Navigating the car insurance landscape can be tricky, especially for military veterans. This guide delves into the specifics of finding the best car insurance options tailored to your needs and circumstances. Understanding your rights and available discounts is key to securing the most favorable rates.

From liability coverage to comprehensive protection, we’ll explore various policy types and their implications for veterans. We’ll also examine specific discounts and benefits designed to recognize your service, and walk you through the process of comparing quotes and choosing the right provider. This comprehensive approach ensures you’re fully equipped to make informed decisions.

Introduction to Military Veteran Car Insurance

Military veterans often face unique considerations when selecting car insurance. Their service history, potentially impacting claims experience and risk profiles, can significantly influence premiums and policy options. Understanding these nuances is crucial for veterans to secure the most suitable and cost-effective coverage.Veterans may encounter specific challenges in the insurance market, including the potential for higher premiums compared to non-veterans, due to perceived higher risk factors.

These factors could include past driving records, or the potential for future claims arising from conditions related to military service. It is also important to understand that policies may differ significantly between providers and their approaches to assessing veterans’ risk profiles.

Understanding Veteran-Specific Discounts and Advantages

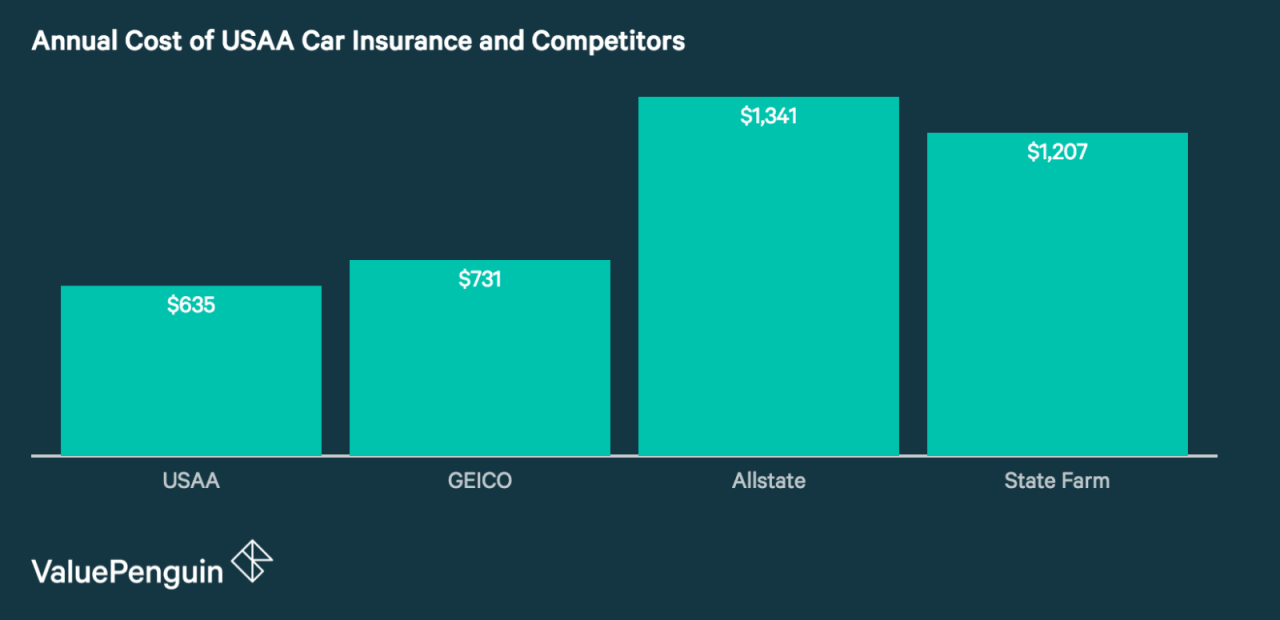

Many insurance providers offer discounts to military veterans. These discounts can range from a small percentage to a substantial amount, resulting in significant savings on premiums. The availability and magnitude of these discounts can vary widely across different providers. Historical data indicates a consistent pattern of veterans receiving these benefits, although there are instances where some insurers do not provide such discounts.

This underscores the importance of thorough research and comparison.

