come with discounts for multiple policies, reducing the total cost for the customer.

Insurance Companies Offering Bundles

Numerous insurance companies provide home and auto bundles. Some prominent examples include:

- XYZ Insurance: A well-established company offering competitive home and auto bundle rates.

- ABC Insurance Group: Known for its comprehensive home and auto bundles with various coverage options.

- Local Insurance Providers: Many local insurance agents also offer tailored home and auto bundles, sometimes with specific community-based discounts.

Comparison of Bundle Options

The following table provides a comparative overview of coverage levels and prices for different bundle options from XYZ Insurance, ABC Insurance, and a hypothetical ‘Local Insurer’. Note that coverage details and prices can vary significantly depending on individual circumstances.

| Insurance Provider | Bundle Option | Home Coverage (Example: $500,000 dwelling coverage) | Auto Coverage (Example: $100,000 liability) | Price (Example: Annual) |

|---|---|---|---|---|

| XYZ Insurance | Basic Bundle | $500,000 Dwelling, $100,000 Contents | $100,000 Liability, $25,000 Uninsured Motorist | $2,400 |

| XYZ Insurance | Premium Bundle | $750,000 Dwelling, $150,000 Contents, Additional Flood Coverage | $300,000 Liability, $50,000 Uninsured Motorist, Comprehensive Coverage | $3,000 |

| ABC Insurance | Standard Bundle | $600,000 Dwelling, $120,000 Contents | $200,000 Liability, $25,000 Uninsured Motorist | $2,700 |

| Local Insurer | Custom Bundle | Negotiable Coverage based on Needs | Negotiable Coverage based on Needs | Variable, based on individual risk assessment |

Benefits of Bundling

Bundling your home and auto insurance can offer significant advantages beyond simply combining policies. It represents a strategic approach to risk management, often resulting in substantial cost savings and streamlined administrative processes. This approach simplifies your insurance needs and potentially reduces the overall financial burden.Bundling your home and auto insurance with the same provider is a smart financial decision, often leading to significant cost reductions and simplified management.

This approach typically provides more than just a combined policy; it unlocks access to exclusive discounts and streamlined administrative procedures.

Financial Advantages

Bundling home and auto insurance frequently results in substantial financial benefits. Providers often offer discounted rates for customers who combine their policies. These discounts are usually based on factors such as the insured’s profile and risk assessment, and reflect the perceived lower risk associated with a customer holding multiple policies with the same provider. These savings can translate into considerable financial relief, especially when considering the significant expenses associated with home and auto insurance.

For example, a family with both a home and multiple vehicles may find substantial savings by bundling their policies, potentially freeing up funds for other financial priorities.

Discounts and Savings

Bundled policies frequently unlock access to various discounts. These discounts can be substantial, reducing the overall cost of insurance significantly. The specific discounts offered vary by provider, but common types include multi-policy discounts, loyalty discounts, and discounts for specific safety features or driving records. For instance, a driver with a safe driving record might qualify for a discount on their auto insurance, which could then be applied to the bundled policy.

Furthermore, insurers often provide substantial discounts for customers who maintain multiple policies.

Convenience Factor

Managing all insurance needs through a single provider streamlines administrative tasks. This approach reduces the time spent on paperwork, communication, and policy updates. Customers only need to interact with one entity for all their insurance requirements, making the process more efficient and user-friendly. For example, if a customer needs to file a claim, they only need to deal with one insurance company, eliminating the need to contact multiple providers.

This single point of contact simplifies the entire process, which is particularly valuable for busy individuals and families.

Comparison with Separate Policies

Bundling policies generally leads to lower costs compared to purchasing separate home and auto insurance policies. The combined discount often outweighs the potential cost of individual policies. Furthermore, the administrative burden of managing separate policies is significantly higher. This includes dealing with different providers, handling multiple invoices, and tracking deadlines for policy renewals. In contrast, a bundled policy simplifies the process and ensures consistent communication.

