Navigating the car insurance landscape in New Mexico can feel overwhelming. Different companies, various coverages, and confusing discounts make finding the best fit challenging. This guide breaks down the essentials, from understanding the nuances of liability, collision, and comprehensive coverage to comparing top insurance providers and their services.

We’ll explore the factors influencing premiums, including driving records, vehicle types, and even credit scores. You’ll discover valuable strategies for securing competitive rates and maximizing savings through discounts and bundling options. Finally, we’ll walk you through the claim process, providing actionable advice to help you navigate this crucial aspect of car ownership.

Introduction to Car Insurance in New Mexico

Car insurance in New Mexico, like in many other states, is a critical aspect of vehicle ownership. It’s a legal requirement to carry liability insurance, and while other coverages are not mandated, they significantly enhance protection for drivers and their vehicles. Understanding the various types of coverage and the factors influencing premiums is essential for making informed decisions about your insurance needs.

Factors Influencing Car Insurance Premiums in New Mexico

Several key factors contribute to the cost of car insurance in New Mexico. Driving record, vehicle type, and location are significant determinants. Drivers with a history of accidents or traffic violations typically face higher premiums. Certain vehicle models and makes are associated with a higher risk of damage or theft, resulting in elevated insurance costs. Geographic location within the state also plays a role, as some areas may experience a higher frequency of accidents or weather-related incidents, which in turn affects premiums.

