Navigating the world of auto insurance can feel overwhelming. Fortunately, online tools like Allstate’s auto quote platform offer a convenient and efficient way to compare policies and find the best coverage for your needs. This guide delves into the Allstate online auto quote process, comparing it to traditional methods, and exploring the factors influencing your rates.

From understanding the steps involved to evaluating the user experience and customer support, this comprehensive overview equips you with the knowledge to make an informed decision. We’ll also cover important aspects like accessibility and inclusivity to ensure a smooth experience for all users.

Understanding the Online Auto Quote Process

Getting an auto insurance quote online is a straightforward process, streamlining the comparison of different policies. This guide details the typical steps involved in obtaining a quote from Allstate, along with a comparison to a major competitor.The Allstate online auto quote process is designed to be user-friendly and efficient. It gathers necessary information to generate a personalized quote tailored to your specific vehicle, driving history, and desired coverage.

Steps in the Allstate Online Auto Quote Process

This section Artikels the typical steps involved in obtaining a quote from Allstate’s website. Understanding these steps will make the process smoother and more efficient.

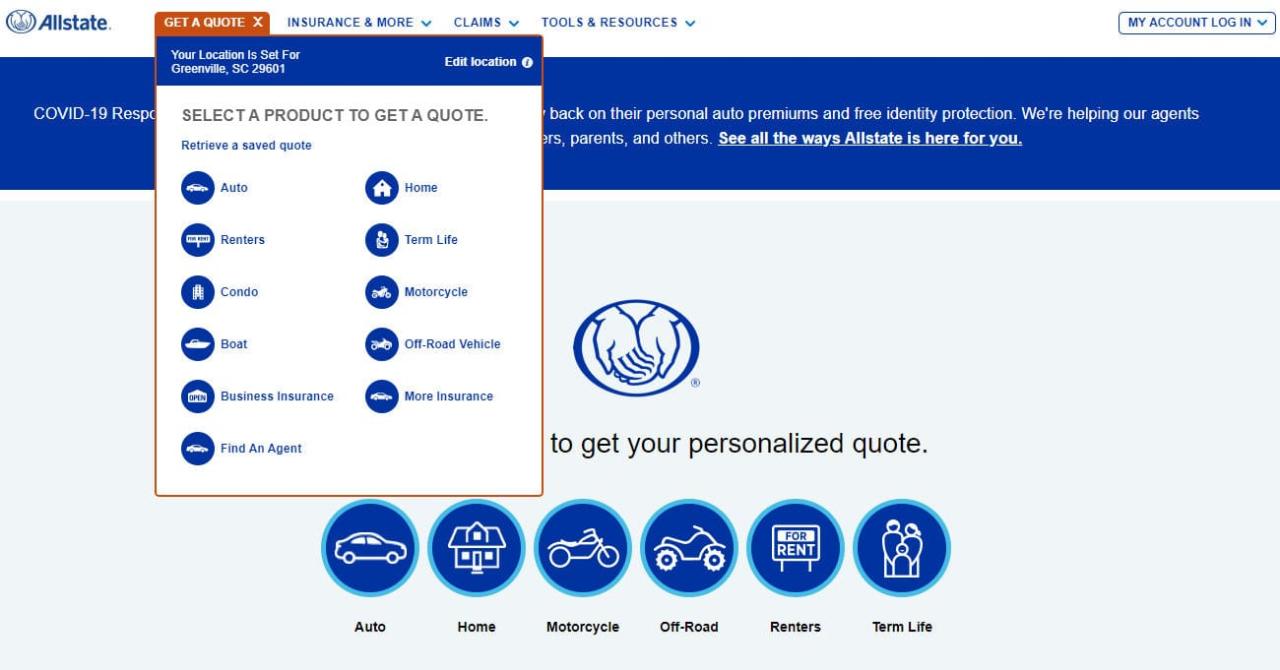

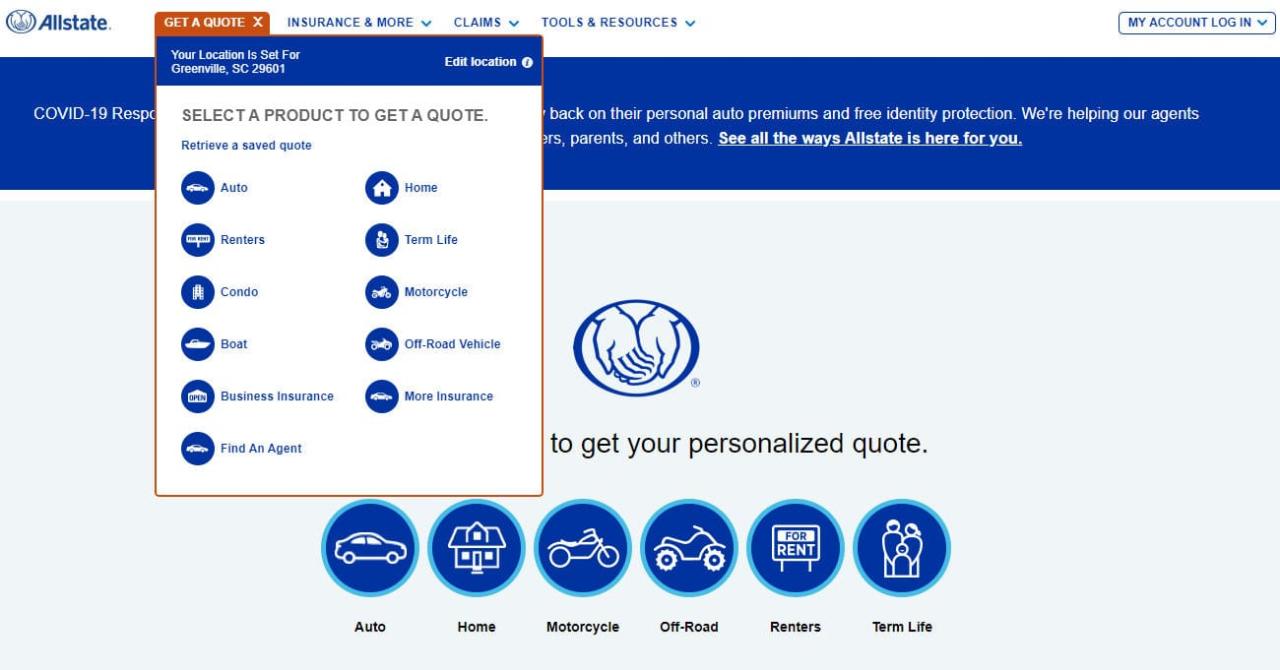

- Visit the Allstate website and navigate to the auto insurance section. This usually involves clicking on a relevant button or link on the homepage.

- Provide basic vehicle information, including make, model, year, and VIN (Vehicle Identification Number). This ensures accurate calculation of potential risks and premiums.

- Enter driver details, such as age, driving history (including any accidents or violations), and location. This information is crucial for assessing the risk associated with the driver.

- Specify desired coverage options and add-ons. Allstate offers various coverage types and optional add-ons, allowing you to customize your policy to meet your specific needs.

- Review the generated quote and, if satisfied, proceed to complete the application. This final step involves reviewing all the details before committing to the policy.

Information Requested During the Quote Process

The following information is typically requested during the Allstate online auto quote process:

- Personal information: Full name, address, phone number, email address.

- Vehicle details: Make, model, year, VIN, and vehicle use (e.g., personal or business).

- Driver information: Age, driving history (including accidents, violations, and driving record), and any other relevant information that can impact the risk assessment.

- Coverage preferences: Desired coverage amounts, optional add-ons (e.g., roadside assistance), and preferred payment options.

Coverage Options Available

Allstate offers various coverage options, including:

- Liability coverage: Protects you from financial responsibility in the event of an accident.