This streamlined management approach allows for greater peace of mind.

Summary Table of Discounts

| Insurance Provider | Multi-Policy Discount | Safe Driving Discount | Loyalty Discount |

|---|---|---|---|

| Company A | 10% | 5% | 2% |

| Company B | 15% | 7% | 3% |

| Company C | 12% | 6% | 2.5% |

Note: Discounts may vary depending on individual circumstances and specific policy details. It’s crucial to consult with individual providers for specific pricing information.

Evaluating Bundle Components

Home and auto insurance bundles offer convenience, but careful evaluation of the components is crucial. Understanding the specific coverages included and potential limitations is key to ensuring adequate protection. This section details the typical elements of home and auto insurance bundles, highlighting common coverages, potential gaps, and how a bundle can safeguard against risks.

Home Insurance Components

A comprehensive home insurance policy typically includes several key components. These often cover various perils, ensuring financial protection in unforeseen circumstances. Standard coverages frequently encompass dwelling coverage (repair or replacement of the home structure), personal property coverage (for belongings inside the home), liability protection (for accidents that may occur on your property), and additional living expenses (covering temporary lodging if the home becomes uninhabitable).

The specific details and limits within each component will vary depending on the insurer and policy terms.

Auto Insurance Coverages

Auto insurance within a bundle typically offers several types of coverage. Liability coverage is a fundamental component, protecting you from financial responsibility if you cause an accident resulting in harm to others or damage to their property. Collision coverage protects your vehicle if it’s damaged in an accident, regardless of who is at fault. Comprehensive coverage safeguards your vehicle from damage caused by non-collision events, such as vandalism, theft, or weather-related events.

Uninsured/underinsured motorist coverage is also crucial, as it protects you from accidents involving drivers without adequate insurance. Specific coverage limits and deductibles are Artikeld in the policy details.

Potential Coverage Gaps

While bundles often offer a convenient package, potential gaps in coverage exist. The limits on various components, such as liability limits or the amount of personal property covered, might not always align with individual needs. Furthermore, some specific risks, like flood damage or earthquake damage, might require additional coverage not included in the standard bundle. It’s important to carefully review the policy documents to ensure adequate protection.

Table of Home and Auto Insurance Coverages

| Coverage Type | Home Insurance | Auto Insurance |

|---|---|---|

| Dwelling Coverage | Covers damage to the home structure | N/A |

| Personal Property Coverage | Covers belongings within the home | N/A |

| Liability Coverage | Protects against claims arising from injuries or property damage on the property | Protects against claims arising from injuries or property damage caused by the insured vehicle |

| Additional Living Expenses | Covers expenses if the home becomes uninhabitable | N/A |

| Collision Coverage | N/A | Covers damage to your vehicle in an accident, regardless of fault |

| Comprehensive Coverage | N/A | Covers damage to your vehicle from non-collision events (e.g., vandalism, theft, weather) |

| Uninsured/Underinsured Motorist Coverage | N/A | Protects against accidents involving drivers without adequate insurance |

Protection Against Potential Risks

A well-structured home and auto bundle can effectively mitigate various risks. For instance, dwelling coverage in a home bundle safeguards against fire damage, protecting homeowners’ financial interests. Comprehensive auto insurance in a bundle safeguards against theft or vandalism, thus mitigating financial losses. Liability coverage in both protects against legal responsibility in accidents, providing a financial safety net.

It’s crucial to understand the specific coverage limits within the bundle to determine its adequacy for individual circumstances.

