Finding the best auto insurance can feel like navigating a maze. This guide unravels the process, providing a structured approach to comparing policies and uncovering the optimal fit for your needs. From understanding the comparison process to utilizing online tools and analyzing policy documents, we’ll equip you with the knowledge to make an informed decision.

We’ll delve into crucial factors like deductibles, coverage limits, and various add-ons, helping you understand how they impact premiums. Furthermore, we’ll explore the strengths and weaknesses of different insurance providers, offering insights into their reputations and customer service.

Understanding the Comparison Process

Comparing auto insurance policies can seem daunting, but a structured approach simplifies the process. Thorough research and a clear understanding of the factors influencing premiums are key to finding the best policy for your needs. This involves scrutinizing coverage options, deductibles, and discounts to ensure you’re getting the most value for your money.A crucial first step is understanding your specific needs and risk profile.

This involves considering your driving history, vehicle type, location, and desired coverage levels. Armed with this knowledge, you can then effectively compare different policies.

Steps Involved in Comparing Policies

Identifying your needs and understanding your driving history are crucial to comparing policies effectively. This involves evaluating your driving record (traffic violations, accidents, etc.), vehicle details (age, make, model, safety features), and your location (high-risk areas vs. low-risk areas). Knowing your needs and circumstances allows for a targeted comparison process, ensuring you find a policy that aligns with your requirements.

The steps generally involve researching different insurance providers, requesting quotes, and meticulously comparing the offered policies.

Key Factors to Consider When Comparing Policies

Several key factors influence the cost and coverage of auto insurance policies. These include the type of coverage offered (liability, collision, comprehensive), deductibles, premiums, discounts, and the financial stability of the insurance provider. Understanding these factors is essential for a comprehensive comparison.

- Coverage Types: Different coverage types offer varying levels of protection. Liability coverage protects you from damages to others, while collision and comprehensive coverages address damage to your own vehicle. Comprehensive coverage typically covers damage from events beyond collision, such as weather events or vandalism.

- Deductibles: Deductibles represent the amount you pay out-of-pocket before the insurance company steps in. A higher deductible often leads to lower premiums, but you’ll need to manage the financial responsibility if a claim occurs.

- Premiums: Premiums are the regular payments you make to maintain your insurance coverage. They are influenced by factors like your driving record, vehicle type, and location. Comparing premiums across different providers is crucial.

- Discounts: Various discounts are available to reduce your premium costs. These can include discounts for safe driving, good student status, or anti-theft devices. Recognizing these discounts can save significant money.

- Financial Stability of the Insurance Provider: A financially stable insurance provider is crucial for ensuring claims are settled promptly and effectively. Checking the insurer’s financial rating and reputation can help gauge their reliability.

Structured Method for Evaluating Insurance Providers

A structured method for evaluating insurance providers can streamline the comparison process. This involves requesting quotes from multiple providers, carefully reviewing the terms and conditions of each policy, and comparing the coverage options and premiums. Comparing different policies in a structured way ensures a thorough evaluation of your insurance needs.

- Gather Quotes: Obtain quotes from multiple insurance providers, ensuring each quote considers your specific needs and circumstances.

- Review Policy Details: Thoroughly review the terms and conditions of each policy, focusing on coverage options, deductibles, and exclusions.

- Compare Coverage Options: Compare the various coverage options offered by different providers, considering the levels of protection provided and their associated costs.

- Analyze Premiums: Analyze the premiums charged by different providers, factoring in the level of coverage and associated discounts.

- Evaluate Provider Stability: Evaluate the financial stability of each insurance provider, considering their reputation and financial ratings.

Comparison Table of Auto Insurance Coverage Types

This table summarizes the different types of auto insurance coverage, their purposes, and their potential implications.

| Coverage Type | Purpose | Potential Implications |

|---|---|---|

| Liability | Covers damages to other people or their property in an accident where you are at fault. | Protects you from significant financial losses if you cause an accident. |

| Collision | Covers damage to your vehicle in an accident, regardless of who is at fault. | Ensures your vehicle is repaired or replaced if damaged in an accident. |

| Comprehensive | Covers damage to your vehicle from events other than collisions, such as vandalism, theft, or weather damage. | Protects your vehicle from unforeseen damage or loss. |

Types of Insurance Discounts and How They Work

Insurance discounts can significantly reduce your premium costs. Understanding how these discounts work can help you leverage them to save money.

