Finding the right full coverage car insurance can feel like navigating a maze. Different policies, confusing jargon, and fluctuating rates make the process daunting. This guide demystifies the process, providing a clear path to understanding full coverage, comparing options, and ultimately, choosing the best policy for your needs.

We’ll walk you through everything from understanding the core components of full coverage to comparing different providers and options. We’ll also delve into crucial aspects like claim procedures and policy details, helping you make an informed decision that protects you and your vehicle.

Understanding Full Coverage Car Insurance

Full coverage car insurance provides a comprehensive safety net for your vehicle, offering protection against a wide range of potential damages. It’s a crucial aspect of vehicle ownership, safeguarding your investment and financial well-being. Understanding its intricacies is essential for making informed decisions about your insurance needs.Full coverage car insurance, in essence, provides financial protection for your vehicle against various perils.

It encompasses a blend of coverages, offering a robust layer of security. This protection extends beyond the basic liability coverage, often considered the minimum requirement.

Components of Full Coverage

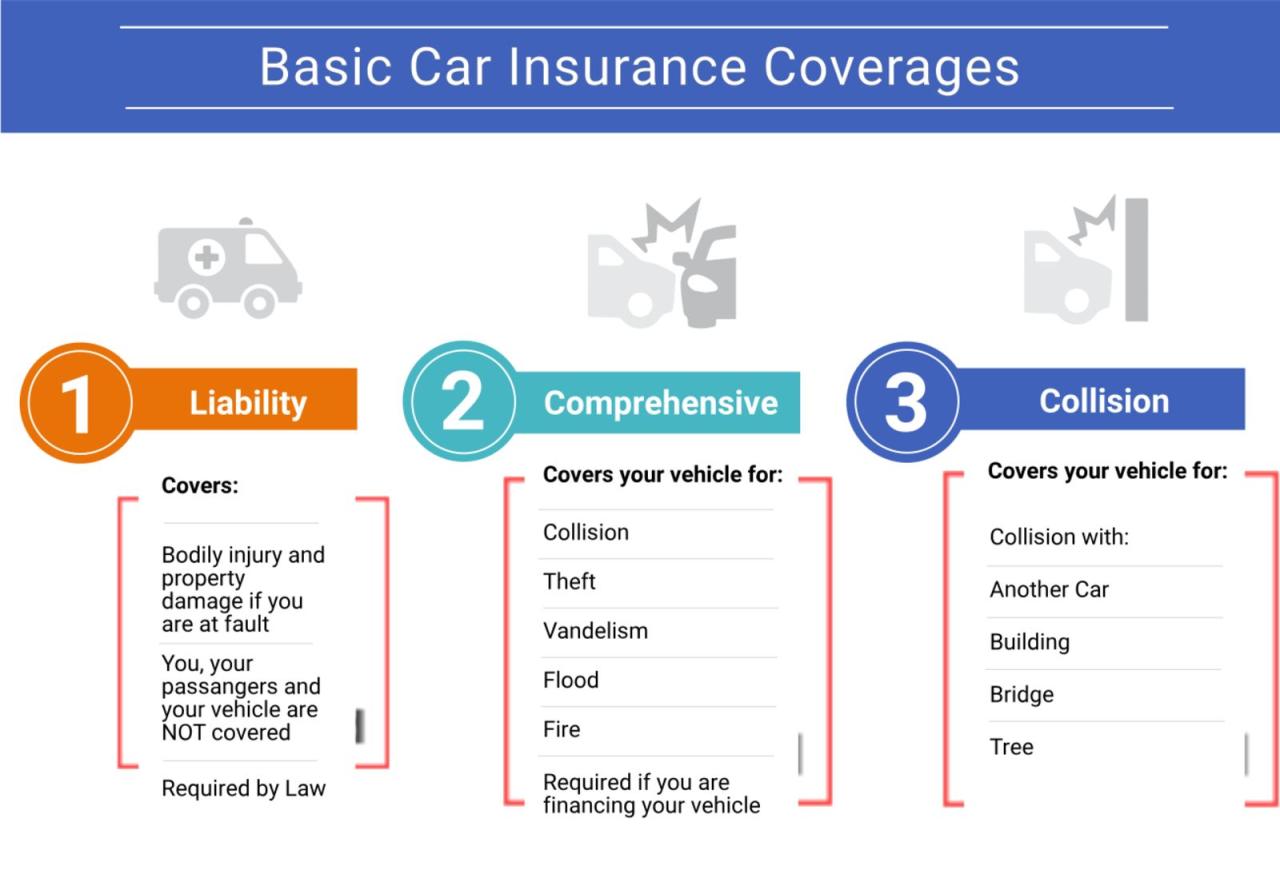

Full coverage insurance typically includes three fundamental components: liability, collision, and comprehensive coverage. These are designed to address different types of risks.

- Liability Coverage: This component covers damages you cause to another person’s property or injuries sustained by others in an accident you’re at fault for. It’s often a mandated coverage, ensuring you’re legally responsible for the damages you inflict.

- Collision Coverage: This coverage kicks in when your vehicle collides with another object, regardless of who is at fault. It pays for the damages to your vehicle, even if you are the responsible party.

- Comprehensive Coverage: This component protects your vehicle against events that aren’t collisions, such as vandalism, theft, fire, hail damage, or even falling objects. It’s an essential layer of protection for unexpected events.

Types of Car Insurance Coverage Options

Beyond the core components, additional coverage options can be purchased. These often include protection for medical expenses and vehicle rental in case of an accident.

