Finding the best auto insurance rates can feel like a daunting task. But with online comparison websites, you can easily compare quotes from multiple insurers and potentially save money. This guide explores the top sites, their features, and how to make the most informed decision.

These websites streamline the process, allowing you to compare coverage options, discounts, and premiums in a user-friendly environment. Understanding the factors influencing insurance costs is key to finding the best deal. Factors like your driving record, vehicle type, and location significantly impact premiums.

Evaluating Website Features

Comparing auto insurance websites involves more than just finding the cheapest quote. A good comparison site streamlines the process, offering clear, comprehensive information and user-friendly navigation. This evaluation focuses on the features that truly differentiate these platforms and how they can simplify your search for the best auto insurance coverage.Effective comparison websites offer a structured approach to evaluating insurance options.

They present information in a digestible format, allowing users to quickly identify key differences between policies and insurers. A key component of this process is the ability to compare and contrast various features and the ease of use of the website itself.

User Interface Comparison

Different websites utilize varying design aesthetics. Some employ a clean, minimalist approach, focusing on straightforward information presentation. Others adopt a more complex, feature-rich design, aiming to showcase a broader range of options. The most effective sites balance visual appeal with clear navigation, ensuring easy access to key details. Websites that allow users to easily filter and sort results, customize searches, and quickly compare quotes are generally considered more user-friendly.

Key Functionalities

These websites offer a range of functionalities beyond basic quote comparison. These functionalities often include the ability to compare coverage options, access policy details, and perform advanced searches. Sophisticated websites allow users to input specific criteria such as desired coverage levels, deductible amounts, and preferred insurers. These features enable users to tailor their search to their particular needs.

Key functionalities often include tools for understanding policy terms, calculating potential savings, and generating personalized quotes.

Quote Calculation Methods

Insurance quotes are calculated using complex algorithms that consider a multitude of factors. The most reliable websites clearly Artikel the factors influencing the final price. These calculations often incorporate actuarial models, historical data, and predictive analytics to determine risk assessment. These models allow the site to generate an estimate of the potential cost for a given policy.

Factors Affecting Insurance Premiums

Various factors influence insurance premiums, impacting the final cost of coverage. Understanding these factors allows informed decisions regarding coverage choices. Premiums are influenced by factors such as the driver’s history, the vehicle’s make and model, and the location of the driver.

| Factor | Impact on Premium | Example |

|---|---|---|

| Driving Record | A clean driving record usually results in a lower premium. Accidents and violations increase the premium. | A driver with multiple speeding tickets will likely pay a higher premium than a driver with a clean record. |

| Vehicle Type | Certain vehicle types, such as sports cars or high-performance vehicles, are often assigned a higher risk factor, leading to higher premiums. | A sports car may have a higher premium than a standard sedan due to its perceived risk of accidents. |

| Location | Areas with higher rates of accidents or theft tend to have higher premiums. | A driver living in a high-crime area may pay more for insurance than someone living in a low-crime area. |

Discounts Available

Insurance companies offer various discounts to incentivize policy purchases. These discounts can significantly reduce the cost of coverage. Common discounts include those for safe driving, multiple vehicles, and anti-theft devices. Sites offering detailed information on available discounts empower users to explore potential savings.

Comparing Quotes from Different Insurers

The best websites allow users to easily compare quotes from multiple insurers. This capability facilitates a comprehensive overview of available options. A well-structured comparison tool enables users to filter and sort quotes based on various criteria, leading to a quicker and more efficient search process. The ability to compare coverage details and premiums is crucial for making an informed decision.

User Experience and Navigation

A user-friendly website design is paramount for a successful auto insurance comparison site. A positive user experience (UX) encourages visitors to easily find the information they need and ultimately compare quotes effectively. A well-structured site guides users smoothly through the process, boosting their confidence in the platform and increasing the likelihood of conversions.A well-designed navigation structure is crucial for guiding users through the comparison process.

An optimal structure allows users to quickly locate the features they need, from comparing coverage options to accessing customer support. This includes clear labeling of menus, logical organization of pages, and intuitive search functionality.

