Comparing car insurance rates can feel like navigating a maze. Reddit, a popular online forum, offers a wealth of user experiences and insights. This exploration dives deep into the process of comparing car insurance rates on Reddit, examining the factors influencing premiums, strategies for savings, and crucial considerations for navigating the platform’s community.

This analysis provides a comprehensive overview of the process of comparing car insurance rates on Reddit, detailing the various factors influencing premiums, including driving history, vehicle type, location, and coverage options. It also explores common strategies for lowering costs, like discounts and bundling, and highlights the importance of verifying information and avoiding potential scams.

Introduction to Car Insurance Rate Comparison

Comparing car insurance rates is crucial for saving money and ensuring adequate coverage. It’s a straightforward process, yet understanding the factors influencing premiums is key to getting the best deal. This guide will walk you through the process, highlighting the importance of online resources like Reddit for efficient comparisons.The cost of car insurance isn’t a fixed amount. Various factors significantly impact your premium, including your driving record, vehicle type, location, and personal details.

A clean driving record, for instance, typically leads to lower premiums, while a newer, more expensive vehicle might result in higher rates. Understanding these factors allows you to make informed decisions and shop around effectively.

Factors Influencing Car Insurance Premiums

Several factors contribute to the final cost of your car insurance. These factors are evaluated by insurance companies to assess risk and determine premiums. Knowing these factors empowers you to make choices that could potentially lower your insurance costs.

- Driving Record: A clean driving record, free of accidents and violations, generally leads to lower premiums. Accidents and traffic violations increase your risk profile, resulting in higher premiums.

- Vehicle Type: The make, model, and year of your vehicle play a role in your premium. High-performance vehicles or those with a higher risk of theft might have higher premiums.

- Location: Geographic location significantly impacts insurance rates. Areas with higher rates of accidents or theft often have higher premiums.

- Personal Details: Factors like age, gender, and marital status, while not always explicit, can still contribute to your risk profile and consequently, your premium.

Significance of Online Resources for Rate Comparison

Online resources, like Reddit, offer a valuable platform for comparing car insurance rates. The collective knowledge and experiences shared on these platforms can be insightful, allowing you to gain valuable perspectives and find competitive rates quickly.

- Community Insights: Reddit communities dedicated to car insurance offer valuable insights from others who have navigated the process. Discussions provide a glimpse into different provider experiences and potentially uncover hidden savings.

- Rate Comparisons: Reddit users often share their insurance quotes, facilitating comparisons across various providers. This allows you to identify potential savings and compare different policies based on specific needs.

- Expert Advice: Experienced Reddit users can offer advice and guidance on choosing the right coverage and negotiating with insurance providers.

Common Car Insurance Providers

This table Artikels some of the most popular car insurance providers. This list is not exhaustive, but it provides a starting point for your research.

| Provider | Description |

|---|---|

| Progressive | A large, well-established insurer known for its competitive rates. |

| State Farm | A major national insurer, often seen as a reliable option. |

| Geico | A well-recognized insurer that often features competitive rates and advertising. |