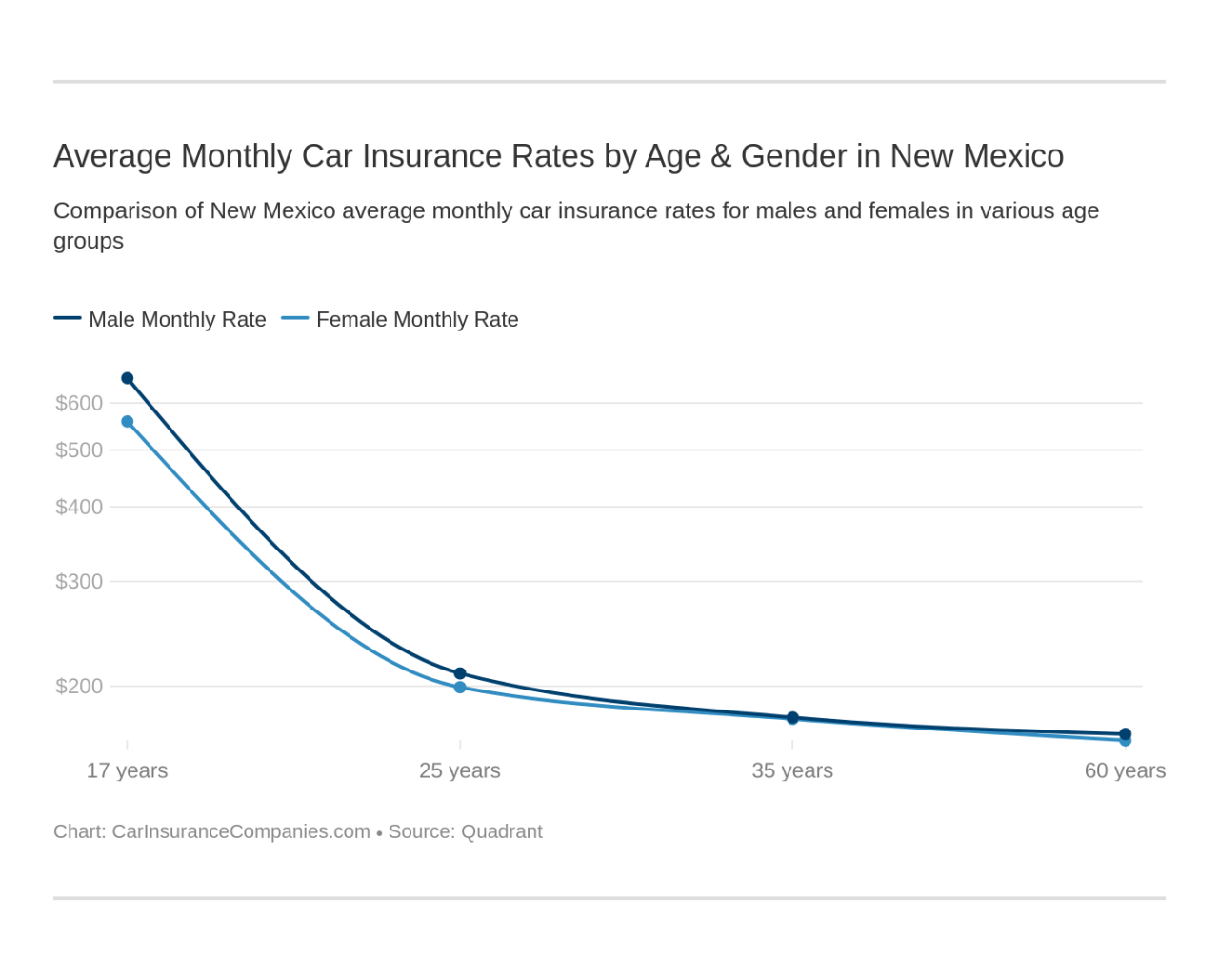

Furthermore, factors like age, gender, and credit history can also influence insurance rates, though these are less significant in New Mexico compared to other states.

Types of Car Insurance Coverage Available in New Mexico

New Mexico offers various car insurance coverages to suit different needs and budgets. These coverages are designed to protect drivers and their vehicles against various potential risks associated with car ownership. Liability coverage, a legal requirement, protects against damages you cause to others. Collision and comprehensive coverages offer further protection for your own vehicle. Understanding the differences between these coverages is crucial to choosing the appropriate level of protection.

Comparison of Liability, Collision, and Comprehensive Coverages

| Coverage Type | Description | Example Scenarios | Potential Cost |

|---|---|---|---|

| Liability | Covers damages you cause to others’ property or bodily injury. | Hitting another car and causing damage, injuring another driver. | Low to Moderate |

| Collision | Covers damage to your vehicle in an accident, regardless of who is at fault. | Your car is damaged in a collision, regardless of whether you were at fault or not. | Moderate to High |

| Comprehensive | Covers damage to your vehicle from events other than collisions, such as vandalism, theft, fire, or hail. | Your car is damaged by hail, or stolen. | Moderate to High |

Comparing Insurance Companies in New Mexico

Choosing the right car insurance provider in New Mexico is crucial for protecting your financial well-being and ensuring peace of mind. Factors like rates, customer service, and claims handling processes significantly impact your overall experience. This section explores the top insurance providers, highlighting key differences to help you make an informed decision.

Top Car Insurance Providers in New Mexico

Several reputable companies offer car insurance in New Mexico. Understanding their strengths and weaknesses can assist in selecting the best fit for your needs. Factors like financial stability, customer reviews, and available discounts are important to consider.

Factors to Consider When Choosing a Provider

When selecting a car insurance provider, several factors should be carefully evaluated. Price is a primary concern, but other factors like customer service and claims handling procedures are also crucial. A company’s reputation and financial stability provide insight into their reliability and ability to fulfill obligations.

Customer Service and Claims Handling

Excellent customer service and efficient claims handling are essential components of a positive insurance experience. Positive customer reviews and testimonials can offer valuable insight into the provider’s responsiveness and helpfulness during both routine inquiries and claim situations.

Advantages and Disadvantages of Major Providers

Each insurance company presents a unique combination of advantages and disadvantages. Careful consideration of these factors is crucial for identifying the provider best suited to your specific requirements.

Rate Comparison of Major Insurance Providers

The following table provides a comparative overview of rates, customer service ratings, and claims handling speed for three major insurance providers in New Mexico. This information, while an example, should be used as a starting point for further research and personalized comparisons.

| Insurance Provider | Rates (Example) | Customer Service Rating | Claims Handling Speed |

|---|---|---|---|

| Provider A | $150/month | Excellent | Fast |

| Provider B | $120/month | Good | Average |

| Provider C | $180/month | Very Good | Very Fast |

Understanding Discounts and Rates

Car insurance premiums in New Mexico, like elsewhere, are influenced by a variety of factors. Understanding these factors and the available discounts can help you find the most affordable coverage. This section delves into the specifics of these discounts and how different criteria impact your rates.Insurance rates are not a static figure; they are dynamic and fluctuate based on various factors.

A clear understanding of these variables is crucial for securing the most suitable coverage.

Available Discounts

Discounts can significantly reduce your car insurance premiums. Many insurers offer a range of discounts tailored to specific situations.

- Safe Driving Discounts: Companies often reward drivers with clean driving records. A history of safe driving, demonstrated by a low number of accidents or violations, can lead to substantial premium reductions. For example, a driver with a clean record might receive a 15% discount compared to one with multiple violations.

- Defensive Driving Courses: Completing defensive driving courses demonstrates a commitment to safe driving practices and can often lead to lower premiums. Insurance companies often offer a discount to drivers who have completed such courses.

- Multiple Policy Discounts: Bundling your car insurance with other insurance policies, such as home or renters insurance, can often result in a combined discount, as insurance companies benefit from the increased customer loyalty and reduced administrative costs.