Navigation Structure for Quote Comparison

A user-friendly navigation structure is essential for effective quote comparison. The structure should be intuitive and allow users to easily locate the information they need to compare policies. This structure should lead users seamlessly through the comparison process, from selecting coverage options to finalizing a quote. Users should not be forced to navigate through multiple layers of menus to find the desired information.

Instead, clear and concise pathways should lead them to the relevant information.

Common Website Navigation Elements

A well-organized website utilizes various navigation elements to facilitate a positive user experience. Understanding these elements and their function is crucial for creating a user-friendly site.

| Element | Description | Example |

|---|---|---|

| Main Navigation Menu | Provides access to key sections of the website, such as “Compare Quotes,” “Coverage Types,” “Customer Support,” and “About Us.” | Home, Compare, Coverage, Support |

| Sub-menus | Offers more detailed options within the main navigation categories, further clarifying the website’s content. | Different types of insurance (car, motorcycle, home), various coverage options (liability, collision) |

| Search Bar | Allows users to quickly find specific information on the website, such as coverage details or policy terms. | Search for “comprehensive insurance” |

| Breadcrumbs | Provides a visual trail of the user’s navigation path, making it easy to return to previous pages. | Home > Compare Quotes > Car Insurance |

| Footer Navigation | Includes links to important pages like contact information, FAQs, privacy policy, and terms of service, usually located at the bottom of the page. | Contact Us, FAQ, Privacy Policy |

Improving User Experience

Several strategies can enhance the user experience on a website. These include utilizing clear language, concise explanations, and easily digestible information. For instance, using bullet points or numbered lists to present information can significantly improve readability and understanding.

Importance of Clear and Concise Information

Clarity and conciseness are paramount for a positive user experience. Complex or ambiguous language can confuse users and deter them from exploring the site. Clear, simple language, avoiding jargon or technical terms, is key to ensuring users understand the information presented.

