Navigating the complexities of Errors and Omissions (E&O) insurance can be daunting. This comprehensive guide simplifies the process, equipping you with the knowledge to find the best E&O insurance policy for your needs. From understanding the nuances of different coverages to evaluating reputable providers, we’ll explore every aspect to empower you to make informed decisions.

Choosing the right E&O insurance is critical for protecting your professional reputation and financial well-being. We’ll delve into key considerations, including policy limits, deductibles, and exclusions, and explain how to evaluate providers based on their strengths, weaknesses, and reviews. This guide provides a practical roadmap to securing optimal coverage and navigating claims.

Defining E&O Insurance

Errors and Omissions (E&O) insurance, also known as professional liability insurance, protects businesses and professionals from financial losses stemming from errors, omissions, or negligent acts in their work. It acts as a safety net, covering claims arising from professional services rendered. This type of insurance is crucial for safeguarding against potential lawsuits and ensuring financial stability in the event of a claim.E&O insurance provides a vital layer of protection against financial repercussions from mistakes or failures in professional service delivery.

It safeguards against losses stemming from client dissatisfaction, reputational damage, or legal proceedings resulting from alleged errors or omissions. This comprehensive coverage offers peace of mind to professionals, enabling them to focus on their work without undue worry about potential liabilities.

Types of E&O Coverage

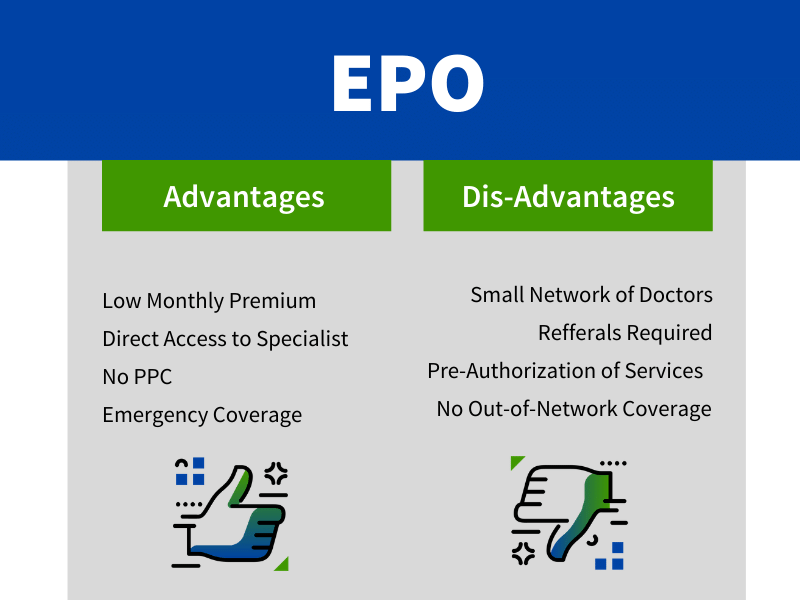

Different types of E&O coverage exist, catering to various professional needs. Beyond the fundamental professional liability coverage, some policies also encompass general liability. This distinction is vital for understanding the breadth of protection offered.

Comparison of E&O Policy Types

The following table Artikels the key differences between professional liability and general liability E&O policies, highlighting coverage details, exclusions, and associated premiums.

| Policy Type | Coverage Details | Exclusions | Premium |

|---|---|---|---|

| Professional Liability | Covers claims arising from errors, omissions, or negligent acts in the performance of professional services. This often includes breaches of contract, misrepresentation, and failure to meet professional standards. Examples include a consultant providing incorrect financial advice leading to client losses or an architect failing to meet building codes, resulting in structural issues. | Exclusions frequently include intentional acts, work performed outside the policy’s defined scope, pre-existing conditions, and claims stemming from bodily injury or property damage not directly related to the professional services. Coverage limitations might exist for claims exceeding a specific dollar amount. | Premiums for professional liability insurance vary based on factors such as the insured’s profession, the scope of services offered, claims history, and the policy’s coverage limits. Higher-risk professions or those dealing with complex issues tend to have higher premiums. |

| General Liability | Provides broader protection, encompassing coverage for incidents involving bodily injury or property damage arising from business operations. This includes claims related to premises liability, product liability, and advertising injury. Examples might include a client tripping on uneven pavement at a business premises, or a product defect leading to harm. | Exclusions can include certain types of intentional acts, specific industries with high inherent risks, and claims exceeding policy limits. It’s crucial to note that general liability is often not enough to cover all potential risks, requiring professional liability coverage for more specific professional services. | General liability premiums are influenced by factors such as the nature of the business, location, size, and claims history. Businesses with higher risk operations or those in hazardous industries typically face higher premiums. |

Identifying Key Considerations for Choosing E&O Insurance

Selecting the right Errors and Omissions (E&O) insurance policy is crucial for professionals who provide services or advice. A well-chosen policy safeguards against financial losses stemming from errors or omissions in professional work. Understanding the key considerations will help ensure a policy that effectively protects your financial interests and professional reputation.Evaluating E&O policies requires careful attention to specific details.