- Uninsured/Underinsured Motorist Coverage: This coverage provides financial protection if you’re involved in an accident with a driver who doesn’t have insurance or whose insurance limits are insufficient to cover your damages.

- Personal Injury Protection (PIP): This coverage compensates for medical expenses and lost wages incurred by you or your passengers in an accident, regardless of who is at fault.

- Rental Reimbursement: This coverage helps offset the cost of renting a vehicle while yours is being repaired after an accident.

Exclusions for Full Coverage Car Insurance

While full coverage provides substantial protection, certain circumstances are typically excluded.

- Pre-existing damage: Full coverage typically won’t cover damage to your vehicle that existed before the policy began. Thorough inspections and declarations of pre-existing conditions are vital.

- Wear and tear: Normal wear and tear on your vehicle isn’t covered under full coverage.

- Damage from war or acts of terrorism: Specific policies might exclude coverage for incidents related to war or terrorism.

- Damage caused by intentional acts: Intentional acts, such as vandalism or arson, are typically not covered.

Importance of Understanding Full Coverage

Understanding full coverage is crucial for safeguarding your financial well-being and vehicle. Without adequate coverage, you could face significant out-of-pocket expenses in the event of an accident or other damages. Knowing what’s included and excluded can help you make informed decisions about your insurance needs.

Comparison of Full Coverage with Other Options

| Feature | Full Coverage | Liability Only |

|---|---|---|

| Coverage for Damage to Your Vehicle | Yes (collision and comprehensive) | No |

| Coverage for Damage to Other Vehicles/People | Yes (liability) | Yes (liability) |

| Financial Protection in Accidents | Significantly higher | Limited to liability |

| Cost | Generally higher | Generally lower |

Finding Full Coverage Car Insurance

Securing full coverage car insurance involves a strategic approach to finding the best policy at a competitive price. Understanding the process allows drivers to make informed decisions and ensure their vehicles are adequately protected. This section details various methods for finding full coverage, comparing quotes, and considering factors impacting premiums.Comprehensive insurance comparisons are crucial to ensuring you get the best possible coverage.

Different providers offer varying terms and conditions, so a thorough comparison is key to finding the most suitable plan.