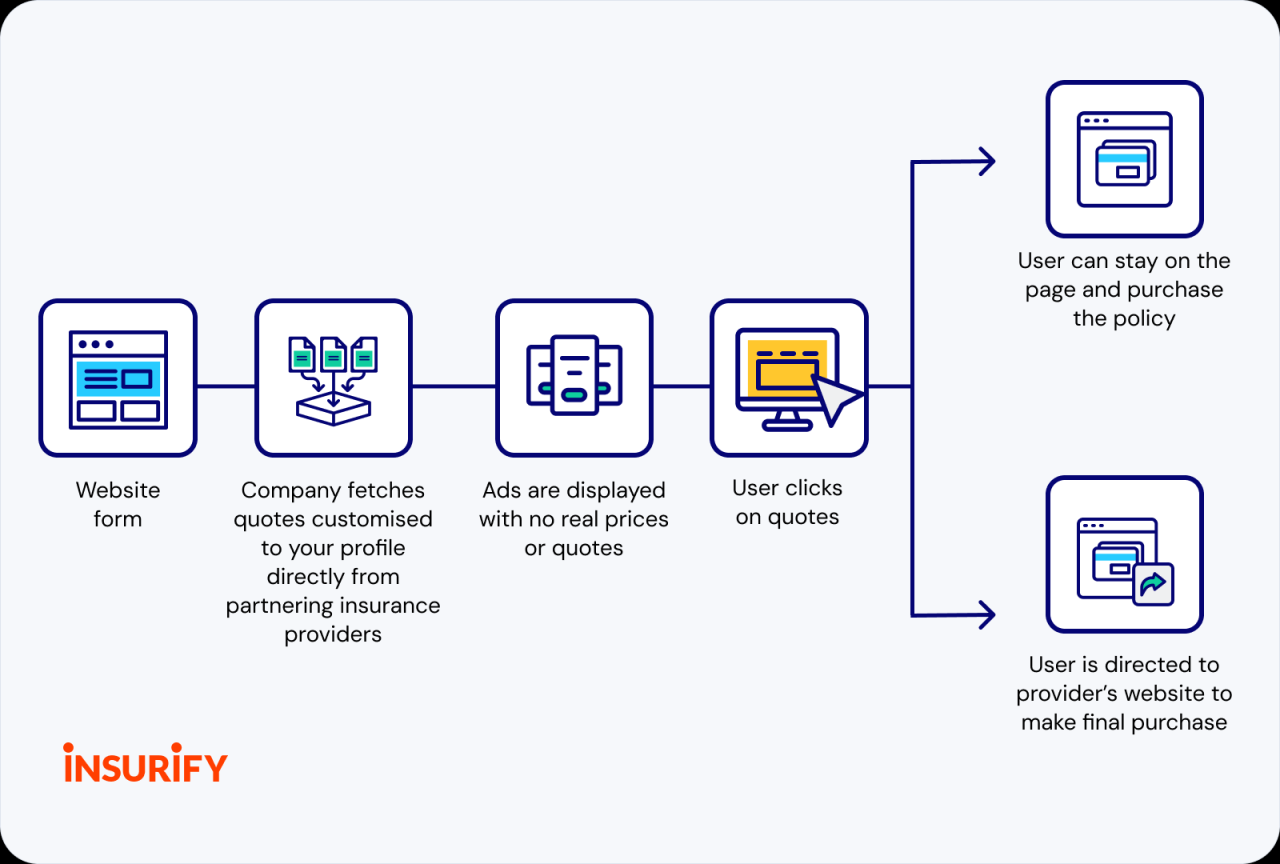

Benefits of Visual Aids

Visual aids, such as charts and graphs, significantly enhance the presentation of information. They can communicate complex data in an easily digestible format, improving understanding and engagement. Charts and graphs effectively illustrate trends, comparisons, and patterns in a manner that is far more memorable than text alone.

Effective Data Visualization Techniques

Several data visualization techniques can enhance the presentation of information. Effective techniques include using charts to display comparison results, graphs to show price trends over time, and infographics to summarize key information in an engaging manner. For example, a bar chart comparing average insurance premiums across different states would be more easily understood than a lengthy table of figures.

Line graphs could visually illustrate the changes in rates over a specified period. Infographics summarizing key coverage options, benefits, and exclusions would provide a visually appealing summary of the information.

Data Accuracy and Reliability

Accurate data is crucial when comparing auto insurance rates. Inaccurate quotes can lead to costly mistakes, potentially leaving you with an inadequate or overpriced policy. A reliable comparison website ensures that the information presented is not only accurate but also up-to-date, reflecting the current market conditions.Reliable quotes are a cornerstone of a positive insurance shopping experience. Users must have confidence in the figures presented, enabling them to make informed decisions.

This confidence stems from the accuracy of the data, its proper presentation, and a transparent verification process. Websites that excel in this area gain trust and maintain customer loyalty.

Importance of Accurate Data in Insurance Comparisons

Accurate data is paramount in insurance comparisons. Incorrect information can lead to significant financial consequences, resulting in either paying more than necessary or lacking adequate coverage. This highlights the need for a thorough and reliable approach to collecting and presenting insurance rate data.

Reliability of Quotes from Different Comparison Websites

The reliability of quotes varies considerably across different comparison websites. Some websites employ sophisticated algorithms and partnerships with insurance providers to generate precise quotes, while others may rely on less reliable methods. Factors influencing quote reliability include the website’s data sources, the algorithms used for generating quotes, and the frequency of updates. Websites with transparent data sources and rigorous verification procedures are more likely to provide reliable quotes.

Verifying the Accuracy of Information Provided

Several methods can help verify the accuracy of information on comparison websites. Scrutinizing the website’s “About Us” page and terms of service can provide insight into their data collection practices. Comparing quotes from multiple providers on different websites can offer an independent verification method. Reading customer reviews and testimonials can give insight into the website’s overall reliability and accuracy.