This involves understanding the policy’s financial protections, potential limitations, and the factors that influence the cost of the insurance. Thorough analysis of these aspects is paramount to selecting the most appropriate coverage for your unique professional needs.

Policy Limits and Deductibles

Policy limits and deductibles are fundamental elements of any insurance policy, including E&O. Policy limits define the maximum amount the insurer will pay for a claim, while deductibles represent the amount you must pay out-of-pocket before the insurer starts covering expenses. These values directly impact your financial responsibility in the event of a claim. Understanding the interplay between these two factors is critical to managing potential financial risks.

Coverage Exclusions and Limitations

E&O policies often contain exclusions and limitations that define specific situations where coverage is not provided. Understanding these exclusions is vital to avoiding situations where a claim might be denied. Carefully reviewing the policy wording for explicit exclusions and implicit limitations is critical. For example, some policies may exclude coverage for intentional misconduct or fraud.

Factors Influencing E&O Premium Costs

Several factors contribute to the cost of E&O insurance premiums. These include the type of professional services provided, the size of the practice, the geographic location, the claims history, and the level of risk associated with the services offered. A higher risk profile typically translates to a higher premium.

E&O Policy Feature Implications

| Feature | Description | Impact on Decision |

|---|---|---|

| Policy Limits | The maximum amount the insurer will pay for a claim. | Higher limits provide greater financial protection but increase premium costs. Consider the potential scope of claims and the financial implications. |

| Deductibles | The amount you pay out-of-pocket before the insurer covers expenses. | Lower deductibles mean less out-of-pocket expense but increase premiums. Balance the cost of premiums against the potential out-of-pocket costs. |

| Exclusions | Specific situations where coverage is not provided. | Thoroughly review exclusions to understand the scope of coverage. Consider whether the exclusions align with your professional activities and potential risks. |

Evaluating E&O Insurance Providers

Selecting the right Errors and Omissions (E&O) insurance provider is crucial for professionals, ensuring financial protection against potential claims. Thorough evaluation considers not only the policy’s terms but also the provider’s reputation, financial stability, and track record. A strong provider offers peace of mind, knowing that in case of a claim, the insurer is capable of handling it effectively and fairly.Evaluating providers extends beyond a simple comparison of policy premiums.

Factors like customer service, claim handling procedures, and the insurer’s overall financial health are equally important. A provider with a proven history of handling complex claims and resolving disputes efficiently is a valuable asset. Understanding these factors empowers professionals to make informed decisions and select an E&O insurer that best suits their needs and risk profile.

Reputable E&O Insurance Providers

Several reputable insurance providers offer E&O coverage. Well-established players often have a proven track record and extensive experience handling various professional liability claims. A provider’s longevity and stability are important indicators of their ability to meet their obligations.

Strengths and Weaknesses of Different Providers

Comparing different providers requires a nuanced approach. One provider might excel in specific industry niches, while another might offer broader coverage. Strengths may include competitive pricing, extensive coverage options, or excellent customer service. Weaknesses could involve limited policy choices, slower claim processing, or higher premiums. It’s essential to weigh the strengths and weaknesses of each provider in relation to individual needs.

Factors to Consider When Choosing a Provider

Choosing the right provider involves considering several crucial factors. Reputation is paramount. Insurers with a positive reputation often indicate reliability and professionalism. Financial stability is equally critical. A financially sound insurer is less likely to face issues in meeting claim obligations.

The insurer’s experience and expertise in handling similar claims is a valuable factor to consider. Understanding the insurer’s claim handling process, and reviewing customer testimonials can provide insights into the provider’s approach.

Importance of Independent Reviews and Comparisons

Independent reviews and comparisons are essential for evaluating E&O insurance providers. Consumer reports and industry publications often provide valuable insights into different providers’ performance. Comparing multiple sources of information allows for a more comprehensive understanding of a provider’s strengths and weaknesses. Thorough analysis of independent reviews helps to identify potential red flags or areas for concern. This impartial assessment provides a clearer picture of the provider’s overall performance.

