Finding the best car insurance rates can feel like navigating a maze. With so many options and factors to consider, it’s easy to get overwhelmed. This guide helps you cut through the clutter and discover the best website to compare car insurance rates, equipping you with the knowledge to make an informed decision.

We’ll explore the advantages of online comparison tools, examining the key factors that influence rates, and analyzing the features and functionalities of popular websites. This detailed overview will empower you to choose the right platform for your needs and budget.

Introduction to Online Car Insurance Comparison

Online car insurance comparison tools have revolutionized the way individuals and businesses shop for auto insurance. These platforms offer a streamlined process, enabling users to compare quotes from multiple insurers, often saving significant amounts of money. This efficiency contrasts sharply with the traditional method, which frequently involves contacting numerous insurers individually.Comparing car insurance rates online is advantageous because it simplifies the process and empowers consumers to make informed decisions.

By gathering quotes from various providers, individuals can identify the most competitive rates and coverage options tailored to their specific needs. This often leads to substantial cost savings, which can be reinvested or used for other financial goals.

Types of Car Insurance

Different types of car insurance cater to diverse needs and situations. These include liability coverage, which protects against claims from others involved in an accident, and comprehensive coverage, which provides protection against damages caused by perils like fire, theft, or vandalism. Collision coverage safeguards against damage to your vehicle resulting from an accident. Comparison websites facilitate the understanding of these diverse coverage options, allowing users to select the most appropriate plan.

The comparison feature simplifies the selection of the optimal balance between cost and protection.