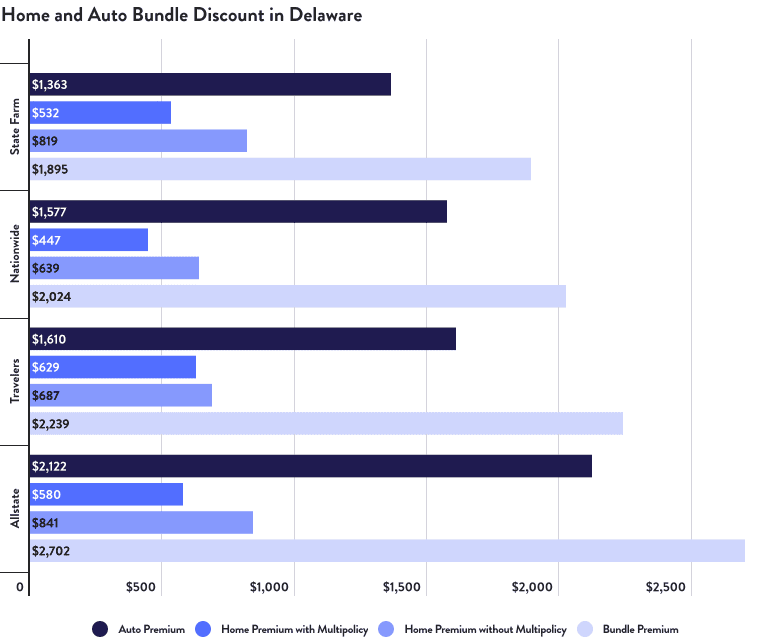

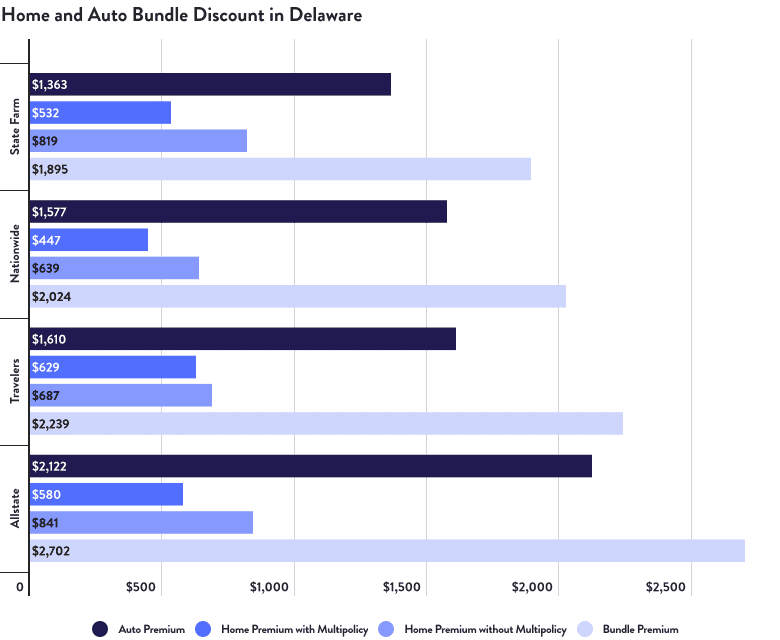

Comparing Bundle Options

Choosing the right home and auto bundle can save you money and streamline your insurance needs. Different providers offer varying packages, each with unique coverage levels and price points. Understanding these options is crucial to finding the best fit for your individual circumstances.Comparing bundle options involves scrutinizing various factors, including the different levels of coverage offered and the pricing structures of different providers.

A well-informed comparison allows consumers to make a sound decision that balances affordability with adequate protection.