- Collision coverage: Reimburses the cost of repairs if your vehicle is damaged in an accident, regardless of who is at fault.

- Comprehensive coverage: Pays for damage to your vehicle from events other than accidents, such as vandalism, theft, or weather-related incidents.

- Uninsured/Underinsured Motorist coverage: Protects you if you are injured by a driver with insufficient or no insurance.

- Other options like roadside assistance and rental car reimbursement can be added to your policy as needed.

Integration with Allstate’s Website

The online quote process seamlessly integrates with Allstate’s overall website. Navigation is intuitive, allowing easy access to relevant pages and information. The site typically includes clear instructions and explanations to guide users through the quote process.

Comparison of Allstate and Geico Online Quote Processes

| Feature | Allstate | Geico |

|---|---|---|

| Ease of Navigation | Generally user-friendly, with clear instructions. | Intuitive and easy to navigate, with straightforward steps. |

| Information Requested | Comprehensive list of required details, allowing for precise risk assessment. | Clear and concise request for essential information, focusing on core details. |

| Coverage Options | Wide range of coverage options and add-ons to customize your policy. | Standard coverage options, with additional options available for customization. |

| Quote Generation Time | Typically quick and efficient, depending on the complexity of the information provided. | Generally fast, generating quotes in a timely manner. |

Comparing Allstate Online Quotes with Traditional Methods

Getting an auto insurance quote is a crucial step in ensuring you have adequate coverage. Choosing between online and traditional methods involves weighing various factors, from speed and convenience to cost implications and security concerns. This comparison highlights the key differences, enabling informed decisions for securing the best possible insurance policy.Traditional methods, like visiting an insurance agent in person, have long been the standard.

However, the rise of online platforms offers a more convenient alternative. Understanding the advantages and disadvantages of each method is essential for navigating the insurance process effectively.

Advantages of Online Allstate Quotes

Online quoting platforms provide significant advantages in terms of speed and convenience. They eliminate the need for scheduling appointments and travel time, allowing you to get a quote instantly. This streamlined process empowers you to compare quotes from different providers, including Allstate, with ease and efficiency. Furthermore, the 24/7 availability of online platforms enhances flexibility, allowing you to obtain quotes at your convenience.

Disadvantages of Online Allstate Quotes

While online quoting offers convenience, potential drawbacks exist. One disadvantage is the potential lack of personalized service. Online platforms often rely on standardized questionnaires, which may not fully capture your unique driving history or circumstances. This can sometimes lead to an inaccurate assessment of your insurance needs. Moreover, you may miss the opportunity for a deeper discussion with an agent to address any specific concerns or questions about coverage options.

Advantages of Traditional Allstate Quotes

Traditional methods offer the benefit of personalized service. An insurance agent can provide tailored advice, explaining different policy options and their implications. This personalized approach ensures a better understanding of the various coverage options and their suitability to your specific needs. Agents can also address complex questions and concerns, offering guidance and support in navigating the insurance process.

Disadvantages of Traditional Allstate Quotes

Traditional methods, while offering personalized service, have certain disadvantages. One major drawback is the time commitment involved. Obtaining a quote may require scheduling an appointment and traveling to an agency. This process can be time-consuming and less flexible compared to online methods.

Cost Implications

The cost of obtaining an auto quote is generally similar between online and traditional methods. Allstate, like other providers, often employs standardized pricing models. However, differences in policy terms and coverage options can affect the final premium. There’s no substantial cost difference between online and offline methods, assuming similar policy details.

Security Considerations

Security is paramount when using online tools. Ensure the website you use is reputable and employs secure encryption protocols (e.g., HTTPS). Avoid sharing sensitive information on unsecured sites. By being cautious and adhering to security best practices, you can protect your personal data.