Common Methods for Finding Full Coverage

Several avenues are available for obtaining full coverage car insurance. These include online comparison tools, direct contact with insurance providers, and recommendations from trusted sources. Each method offers a unique approach to finding suitable coverage, and understanding the nuances of each is vital.

Comparing Quotes from Different Providers

Comparing quotes from multiple insurance providers is essential to secure the most competitive rates. This involves gathering information from various companies and carefully evaluating the offered policies.

Steps for Comparing Rates

- Identify your needs: Determine the specific coverage types required, such as liability, collision, and comprehensive. Consider your vehicle’s value and the extent of protection you desire.

- Gather quotes online: Utilize online comparison tools to obtain quotes from different insurance providers. Input your vehicle details, driving history, and desired coverage to receive personalized estimates.

- Compare policy details: Scrutinize the coverage limits, deductibles, and premium amounts provided by each insurer. Pay close attention to any exclusions or limitations.

- Contact providers directly: Don’t hesitate to reach out to insurance providers for clarifications or to ask about specific policy features. This direct interaction can provide further insight into the terms of the coverage.

- Evaluate policy features: Assess the policy’s additional features, such as roadside assistance, rental car reimbursement, and uninsured/underinsured motorist protection. Consider how these benefits align with your needs.

Factors Influencing Car Insurance Rates

Several factors significantly impact the cost of car insurance premiums. These elements are considered by insurers when calculating your policy price.

Factors Affecting Premiums

| Factor | Description | Impact on Premium |

|---|---|---|

| Driving history | Accidents, traffic violations, and claims history | Higher for drivers with a history of accidents or violations |

| Vehicle type | Make, model, and year of the vehicle | Can vary depending on the vehicle’s safety features and theft risk |

| Location | Geographic area where the vehicle is primarily driven | Premiums can differ based on local accident rates and theft statistics |

| Age and gender | Demographic factors influencing risk assessment | Generally, younger drivers and males often face higher premiums |

| Coverage level | Amount of coverage selected (e.g., liability limits) | Higher coverage amounts typically result in higher premiums |

| Claims history | Number and severity of past claims filed | Higher claims history often leads to higher premiums |

Examples of Insurance Providers

Several reputable insurance providers offer full coverage car insurance. These include well-known companies like State Farm, Allstate, Geico, Progressive, and Nationwide. Each provider has its own pricing structure and policy features.

Comparing Full Coverage Options

Full coverage car insurance provides comprehensive protection against various risks, but the specific features and levels of coverage can vary significantly. Understanding these differences is crucial for making an informed decision that aligns with your needs and budget. Different insurers offer various full coverage options, and each option comes with a unique set of benefits and drawbacks.Comparing different full coverage options allows drivers to identify the best fit for their circumstances.

This comparison considers factors such as the type of vehicle, driving habits, location, and financial situation to ensure the chosen coverage aligns with the specific needs of the driver.

Coverage Levels and Features

Different full coverage options offer varying degrees of protection. Understanding these differences helps drivers choose the appropriate coverage level for their needs. Policyholders should thoroughly evaluate their coverage options to select the one that balances protection and cost.

- Basic Full Coverage: This option typically includes liability coverage, collision coverage, and comprehensive coverage. Collision coverage protects against damage to your vehicle in an accident, while comprehensive coverage protects against damage from events like vandalism, theft, or weather-related incidents. Basic full coverage often comes with a lower premium compared to other options.

- Enhanced Full Coverage: This level of coverage often includes additional benefits, such as uninsured/underinsured motorist protection. This extra protection safeguards against accidents involving drivers who lack insurance or have insufficient coverage. Enhanced coverage also often includes a higher level of protection for medical payments and rental car expenses in the event of an accident. The premium for this option is usually higher due to the expanded coverage.

- Premium Full Coverage: This option provides the highest level of protection, frequently including extras like roadside assistance, gap insurance, and accident forgiveness. Roadside assistance offers assistance with vehicle issues like flat tires or dead batteries. Gap insurance covers the difference between the actual cash value of the vehicle and the outstanding loan amount. Accident forgiveness policies can help avoid an increase in insurance rates after an accident.