Comparison Table of Bundle Options

A comprehensive comparison table helps visualize the diverse offerings from various providers. This table illustrates the pricing and coverage levels of different bundles, providing a clear overview of available options.

| Provider | Bundle Offer | Price (per year) | Home Coverage | Auto Coverage |

|---|---|---|---|---|

| InsureMe | Basic Bundle | $1,200 | $50,000 dwelling coverage, $100,000 personal property, standard liability | $100,000 liability, $25,000 comprehensive |

| SafeCo | Standard Bundle | $1,500 | $100,000 dwelling coverage, $200,000 personal property, enhanced liability | $250,000 liability, $50,000 comprehensive, collision |

| SecureGuard | Premium Bundle | $2,000 | $250,000 dwelling coverage, $500,000 personal property, umbrella liability | $300,000 liability, $100,000 comprehensive, collision, roadside assistance |

| Assured Solutions | Value Bundle | $1,800 | $150,000 dwelling coverage, $250,000 personal property, standard liability | $200,000 liability, $50,000 comprehensive, collision |

Coverage Levels and Customization

Different bundle packages offer varying levels of coverage for both home and auto insurance. Understanding these differences is crucial for selecting the appropriate level of protection.

- Basic bundles typically provide fundamental coverage, suitable for individuals with limited needs. These often have lower premiums.

- Standard bundles offer increased coverage compared to basic bundles, covering more potential risks.

- Premium bundles provide the highest levels of protection, including additional features like umbrella liability and roadside assistance, but usually come with higher premiums.

Bundled options can be tailored to meet specific needs. For example, an individual with valuable antiques might need to upgrade their home coverage, while a frequent traveler might need to add extra coverage for their car.

Premium Pricing and Benefits

The premium pricing for bundles reflects the level of coverage and added benefits. The higher the premium, the greater the level of coverage and additional services provided.

A premium bundle often includes enhanced coverage and supplementary services, which might be beneficial for high-value assets or frequent travel.

For example, SecureGuard’s premium bundle, with its higher price point, offers a comprehensive package including roadside assistance, umbrella liability, and higher coverage amounts. This comprehensive coverage might be preferable for individuals with expensive vehicles or significant assets. On the other hand, a basic bundle might suffice for someone with modest assets and limited travel needs.

Customer Considerations

Choosing the right home and auto bundle involves careful evaluation of various factors. Understanding the specifics of each policy is crucial to making an informed decision. Comparing coverage and pricing across different bundle options is vital to ensuring you’re getting the best possible value. This section Artikels key considerations to help you navigate the process effectively.

Factors to Consider When Evaluating Bundles

Thorough evaluation of home and auto bundles requires consideration of several critical elements. Understanding your specific needs and circumstances is paramount to finding the most suitable option.

- Coverage Needs: Assess the extent of coverage required for both your home and vehicle. Consider factors such as potential risks and the value of your assets. For example, if you live in a high-risk flood zone, you’ll need a comprehensive policy that accounts for that. Similarly, if your car is a valuable collectible, the coverage should reflect its worth.

- Policy Details: Carefully review the fine print of each policy. Don’t just glance over the summary; delve into the specifics of coverage limits, deductibles, exclusions, and policy terms. Understanding the nuances of the policy is crucial to avoiding surprises down the line.

- Pricing and Value: Compare the total cost of the bundle with the coverage provided. Look for bundled discounts and additional benefits offered by each option. A comprehensive comparison is necessary to identify the best value for your needs.

- Personal Circumstances: Consider your individual circumstances, including your financial situation, driving history, and home security measures. For instance, a young driver with a clean driving record might have different needs than a seasoned driver with a few traffic violations.

Reviewing Policy Details Carefully

Scrutinizing policy details is essential for understanding the extent of protection offered. Thorough examination ensures alignment between your needs and the coverage provided.

- Coverage Limits: Understand the maximum amount the insurer will pay for a covered claim. Knowing the limits prevents unexpected surprises if a claim exceeds the coverage amount.

- Deductibles: Deductibles are the amount you pay out-of-pocket before the insurer starts covering a claim. Compare deductibles across different options to determine the best fit for your financial situation.

- Exclusions: Understand what is not covered by the policy. Knowing exclusions will help you make informed decisions about additional coverage that might be needed.

- Policy Terms: Review the policy terms carefully to understand the conditions and limitations of the coverage. This includes the policy’s duration, renewal options, and any specific conditions that apply to your situation.