Importance of Comparing Quotes and Policies

Comparing quotes and policies is essential for veterans to find the best possible coverage at the most competitive price. Veterans should research and understand the different policy options available, including coverage amounts, deductibles, and optional add-ons. A comprehensive comparison will help identify potential cost savings and ensure veterans obtain the most suitable protection for their needs. Using comparison websites or directly contacting multiple insurers is crucial for obtaining a complete overview of the market.

Different insurers may have varying approaches to assessing veteran risk, and this must be considered when comparing quotes. The best policy for a veteran will depend on individual driving history, vehicle type, and specific needs.

Types of Car Insurance for Veterans

Understanding the various types of car insurance available is crucial for military veterans to ensure adequate protection and financial security. Different policy types cater to different needs and risks, and understanding these distinctions can lead to more informed decisions about coverage.Comprehensive car insurance policies provide broader protection against a wide array of risks, including damage from vandalism, hail, fire, or theft, beyond what liability insurance covers.

Liability insurance, on the other hand, only protects you in the event of an accident where you are deemed at fault. Collision insurance covers damages to your vehicle in an accident, regardless of who is at fault.

Liability Insurance

Liability insurance is the most fundamental type of coverage. It protects you financially if you cause an accident and are found legally responsible. This coverage pays for damages to the other party’s vehicle and medical expenses. For veterans, this coverage is essential, as accidents can lead to substantial financial burdens. A veteran might have to pay for damages to another driver’s vehicle, medical expenses, or legal fees.

Without this coverage, personal finances could be significantly affected. For example, a veteran involved in a fender bender that resulted in property damage might face considerable financial hardship without liability coverage.

Collision Insurance

Collision insurance covers damage to your vehicle in an accident, regardless of who is at fault. This type of coverage is beneficial for veterans because it protects their investment in their vehicle. Collision coverage is crucial in situations where the veteran is responsible for the accident. This is often more financially beneficial than having to pay for repairs or replacement out of pocket.

For instance, a veteran involved in a collision might have significant vehicle damage even if not entirely at fault, necessitating repair or replacement costs covered by the policy.

Comprehensive Insurance

Comprehensive insurance covers damage to your vehicle from events other than collisions, such as vandalism, fire, hail, or theft. This additional coverage is beneficial to veterans as it protects against unexpected incidents that can severely impact their vehicle’s value. Consider a scenario where a veteran’s vehicle is vandalized. Comprehensive insurance would cover the repairs or replacement, minimizing financial losses.

This protection is crucial for peace of mind and avoiding significant out-of-pocket expenses.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist coverage protects veterans if they are involved in an accident with a driver who has insufficient or no insurance. This coverage is particularly important for veterans, as accidents with uninsured drivers can result in substantial financial burdens. This is critical as uninsured drivers pose a significant risk to veterans. For example, a veteran involved in an accident with an uninsured driver would rely on this coverage to pay for damages to their vehicle and medical expenses.

Factors Affecting Premiums

Several factors influence the premium cost of each policy type for veterans. These include the vehicle’s make, model, and year, the driver’s driving record, and the location where the vehicle is primarily driven. Furthermore, claims history and the deductible chosen by the veteran will also impact the premium. A veteran with a clean driving record and a newer vehicle might expect a lower premium compared to a veteran with a history of accidents or a high-risk vehicle.

Discounts and Benefits Specific to Veterans

Many insurance providers offer specific discounts and benefits to military veterans, recognizing their service and sacrifice. These advantages can significantly reduce the cost of car insurance premiums. Understanding these programs can save veterans money on their insurance policies.Numerous insurance companies acknowledge the unique contributions of veterans and offer various incentives. These discounts can range from reduced premiums to special customer service packages, demonstrating appreciation for their service.

Specific Discounts and Benefits

Veterans often qualify for discounts that reflect their service history and commitment to the nation. These discounts can translate to substantial savings on their car insurance premiums. Recognizing the value of their service, many insurance providers offer special programs and initiatives.

- Service-Connected Disability Discounts: Veterans with service-connected disabilities may qualify for reduced premiums. The level of discount typically depends on the severity of the disability. This recognition acknowledges the impact of service-related injuries on veterans’ financial well-being.