Obtaining Quotes from Various Providers

Obtaining quotes from multiple providers is a vital step in the selection process. This allows for direct comparisons of pricing, coverage options, and policy terms. Comparing policies directly ensures that the most favorable coverage is selected. A quote comparison process should be structured to avoid missing critical information. This process helps to identify any potential gaps in coverage or areas where adjustments might be necessary.

Comparison Table of E&O Insurance Providers

This table provides a comparative overview of different E&O insurance providers. It highlights key aspects, including strengths, weaknesses, and reviews. Use this as a starting point to identify potential candidates for your needs.

Understanding E&O Policy Coverage

Errors and omissions (E&O) insurance policies are designed to protect professionals from financial losses arising from mistakes or failures in their work. Understanding the specific coverages and exclusions within a policy is crucial for ensuring adequate protection and avoiding unexpected financial burdens. A thorough review of the policy language is vital to anticipate potential claims and optimize your protection.

Typical Coverages in E&O Policies

E&O policies typically cover a range of professional liabilities. Common coverages include defense costs, settlements, and judgments related to claims of negligence, errors, or omissions in professional services. This can include legal fees, expert witness costs, and other expenses associated with defending against a claim. Some policies may also include coverage for certain pre-judgment interest or costs.

Coverage for reputational damage, while not always a standard component, is becoming increasingly important in some industries.

Typical Exclusions from E&O Policies

It’s equally important to understand what an E&O policydoes not* cover. Exclusions are designed to limit the scope of coverage and prevent frivolous claims. Common exclusions include intentional acts, fraud, criminal behavior, and claims stemming from services provided outside the policy’s defined scope. Policies often exclude coverage for work performed before the policy’s effective date or after its expiration.

Additionally, claims resulting from inadequate or insufficient supervision or training may also be excluded. Specific wording of the policy is critical to understanding any potential limitations.

How Policy Language Impacts Claims Processing

The precise language used in an E&O policy directly impacts how claims are processed. Clear and concise language is essential for avoiding ambiguity and ensuring clarity during a claim event. Policyholders should carefully review policy wording to understand the definitions of covered services, geographical limitations, and the process for reporting and handling claims. Understanding the process for reporting a claim and the required documentation will significantly influence a smooth claim processing experience.

Policy Coverage Scenarios

| Scenario | Coverage Application | Policy Section |

|---|---|---|

| Client Negligence | Generally, E&O policies do not cover losses arising from client negligence. This is because the professional’s duty is typically to the professional client, not the client’s business dealings with third parties. | Typically found in the “Exclusions” or “Definitions” section. |

| Professional Error | An E&O policy would typically cover claims stemming from a professional error. Examples include inaccurate financial advice, a missed deadline, or incorrect legal interpretations. | Typically found in the “Covered Services” or “Definitions” section. |

| Inadequate Supervision | Coverage for claims arising from inadequate supervision of staff would depend on the specific wording of the policy. Many policies exclude coverage for such claims. | Typically found in the “Exclusions” section, specifically outlining limitations for staff supervision. |

| Violation of Regulatory Standards | If a professional violates a regulatory standard and a client suffers a loss, the E&O policy may not cover this claim. Policies often exclude losses arising from violation of professional standards. | Exclusions section, often detailing specific regulatory requirements and exclusions for non-compliance. |

Claims and Policy Handling

Navigating the claims process under an Errors and Omissions (E&O) policy can be complex. Understanding the steps involved, how to interact with adjusters, and recognizing potential claim denials is crucial for a smooth and successful outcome. This section details the process from initial claim filing to potential appeals, highlighting the importance of policy language in the final determination.Filing an E&O claim typically involves a multi-step process.

Proper documentation and adherence to policy guidelines are essential for a favorable outcome. The key to successful claims management lies in clear communication and meticulous record-keeping.

Claim Filing Procedures

Understanding the steps involved in filing an E&O claim is vital for efficient processing and a positive outcome. A well-organized approach minimizes delays and ensures all necessary information is provided.

- Initial Notification: Promptly notify your insurance carrier about the claim. This often involves specific forms or procedures Artikeld in your policy. Failure to adhere to these guidelines can impact the claim’s processing.

- Gathering Documentation: Compile all relevant documents related to the claim, including client correspondence, project details, and any supporting evidence. Accurate and complete documentation strengthens your claim.

- Policy Review: Carefully review your E&O policy’s specific claim procedures. Understanding your policy’s coverage limits, exclusions, and reporting requirements is crucial.

- Claim Form Completion: Completing the insurance company’s claim form accurately and thoroughly is essential. Providing all requested information ensures a clear understanding of the situation.

Dealing with Insurance Adjusters

Effective communication with insurance adjusters is paramount throughout the claim process. Understanding their role and how to present your case effectively is crucial.