| Allstate | A major insurer offering a wide range of policies. |

| Nationwide | Another large national insurer with diverse coverage options. |

Reddit Discussion Insights

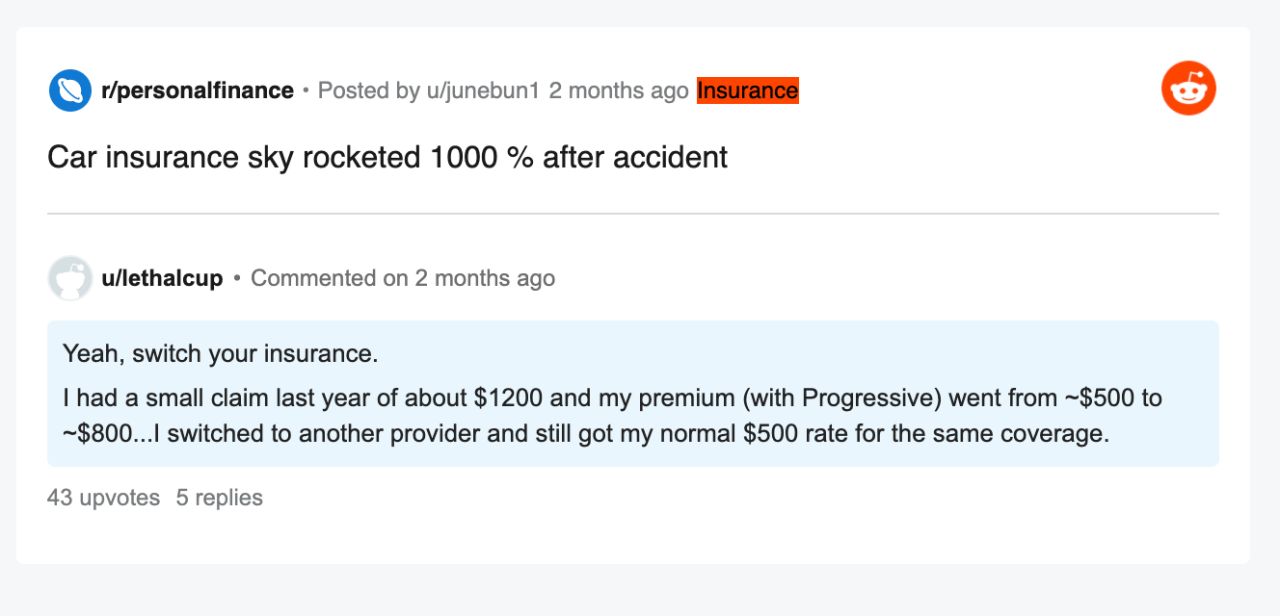

Reddit serves as a valuable resource for understanding public sentiment and practical advice regarding car insurance rates. Users often share their experiences, frustrations, and solutions, offering a wealth of information beyond traditional comparison websites. This analysis delves into common themes and strategies gleaned from Reddit threads.Reddit discussions reveal a significant level of user concern regarding the perceived unfairness and complexity of car insurance pricing.

Users frequently express frustration over seemingly arbitrary rate increases and the difficulty in understanding the factors influencing their premiums.

Common Complaints and Concerns

Users on Reddit frequently voice complaints about the opaque nature of car insurance pricing models. They express difficulty in understanding why their rates change, and often feel that the justifications provided by insurance companies are inadequate. A recurring issue is the perceived lack of transparency in how companies calculate risk factors and adjust premiums accordingly. Another frequent complaint is the high cost of insurance, especially in high-risk areas or for specific vehicle types.

Strategies for Saving Money

Redditors actively share strategies for reducing car insurance costs. A popular approach involves bundling insurance policies with other services, such as home or renters insurance. Another frequently discussed method involves exploring discounts, such as those available for safe driving records or certain driver profiles (e.g., young drivers with good grades). Furthermore, many users advocate for comparing rates across multiple insurance providers using comparison tools and considering the factors impacting rates, such as vehicle type, location, and driving history.

Insurance Company Offerings

Reddit users often compare and contrast the offerings of various insurance companies. State Farm, Geico, Progressive, and Allstate are frequently mentioned as popular choices, with varying user experiences. Some users highlight positive experiences with particular companies, emphasizing aspects like customer service or convenient online platforms. However, there are also instances of negative feedback, often relating to high premiums or complicated claim processes.

Discounts Mentioned in Reddit Threads

A significant number of discounts are mentioned in Reddit threads. Safe driver discounts, multi-policy discounts, and discounts for certain vehicle features (e.g., anti-theft devices) are common. Bundling discounts, which involve combining car insurance with other policies, are also frequently cited as a way to save money.

Top 5 Frequently Asked Questions

- How can I find the cheapest car insurance rates in my area?