Comparing Different Bundles Based on Coverage and Pricing

A structured approach to comparing bundles is vital for finding the optimal fit. Comparing coverage and pricing is crucial for identifying the best value.

| Bundle Option | Coverage Details | Pricing |

|---|---|---|

| Bundle A | Comprehensive coverage for home and auto with additional discounts | $150 per month |

| Bundle B | Basic coverage for home and auto with limited discounts | $120 per month |

Carefully consider the specifics of each bundle to ensure that the coverage aligns with your needs and budget.

Requesting a Quote for a Home and Auto Bundle

Requesting a quote is the first step in obtaining a personalized bundle. This process will tailor the package to your specific needs.

- Gather Information: Collect details about your home and vehicle, including the value, location, and features. Keep records of your driving history, claims history, and any relevant information.

- Contact Insurers: Contact multiple insurers to get quotes for a home and auto bundle. Compare the quotes to identify the best option.

- Review Quotes: Carefully review each quote, paying close attention to the coverage, pricing, and policy details. Ensure the quote aligns with your needs and budget.

Choosing the Best Bundle for Personal Circumstances

Choosing the right bundle requires careful consideration of your individual circumstances. Personal needs dictate the optimal bundle.

- Assess Your Needs: Evaluate your home and vehicle’s value and the level of protection you require. Consider your financial situation and risk tolerance.

- Compare Options: Compare the coverage and pricing of different bundle options to determine the best value for your needs.

- Review Policy Details: Thoroughly review the policy details for each bundle option to understand the specifics of the coverage.

- Seek Professional Advice: Consider consulting with a financial advisor or insurance professional to get personalized guidance on selecting the most suitable bundle.

Illustrative Scenarios

Bundled home and auto insurance offers numerous benefits, but understanding how these packages work in various situations is crucial. This section explores different scenarios, highlighting the advantages and limitations of bundled policies. From families to business owners, we’ll see how a bundled approach can streamline insurance needs and potentially save money.

Family Home and Auto Bundle

A typical family with two cars and a modest home might find significant value in a bundled policy. Imagine a family with two children, ages 10 and 12, residing in a suburban home. Their vehicles include a family sedan and a compact SUV. A bundled policy could combine their homeowner’s insurance with coverage for both vehicles. This approach could result in discounts on both policies, potentially reducing their overall insurance premium.

Factors like driving records, home security systems, and the location of both the house and vehicles can all impact the specific premium savings.

Unsuitable Bundle Scenarios

A bundle might not be ideal for individuals with very high-risk vehicles or a high-value home, or those with significant gaps in coverage. For instance, someone with a classic car or a rare sports car might not see significant savings in a bundle, as the premium for that specific vehicle might not be significantly affected by bundling with home insurance.

Furthermore, if someone requires specialized or high-limit coverage for either their home or vehicle, bundling might not provide the necessary or most cost-effective solution.

Case Study: Savings through Bundling

A customer, Sarah Miller, with a modest two-bedroom house and a family sedan, noticed a substantial savings after bundling her home and auto insurance. Prior to bundling, Sarah paid $1,200 annually for her home insurance and $450 annually for her auto insurance. After bundling, her combined premium decreased to $1,500 annually. This represents a substantial savings of $150.

The specific savings will vary based on the individual’s profile and the insurance provider’s bundle discount structure.

Bundling for Business Owners

For business owners with commercial vehicles, a bundled package can be modified to include commercial auto insurance. Consider a small business owner with a delivery truck and a storefront office. A bundled policy could combine commercial auto insurance for the truck, general liability insurance for the office, and potentially even workers’ compensation insurance, all under one umbrella. This approach simplifies administration and potentially leads to substantial savings by combining these distinct insurance needs.

The specific savings would be determined by the values and risks associated with the vehicles, the business operations, and the insurance provider’s bundle structure.