Comparison Table

| Feature | Online Quote | Traditional Quote |

|---|---|---|

| Speed | Instantaneous | Variable, appointment-dependent |

| Convenience | High, 24/7 access | Moderate, requires scheduling |

| Cost | Comparable | Comparable |

| Personalization | Limited | High |

| Security | Requires vigilance | Generally secure if reputable agency |

| Flexibility | High | Lower |

Factors Influencing Auto Insurance Rates

Understanding the factors that shape your auto insurance premiums is crucial for making informed decisions. These factors are not arbitrary; they are carefully considered by insurance companies to assess risk and accurately price coverage. Allstate’s online quoting system incorporates these factors to provide you with a personalized and accurate estimate.Allstate’s online quote process is designed to reflect the multifaceted nature of risk assessment in auto insurance.

This includes a comprehensive evaluation of driver demographics, vehicle characteristics, and driving history. The system meticulously analyzes these details to generate a tailored quote, allowing you to compare coverage options with different premium structures.

Driver Demographics

Driver age, gender, and location significantly impact insurance rates. Younger drivers, particularly those in high-accident areas, generally face higher premiums due to their perceived higher risk. Driving experience, reflected in the number of years licensed, is also a key consideration. A longer driving history generally results in lower premiums, assuming a safe driving record.

Vehicle Type and Features

The type of vehicle, including its make, model, and year, plays a crucial role in determining premiums. Certain vehicles are statistically more prone to theft or damage, leading to higher insurance costs. Vehicle features, such as anti-theft devices and safety equipment, are also evaluated and can potentially influence premiums. For example, a car with advanced safety features like airbags and electronic stability control might have a lower premium compared to a similar model without these features.

Mileage and Driving Habits

Mileage driven annually is a key factor. Higher mileage often correlates with a greater potential for accidents or wear and tear on the vehicle, potentially leading to higher premiums. Furthermore, the system considers the location where the vehicle is primarily driven, potentially affecting the insurance rate based on accident statistics and traffic patterns. Allstate considers driving habits like speeding and aggressive driving, as indicated by traffic violation records.

Driving History

Accidents, traffic violations, and claims all contribute to a driver’s overall driving history. A clean driving record, devoid of major violations, will generally result in lower premiums. Conversely, a history of accidents or violations will increase premiums, reflecting the increased risk associated with these incidents. For example, a driver with a history of at-fault accidents will likely pay more for insurance compared to a driver with no accidents.

Insurance Claim History

The number and severity of previous claims are important considerations in the pricing of auto insurance. A history of claims, regardless of fault, can raise premiums as it suggests a higher risk profile for the insurer.

Table: Factors Influencing Auto Insurance Rates

| Factor | Potential Impact on Rates |

|---|---|

| Driver Age | Younger drivers typically have higher rates due to perceived higher risk. |

| Vehicle Type | Certain vehicles, due to theft or damage risk, have higher premiums. |

| Mileage | Higher mileage often correlates with greater potential for accidents or wear and tear, leading to higher premiums. |

| Driving History | Accidents, violations, and claims increase the risk profile and result in higher premiums. |

| Claims History | A history of claims, regardless of fault, can raise premiums. |

| Location | High-accident areas may have higher rates. |

User Experience and Website Functionality

The user experience (UX) of an online auto quote platform is critical to a positive customer interaction. A well-designed platform should make the quoting process straightforward, efficient, and transparent. A seamless experience encourages customers to complete the quote and potentially choose Allstate.

Evaluating the Allstate Online Auto Quote Platform

Allstate’s online auto quote platform should be evaluated based on several key aspects of user interface (UI) and navigation. Factors like intuitive navigation, clear presentation of information, and ease of completing the quote are paramount. A user-friendly platform ensures a positive experience, leading to potential conversions.

Clarity and Comprehensiveness of Information

The clarity and comprehensiveness of the information presented on the platform directly impact the user’s understanding of the quoting process and the associated insurance options. Well-structured information, along with clear explanations of different coverage options and associated costs, fosters customer confidence. Vague or insufficient information can lead to confusion and potentially deter customers from proceeding.