- What factors influence car insurance premiums?

- How do I dispute a car insurance rate increase?

- Are there any discounts available for safe drivers?

- What is the best way to compare car insurance quotes?

Finding reliable information on Reddit requires careful consideration. Users often provide personal experiences and comparisons, but it’s important to treat this information as anecdotal evidence rather than definitive proof. Directly contacting insurance companies for specific information or utilizing online comparison tools is recommended for more objective data.

Finding Accurate and Reliable Information

Users often recommend leveraging online comparison tools and directly contacting insurance companies for accurate quotes. Reddit can be a helpful starting point for identifying potential issues or specific concerns, but it is not a substitute for thorough research and official communication with insurance providers. Verify claims with official sources and seek professional advice when necessary.

Insurance Provider Strengths and Weaknesses

| Insurance Provider | Strengths (Reddit Perception) | Weaknesses (Reddit Perception) |

|---|---|---|

| State Farm | Wide network, strong customer service reputation | Potentially higher premiums in some areas |

| Geico | Competitive rates, user-friendly online platform | May have limitations in certain claim processes |

| Progressive | Innovative programs, mobile app features | Limited local support in some areas |

| Allstate | Good value for money, flexible coverage options | Potential for lengthy claim procedures |

The table above reflects user perceptions, which can vary. Directly contacting providers and conducting thorough research are essential for making informed decisions.

Factors Affecting Car Insurance Rates

Car insurance premiums aren’t a one-size-fits-all figure. Numerous factors influence the cost of coverage, from your driving record to the make and model of your vehicle. Understanding these elements can help you make informed decisions about your insurance choices and potentially save money.

Driving History’s Impact on Premiums

Driving history is a significant determinant of insurance rates. A clean driving record, characterized by a lack of accidents or traffic violations, typically translates to lower premiums. Conversely, drivers with a history of accidents or violations face higher rates. Insurance companies assess risk based on past behavior, and this is a key factor in determining your premium.

For example, a driver with multiple speeding tickets or at-fault accidents will likely pay a considerably higher premium compared to a driver with a clean record. Insurance companies use this data to predict future risk.

Vehicle Type and Model’s Influence on Costs

The type and model of your vehicle also impact your insurance premiums. Certain vehicles are inherently more expensive to insure due to their design, value, or perceived risk of theft or damage. Luxury vehicles and sports cars, for instance, often come with higher premiums. Additionally, vehicles known for mechanical issues or higher repair costs are usually associated with higher premiums.

This is because the insurance company has to factor in the potential costs associated with repairs or replacement in the event of an accident. For example, a high-performance sports car will likely have a higher premium than a compact sedan, as the potential for costly repairs is often greater.

Location and Demographics in Insurance Rates

Geographic location and demographics also play a crucial role in determining car insurance rates. Areas with higher crime rates or accident frequency generally have higher insurance premiums. Similarly, demographic factors like age and gender can also influence rates. Younger drivers, for instance, are often considered higher risk and face higher premiums than older drivers. A particular region with a high concentration of uninsured drivers or a history of severe weather events could have higher insurance rates to account for the elevated risk.

For instance, a coastal region with a high frequency of hurricanes might have higher insurance rates compared to a region in the interior of the country.

Coverage Options and Premium Effects

Different coverage options affect insurance premiums. Comprehensive coverage, which protects against damage from perils like vandalism or hail, typically results in a higher premium than liability-only coverage. Collision coverage, which pays for damage to your vehicle in an accident, also leads to higher premiums. The more comprehensive the coverage, the higher the premium. Choosing additional add-ons like roadside assistance or rental car coverage will also increase the premium.

Deductibles and Car Insurance Costs

Deductibles directly impact car insurance costs. A higher deductible means a lower premium, but you’ll be responsible for a larger out-of-pocket payment if you file a claim. Conversely, a lower deductible leads to a higher premium. This relationship is a trade-off between cost and financial responsibility. For example, a driver choosing a $1,000 deductible will likely pay less in premiums than a driver with a $500 deductible, but will pay $1,000 if a claim is made.