- Understanding Adjuster Role: Insurance adjusters evaluate the claim against the policy’s terms and conditions. They investigate the incident and determine the extent of coverage.

- Clear Communication: Maintain open and honest communication with the adjuster. Provide all requested information promptly and clearly, ensuring a shared understanding of the situation.

- Documentation Verification: Ensure the adjuster has all necessary documentation to accurately assess the claim. This includes evidence supporting your case.

- Negotiation Strategies: If necessary, engage in negotiation with the adjuster to reach a resolution that aligns with the policy’s provisions.

Common Claim Denials and Appeals

Recognizing potential reasons for claim denial and understanding the appeal process is vital. Knowing the typical grounds for denial empowers proactive measures to mitigate risk.

- Coverage Exclusions: Claims falling outside the policy’s coverage exclusions may be denied. Understanding these exclusions in advance helps avoid potential problems.

- Failure to Report: Claims not reported within the policy’s stipulated timeframe may be denied. Adhering to the reporting deadlines is crucial.

- Insufficient Documentation: Claims lacking sufficient supporting documentation may be denied. Thorough documentation is vital for a successful claim.

- Appealing Denials: If a claim is denied, carefully review the denial letter and consider appealing. Appeals often require providing additional evidence or clarifying ambiguities.

Policy Language and Claim Outcomes

The precise language of your E&O policy significantly impacts claim outcomes. Understanding the nuances of policy wording can help you anticipate and avoid issues.

- Policy Review Importance: Thorough review of your E&O policy is essential for a comprehensive understanding of its terms and conditions.

- Ambiguity Resolution: If policy language is ambiguous, clarify with your insurance provider. Seek clarification on any points that are not completely clear.

- Understanding Coverage Limits: Understanding the policy’s coverage limits, including the amount and scope of coverage, is vital.

- Exclusions Awareness: Understanding the policy’s exclusions is key to avoiding claim denials based on ineligible circumstances.

Step-by-Step E&O Claim Filing Guide

A structured approach to filing an E&O claim streamlines the process.

- Notification: Immediately notify your insurance carrier of the incident.

- Documentation: Gather all pertinent documents, including client records, contracts, and communication logs.

- Policy Review: Review your policy’s specific claim procedures and coverage details.

- Claim Form: Complete the insurance company’s claim form accurately.

- Adjuster Communication: Maintain open communication with the adjuster throughout the process.

- Appeal (if necessary): If denied, understand the appeal process and gather further evidence.

Illustrative Case Studies

Understanding successful and unsuccessful claims is crucial for effectively navigating errors and omissions (E&O) insurance. Analyzing real-world scenarios provides valuable insights into the nuances of policy coverage, claim handling, and the factors influencing claim outcomes. This section delves into illustrative case studies to highlight these aspects.

Successful E&O Claims

Successful E&O claims often involve situations where the insured acted in accordance with professional standards, yet faced unforeseen circumstances. For example, a financial advisor correctly followed investment strategies, but a market downturn negatively impacted client portfolios. While the advisor’s actions were sound, the resulting losses were significant. The E&O policy covered these losses because the advisor acted within the accepted standards of practice.

Another example includes a consulting firm providing accurate recommendations, but a client misinterpreted them. The consultant’s liability was limited because they provided the correct information, and the policy covered the subsequent loss stemming from the client’s misinterpretation.

Claims Denied or Settled for Less Than Expected

Claims denied or settled for less than anticipated frequently stem from a lack of documentation, failure to adhere to policy requirements, or a failure to properly identify the scope of professional services rendered. A consultant who failed to maintain comprehensive records of client interactions saw their claim denied due to insufficient documentation. A marketing firm, while providing services, did not fully disclose potential risks, leading to a reduced settlement amount because of a lack of complete disclosure.

Factors Contributing to Successful Claim Outcomes

Several factors significantly impact the outcome of E&O claims. Maintaining meticulous records, including detailed client interactions, service descriptions, and supporting documentation, is crucial. Promptly reporting any potential claim issues and cooperating fully with the insurance provider during the claim investigation process is equally important. Furthermore, a strong understanding of the specific policy wording, including exclusions and limitations, can help prevent costly errors.

A well-defined and documented professional relationship with the client, demonstrating adherence to professional standards, also contributes to a successful claim outcome.

Illustrative Case Study: Policy Interpretation

A graphic designer, specializing in website design, was hired by a small business. The designer’s contract specified the scope of work, including website development, maintenance, and minor design revisions. During the development phase, the client requested significant changes that went beyond the initial scope of work. The designer, recognizing the scope creep, documented each change request and communicated the potential cost implications to the client.