The cost of this option is typically the highest.

Impact of Coverage Levels on Costs

The level of coverage significantly influences the cost of car insurance. A higher coverage level generally leads to a higher premium, but the financial protection it provides might be worth the increased cost. Drivers should carefully weigh the added protection against the cost implications.

| Option | Coverage A | Coverage B | Coverage C |

|---|---|---|---|

| Basic Full Coverage | Liability, Collision, Comprehensive | Liability, Collision, Comprehensive, Uninsured/Underinsured Motorist | Liability, Collision, Comprehensive, Uninsured/Underinsured Motorist, Roadside Assistance, Accident Forgiveness |

| Premium | Lower | Higher | Highest |

| Protection | Standard protection | Enhanced protection | Maximum protection |

Potential Risks Associated with Each Option

Each full coverage option carries potential risks. Understanding these risks allows drivers to make informed decisions about their coverage.

- Basic Full Coverage: Lower premiums may mean less protection against severe accidents or damage to the vehicle. This option may not provide sufficient financial protection in case of an accident involving uninsured or underinsured drivers.

- Enhanced Full Coverage: The increased protection might not entirely eliminate the risk of financial hardship due to an accident, depending on the specific circumstances. Higher premiums can pose a financial burden.

- Premium Full Coverage: While offering comprehensive protection, the premium is a significant financial commitment. Policyholders should assess whether the added benefits justify the cost, considering their individual circumstances.