- Military Affiliation Discounts: Insurance companies frequently offer discounts to veterans who were active-duty military members. The discount amount varies depending on the company and the specific veteran’s service history. Such discounts are a way to acknowledge and reward the contributions of veterans.

- Veteran-Specific Customer Service: Some companies provide dedicated customer service representatives specializing in assisting veterans with their insurance needs. This personalized approach aims to address any unique concerns or questions veterans may have. This dedicated service can enhance the overall insurance experience for veterans.

- Reduced Premiums: Certain insurers may offer reduced premiums specifically for veterans, which can translate into substantial savings. This is a common practice in the insurance industry to support and recognize the sacrifices of veterans.

Verification and Claiming Discounts

To verify and claim veteran-specific discounts, veterans need to provide documentation proving their status as veterans. This process ensures the discount is accurately applied.

- Documentation Requirements: Typically, veterans are required to present proof of military service, such as a DD Form 214 (Certificate of Release or Discharge from Active Duty). This form details the veteran’s service history and discharge status. Providing this documentation is a crucial step in verifying eligibility for veteran discounts.

- Contacting the Insurance Provider: Veterans should contact their insurance provider to inquire about the specific requirements and procedures for claiming veteran discounts. This direct communication ensures that the appropriate documentation is requested and that the process is straightforward.

- Verification Process: The insurance provider will verify the veteran’s status and eligibility for the discount. This verification process ensures that the veteran meets the eligibility criteria established by the insurance company. This is a necessary step to ensure that the discount is applied correctly.

Applying for Veteran Discounts

The application process for veteran discounts typically involves providing the required documentation to the insurance company. This documentation is crucial for validating the veteran’s status.

- Contacting the Insurance Provider: The first step is contacting the insurance provider to inquire about the process for applying for veteran discounts. This is a vital step to initiate the application process and obtain necessary details.

- Providing Documentation: Veterans must submit the required documentation, which typically includes a copy of their DD Form 214. This form is essential to prove their military service and discharge status. Submitting the required documents is crucial to the application process.

- Review and Approval: The insurance provider reviews the submitted documentation to verify the veteran’s eligibility. Once approved, the discount will be applied to the policy. The provider ensures that the application process is completed correctly and that the discount is applied according to their guidelines.

Table of Veteran-Specific Discounts

This table illustrates the possible discounts offered by various insurance companies to veterans. Note that specific discounts and amounts may vary.

| Insurance Company | Veteran-Specific Discount |

|---|---|

| Company A | 5% discount on premiums for active-duty veterans |

| Company B | 10% discount on premiums for veterans with service-connected disabilities |

| Company C | Reduced premiums for veterans and spouses |

Comparing Car Insurance Quotes for Veterans

Securing the best car insurance rates as a veteran requires a strategic approach to comparing quotes. Understanding the specific factors influencing premiums and utilizing effective comparison methods are key to finding a policy that fits your needs and budget. This process is crucial for maximizing savings and ensuring adequate coverage.Comparing quotes isn’t just about finding the lowest price; it’s about finding the right balance between cost and comprehensive protection.

A well-structured comparison method ensures you evaluate all aspects of different policies, leading to informed decisions.

Factors to Consider When Comparing Quotes

A thorough evaluation of key factors significantly impacts the final cost of your policy. Consider these elements when scrutinizing quotes:

- Driving history: Accidents, speeding tickets, and at-fault claims directly affect premiums. A clean driving record is generally rewarded with lower rates. For instance, a driver with a history of traffic violations will likely pay a higher premium than a driver with a clean record.

- Vehicle type and value: The make, model, and year of your vehicle, along with its estimated value, play a role in calculating the premium. Luxury vehicles or high-performance cars often come with higher insurance costs compared to more standard models.

- Coverage options: Comprehensive, collision, liability, and uninsured/underinsured motorist coverages are crucial. Adjusting these options can significantly impact the premium. A policy with comprehensive coverage will often have a higher premium compared to a policy with only liability coverage.

- Deductibles: A higher deductible lowers the premium, but you’ll pay more out-of-pocket in the event of a claim. Choosing a deductible that balances your financial situation and desired coverage is important.