- Safe Driving Discounts: Many insurers offer discounts to drivers with a clean driving record. This can include programs like accident-free driving rewards.

- Good Student Discounts: Discounts are often available to students with a good academic record, recognizing their lower risk profile.

- Anti-theft Device Discounts: Installing anti-theft devices in your vehicle can often lead to a discount, reducing the risk of theft.

- Multi-policy Discounts: Insuring multiple vehicles or other types of insurance (home, etc.) with the same provider can often result in a multi-policy discount.

- Bundling Discounts: Bundling insurance with other services, like roadside assistance, can sometimes lead to discounts.

Identifying Key Features for Comparison

Choosing the right auto insurance policy involves understanding its key features. This careful consideration helps ensure you’re adequately protected and aren’t paying more than necessary. Analyzing deductibles, coverage limits, and add-ons is crucial for a comprehensive comparison.

Deductibles and Their Impact on Premiums

Deductibles represent the amount you pay out-of-pocket before your insurance company starts covering expenses. Lower deductibles generally mean higher premiums, as the insurer bears a greater financial risk. Conversely, higher deductibles result in lower premiums, but you’ll need to pay more directly if a claim arises. This trade-off between premium cost and out-of-pocket expenses needs careful consideration. For example, a driver with a higher income and a good driving record might be comfortable with a higher deductible, while a driver with a lower income or a more frequent need for repairs might prefer a lower deductible, even if it means higher premiums.

Coverage Limits and Their Impact on Cost

Coverage limits define the maximum amount your insurance policy will pay for a claim. Higher limits usually mean a higher premium, but they provide greater financial protection in the event of significant damage or injury. Understanding your financial needs and potential risks is crucial in setting appropriate limits. For instance, a policyholder with a newer, more expensive car might require higher collision and comprehensive coverage limits compared to someone with an older vehicle.

Insurance Add-ons and Their Influence on Premiums

Insurance policies often come with various add-ons, each influencing the premium. These extras can range from roadside assistance to rental car coverage. Analyzing the cost-benefit ratio of these add-ons is important. For example, roadside assistance can be a valuable feature for drivers who live in remote areas or frequently travel long distances. The cost of this add-on is often justified by the peace of mind it provides.

Comparison of Policy Options: Liability, Collision, and Comprehensive

Liability coverage protects you if you’re at fault for an accident and harm others. Collision coverage pays for damage to your vehicle regardless of who is at fault, while comprehensive coverage covers damage from events like theft, vandalism, or weather-related incidents. Each type of coverage serves a specific purpose and influences the overall premium cost. For example, a driver living in an area with high theft rates might prioritize comprehensive coverage, while a driver in a low-theft area might opt for a more basic policy.

Examples of Add-ons and Their Premium Impact

Various add-ons, such as roadside assistance and rental car coverage, can significantly impact premiums. For instance, adding roadside assistance to your policy might increase your premium by a few dollars per month, but it provides peace of mind in case of a breakdown. Similarly, rental car coverage will add to the cost, but it’s crucial for drivers who need a replacement vehicle while their car is being repaired.

Ultimately, the decision to include these add-ons depends on individual needs and budget.

Exploring Different Insurance Providers

Choosing the right auto insurance provider is crucial for securing financial protection and peace of mind. This section delves into the key factors to consider when comparing various insurance companies in a specific region. Understanding their strengths, weaknesses, policy offerings, financial stability, and customer service will empower you to make an informed decision.

Comparing Major Auto Insurance Providers

Evaluating different insurance providers involves analyzing their strengths and weaknesses relative to specific needs. Factors like coverage options, pricing structures, and customer service quality are essential aspects of this comparison.