Insurance Company Pricing Models

Insurance companies use various pricing models to determine premiums. Some companies focus on actuarial data, analyzing historical claims data to predict future risk. Others utilize a combination of factors, such as driving history, vehicle characteristics, and location. This variety in pricing models reflects the different approaches taken by insurance companies to assess and price risk. For example, some insurers may prioritize a driver’s accident history, while others may focus on the value of the vehicle.

Factors Influencing Claims Frequency and Severity

Claims frequency and severity significantly influence insurance company pricing. Factors like weather patterns, traffic congestion, and driver behavior contribute to the frequency and severity of claims. Increased claims frequency or severity will lead to higher premiums to compensate for the increased risk. For instance, a region experiencing an unusually high number of hailstorms could lead to a surge in claims, resulting in higher premiums for drivers in that area.

Strategies for Lowering Car Insurance Costs

Savvy car owners actively seek ways to reduce their insurance premiums. Understanding available discounts, bundling options, and safe driving practices can significantly impact your monthly payments. This section delves into proven strategies to achieve lower car insurance costs.

Available Discounts and How to Obtain Them

Numerous discounts are available to reduce car insurance costs. These discounts often depend on factors like your driving history, vehicle features, and lifestyle choices. Actively seeking and understanding these discounts can yield substantial savings.

- Safe Driver Discounts: Companies frequently offer discounts for drivers with clean records. This often translates to a lower premium. Maintaining a safe driving record through responsible behavior and avoiding accidents is crucial.

- Defensive Driving Courses: Completing a defensive driving course demonstrates a commitment to safe driving practices and often results in a discount. These courses cover topics such as hazard perception, vehicle control, and accident avoidance.

- Anti-theft Devices: Installing approved anti-theft devices on your vehicle can significantly reduce the risk of theft, often leading to a discount on your premiums. Examples include alarm systems and tracking devices.

- Student Discounts: Many insurers offer discounts to students who are under a certain age and have a clean driving record.

- Multiple Car Discounts: Insuring multiple vehicles with the same company can result in a reduced premium for each vehicle. This bundling often leads to substantial savings.

- Telematics Programs: These programs use devices to monitor your driving habits, providing discounts for safe and efficient driving. Drivers can actively participate in these programs and potentially see lower premiums.

Bundling Insurance Policies

Combining multiple insurance policies, such as car, home, and life insurance, with the same provider can result in substantial savings. This is due to the insurer’s cost-effectiveness from consolidated operations and increased customer loyalty. Bundling often reduces administrative costs, enabling insurers to offer discounted premiums.

Improving Driving History and Reducing Accident Risk

A spotless driving record is paramount to securing favorable car insurance rates. Avoid accidents, maintain a good driving record, and practice defensive driving to keep premiums low. This strategy prioritizes accident prevention and responsible driving habits.

- Avoid Distracted Driving: Concentrate on the road and avoid distractions like cell phone use, eating, or adjusting the radio while driving. This is a crucial element of safe driving.

- Maintain Vehicle Maintenance: Regular vehicle maintenance, including tire pressure checks, oil changes, and brake inspections, can help prevent mechanical failures and accidents. This maintenance contributes to safe driving.

- Follow Traffic Laws: Adherence to traffic laws, including speed limits and signal observance, is crucial for accident prevention and a favorable driving record. Following these rules significantly reduces risk.

Comprehensive and Collision Coverage

Comprehensive and collision coverage is essential for protecting your vehicle from damage, whether from accidents or other incidents. These coverages can help mitigate financial burdens and protect your investment. Understanding these coverages and their benefits is vital.