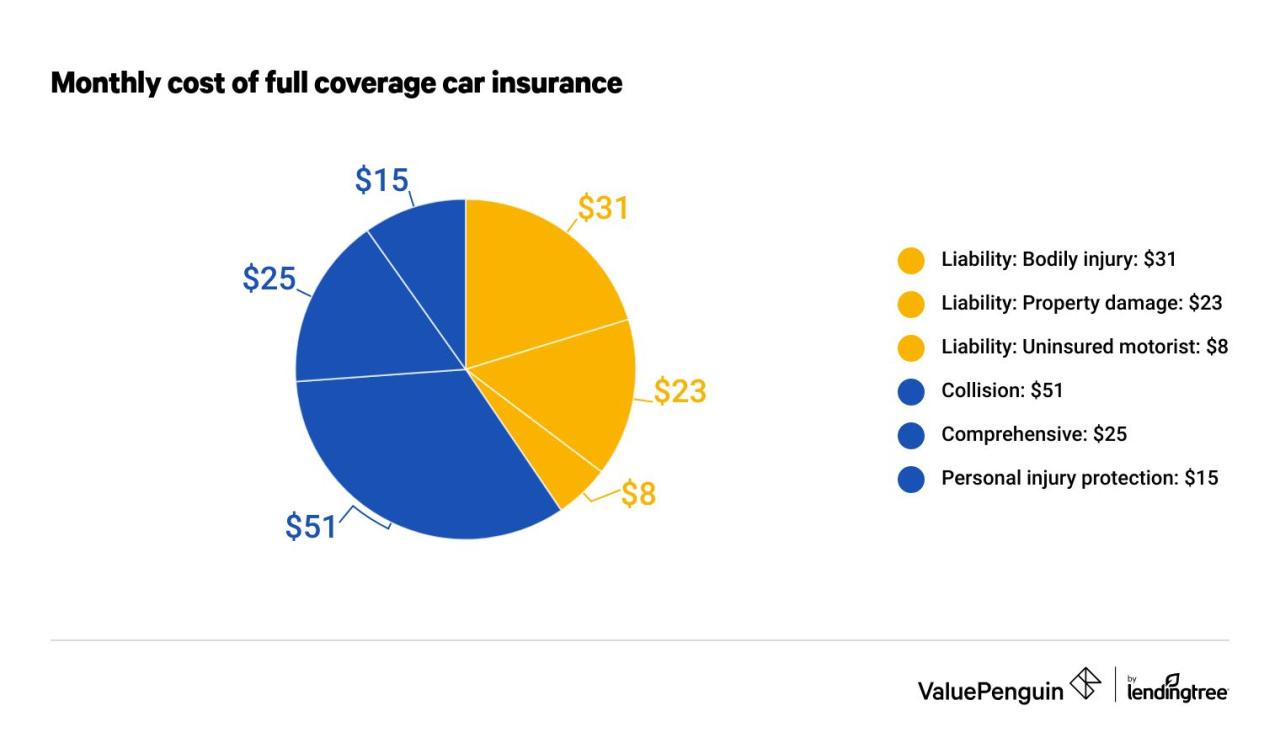

Policy Details and Costs

Understanding the specifics of your full coverage car insurance policy is crucial for informed decision-making. Policy details, including clauses, conditions, and cost structures, vary significantly between insurers and policy types. Careful consideration of these elements ensures you are adequately protected and avoid unexpected costs.Full coverage policies, while providing comprehensive protection, often come with a range of clauses and conditions.

Understanding these clauses is vital to ensure you are aware of your rights and responsibilities under the policy. The costs associated with full coverage are determined by a multitude of factors, and the deductibles chosen can significantly impact the overall premium.

Typical Policy Clauses and Conditions

A comprehensive full coverage policy typically includes clauses addressing various scenarios. These clauses Artikel the insurer’s obligations and the policyholder’s responsibilities in different situations. Understanding these clauses is vital to knowing what is and isn’t covered under the policy.

- Collision Coverage: This clause covers damages to your vehicle resulting from a collision with another vehicle or an object, regardless of who is at fault.

- Comprehensive Coverage: This clause covers damages to your vehicle from events other than collisions, such as vandalism, theft, fire, hail, or weather-related damage. It also often includes coverage for incidents like hitting an animal.

- Liability Coverage: This clause covers damages you may cause to another person or their property in an accident where you are at fault.

- Uninsured/Underinsured Motorist Coverage: This protects you if you are involved in an accident with a driver who doesn’t have insurance or whose insurance is insufficient to cover the damages.

- Medical Payments Coverage: This clause provides coverage for your own medical expenses, as well as those of others involved in an accident you are at fault for.

Premium Calculation Methods

Insurance premiums for full coverage are calculated using various factors. Understanding these methods helps you compare different policies and anticipate costs.

- Vehicle Characteristics: Factors like the make, model, year, and value of your vehicle influence the premium. A newer, more expensive vehicle is generally more expensive to insure.

- Driving History: Your driving record, including accidents, violations, and claims, plays a significant role in premium calculations. A clean driving record usually results in lower premiums.

- Location: Geographic location can impact premiums, as certain areas may have higher rates due to higher accident or theft rates.

- Deductible Amount: Higher deductibles result in lower premiums, but you are responsible for paying a larger amount out-of-pocket if a claim is made.

- Policy Limits: The limits you choose for liability, collision, and comprehensive coverage influence the premium. Higher limits usually result in higher premiums.

Policy Deductibles and Their Impact

The deductible is the amount you pay out-of-pocket before your insurance company starts covering the claim. Choosing a higher deductible can lead to lower premiums, but you will have to pay more out-of-pocket in case of a claim.

- Example: A deductible of $500 means you pay $500 towards repairs or damages before your insurance kicks in. This could mean a lower monthly premium but a higher initial payment if you have a claim.

- Impact: A higher deductible often correlates to a lower premium, making the policy more affordable. However, this is balanced against the higher financial responsibility in case of an accident or damage to your vehicle.

Importance of Policy Exclusions

Policy exclusions Artikel situations or circumstances where your insurance coverage does not apply. Carefully reviewing these exclusions ensures you understand what is not covered under the policy.