Range of Policies Offered

Different insurance companies offer a variety of policies tailored to various needs and budgets. Understanding the specific coverages available is vital in selecting a policy that aligns with personal circumstances.

- Some providers specialize in comprehensive coverage, including collision, liability, and uninsured/underinsured motorist protection.

- Others might offer add-on coverages like roadside assistance, rental car reimbursement, or gap insurance, depending on their focus.

- Policies may differ in terms of deductibles, premiums, and policy limits. It’s crucial to scrutinize these details carefully.

Financial Stability and Reputation

A company’s financial stability and reputation directly influence the reliability of its coverage. Evaluating the company’s claims-paying history and financial strength is essential for long-term security.

- A strong financial rating from independent rating agencies indicates a lower risk of insolvency.

- Reviewing customer reviews and online feedback can provide insights into the company’s reputation and handling of claims.

- A company’s history and track record are significant factors in assessing its long-term financial health.

Customer Service Experience

A positive customer service experience is crucial when navigating claims or policy-related inquiries. Assessing the availability, responsiveness, and helpfulness of the customer service team is important.

- Look for companies with multiple contact options, including phone, email, and online portals.

- Consider the speed and efficiency of claim processing, as well as the overall communication style.

- Testimonials and reviews from other policyholders can provide valuable insights into the customer service experience.

Policy Price Comparison

A critical step in comparing providers is evaluating policy prices. This comparison should consider various factors beyond just the premium amount.

| Insurance Provider | Premium (Annual) | Deductible | Coverage Options |

|---|---|---|---|

| Company A | $1,200 | $500 | Comprehensive, Collision, Liability |

| Company B | $1,500 | $1,000 | Comprehensive, Collision, Liability, Uninsured/Underinsured |

| Company C | $1,000 | $250 | Comprehensive, Collision, Liability, Roadside Assistance |

Note: These are example prices and may not reflect actual rates. It is crucial to obtain personalized quotes from each provider to get accurate pricing based on individual circumstances.

Utilizing Online Comparison Tools

Online comparison tools are invaluable resources for finding the best auto insurance rates. These platforms aggregate data from multiple insurance providers, enabling a quick and efficient comparison of policies. They simplify the process, saving you significant time and effort in navigating the often-complex world of auto insurance.