Ease of Finding Specific Information and Completing the Quote

The ease with which users can find specific information and complete the online quote is crucial. A user should be able to easily locate relevant details, such as various coverage options and associated costs. The quote form should be straightforward and logical, with clear prompts and fields. Complex or convoluted processes can discourage users from completing the quote, potentially losing a customer.

Strengths and Weaknesses of the Online Platform

The following table summarizes potential strengths and weaknesses of Allstate’s online auto quote platform, based on user feedback. This information is crucial for identifying areas for improvement and optimizing the platform.

| Aspect | Strengths | Weaknesses |

|---|---|---|

| Navigation | Intuitive menu structure and clear categorization of options. Simple and easy to use search functions. | Some users find certain sections difficult to navigate. Navigation could be improved for specific coverage options. |

| Information Presentation | Comprehensive details on various coverage types and associated costs. Clear explanations of policy terms. | Some users feel the information is too dense or lacks visual aids. Some critical details are not readily available. |

| Quote Completion | User-friendly form with clear prompts. The process is relatively quick and efficient. | Some users find the form to be overly long or complex, leading to frustration. Limited flexibility in customizing coverage options. |

| Overall Experience | The platform is generally user-friendly and well-designed. The majority of users find it easy to complete the quote process. | Some users report difficulty accessing customer support or troubleshooting issues. The platform could be improved to address specific user needs. |

Customer Service and Support

Getting the right auto insurance can be a complex process. Understanding the available customer support options and how to contact Allstate for assistance is key to a smooth experience. This section details the various ways Allstate handles customer inquiries and resolves issues related to online auto quotes.Allstate provides multiple channels for customer service, recognizing the need for diverse communication preferences.

This approach aims to make it easy for customers to reach the support they need, whether it’s through a quick question or a more involved issue.

Customer Support Channels

Allstate offers several avenues for contacting customer service, catering to different needs and preferences. These options are designed to be convenient and efficient.

- Phone Support: Direct phone lines provide immediate assistance for complex issues or inquiries requiring personalized guidance. A dedicated phone number for auto insurance inquiries streamlines the process.

- Online Chat: Live chat functionality is available on Allstate’s website, allowing for real-time interaction with a representative. This is ideal for quick questions or clarifications about the online quoting process.

- Email Support: Email is a reliable method for submitting inquiries or detailed requests, offering a written record of the interaction. Allstate typically responds to emails within a reasonable timeframe.

- Contact Form: A dedicated online contact form simplifies the process of submitting requests, collecting specific information, and enabling customers to receive follow-up correspondence. This is useful for non-urgent inquiries.

Contacting Customer Service

The process for contacting Allstate for support is generally straightforward and clearly Artikeld on their website. Customers can find contact information and specific support options tailored to their needs.

- Website Navigation: Navigating to the appropriate support page or contact section is straightforward on the Allstate website. The site usually provides clear links and menus.

- Contact Information: Finding contact details, such as phone numbers, email addresses, and online chat options, is typically easy to locate on the website. These details are usually readily available on the main website pages.

- Support Ticket System: For more complex issues, Allstate may utilize a support ticket system to track and manage customer inquiries effectively. This system allows for efficient routing of requests to appropriate personnel.

Common Customer Service Issues and Solutions

Understanding typical customer service issues allows for efficient resolution. Allstate addresses these issues proactively.

- Incorrect Quotes: If a customer receives an inaccurate quote, Allstate representatives can review the details, identify the source of the error, and provide a corrected quote. This involves checking for accurate input of vehicle information, driver details, and coverage options.

- Policy Changes: For modifications to existing policies, Allstate representatives can guide customers through the necessary procedures, ensuring accurate updates and providing clear explanations. Changes to coverage, premiums, or drivers can be accommodated through this process.

- Billing Inquiries: Regarding billing inquiries, Allstate offers clear explanations of charges, payment methods, and policy renewal details. Issues are typically resolved by verifying the policy details, clarifying billing cycles, and providing alternative payment options.