- Vehicle-Specific Discounts: Specific features of your vehicle, such as anti-theft devices or safety features, can lead to discounts. Insurers recognize the added security and reduced risk associated with these features.

- Payment Discounts: Paying your premiums on time and in full can result in a discount. Some insurers offer discounts to drivers who utilize automatic payments or pay in advance.

Factors Affecting Rates

Several key factors influence your car insurance rates in New Mexico.

- Driving Record: A clean driving record is a major factor. Accidents and violations significantly increase premiums, reflecting the higher risk associated with these events. This is due to the increased probability of future claims and the cost of handling those claims.

- Vehicle Type: The type of vehicle you drive also plays a role. Certain vehicles, based on their make, model, and year, are considered more prone to theft or damage. Insurance rates for these vehicles often reflect this increased risk. For instance, sports cars with high horsepower are often associated with higher premiums due to the perceived risk of accidents compared to sedans.

- Location: Your location significantly affects rates. Areas with higher rates of accidents or crime typically have higher premiums. This reflects the greater risk associated with driving in these areas.

Bundling Insurance Policies

Bundling your insurance policies can lead to significant savings. This strategy involves combining different insurance policies under a single provider. It often results in discounts as it demonstrates customer loyalty and reduces administrative overhead.

Strategies for Lowering Premiums

Various strategies can help reduce your car insurance premiums. Reviewing your current policy and considering discounts available to you is a first step. Maintaining a clean driving record is crucial for securing favorable rates. Exploring different insurance providers is also recommended.

- Compare Quotes from Multiple Providers: Get quotes from various insurance companies to compare their rates and coverage options. This approach ensures you are obtaining the most competitive rates for your specific needs.

- Maintain a Clean Driving Record: Avoiding accidents and traffic violations is crucial for keeping your premiums low. A clean driving record directly impacts your rate and can result in substantial savings.

- Consider Discounts: Explore available discounts based on your vehicle, driving history, and insurance policies. These discounts can significantly reduce your premiums.

Impact of Credit Score on Rates

While not always a direct factor, your credit score can indirectly impact your insurance rates. In some cases, insurers may consider your credit history as an indicator of your responsibility and ability to manage financial obligations, which can influence their assessment of risk.

Navigating the Claims Process in New Mexico

Filing a car insurance claim in New Mexico can be a straightforward process if you’re prepared. Understanding the steps involved and common pitfalls can help ensure a smoother experience. This section Artikels the procedure for handling a claim, along with strategies for resolving potential disputes.

Steps Involved in Filing a Claim

The claim process typically involves several steps, starting with reporting the accident and ending with the resolution of the claim. Prompt action and thorough documentation are crucial for a successful claim.

- Report the accident to the police. A police report is often required to establish the circumstances of the accident and assign liability. It serves as an official record of the incident, documenting details such as the location, time, involved parties, and observed damages. This step is critical as it can significantly impact the claim’s outcome.

- Notify your insurance company. Contact your insurance company as soon as possible after the accident. Provide them with the necessary details, including the date, time, location, and involved parties. Adhering to your policy’s notification procedures is essential. Your policy will specify the timeframe for reporting an accident. Failure to report within this timeframe may affect the claim’s processing.

- Gather all relevant documents. Compile all necessary documents, including the police report, medical records, repair estimates, and any other relevant information. Comprehensive documentation is vital. This demonstrates your preparedness and ensures a smoother claims process. Ensure all documentation accurately reflects the situation.

- Provide supporting documentation. Submit all requested documentation to your insurance company. This may include photographs of the damage, repair estimates from an auto body shop, medical bills, and witness statements. These documents support your claim and provide evidence to the insurance company regarding the extent of the damage.

- Cooperate with the insurance adjuster. Cooperate fully with the insurance adjuster during the investigation. Answer questions truthfully and provide any additional information requested. Honesty and transparency are key to resolving the claim effectively.

- Negotiate and resolve the claim. Discuss the claim with the insurance company to determine the best course of action. This may involve negotiations regarding the amount of compensation or the terms of the settlement. Be prepared to discuss the details of the claim and to justify your position.

Common Reasons for Claim Denials

Insurance companies may deny claims due to various reasons. Understanding these common reasons can help you avoid potential pitfalls.

- Failure to report the accident within the policy’s timeframe.

- Lack of sufficient documentation, including a police report or repair estimates.

- Exaggerated or fraudulent claims.

- Violation of policy terms, such as driving under the influence or engaging in risky behaviors.

- Pre-existing conditions that contribute to the damage.

Importance of Documentation and Communication

Thorough documentation and clear communication are vital for a successful claim. Precise and detailed records are crucial to prove the validity of the claim. Maintain open communication with your insurance company throughout the process.