- Geographic location: Your location influences the insurance rates due to factors like traffic density, accident rates, and claims frequency. Areas with higher accident rates tend to have higher premiums.

Collecting Quotes from Multiple Providers

A systematic approach to gathering quotes from various insurance providers is crucial for finding the best deal. A well-organized process ensures you don’t miss any potential savings.

- Use online comparison tools: These tools simplify the process by allowing you to input your vehicle details and get quotes from multiple providers simultaneously. These tools are designed to compare policies side-by-side, making the selection process more efficient.

- Contact insurance agents directly: Insurance agents can provide tailored advice and may have access to exclusive discounts or offers for veterans. Personal interaction with agents allows for clarification of coverage options and potential discounts.

- Seek recommendations from fellow veterans: Word-of-mouth recommendations from other veterans can provide insights into reliable providers and beneficial programs.

Comparing Policy Features and Costs

A structured comparison of policy features and costs helps you make informed decisions. Using a table is a helpful way to organize the information.

| Insurance Provider | Coverage Type | Premium (Annual) | Deductible | Discounts for Veterans |

|---|---|---|---|---|

| Company A | Full Coverage | $1,500 | $500 | Yes (5%) |

| Company B | Full Coverage | $1,200 | $1,000 | Yes (3%) |

| Company C | Liability Only | $800 | $1,500 | Yes (1%) |

Note: Premiums and discounts are examples and may vary based on individual circumstances.

Reviewing Policy Details and Exclusions

Carefully reviewing the fine print is essential for understanding the complete scope of coverage. Identifying potential exclusions and understanding policy limitations helps avoid surprises later.

Thorough review of policy details and exclusions is crucial to ensure the policy meets your specific needs.

Understanding the policy’s terms and conditions will help you avoid unforeseen issues and ensure the insurance meets your specific requirements.

Understanding Coverage Limits and Exclusions

Knowing your car insurance coverage limits and exclusions is crucial for veterans. It ensures you’re adequately protected in case of an accident or damage to your vehicle. Understanding these limits prevents unpleasant surprises when a claim is filed. This section details the significance of these elements and provides examples to illustrate their impact.Understanding the specifics of your policy, particularly the limits and exclusions, is vital.

This knowledge empowers you to make informed decisions about your insurance needs. It allows you to avoid financial hardship in the event of an unforeseen incident.

Coverage Limits

Coverage limits define the maximum amount your insurance company will pay for a covered claim. These limits are typically expressed in dollar amounts. Knowing these limits helps you understand the financial protection you have in place. It’s important to ensure these limits align with your vehicle’s value and your financial needs. Adequate coverage is paramount.

Liability Coverage Limits

Liability coverage protects you if you’re at fault in an accident and cause damage to another person or their property. The limits dictate the maximum amount the insurer will pay for injuries or property damage. Higher limits offer greater financial protection for those involved in an accident. Review your policy carefully to confirm these limits are sufficient.

Collision Coverage Limits

Collision coverage pays for damage to your vehicle, regardless of who is at fault. Understanding the collision coverage limits ensures you have the necessary financial cushion to repair or replace your car if it’s involved in a collision. These limits are crucial in ensuring the vehicle’s value is protected in case of damage.

Comprehensive Coverage Limits

Comprehensive coverage protects your vehicle from damage caused by events other than collisions, such as theft, vandalism, or weather events. Understanding the comprehensive coverage limits is vital in safeguarding your vehicle against unforeseen incidents. This coverage often has a separate limit from collision coverage.

Common Exclusions in Car Insurance Policies

Understanding the exclusions in your policy is equally important as knowing the limits. Exclusions are specific situations where your coverage won’t apply. These exclusions vary by insurer, so it’s essential to thoroughly review your policy document. Be aware of potential gaps in coverage.

Examples of Situations Impacted by Coverage Limits and Exclusions

- If you cause an accident resulting in $100,000 in damages, and your liability coverage limit is $50,000, your insurance company will only cover up to that amount.

- If your car is stolen, and your comprehensive coverage limit is $10,000, your insurer will pay a maximum of $10,000 to replace it, regardless of the actual value of the vehicle.