Comparison with Other Providers

Allstate’s customer service approach is comparable to other major insurance providers. The range of contact methods and responsiveness vary across different providers.

- Average Response Time: Allstate aims to respond to customer inquiries within a reasonable timeframe. Different providers have varying response times for support requests, so comparing these across multiple companies is useful.

- Problem Resolution: Allstate strives to resolve customer issues promptly and efficiently. This efficiency can differ across various providers, depending on the specific support channels.

Customer Service Integration with Online Quote Process

Customer service seamlessly integrates with the online quote process. Allstate leverages customer support throughout the quoting process.

- Guidance Through Quotes: During the online quoting process, customers can readily access support through various channels if they encounter issues or need clarification. This is essential for a smooth online experience.

- Post-Quote Support: After completing an online quote, Allstate provides support to answer follow-up questions, confirm policy details, and address any concerns. This demonstrates Allstate’s commitment to the customer beyond the initial quote.

Illustrative Examples of Quotes

Getting an accurate estimate of your auto insurance premium is crucial for informed financial planning. This section provides real-world examples of how different factors influence Allstate auto insurance quotes. Understanding these examples can help you anticipate potential costs and make informed decisions about your coverage.

Scenarios with Varying Coverage Needs and Driver Profiles

Different driving habits, vehicle types, and coverage choices significantly impact your insurance premium. The following examples illustrate these variations.

- Scenario 1: A young driver with a new, sporty car and limited driving history will likely have a higher premium compared to an older, experienced driver with a more modest vehicle.

- Scenario 2: A family with multiple vehicles and a history of safe driving might qualify for bundled discounts, leading to a lower overall premium.

- Scenario 3: A business owner using their vehicle for commercial purposes will need commercial auto insurance, which typically has a higher premium than personal auto insurance.

Estimated Premiums for Different Vehicle Types and Driver Categories

The value of a vehicle and the driver’s age, experience, and location directly affect the premium.

- A sporty, high-performance car, driven by a young driver with a recent traffic violation, is likely to have a significantly higher premium compared to a standard sedan driven by a mature, experienced driver with a clean driving record.

- A classic or antique vehicle may have a unique premium calculation, taking into account its value and potential repair costs.

- Drivers in high-accident areas may have higher premiums than drivers in areas with a lower accident rate.

Breakdown of the Final Quoted Premium

Understanding the components of your quoted premium is essential for evaluating the value of different plans. The following table demonstrates the breakdown of a sample quote.

| Component | Description | Example Amount ($) |

|---|---|---|

| Base Premium | Fundamental cost of coverage | 500 |

| Collision Coverage | Protects against damage to your vehicle in an accident | 150 |

| Comprehensive Coverage | Covers damage from events other than accidents, such as vandalism or theft | 100 |

| Liability Coverage | Protects you against legal claims for damages caused to others | 200 |

| Additional Discounts | Applied for factors like good driving record | -50 |

| Total Premium | Final cost of the policy | 900 |

Comparison of Quotes from Different Allstate Plans

Allstate offers various plans with different levels of coverage and premiums.

- Plan A: Focuses on comprehensive coverage, typically has a higher premium than a plan with limited coverage, and may include additional features.

- Plan B: Provides a balance of coverage and cost, including liability and collision coverage, and might have a mid-range premium.

- Plan C: Offers basic coverage at a lower premium, suitable for drivers with minimal needs.

Summary of Quote Examples

The following table summarizes various quote examples, highlighting key details.

| Scenario | Vehicle Type | Driver Profile | Estimated Premium ($) | Key Features |

|---|---|---|---|---|

| Young Driver, New Car | Sports Coupe | Recent License, Minor Violations | 1,200 | Higher liability limits, higher comprehensive coverage |

| Experienced Driver, Sedan | Sedan | Clean Record, Long Driving History | 800 | Standard liability coverage, collision coverage |

| Family, Multiple Vehicles | SUV, Sedan | Clean Records, Good Driving History | 1,000 | Bundled discounts, comprehensive coverage |

Accessibility and Inclusivity of the Platform

Ensuring a positive user experience for all is crucial for a successful online auto quote platform. This involves considering the diverse needs and abilities of users, ranging from those with visual impairments to those who prefer simple navigation. A truly inclusive platform fosters trust and broadens the reach of the service.A well-designed platform prioritizes accessibility by adhering to web accessibility guidelines and standards.