- Example: Damage caused by war, intentional acts, or pre-existing conditions may be excluded from coverage.

- Significance: Understanding policy exclusions prevents surprises and helps you make informed decisions about the level of coverage you need.

Policy Clauses and Conditions Summary

| Clause | Description | Impact |

|---|---|---|

| Collision Coverage | Covers damage to your vehicle from a collision, regardless of fault. | Protects you financially in case of collision-related damage. |

| Comprehensive Coverage | Covers damage from events other than collisions, like theft or vandalism. | Provides protection against various non-collision incidents. |

| Liability Coverage | Covers damages you cause to others in an accident. | Protects you from financial liability if you cause damage to others. |

| Uninsured/Underinsured Motorist Coverage | Protects you if you’re in an accident with an uninsured or underinsured driver. | Provides financial protection if you’re involved in an accident with a driver lacking sufficient insurance. |

| Medical Payments Coverage | Covers medical expenses for you and others involved in an accident. | Provides financial protection for medical expenses incurred in an accident. |

Claim Procedures and Processes

Navigating the claim process for your full coverage car insurance can feel daunting. However, understanding the steps involved can significantly ease the process and help you receive the compensation you’re entitled to. This section details the typical procedures, timeframes, and dispute resolution methods, providing a clear roadmap for filing a claim.

Steps Involved in Filing a Claim

Filing a claim for full coverage car insurance typically involves several steps. First, you must contact your insurance provider to report the incident. Accurate and prompt reporting is crucial for a smooth claim process. Gathering necessary information, including the date, time, location, and description of the accident, is important. This will help ensure a clear and comprehensive record of the event.

Typical Timeframes for Processing Claims

The timeframe for processing a full coverage car insurance claim can vary depending on several factors. Factors like the complexity of the claim, the availability of evidence, and the insurance company’s internal procedures can all influence the processing time. Generally, claims involving minor damage may be processed within a few weeks, while more complex claims, such as those involving significant damage or legal disputes, might take longer.

Procedures for Resolving Disputes

Disputes are sometimes unavoidable in the claim process. Insurance companies have established internal dispute resolution procedures to address disagreements. These procedures typically involve escalating the matter to higher levels of review within the company. If the internal dispute resolution process proves unsatisfactory, you may have recourse to external dispute resolution mechanisms, like mediation or arbitration.

Submitting Documentation for Claims

Thorough documentation is essential for a successful claim. This often includes police reports, medical records (if applicable), repair estimates, and photographs of the damage. Insurance companies typically have specific requirements for the format and content of this documentation. Following these requirements ensures the claim process moves smoothly and avoids delays. Adhering to the guidelines provided by the insurer in terms of document submission helps streamline the process.

Step-by-Step Guide to Filing a Full Coverage Car Insurance Claim

- Report the incident: Contact your insurance provider immediately to report the accident or damage. Provide as much detail as possible, including the date, time, location, and a description of the incident.

- Gather documentation: Collect all relevant documents, such as police reports, medical records, repair estimates, and photographs of the damage. Be sure to keep copies of all submitted documents.

- Complete the claim form: Carefully complete the claim form provided by your insurance company, ensuring accuracy in all the details.

- Submit documentation: Submit the required documentation to the insurance company, either through mail, online portal, or in person, following the guidelines provided by your insurer.

- Follow up: Check on the status of your claim periodically and maintain communication with your insurance representative if necessary. This ensures the claim is being processed efficiently.

Choosing the Right Coverage

Selecting the appropriate full coverage car insurance option is crucial for protecting your financial well-being and ensuring peace of mind. Carefully considering various factors, understanding personalized advice, and recognizing potential savings opportunities are key to making an informed decision.Choosing the right coverage involves a multifaceted approach, acknowledging your specific needs and potential risks. Insurance professionals offer invaluable insights, helping you navigate the complexities of different policy options.

This careful evaluation can ultimately lead to significant cost savings without compromising essential protection.