- If you are involved in an accident, and your vehicle is damaged, but the damage falls under an exclusion (e.g., damage caused by wear and tear), your insurance will not cover the repairs.

Summary of Common Coverage Limits and Exclusions

| Coverage Type | Description | Example Exclusion | Potential Impact on Veterans |

|---|---|---|---|

| Liability | Covers damage to others in an accident where you are at fault. | Pre-existing conditions in a vehicle accident | Insufficient limits can result in significant financial responsibility if you are involved in an accident. |

| Collision | Covers damage to your vehicle in an accident, regardless of fault. | Damage caused by wear and tear | Insufficient limits may not cover the full cost of repairs or replacement. |

| Comprehensive | Covers damage to your vehicle from events other than collisions. | Damage from a war zone | Exclusions can limit the coverage for damage from unexpected events like vandalism or theft. |

Choosing the Right Insurance Provider for Veterans

Selecting the right auto insurance provider is crucial for military veterans, given their unique circumstances and potential eligibility for special discounts and benefits. A thorough understanding of provider reputations, customer service, and available discounts can help veterans make informed decisions. Veterans should actively seek providers with a demonstrated history of positive interactions with veterans.Choosing an insurance provider is more than just selecting a low price; it’s about finding a company that understands your needs and provides reliable service.

Consider factors such as the provider’s track record with veterans, the accessibility of customer support, and the ease of filing claims. Veterans’ experiences with specific providers are invaluable resources, and reading testimonials can significantly inform your decision.

Comparing Insurance Provider Reputations for Veterans

Different insurance providers cultivate varying reputations among veterans. Some companies may have a history of strong customer service, responsive claims handling, and clear communication, while others might face criticism regarding lengthy claim processes or unresponsive customer support. Researching a company’s overall standing and specifically how it handles veteran interactions can provide significant insight. For example, a company known for quick claim processing might be preferred by veterans who value efficiency.

Assessing Customer Service and Support for Veterans

Customer service and support are vital aspects to consider. Reviewing the accessibility of different support channels, like phone, email, and online portals, can offer insight into how easily veterans can reach representatives. Companies with 24/7 support or readily available online resources might be more appealing to those with demanding schedules or geographical limitations. Some providers may have dedicated veteran service representatives, providing a tailored approach to veteran needs.

Importance of Reading Reviews and Testimonials from Other Veterans

Veteran testimonials and reviews are crucial resources in evaluating an insurance provider’s suitability. These firsthand accounts offer a more realistic perspective than generalized company descriptions. Look for reviews that specifically mention the company’s responsiveness to veteran needs, such as handling claims involving military-related circumstances or recognizing veteran-specific discounts. A combination of positive reviews and testimonials often points to a company that prioritizes veterans.

Real-life examples of successful claims handled by a particular company can help veterans assess the company’s efficiency.

Factors to Consider When Selecting an Insurance Provider

Several factors should guide veterans in selecting an insurance provider. These factors include cost-effectiveness, including discounts specifically for veterans. Assessing the company’s financial stability is essential to ensure that the provider can meet obligations in the event of claims. A provider with a strong reputation for handling claims quickly and efficiently is highly desirable. A clear understanding of the coverage limits and exclusions offered by different providers is crucial.

Lastly, the ease of navigating the provider’s website and online resources should be considered. Providers with user-friendly online platforms often streamline the claim process and allow for efficient policy management.

Navigating the Claims Process as a Veteran

Filing a car insurance claim can be a stressful experience, but understanding the process and the potential nuances for veterans can make it smoother. This section details the steps involved, potential differences based on insurance providers, common pitfalls, and how insurance agents can help.

Steps in the Claims Process

The claims process typically involves reporting the accident, gathering necessary documentation, and providing this to the insurance provider. Thorough record-keeping is crucial.

- Reporting the Accident: Immediately report the accident to your insurance company and local authorities, as required by law. This is critical for initiating the claims process and ensuring accurate documentation of the incident.

- Gathering Documentation: Collect all relevant paperwork, including police reports, medical records, and witness statements. Photos of the damage to the vehicle(s) and any injuries sustained are highly recommended. Obtain a copy of the vehicle registration, and any proof of the insurance policy number.