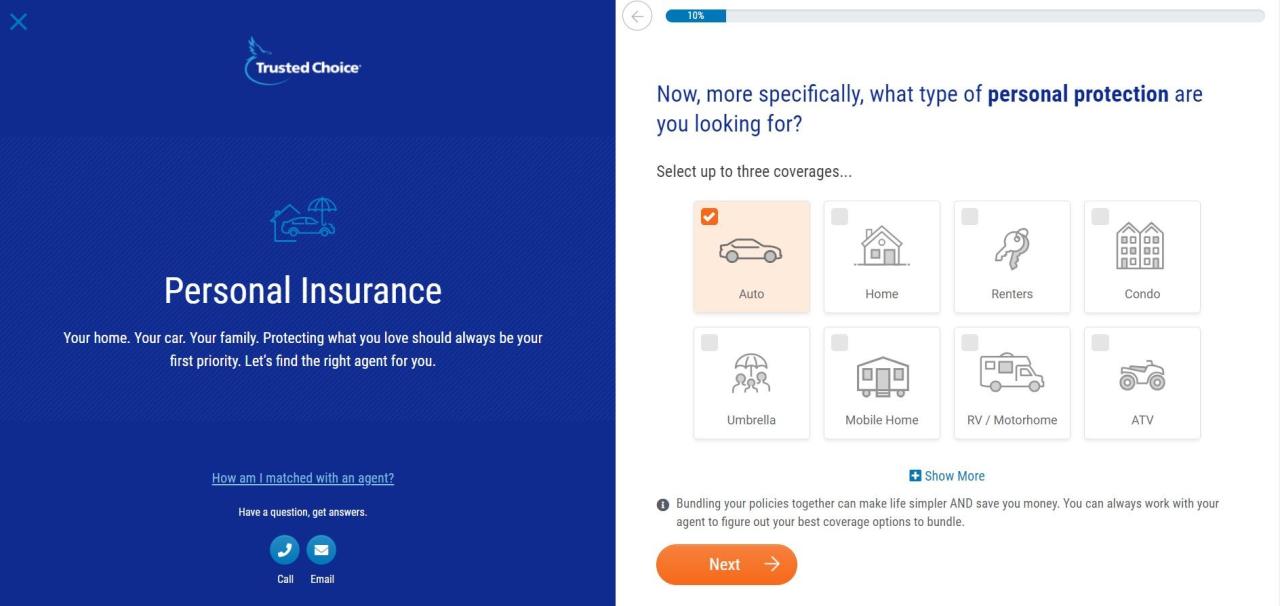

Features of Common Comparison Tools

Comparison tools typically offer a user-friendly interface for inputting your vehicle information, driving history, and desired coverage levels. They usually display results in a clear and concise format, highlighting key policy details like premiums, coverage limits, and deductibles. Many tools also allow you to filter results based on specific criteria, such as location, vehicle type, or desired add-ons.

The presentation of this information is designed for easy readability and quick comprehension, allowing users to rapidly identify the most suitable options.

Using a Typical Comparison Tool

A typical comparison tool will request information about your vehicle, driving history, and desired coverage. Begin by providing details about your vehicle, including make, model, year, and vehicle identification number (VIN). Then, enter your driving history, including any accidents or violations. Finally, specify the desired coverage levels, including liability, collision, comprehensive, and uninsured/underinsured motorist coverage. After entering this data, the tool will present a list of options from various insurers, outlining the premiums and policy details.

This detailed information is designed to facilitate a clear understanding of each option.

Finding Reliable and Unbiased Resources

Look for comparison tools that are reputable and have clear terms of service. Avoid tools with hidden fees or undisclosed biases. Consider tools that partner with a variety of insurance providers, ensuring a broader range of options. Read reviews from other users and seek out resources that prioritize transparency. This approach helps users find reliable and unbiased information, and avoid potential pitfalls.

Inputting Specific Needs

Most comparison tools allow you to input specific needs into the comparison process. You can refine your search by specifying your desired coverage limits, deductibles, and add-ons. For instance, you can choose to prioritize policies with high liability limits or those that include roadside assistance. The platform will filter the options to present those that match your precise criteria.

Many platforms also offer the option to specify your preferred payment schedule or coverage options, enabling users to customize their search to meet their unique requirements.

Limitations and Biases

Online comparison tools may have limitations, such as not including all insurance providers in their database. Additionally, the tools may not always be fully transparent about the algorithms used to rank insurance providers. Some tools may show a preference for certain providers based on undisclosed partnerships. These factors can influence the accuracy of the results. It is important to understand the limitations and biases that can affect the accuracy of the comparisons.

A critical evaluation of the provided information is essential to determine its relevance to your particular needs.

Analyzing Policy Documents

Thorough review of your auto insurance policy documents is crucial for understanding the coverage you’re purchasing. This step often reveals critical details that online comparison tools might not highlight. It ensures you’re not unknowingly accepting limitations or exclusions that could leave you vulnerable in the event of a claim.Policy documents contain the specifics of your agreement with the insurance company.

They detail the exact terms and conditions, outlining what is covered and what is not. Careful analysis can prevent unpleasant surprises down the road.

Key Elements to Look For

Understanding the core components of your policy is essential. Pay close attention to the policy’s definition of covered perils, including specific types of accidents or incidents. Note the limits of liability for damages to your vehicle, and other parties involved in an accident. The policy should explicitly state your responsibilities and obligations. Reviewing the policy’s terms and conditions will allow you to identify areas of clarity and ambiguity.

Understanding Policy Exclusions and Limitations

Policy exclusions and limitations delineate the circumstances where coverage will not apply. These clauses are vital for understanding what is not protected. Carefully review these sections, as they often detail scenarios such as pre-existing conditions, specific types of vehicle use, or geographic restrictions. These exclusions might pertain to certain types of vehicles, specific geographic locations, or certain types of accidents.