Comparing Discount Options and Potential Savings

| Discount Type | Description | Potential Savings (Example) |

|---|---|---|

| Safe Driver | Clean driving record | 5-15% |

| Defensive Driving | Completion of course | 3-10% |

| Anti-theft Device | Installation of approved device | 2-8% |

| Multiple Car | Insuring multiple vehicles with one company | 5-15% |

| Telematics | Participation in program | 3-10% |

Negotiating Insurance Premiums

Negotiating insurance premiums can be beneficial, especially if you have a clean driving record or have been a loyal customer. Reach out to your insurer to explore possible discounts or rate reductions. This proactive approach can often lead to lower premiums.

Steps for Comparing Insurance Rates

| Step | Action |

|---|---|

| 1 | Gather information about your vehicle and driving history. |

| 2 | Compare rates from multiple insurance providers. |

| 3 | Request quotes and evaluate coverage options. |

| 4 | Analyze discounts and bundling options. |

| 5 | Negotiate premiums if possible. |

Tools and Resources for Comparison

Finding the best car insurance rates involves more than just browsing a few websites. Utilizing the right tools and resources can significantly streamline the process and help you identify the most advantageous options. This section will explore various avenues for comparison, from online platforms to expert guidance.

Reputable Car Insurance Comparison Websites

A multitude of online platforms specialize in comparing car insurance quotes. These websites act as centralized hubs, aggregating quotes from multiple insurers. This significantly reduces the time and effort required to obtain comprehensive comparisons. Choosing reputable sites is crucial; they typically have established track records and transparent processes, ensuring accurate and unbiased results.

- Insurify, Policygenius, and Compare.com are examples of well-regarded comparison websites. These platforms allow you to input your vehicle details, driving history, and location to receive quotes from various insurers.

Online Calculators for Estimating Premiums

Many insurance companies and comparison websites offer online calculators to provide preliminary estimates of your car insurance premiums. These tools typically require you to input similar details as those used on comparison websites.

- Examples include State Farm’s online calculator, which considers factors like your vehicle’s make and model, your driving history, and your location.

- These calculators provide a quick initial assessment, enabling you to gauge potential costs and compare across different providers.

Effective Use of Online Comparison Tools

Using comparison tools effectively involves careful input and consideration of various factors. It’s important to accurately and completely fill out all required information. Providing accurate data will ensure you receive relevant and precise quotes. Remember to compare more than just the premium amount. Look at the coverage options and deductibles offered by each insurer.

- A crucial step is to check the terms and conditions of each policy, including any hidden fees or limitations.

- Compare quotes from different insurers to determine the best value for your specific needs.

Independent Insurance Agents

Independent insurance agents act as intermediaries, providing personalized guidance and tailored solutions for car insurance needs. They work with multiple insurance providers, enabling them to explore a wider range of options to find the most suitable policy for your individual circumstances.

- Their expertise in navigating the insurance landscape can be valuable, especially for complex situations or when seeking specific coverages.

- Independent agents can often negotiate better rates and provide more comprehensive advice.

Financial Advisors for Insurance Planning

Financial advisors often integrate insurance planning into their broader financial strategies. They can assess your overall financial situation and recommend insurance solutions that align with your long-term goals. They can also help you understand the implications of various insurance choices on your budget.

- A financial advisor can provide insights into potential risks and tailor insurance strategies to mitigate those risks.

- They can help you analyze the impact of insurance costs on your financial planning.

Popular Online Comparison Tools

The table below highlights popular online comparison tools and their key features.

| Tool | Key Features |

|---|---|

| Insurify | Comprehensive quote comparisons, user-friendly interface, and various coverage options |

| Policygenius | Clear and straightforward comparisons, helpful resources, and customer support |

| Compare.com | Extensive database of insurers, wide range of policies, and potential for competitive rates |

| Insure.com | Multiple insurance options, interactive tools for coverage customization, and customer service |

Understanding Reddit’s Community Dynamics

Reddit’s vibrant car insurance comparison discussions can be a valuable resource, but it’s crucial to approach them with a discerning eye. The platform’s collaborative nature fosters the sharing of experiences, but also invites the potential for misinformation and biased opinions. Navigating these complexities is key to making informed decisions.Reddit communities offer a wealth of user-generated content, including reviews and testimonials.