Strategies for Resolving Disputes with Insurance Companies

Disputes with insurance companies can arise. Employing appropriate strategies can help you resolve these issues.

- Review your insurance policy carefully.

- Gather all relevant documentation and evidence to support your claim.

- Seek legal counsel if necessary.

- Maintain detailed records of all communication with the insurance company.

- Consider mediation or arbitration to resolve disputes.

Step-by-Step Procedure for Filing a Claim

The following steps provide a clear procedure for filing a claim.

| Step | Description | Required Documents |

|---|---|---|

| 1 | Report the accident to the police. | Police report, medical records |

| 2 | Notify your insurance company. | Insurance policy details |

| 3 | Gather all relevant documents. | Proof of damage, repair estimates |

| 4 | Cooperate with the insurance adjuster. | Supporting documentation, responses to inquiries |

| 5 | Negotiate and resolve the claim. | All previous documentation, potential settlement agreements |

Tips for Choosing the Best Car Insurance in New Mexico

Securing the right car insurance policy in New Mexico is crucial for protecting your financial well-being and your vehicle. Understanding the nuances of different plans and providers can lead to significant savings and peace of mind. This section provides practical advice for navigating the process and making informed decisions.Choosing the right car insurance plan involves careful consideration of your specific needs and circumstances.

Factors such as your driving history, vehicle type, and location all play a role in determining the most suitable coverage. This section will help you understand how to approach the process with a strategic perspective.

Comparing Insurance Policies and Providers

A crucial step in finding the best car insurance is comparing policies and providers. This involves researching various companies and evaluating their coverage options, premiums, and customer service ratings. Comparing policies side-by-side allows for a clear understanding of the various benefits and costs associated with each plan. This comparison can help you identify the most cost-effective option that aligns with your needs.

Importance of Reading Policy Details Carefully

Insurance policies can be complex documents. Thorough review of the fine print is essential to avoid any surprises or misunderstandings down the line. Pay close attention to exclusions, limitations, and any specific conditions Artikeld in the policy. Understanding the specific terms and conditions of the policy will help you make a well-informed decision. By reading the policy details carefully, you can identify potential gaps in coverage and ensure you have comprehensive protection.

Benefits of Obtaining Multiple Quotes

Obtaining multiple quotes from different insurance providers is a highly recommended practice. This allows you to compare pricing and coverage options across various companies. By comparing quotes, you can identify the most cost-effective policy without sacrificing essential coverage. For instance, a policy that appears less expensive from one provider might offer less comprehensive coverage than a more expensive one from another provider.

Therefore, it’s essential to evaluate the value proposition of each quote.

Questions to Ask Insurance Providers Before Committing

Before committing to a particular car insurance policy, it’s important to ask pertinent questions. This step allows you to gain a clear understanding of the terms and conditions of the policy. This ensures you make an informed decision that aligns with your financial needs and requirements. Examples of questions to ask include:

- What discounts are available, and how can I qualify for them?

- What is the process for filing a claim?

- What is the deductible amount, and how does it affect my premium?

- What is the coverage amount for liability, collision, and comprehensive?

- What is the company’s customer service reputation?

- What is the cancellation policy, and what are the associated fees?

- Are there any additional fees or charges associated with the policy?

By asking these crucial questions, you can assess the provider’s reliability and ensure you have a transparent understanding of the policy’s terms and conditions. This proactive approach empowers you to make an informed decision that aligns with your financial situation.

Final Review

In conclusion, securing the best car insurance in New Mexico involves careful consideration of coverage types, provider comparisons, and understanding rate influences. By leveraging discounts, bundling options, and proactive claim management, you can significantly reduce your insurance costs while ensuring adequate protection. This guide empowers you with the knowledge to make informed decisions, ultimately leading to peace of mind on the road.

Question Bank

What factors affect my car insurance rates in New Mexico?

Your driving record, vehicle type, location, and even your credit score can impact your car insurance premiums. Insurance companies use these factors to assess your risk profile and adjust rates accordingly.

How do I file a claim in New Mexico?

First, report the accident to the police. Next, notify your insurance company, and gather all relevant documentation, including police reports, medical records, and repair estimates.

What are some common reasons for claim denials?

Common reasons for claim denials include failure to report the accident promptly, insufficient documentation, or providing inaccurate information.

Are there discounts available for car insurance in New Mexico?

Yes, various discounts are available, such as those for safe driving records, bundling policies, or owning a specific vehicle type. Check with your insurer for specific details and eligibility criteria.

How can I compare car insurance providers effectively?

Obtain quotes from multiple providers, compare their coverage options, and thoroughly review policy details. Consider customer service ratings and claims handling speeds when making your decision.