Importance of Reading the Fine Print

The fine print in insurance policies often contains critical details that are easily overlooked. These sections specify the procedures for filing claims, the conditions for coverage continuation, and the potential for policy cancellation. Reviewing the fine print is crucial for ensuring you understand the full implications of the policy. Thorough understanding of policy conditions is paramount for mitigating risk and ensuring a smooth claim process.

Legal Implications of Not Understanding Policy Terms

Failing to comprehend the terms of your auto insurance policy can have significant legal ramifications. A lack of understanding could lead to disputes during a claim process or, in severe cases, the denial of a claim. Understanding your rights and obligations under the policy is essential to avoiding potential legal issues.

Structured Method for Extracting Key Data Points

A structured approach to reviewing your policy documents can streamline the process. Create a table to categorize key information. This should include columns for the type of coverage, the coverage amount, the deductible, the policy exclusions, and the limitations.

| Coverage Type | Coverage Amount | Deductible | Exclusions | Limitations |

|---|---|---|---|---|

| Collision | $10,000 | $500 | Damage from hitting a stationary object | Geographical limitations |

| Comprehensive | $5,000 | $250 | Damage from fire, vandalism | Restrictions for certain types of vehicles |

This structured method helps in identifying crucial details in a concise and organized manner, making the process of comparing policies significantly more efficient.

Practical Application and Best Practices

Putting together all the information you’ve gathered about auto insurance policies is only the first step. Knowing how to apply this knowledge to make a sound decision and understanding the implications of different choices is crucial. This section will demonstrate practical strategies for making an informed decision, including examples of different policy scenarios, cost implications, and a checklist for comparison.

It will also show how to use the comparison results to potentially negotiate better rates.Applying the information gathered about different auto insurance policies requires a structured approach. A clear understanding of your individual needs and driving history is paramount. This involves considering factors like your vehicle type, driving habits, and desired coverage levels. Ultimately, the goal is to choose a policy that provides sufficient protection without unnecessary expenses.

Making an Informed Decision

To make an informed decision, meticulously review the gathered data from various insurance providers. Carefully analyze the policy details, focusing on the specific coverage types and associated costs. Understand the nuances of each policy, considering deductibles, premiums, and add-on coverage options. This process will empower you to make a decision aligned with your specific financial situation and risk tolerance.

Policy Scenario Examples and Cost Implications

Consider these illustrative scenarios and their potential cost implications:

- A young driver with a clean driving record might find comprehensive coverage with a lower deductible, resulting in a lower premium compared to a driver with a recent accident.

- A driver with a high-value sports car might require higher coverage limits for potential damage, which could lead to higher premiums compared to a driver with a less expensive vehicle.

- Adding features like roadside assistance or rental car coverage to a policy will increase the premium.

Checklist for Comparing Policies

Use this checklist to streamline the comparison process:

- Review the coverage types offered by each provider, focusing on liability, collision, comprehensive, and uninsured/underinsured motorist coverage.

- Compare deductibles, premiums, and any additional coverage options.

- Consider discounts for safe driving habits, anti-theft devices, or bundling with other insurance products.

- Evaluate the financial stability and reputation of each insurance provider.

- Thoroughly read the policy documents for clarity on coverage specifics and exclusions.

Impact of Driving Records on Premiums

The following table demonstrates how different driving records can affect premiums:

| Driving Record | Premium Impact |

|---|---|

| Clean driving record (no accidents or violations) | Lower premium |

| Minor traffic violation (e.g., speeding ticket) | Potentially slightly higher premium |

| At-fault accident | Significantly higher premium (potentially for several years) |

| Multiple accidents or serious violations | Substantially higher premium (potentially leading to difficulty obtaining coverage) |

Negotiating Better Rates

Thorough research and comparison of different policies can provide leverage for negotiating better rates.

After analyzing policy documents, contact providers to inquire about potential discounts or lower premiums. Demonstrate your understanding of the market and the policies available. A well-prepared comparison, backed by your research, strengthens your position when negotiating with insurance providers.