However, these should be considered one piece of a much larger puzzle in your research. The collective wisdom of a community can be insightful, but individual experiences don’t always represent the broader picture of car insurance rates.

User Reviews and Testimonials

User reviews and testimonials provide valuable insights into real-world experiences with various insurance providers. However, it’s essential to remember that individual experiences can be highly variable. One user’s positive experience with a specific company might not be replicated for another person due to factors like driving record, vehicle type, location, and more. Treat these accounts as anecdotes, not definitive proof of a company’s overall performance.

Verifying Information from Reddit Users

Verifying information from Reddit users requires careful scrutiny. Look beyond the initial statement and check for supporting evidence. Does the user provide details about their driving history, car make and model, location, and insurance policies? If the information lacks crucial context, consider it less reliable.

Differentiating Helpful and Misleading Advice

Distinguishing helpful from misleading advice requires critical thinking. Look for advice backed by specific details, such as policy numbers, rate comparisons, or links to reputable sources. Advice based on vague generalizations or unsubstantiated claims should be approached with caution. For instance, claims about dramatic rate reductions without supporting evidence are often misleading.

Identifying Potential Scams or Misinformation

Be wary of unusually aggressive sales pitches or promises that seem too good to be true. Red flags include overly enthusiastic endorsements, guarantees of the lowest rates, or promises of immediate savings without detailed explanations. Always research independently and verify claims before making any decisions. A scam artist might even pose as a helpful user within the community, giving out deceptive advice to trick you.

Potential Risks of Relying Solely on Reddit Information

| Potential Risk | Explanation |

|---|---|

| Inaccurate Information | Reddit users may share incorrect or outdated information, leading to poor choices. |

| Bias and Subjectivity | Individual experiences may be influenced by personal biases or limited perspectives, leading to skewed conclusions. |

| Lack of Comprehensive Data | Reddit posts may not contain the complete data necessary for a thorough comparison, potentially missing crucial factors. |

| Unintentional Errors | Mistakes in calculations or data entry within user posts can lead to incorrect estimations. |

| Exposure to Scams | Malicious actors may use Reddit to spread misinformation or offer fraudulent services. |

“While Reddit can offer valuable insights, it’s crucial to treat information as suggestive rather than definitive. Always verify claims with official sources.”

Wrap-Up

In conclusion, comparing car insurance rates on Reddit can be a valuable resource, but it’s essential to approach the information with discernment. By understanding the factors affecting premiums, exploring various strategies for savings, and utilizing reliable resources, you can make informed decisions about your car insurance. Remember to verify information, consider alternative resources, and prioritize your own research for the best possible outcomes.

FAQ Overview

What are some common complaints about car insurance rates on Reddit?

Reddit users often express frustration with perceived rate increases, lack of transparency in pricing models, and difficulty understanding the various discounts available. Some also report issues with claims processing times and unsatisfactory customer service experiences.

How can I identify potential scams or misinformation on Reddit regarding car insurance?

Be wary of overly simplistic solutions or promises of significantly lower rates without providing supporting details. Cross-reference claims with reputable sources and look for inconsistencies or red flags in the user’s profile or posting history.

What are the top 3 most frequently asked questions about car insurance rates on Reddit?

Common questions include: How to get the best discounts, the impact of driving history on premiums, and ways to negotiate insurance rates.

What are the strengths and weaknesses of different car insurance providers, according to Reddit users?

Reddit users frequently discuss various insurance providers’ strengths, such as their claim handling procedures, and weaknesses, like their pricing structures or customer service responsiveness.

Are there any specific online calculators for estimating car insurance premiums that are mentioned on Reddit?

While Reddit may discuss general tools, specific calculator recommendations might vary and should be verified against reliable online resources.