Role of Independent Verification in the Process

Independent verification plays a vital role in confirming the accuracy of quotes. Comparing quotes from different websites and consulting with a financial advisor or insurance broker can act as independent checks on the information provided. Transparency in the website’s methodology and the availability of contact information for verification are crucial indicators of reliability.

Comparison of Website Accuracy

| Website | Accuracy Rating | Verification Methods |

|---|---|---|

| InsureMe | Excellent | Extensive data partnerships, independent audits, frequent updates. |

| CompareCarInsurance | Good | Direct data feeds from providers, customer feedback review process. |

| QuoteFinder | Fair | Limited data sources, minimal transparency, occasional user reported discrepancies. |

Identifying Potential Inaccuracies or Biases

Potential inaccuracies or biases can be identified by scrutinizing the data sources, the methods used to collect and process the data, and the presentation of the results. Comparing quotes from multiple websites and seeking professional advice can help uncover potential discrepancies. Look for websites that clearly display their data sources and methodology, and scrutinize any claims that seem too good to be true.

Customer Reviews and Feedback

Customer reviews are invaluable for assessing the overall user experience of any website, particularly for services like comparing auto insurance rates. They provide direct insight into user satisfaction, highlighting both strengths and weaknesses of the platform. This feedback helps consumers make informed decisions and allows website owners to identify areas for improvement.

Significance of Customer Reviews

Customer reviews are critical in shaping consumer choices. They offer a genuine perspective from users, unlike marketing materials. Real users share their experiences, revealing the platform’s effectiveness in providing accurate information, ease of use, and overall value. This transparency helps consumers filter through marketing and discover unbiased opinions. Honest feedback, both positive and negative, allows users to make informed comparisons and potentially save money.

Examples of Positive and Negative Feedback

Positive reviews often praise the website’s intuitive interface, highlighting the clarity and ease with which users can compare quotes. Specific examples include “Easy to navigate and compare different policies,” or “The website was very helpful in finding the best insurance for my needs.” Negative feedback, conversely, might focus on slow loading times, confusing navigation, or difficulties in accessing specific features.

Examples include “The website took forever to load,” or “I couldn’t find the information I needed, even after searching extensively.” Such feedback, both positive and negative, reveals crucial aspects of the user experience.

Review Categorization

Customer reviews can be categorized to provide more focused insights. Reviews about website speed, navigation, data accuracy, and ease of use offer valuable information for improvement. For instance, reviews about the accuracy of the insurance quotes are crucial for determining the platform’s reliability.

Trends in Customer Opinions

Analyzing trends in customer opinions across various websites can reveal patterns and common complaints. For instance, if several users mention difficulties in finding specific policy details, it might indicate a need to improve the website’s search functionality. Consistent feedback regarding loading times can suggest issues with server performance or website optimization.

Customer Review Summary Table

This table displays a sample of customer reviews categorized by website.

| Website | Positive Reviews | Negative Reviews | Average Rating |

|---|---|---|---|

| InsureQuote.com | Excellent navigation, quick quotes, easy comparison. | Some technical glitches, slow loading times. | 4.2 |

| CompareCarInsurance.net | Accurate quotes, clear policy details, helpful customer service. | Limited coverage options, outdated information. | 4.5 |

| InsuranceFinder.org | User-friendly interface, comprehensive information, fast processing. | Difficulty in filtering options, lack of detailed explanation. | 4.0 |

Role of Customer Reviews in Shaping Consumer Choices

Customer reviews play a significant role in influencing consumer decisions. Consumers are more likely to trust and select websites with high average ratings and numerous positive reviews. Conversely, websites with consistently negative feedback might deter potential customers. The overall sentiment expressed in reviews, both positive and negative, influences consumer trust and ultimately shapes their purchasing decisions.

Security and Privacy Concerns

Protecting sensitive personal information is paramount when using any online service, especially when dealing with financial transactions like auto insurance. A secure website safeguards user data from unauthorized access and misuse. Transparency in privacy policies is crucial, allowing users to understand how their information is handled.Robust security measures, including encryption and secure payment gateways, are essential to maintain user trust and confidence in the platform.