Despite this, the client claimed the website did not meet their expectations and demanded a refund. The designer filed a claim with their E&O insurance provider.The policy, while covering errors and omissions in the initial design work, contained an exclusion for costs associated with changes requested after the initial scope of work. The claim was ultimately settled for a reduced amount, reflecting the proportion of the work that fell within the policy’s coverage.

The designer’s meticulous documentation of the scope creep, communication with the client, and understanding of the policy wording were crucial factors in mitigating the claim’s impact. The documentation demonstrated adherence to professional standards, preventing the claim from being denied completely.

Staying Updated on E&O Trends

Staying abreast of evolving E&O insurance trends is crucial for businesses to effectively manage risks and maintain compliance. Understanding the shifting landscape of legal precedents, technological advancements, and industry best practices allows for proactive risk mitigation and optimized policy management. This proactive approach safeguards against unforeseen liabilities and fosters a stronger, more resilient business posture.Recent updates to E&O insurance policies often reflect changes in legal interpretations and regulatory frameworks.

These adjustments can impact coverage, exclusions, and policy limits. Keeping a watchful eye on these developments ensures that businesses are adequately protected against potential risks.

Recent Changes and Updates to E&O Policies

Evolving legal standards, particularly concerning digital communications and social media, are driving modifications to E&O policies. These changes often encompass provisions related to online conduct, social media use, and electronic data handling. For example, policies may now explicitly address the liability associated with client data breaches, a risk significantly heightened with the increased reliance on online platforms. Businesses must remain informed of these evolving aspects to ensure their policies align with the current legal landscape.

Industry Best Practices for E&O Policy Management

Implementing robust risk management strategies is paramount for effective E&O policy management. A proactive approach, encompassing thorough internal reviews and regular training for employees, is a key element. Policies should be regularly reviewed and updated to reflect current legal and technological developments. For instance, establishing clear social media guidelines for employees and conducting regular cybersecurity training sessions are crucial to minimize potential risks.

Proactive communication with insurance providers to understand any relevant policy updates is also essential.

Impact of Emerging Technologies on E&O Insurance

The increasing use of artificial intelligence (AI) and automation in various business processes has brought about new challenges and opportunities for E&O insurance. AI-driven tools can streamline operations, enhance decision-making, and boost efficiency, but they can also introduce new liability exposures. Policies need to account for the specific risks associated with AI and automation, including potential biases in algorithms or errors in automated systems.

E&O policies are adapting to address these issues, potentially incorporating clauses to cover AI-related errors and omissions. Furthermore, the increasing reliance on cloud computing introduces concerns about data security and privacy, which are now frequently addressed in E&O policies.

Importance of Staying Informed About Legal and Regulatory Changes

Keeping up with legal and regulatory developments is crucial for managing E&O risks effectively. Changes in state laws, federal regulations, and evolving case precedents can significantly impact coverage and liability exposures. For instance, the introduction of new privacy regulations, such as GDPR or CCPA, directly affects the handling of client data and necessitates policy adjustments. Continuous monitoring of relevant legal updates and engaging with legal counsel to understand the implications of these changes are critical steps to maintain a comprehensive understanding of E&O risks.

Last Word

In conclusion, securing the best E&O insurance involves a thorough understanding of coverage types, provider evaluations, and policy specifics. By considering policy limits, deductibles, exclusions, and provider reputation, you can make a well-informed decision. This guide has provided a roadmap to navigate the complexities of E&O insurance, empowering you to confidently protect your professional interests. Remember to stay updated on industry trends and legal changes for continued peace of mind.

General Inquiries

What are some common situations where E&O insurance is necessary?

E&O insurance protects professionals from claims arising from errors, omissions, or negligent acts in their professional capacity. This can include situations like misrepresenting information, failing to meet professional standards, or causing harm due to a professional mistake.

How do policy limits and deductibles affect my E&O insurance?

Policy limits define the maximum amount the insurer will pay for a claim, while deductibles are the amount you must pay out-of-pocket before the insurance coverage kicks in. Choosing appropriate limits and deductibles depends on your risk tolerance and financial capacity to handle potential claims.

What are some factors influencing E&O premium costs?

Several factors affect E&O premiums, including your profession, the industry you’re in, your experience level, the types of clients you serve, and any prior claims or lawsuits. The complexity and potential risks associated with your line of work will also play a significant role.

What should I look for when evaluating E&O insurance providers?

Reputable E&O providers often have a strong track record, excellent financial stability, and experience handling claims for similar professions. Independent reviews and comparisons of various providers are invaluable for making a well-informed choice.