This proactive approach not only caters to users with disabilities but also improves the overall usability for everyone. For example, using clear language and intuitive navigation benefits all users, regardless of their background or technical proficiency.

Accessibility for Users with Disabilities

This section Artikels the key considerations for designing an accessible online auto quote platform for users with disabilities. Adhering to web accessibility guidelines is essential for ensuring that the platform is usable by individuals with a wide range of disabilities. These guidelines cover various aspects, from screen reader compatibility to keyboard navigation. This approach makes the platform usable by individuals with visual, auditory, motor, or cognitive impairments.

Measures for Inclusivity of Diverse User Groups

Inclusivity goes beyond accessibility and extends to accommodating diverse user groups. The platform should strive to be welcoming and respectful of different cultural backgrounds, language preferences, and learning styles. This involves using clear and concise language, providing multilingual support where appropriate, and offering diverse examples that reflect a variety of situations.

Importance of Clear Language and Simple Navigation

Clear and concise language is fundamental to a user-friendly experience. Complex jargon or technical terms should be avoided, and the platform should employ straightforward language. Simple navigation is equally important, ensuring users can easily find the information they need without difficulty. This straightforward approach enhances the user experience for everyone.

Demonstrating Platform Accessibility for a Wider Audience

A key aspect of a successful online platform is demonstrating accessibility to a wider audience. This can be achieved by incorporating diverse user stories and examples throughout the design process. For example, consider scenarios where users have different levels of technical proficiency, language preferences, or cognitive abilities. Thorough testing with diverse user groups is essential.

Guidelines for Improving Platform Accessibility

| Aspect | Guidelines |

|---|---|

| Visual Design | Use sufficient color contrast between text and background. Provide alternative text descriptions for images and graphics. Ensure sufficient font size and readability. |

| Navigation | Use clear and concise labels for all links and buttons. Implement keyboard navigation for all interactive elements. Provide a sitemap or navigation menu. |

| Content | Use clear and concise language. Avoid jargon or technical terms. Provide text alternatives for non-text content (e.g., images, videos). Offer multilingual support. |

| Functionality | Ensure that all forms and interactive elements are accessible to users with disabilities. Provide clear instructions and error messages. Use screen reader-compatible input methods. |

| Testing | Conduct thorough user testing with diverse users, including those with disabilities. Use assistive technologies to test the platform. Gather feedback from users with disabilities. |

Conclusive Thoughts

In conclusion, Allstate’s online auto quote platform provides a streamlined and accessible way to secure affordable coverage. By comparing online and offline methods, understanding rate-influencing factors, and assessing the user experience, you can confidently choose the best auto insurance plan for your circumstances. Remember to thoroughly review the various coverage options and compare quotes to find the best value.

Frequently Asked Questions

What types of coverage are available through Allstate’s online quote?

Allstate offers various coverage options, including liability, collision, comprehensive, and uninsured/underinsured motorist coverage. The specific options available may depend on your individual circumstances and state requirements.

How long does it typically take to receive a quote online?

The quote process is generally quick, often completing within minutes. The exact time depends on the accuracy and completeness of the information provided.

Can I compare Allstate’s online quotes with other companies?

Yes, the guide includes a comparison table to help you assess Allstate’s online quote process against a competitor like Geico.

What are the security measures for online quotes?

Allstate utilizes secure online platforms with industry-standard encryption to protect your personal information. However, always exercise caution and use strong passwords.

What if I have questions after receiving my quote?

Allstate offers various customer support options, including phone, email, and online chat, to assist with any questions or concerns.