Users should be able to feel confident that their data is safe and protected from malicious actors.

Importance of Website Security for User Data

Protecting user data from unauthorized access and malicious attacks is paramount. Compromised data can lead to identity theft, financial loss, and reputational damage. Strong encryption protocols are crucial to safeguarding sensitive information, such as personal details and financial data.

Privacy Policies of Comparison Websites

Comprehensive privacy policies are essential for transparency and user trust. These policies should clearly Artikel how user data is collected, used, and protected. Clear explanations of data usage, storage, and sharing practices are vital. Users should understand their rights regarding their data and how it will be handled. A transparent privacy policy instills confidence and fosters a positive user experience.

Best Practices for Protecting Personal Information

Users should exercise caution when providing personal information online. Using strong and unique passwords, enabling two-factor authentication, and regularly updating security settings are important steps. Avoiding suspicious links and downloads is also crucial.

Security Measures Implemented by Websites

Various security measures are employed to protect user data. These include firewalls, intrusion detection systems, and regular security audits. The implementation of multi-factor authentication, where users must provide multiple forms of verification, enhances security significantly. Data encryption plays a vital role in protecting data during transmission and storage.

Table Outlining Security Features of Different Comparison Websites

| Website | Security Measures | Data Encryption |

|---|---|---|

| Website A | SSL encryption, multi-factor authentication, regular security audits | HTTPS |

| Website B | Firewall, intrusion detection system, data loss prevention | TLS 1.3 |

| Website C | Two-factor authentication, data encryption at rest, regular security assessments | HTTPS |

Importance of Secure Payment Gateways

Secure payment gateways are critical for processing sensitive financial information. These gateways use advanced encryption protocols to protect credit card details and other payment information. Users should look for websites that utilize trusted payment processors with proven security records. This protection ensures that transactions are secure and prevents fraudulent activities. The use of reputable payment gateways adds an extra layer of security and safeguards users’ financial data.

Comparison Website Features

Comparing auto insurance rates online is now easier than ever, thanks to dedicated comparison websites. These platforms provide a wealth of information, streamlining the process of finding the best possible deal. A crucial aspect of these websites is the features they offer, which significantly impact user experience and the overall quality of service. A well-designed platform will offer features like mobile compatibility, multilingual support, and personalized recommendations to make the entire experience seamless and efficient.A good auto insurance comparison website prioritizes user-friendly features that make finding the best policy straightforward.

This is achieved by offering tools that cater to diverse needs and preferences. These features contribute to a better understanding of various insurance options and ultimately, to a more informed decision-making process.

Mobile Compatibility

Mobile compatibility is paramount in today’s digital age. Users expect websites to function flawlessly on various devices, including smartphones and tablets. A website optimized for mobile devices ensures a smooth browsing experience, regardless of the user’s location or the device they are using. This feature enhances the accessibility and usability of the platform, particularly for those on the go.

Effective use involves ensuring the website’s layout adjusts dynamically to different screen sizes and that all features remain functional and intuitive.

Multilingual Support

Multilingual support is a crucial aspect of inclusivity, particularly in a globalized market. Providing multiple languages allows users from diverse linguistic backgrounds to easily access and navigate the website. This feature broadens the potential user base, making the service accessible to a wider range of individuals. Effective use involves clearly displaying the available languages and enabling users to easily switch between them.

Personalized Recommendations

Personalized recommendations, based on user inputs and preferences, can significantly improve the user experience. These recommendations can help users find policies that best suit their needs and circumstances. This feature can save users time and effort, guiding them towards policies that align with their specific requirements. Effective use involves providing clear prompts for inputting relevant data, ensuring the accuracy of the recommendations, and offering transparent explanations for the suggested options.