Visual Representation of Data

Effective visualization significantly aids in understanding and comparing auto insurance options. Visual representations, like charts and infographics, transform complex data into easily digestible formats, enabling quick comparisons and informed decisions. This allows consumers to grasp the nuances of coverage options and premium structures at a glance.

Visual Representation of Coverage Options

Visualizing the various coverage options is crucial for understanding their scope and application. A well-designed graphic could use icons or symbols to represent different types of coverage, such as liability, collision, comprehensive, and uninsured/underinsured motorist coverage. Each icon could be color-coded or have a distinct visual representation, making it simple to differentiate between the various types. For example, a shield icon could represent liability coverage, while a car icon with a damaged part could represent collision coverage.

A clear legend explaining each symbol would further enhance understanding.

Comparison of Premiums Based on Factors

A table or bar chart can effectively illustrate how premiums vary based on factors like age, driving record, vehicle type, and location. For instance, a table could list different age groups and corresponding average premiums. Bar charts can be used to compare premiums for various vehicle types (e.g., economy car vs. luxury SUV). The use of color-coding for different factors can further improve the clarity and visual appeal of the chart.

An example table could show how a 25-year-old driver with a clean driving record pays significantly less than a 19-year-old with a few traffic violations for the same car model and location.

Illustration of Cost Savings from Discounts

Infographics are ideal for showcasing cost savings from various discounts. A pie chart could visually represent the percentage of savings achieved from each discount. For example, a discount for a safe driving record could be shown as a large slice of the pie chart, indicating its significant contribution to overall savings. Color-coding and clear labels would ensure easy understanding of the discount breakdown.

A visual could show that a driver with a clean driving record and an anti-theft system installed in their vehicle could save 15% on their premium compared to a similar driver without these factors.

Process of Finding the Best Auto Insurance

A flow chart can effectively illustrate the process of finding the best auto insurance. Each step, from initial research to policy selection, can be represented as a box or shape. Arrows connecting these shapes will indicate the flow from one step to the next. This visual representation clarifies the sequence of steps involved and ensures a clear understanding of the process.

The flow chart could start with “Identify needs” and lead to “Compare quotes,” “Analyze policies,” and finally “Select policy.”

Comparative Pricing Data Using Graphs

Line graphs are excellent for displaying comparative pricing data over time or across different providers. For example, a line graph can show the trend of premiums for a specific car model over the last five years. Another graph could show how premiums vary across different insurance providers for the same driver profile. This type of visualization makes it easier to spot trends and patterns in pricing.

A graph could show that a particular insurance company consistently offers lower premiums for drivers with a clean driving record, compared to other companies.

Final Conclusion

In conclusion, comparing auto insurance effectively requires a multifaceted approach. By understanding the comparison process, identifying key features, exploring providers, utilizing online tools, and analyzing policy documents, you can confidently navigate the insurance landscape and secure the best possible coverage. Remember to prioritize your needs and thoroughly research each aspect of a policy to make a financially sound decision.

Questions and Answers

How do discounts affect my auto insurance premiums?

Discounts can significantly reduce your premiums. They often come from factors like safe driving records, anti-theft devices, or bundling insurance with other services. Each insurer has different discounts, so it’s worth exploring the various options available.

What are the limitations of online comparison tools?

While online tools are convenient, they might not always provide a complete picture. They may not factor in every nuance of your individual circumstances or personal discounts offered by specific providers. It’s essential to verify the information presented with direct quotes from the insurance companies.

What is the importance of reading policy exclusions and limitations?

Policy exclusions and limitations are critical. Understanding these provisions prevents surprises later on. They Artikel specific situations where coverage might not apply, ensuring you have a clear understanding of what your policy truly covers.

How can I negotiate better rates after comparing policies?

After comparing quotes, you can use the gathered information to negotiate better rates. Knowing the market rates for similar coverage can help you confidently request a better price from your preferred provider. This often requires a proactive approach and a clear understanding of your insurance needs.