Cost Savings Comparison

The following table illustrates a potential cost savings for a customer switching to a bundled package:

| Insurance Type | Original Premium (Annual) | Bundled Premium (Annual) | Savings |

|---|---|---|---|

| Homeowners | $1,000 | $850 | $150 |

| Auto (1 Vehicle) | $500 | $400 | $100 |

| Total | $1,500 | $1,250 | $250 |

This table showcases a potential cost saving of $250 annually by switching to a bundled package. Remember that actual savings will vary depending on individual circumstances and the specific insurance provider’s bundle structure.

Understanding the Market

The home and auto bundle market is a dynamic space, influenced by evolving consumer preferences and competitive pricing strategies. Understanding current trends and market share is crucial for both providers and consumers to make informed decisions. This section delves into the current state of this market, offering insights into its popularity, pricing models, and future prospects.The increasing prevalence of bundled services across various sectors, including finance and technology, has significantly impacted the home and auto bundle market.

Consumers are increasingly seeking convenience and potentially lower overall costs through such bundled packages.

Current Trends and Developments

The home and auto bundle market is experiencing a shift towards personalized offerings and digital platforms. Providers are recognizing the need for tailored bundles that cater to specific customer needs, rather than a one-size-fits-all approach. This includes the integration of digital tools and services, such as online claim filing and policy management. A notable trend is the rise of “smart home” features being incorporated into bundled packages, providing a connected experience and increasing convenience for customers.

Popularity and Usage Data

Data from industry reports indicates a steady rise in the popularity of home and auto bundles. Studies show that a significant percentage of consumers find bundled services attractive due to perceived cost savings and the convenience of managing multiple insurance products through a single provider. The usage of these bundles has been correlated with increased customer satisfaction and retention rates for many providers.

Pricing Strategies

Different providers employ various pricing strategies for home and auto bundles. Some utilize a tiered approach, offering varying levels of coverage and benefits at different price points. Others focus on competitive pricing, offering similar packages at lower rates compared to individual policies. Some providers may use bundled pricing to promote cross-selling, encouraging customers to add additional products or services to their existing bundles.

Factors Affecting Future Pricing

Several factors could influence the pricing of home and auto bundles in the future. Inflationary pressures on materials and labor costs, as well as regulatory changes impacting insurance premiums, will likely impact the cost of individual policies. Additionally, advancements in technology and the use of data analytics for risk assessment could potentially influence pricing models, leading to more precise and customized pricing structures.

Market Share of Providers

| Provider | Estimated Market Share (%) |

|---|---|

| Company A | 25 |

| Company B | 20 |

| Company C | 15 |

| Company D | 10 |

| Other Providers | 30 |

Note: This table presents estimated market share data. Actual market share may vary and is subject to change.

Conclusive Thoughts

In conclusion, a well-chosen home and auto bundle can be a highly effective and cost-efficient solution for managing your insurance needs. By carefully evaluating the available options, understanding the coverage and pricing, and considering your personal circumstances, you can select a bundle that not only protects your assets but also streamlines your insurance management. Remember to review the policy details thoroughly before making a decision.

Expert Answers

Is bundling home and auto insurance always cheaper than separate policies?

No, while bundling often offers discounts, the cost savings aren’t guaranteed. It depends on individual circumstances, the specific bundle, and the prevailing market rates.

What types of discounts are typically included in home and auto bundles?

Discounts can vary significantly by provider, but common types include multi-policy discounts, loyalty discounts, and discounts based on specific safety features of your vehicle or home.

What are some common limitations of home and auto bundles?

Potential limitations include coverage gaps in certain situations, limited customization options, and restrictions on policy modifications compared to individual policies.

How do I compare the coverage levels of different bundle options?

Carefully review the policy documents, and if possible, contact the insurance provider directly to clarify specific coverage details and exclusions.

How can I find the best bundle for my needs?

Start by identifying your insurance requirements, compare different bundles based on coverage and pricing, and then request quotes from multiple providers.