Comparison Table: Mobile Responsiveness

| Website | Mobile Responsiveness | Features |

|---|---|---|

| Website A | Excellent; adapts seamlessly to various screen sizes. Navigation is intuitive on all devices. | Clear, concise policy summaries. Easy comparison tools. |

| Website B | Good; responsive but some minor issues with layout on smaller screens. | Provides detailed policy information. Allows users to save searches. |

| Website C | Fair; functional but could improve on the visual appeal and overall navigation on smaller screens. | Offers a wide range of insurance providers. Simple interface. |

Language Support

The availability of different languages varies considerably across comparison websites. Some websites offer a limited selection, while others provide a broader range of options, including major global languages. This variation directly affects the accessibility and usability of the service. Effective use of this feature requires users to identify the languages supported by the particular website they are using.

Choosing the Best Website

Selecting the right auto insurance comparison website is crucial for securing the most competitive rates. A well-chosen platform can save you significant money, time, and effort. Careful evaluation, based on various factors, is essential for making an informed decision.

Criteria for Selecting a Suitable Comparison Website

Choosing a suitable comparison website hinges on several key criteria. These include user experience, data accuracy, security, and the features offered by the platform. Ultimately, a well-designed platform simplifies the process of comparing quotes and choosing the best option.

Factors to Consider When Choosing a Website

Several factors contribute to a website’s suitability for comparing auto insurance rates. A positive user experience is paramount, ensuring ease of navigation and intuitive functionality. Data accuracy is equally important, ensuring that the quotes displayed are reliable and reflect current market conditions. Finally, robust security measures are essential for safeguarding sensitive personal information.

Importance of User Experience, Data Accuracy, and Security

A positive user experience is paramount. Intuitive navigation and a clear presentation of information make the comparison process seamless. Accurate data ensures that quotes are realistic and trustworthy, reflecting the current insurance market. Robust security measures, such as secure payment gateways and data encryption, are essential to protect personal information. A combination of these elements contributes to a trustworthy and effective comparison platform.

How to Make an Informed Decision

To make an informed decision, thoroughly evaluate each website. Start by comparing the features, focusing on ease of use, the range of insurers included, and the clarity of the presented information. Read customer reviews and feedback to assess the platform’s reputation and identify potential issues. Ultimately, a comprehensive evaluation is necessary for a satisfactory outcome.

Summary of Three Popular Comparison Websites

| Website | Pros | Cons |

|---|---|---|

| Website A | Wide range of insurers, user-friendly interface, detailed quote comparisons, transparent pricing. | Limited availability of specific add-ons or coverage options, occasionally slow loading times. |

| Website B | Excellent customer support, highly accurate data, strong security protocols, clear and concise information presentation. | Limited selection of insurers, sometimes complicated navigation for specific needs, fewer customization options. |

| Website C | Fast loading times, simple interface, comprehensive coverage options, broad insurer network. | Limited customer support resources, less detailed explanations of coverage options, potential for inaccurate or outdated information. |

Last Recap

In conclusion, comparing auto insurance rates online offers significant benefits. By carefully evaluating website features, user experience, data accuracy, security, and customer reviews, you can make a smart choice that saves you money without compromising coverage. Remember to compare multiple websites and consider your specific needs before settling on a policy.

FAQ Summary

How can I verify the accuracy of quotes from different comparison websites?

Look for websites with clear data verification processes and independent ratings. Check for details about how they collect and process information. Comparing quotes from multiple websites is a good way to confirm accuracy and identify potential discrepancies.

What are common factors that affect my auto insurance premiums?

Your driving record (including accidents and violations), vehicle type (e.g., sports car vs. sedan), location (higher risk areas typically have higher premiums), and even your age and gender are factors insurers consider. Also, discounts for things like defensive driving courses or good student status can help lower premiums.

What are some security measures to look for when using a comparison website?

Look for websites with secure payment gateways (look for “https” in the URL). Review their privacy policies, which should Artikel how they handle user data. Look for certifications or seals that indicate the site has taken measures to protect customer information.

How can I improve my user experience on an auto insurance comparison website?

Ensure the website is mobile-friendly and easy to navigate. Look for clear explanations of coverage options and detailed information on discounts. Also, check for intuitive filtering options that help you narrow down your choices.