- Submitting the Claim: Complete the necessary claim forms provided by your insurance company, thoroughly detailing the incident and supporting documentation. This is often facilitated through a dedicated claims portal or via a claims adjuster.

- Following Up: Keep in regular contact with your insurance provider to check on the status of your claim and address any questions they might have. A clear understanding of the claim’s progress helps prevent delays.

Differences in Claims Processes Across Providers

While the general steps are similar across insurance providers, variations can exist. Some providers may have more streamlined online portals, while others might prefer traditional mail-based submissions. It’s vital to understand your specific provider’s procedures.

| Insurance Provider | Claim Process |

|---|---|

| Company A | Online portal with video chat for statements; emphasis on digital documentation |

| Company B | Traditional mail submission; detailed paper forms, requiring physical documents |

| Company C | Hybrid approach; online portal for initial reporting, with physical documents for certain claims |

Common Reasons for Claim Denials and How to Avoid Them

Understanding potential pitfalls can help veterans avoid claim denials. Lack of proper documentation or misrepresentation of facts can lead to rejection.

- Incomplete Documentation: Ensure all necessary documents are provided, such as police reports and medical records. Complete and accurate information is essential for a successful claim.

- Unreported Accidents: Failing to report an accident promptly can lead to claim denial. If an accident isn’t reported to the insurer, the claim will not be processed.

- Exaggerated Claims: Be truthful and transparent about the extent of the damages. Providing inaccurate or inflated information can result in the claim being denied.

- Failure to Comply with Policy Terms: Review your policy carefully to ensure you understand the specific requirements and conditions. Understanding the exclusions and limitations in your policy can prevent issues.

The Role of Insurance Agents in Helping Veterans

Insurance agents can play a vital role in navigating the claims process, especially for veterans. They can offer valuable assistance in understanding policy specifics, gathering necessary documentation, and communicating with the insurance company.

“A knowledgeable agent can help veterans navigate the often complex process of filing a claim and potentially expedite the process.”

Insurance for Specific Vehicles for Veterans

The type of vehicle you drive significantly impacts your car insurance premiums. Factors like age, make, model, and features all play a role in determining the risk your insurer perceives. Understanding these nuances is crucial for veterans seeking the most competitive rates.

Impact of Vehicle Age on Insurance Costs

Older vehicles often have higher insurance costs for several reasons. Reduced resale value and potentially more frequent repairs increase the risk of financial loss for insurers. Parts may be harder to source, increasing repair costs. Safety features, like airbags or anti-lock brakes, might be less prevalent in older models, which also increases risk. Furthermore, older vehicles may not meet current safety standards, further increasing the perceived risk by insurers.

For example, a 1995 sedan will likely have a higher insurance premium than a similarly equipped 2023 model.

Insurance for Sports Cars and High-Performance Vehicles

High-performance vehicles, such as sports cars or muscle cars, tend to have higher insurance premiums due to their increased risk of accidents and potential for higher repair costs. The combination of speed and potentially less-refined safety features elevates the risk profile for insurers. The greater potential for higher-value parts, more complex mechanical systems, and greater accident severity also increases the insurance premium.

For instance, a high-performance sports car will usually have a higher premium compared to a standard sedan.

Influence of Vehicle Features on Insurance Premiums

Vehicle features, such as anti-theft devices, airbags, and advanced safety systems, can influence insurance premiums. The presence of these features typically lowers premiums as they reduce the likelihood of accidents and the severity of damages if an accident does occur. Anti-theft systems, for example, can deter theft, minimizing the financial burden on the insurer. A car with advanced driver-assistance systems like lane departure warnings and automatic emergency braking will typically have a lower premium than one without these features.

Comparison of Insurance Costs for Various Vehicle Types

| Vehicle Type | General Insurance Cost Considerations | Example Premium Range (Illustrative, not guaranteed) |

|---|---|---|

| Compact Sedan (2023 Model) | Generally lower repair costs, higher availability of parts, and often more fuel-efficient. | $120-$180 per month |

| Sports Car (2020 Model) | Higher repair costs, potential for higher-value parts, and increased risk due to higher speed capabilities. | $180-$250 per month |

| SUV (2022 Model) | Higher repair costs, potentially more complex systems, and larger vehicle size, resulting in increased accident severity potential. | $150-$220 per month |

| Truck (2015 Model) | Higher repair costs, potential for damage to other vehicles in accidents, and potential for higher liability exposure. | $170-$250 per month |

Note: These are illustrative examples and premiums will vary based on individual factors, including driving history, location, and deductible.