Factors to Consider

Understanding the key factors influencing your coverage choice is paramount. These factors include your vehicle’s value, your driving history, your location, and your financial situation. A thorough evaluation of these factors will guide you towards the most suitable policy.

- Vehicle Value: The higher the value of your vehicle, the higher the potential for financial loss in an accident. Consequently, a higher coverage limit might be necessary. For instance, a luxury sports car requires more comprehensive coverage than a basic economy model.

- Driving History: A clean driving record often translates to lower premiums. Conversely, accidents or traffic violations can increase your insurance costs. This relationship between driving history and premiums is well-documented and directly affects your insurance costs.

- Location: Areas with higher rates of accidents or severe weather conditions generally have higher insurance premiums. Your location significantly impacts your potential risks, and insurance companies adjust their rates accordingly.

- Financial Situation: Your ability to absorb financial losses in the event of an accident or theft should be a key factor. If you have significant assets, you might consider lower coverage amounts. Conversely, individuals with limited financial resources might benefit from higher coverage levels to protect their assets.

Personalized Advice from Insurance Professionals

Seeking advice from insurance professionals is a vital step in the insurance selection process. Insurance agents can provide tailored recommendations based on your unique circumstances, ensuring the most suitable coverage.

Professional guidance is essential because insurance policies are complex. Agents have the knowledge and experience to assess your needs and risks, identifying specific coverage gaps or opportunities for cost savings. They can also explain policy details in plain language, helping you understand the intricacies of your coverage.

Potential Savings Through Careful Consideration

Careful evaluation of your insurance options can yield significant savings. This includes understanding the various coverage levels available, comparing different insurance providers, and actively seeking discounts.

Discounts are often available for various factors, including safe driving habits, anti-theft devices, and bundled insurance packages. By taking advantage of these opportunities, you can considerably reduce your insurance costs without sacrificing essential protection.

Examples of Coverage Benefits

Different coverage options offer varying levels of protection. The best option for you depends on your individual circumstances and needs. Consider the following examples:

| Situation | Most Beneficial Coverage |

|---|---|

| Young driver with a new car | Higher liability coverage and comprehensive coverage, as they are at a higher risk for accidents and the car value is higher |

| Experienced driver with an older car | Lower liability coverage, focusing on necessary protection against potential damages. |

| Driver living in a high-crime area | Comprehensive coverage to protect against theft, vandalism, and other damages. |

Understanding Your Specific Needs and Risks

Thorough understanding of your personal situation is critical to selecting the right coverage. This includes evaluating your driving habits, the value of your assets, and potential risks in your location.

Evaluating your specific circumstances helps you to avoid unnecessary costs. A detailed analysis of your needs ensures that your insurance policy aligns with your financial capabilities and risk tolerance.

Summary

In conclusion, securing full coverage car insurance is a crucial step in responsible vehicle ownership. This guide has equipped you with the knowledge to navigate the complexities of the process, from understanding different coverage options to comparing quotes and handling claims. Remember to carefully consider your individual needs and risks, and seek personalized advice from insurance professionals to find the optimal coverage for your situation.

Clarifying Questions

What is the difference between full coverage and liability-only insurance?

Full coverage insurance protects you from damages to your vehicle (collision and comprehensive) and liability to others. Liability-only insurance only covers damages you cause to others. Full coverage provides more protection but comes at a higher premium.

How do I compare car insurance quotes?

Comparing quotes involves gathering quotes from multiple providers. Use online comparison tools or contact insurers directly. Be sure to compare similar coverage levels for an accurate assessment.

What factors affect my car insurance rates?

Several factors influence your rates, including your driving history, vehicle type, location, and credit score. Specific discounts or surcharges based on factors like your vehicle’s make and model are also significant.

What are the typical exclusions in a full coverage policy?

Exclusions vary, but generally, policies exclude damage caused by wear and tear, intentional acts, or events specifically excluded in the policy document. Always review the specific policy details.