Resources for Military Veterans on Car Insurance

Finding the right car insurance can be challenging, but it’s even more important for veterans. Navigating the complexities of coverage, discounts, and financial assistance programs can be simplified with the right resources. This section details vital online tools, government support, and veteran-specific organizations dedicated to easing the process.

Online Resources for Car Insurance Information

A wealth of information is available online to help veterans understand car insurance. Dedicated websites and comparison tools provide comprehensive details on coverage options, discounts, and provider profiles. These resources allow veterans to compare policies, understand policy terms, and find tailored options to meet their specific needs.

- Government websites like the Department of Veterans Affairs (VA) and the National Insurance Consumer Helpline can offer guidance on insurance-related matters. They provide resources for understanding your rights as a consumer and can connect you to helpful tools and services.

- Independent comparison websites provide valuable tools for evaluating various insurance options. These tools facilitate comparing quotes from different providers, allowing veterans to analyze coverage, premiums, and discounts.

- Veteran-focused financial websites frequently include articles and guides on managing finances, including car insurance, tailored for veterans.

Government Programs and Agencies Offering Assistance

Several government programs and agencies extend support to veterans concerning car insurance. These programs often include financial aid, assistance in finding affordable policies, and educational resources to aid in understanding insurance policies.

- The Department of Veterans Affairs (VA) offers numerous programs and services for veterans, including assistance with accessing affordable healthcare and benefits. Veterans should explore VA resources to determine if they qualify for financial aid and support in insurance.

- The Consumer Financial Protection Bureau (CFPB) provides a wealth of information about consumer rights and financial issues, including insurance. Their website offers educational materials, tools, and FAQs for understanding various insurance types and rights.

Contact Information for Veteran-Specific Organizations

Several veteran-specific organizations and advocacy groups provide valuable resources and support for veterans. They offer assistance in navigating the complexities of car insurance and provide connections to relevant experts.

- Veteran organizations like the American Legion, the Disabled American Veterans, and the Vietnam Veterans of America may have resources and programs to help veterans find affordable insurance or connect them with relevant specialists.

- Organizations focused on financial literacy for veterans frequently offer workshops, seminars, and one-on-one guidance to help veterans make informed decisions about insurance and other financial matters.

Financial Assistance for Veterans Regarding Car Insurance

Financial assistance for veterans regarding car insurance is available in various forms. This can range from discounts offered by insurance providers to specific programs that directly help with premiums or other expenses.

- Many insurance providers offer discounts to veterans. These discounts can significantly reduce premiums and make insurance more affordable. It’s important to inquire about these discounts directly with the provider.

- Some organizations may provide financial aid to help veterans cover the cost of car insurance. These organizations often offer grants, loans, or other forms of support to ease the financial burden.

Final Thoughts

In conclusion, securing the best car insurance as a military veteran involves careful consideration of your unique needs and access to resources tailored to your service. By understanding the available policy types, discounts, and the claims process, you can confidently navigate the insurance market. Remember to compare quotes, read reviews, and leverage the available resources for veterans to find the optimal solution for your situation.

FAQ Overview

What are common challenges veterans face in the insurance market?

Some veterans may face challenges due to gaps in their insurance history or past claims, impacting their rates. Insurance providers may also not be fully aware of the specific benefits and discounts available to veterans.

How can I verify and claim veteran-specific discounts?

Contact the insurance provider directly and provide documentation such as your DD214. Be prepared to furnish necessary details to support your claim. Always keep records of your interactions and communications.

What types of vehicles have a high impact on insurance costs for veterans?

Older vehicles, high-performance cars, and sports cars generally come with higher insurance premiums. The vehicle’s make, model, and features are all factors influencing the final rate.

What are some online resources for veterans seeking car insurance information?

The Department of Veterans Affairs (VA) and various veteran-specific organizations may offer helpful information and resources regarding car insurance. Check their websites for details.