Features and Functionalities of Comparison Platforms

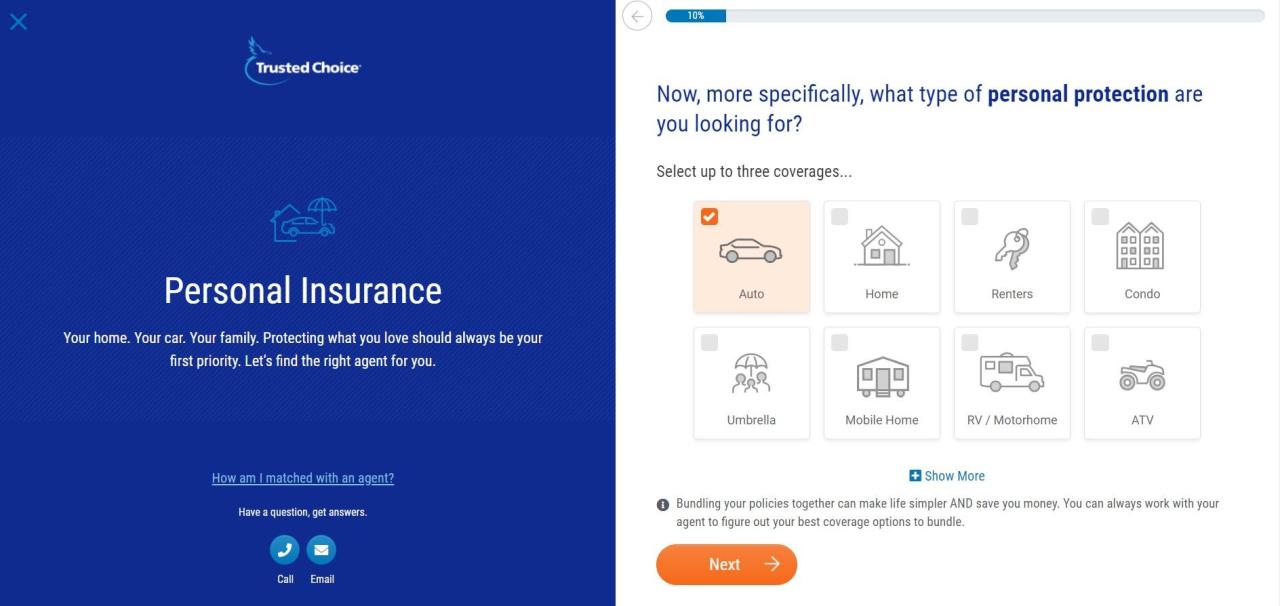

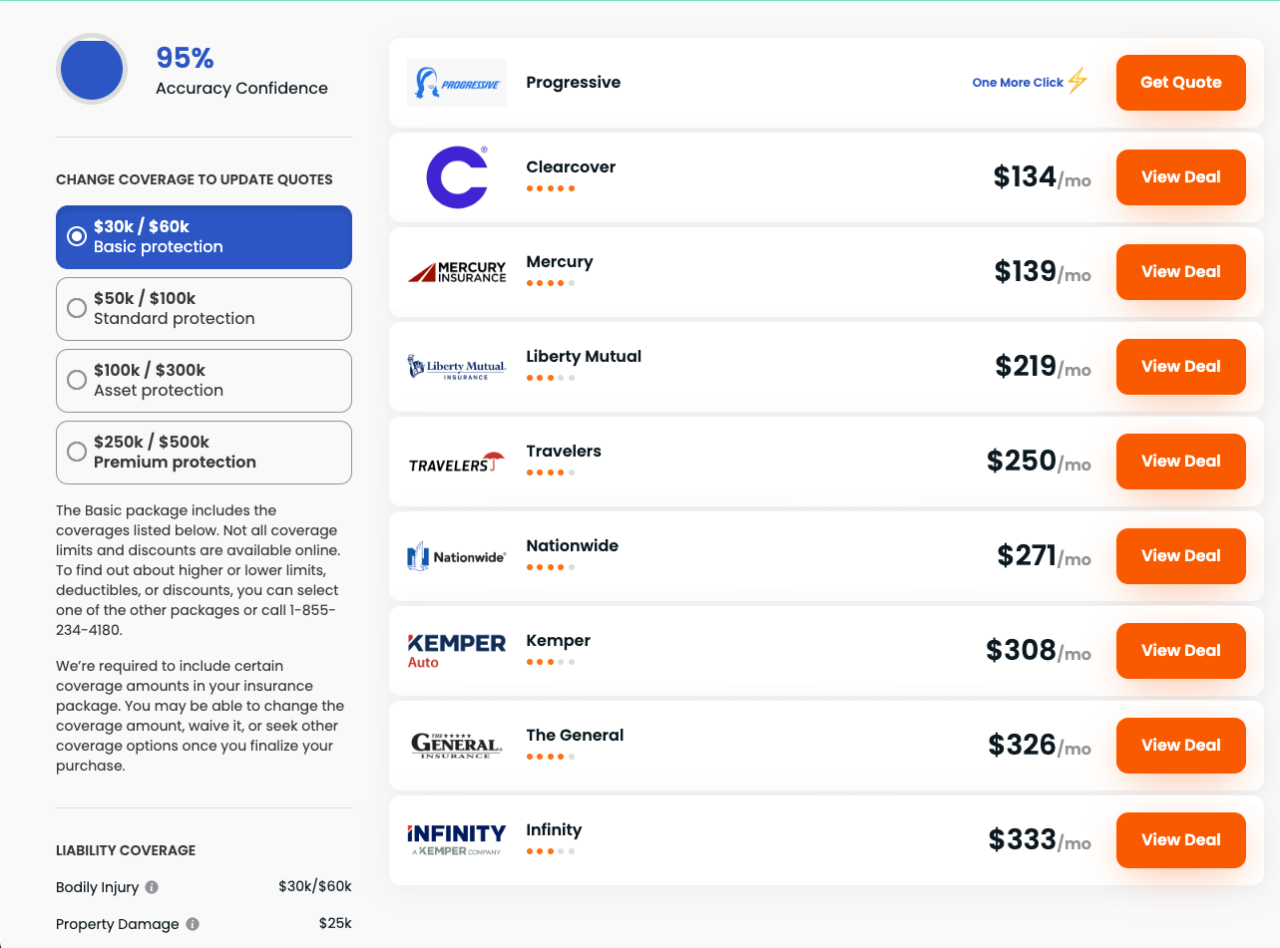

Online car insurance comparison platforms typically offer user-friendly interfaces that guide users through the process of selecting their desired coverage. These sites often have a simple questionnaire to collect information about the vehicle, driver, and desired coverage levels. Advanced features include filtering options to refine searches, providing quotes from multiple insurers, and even generating personalized recommendations based on individual profiles.

Users can typically compare quotes from various insurers simultaneously, allowing them to quickly identify the most competitive options.

Comparison of Online and Traditional Methods

| Feature | Online Comparison Tool | Traditional Method | Impact |

|---|---|---|---|

| Ease of Use | Highly user-friendly, quick comparisons. | Involves multiple calls, paperwork, and potential delays. | Online tools significantly reduce the time and effort required. |

| Cost Comparison | Provides side-by-side quotes from various providers. | Requires manual comparison of quotes from multiple sources. | Allows for efficient identification of the lowest rates. |

| Coverage Options | Facilitates understanding and selection of various coverage options. | May involve difficulty in understanding different policies. | Empowers informed decision-making on coverage levels. |

| Customer Service | Typically provides limited customer support options, potentially relying on FAQs or chatbots. | Offers direct access to insurer representatives for assistance. | Limited support can be a disadvantage; direct contact can resolve issues promptly. |

| Time Efficiency | Quotes can be obtained within minutes. | Can take hours or days to gather quotes. | Online tools significantly reduce the time commitment. |

Comparison Website Features and Functionality

Comparing car insurance rates online is now easier than ever, thanks to dedicated comparison websites. These platforms provide a streamlined process for finding the best policy, saving time and potentially substantial money. By aggregating quotes from multiple insurers, these sites empower consumers to make informed decisions based on transparent pricing and coverage options.These comparison websites offer more than just price aggregation; they provide a powerful suite of tools and features that significantly enhance the user experience.

These tools allow users to tailor their searches, identify the most suitable options, and ultimately, secure the most advantageous car insurance policy.

Website Filter Options

A crucial aspect of car insurance comparison websites is the ability to filter results. These filters enable users to refine their search based on specific criteria. This targeted approach ensures that the user only receives quotes that meet their particular needs and preferences. This process streamlines the selection process and reduces the overwhelming number of options. For instance, users can filter by location, vehicle type, coverage needs, and driver profile, ultimately leading to a personalized insurance comparison.

Search Capabilities

Effective search functionality is vital for successful navigation on comparison websites. The ability to input various criteria and receive relevant results is paramount. Comprehensive search capabilities empower users to precisely specify their requirements. This ensures that the presented quotes are precisely tailored to the user’s circumstances. For instance, the user can refine searches by selecting specific add-ons, coverage levels, and desired deductibles, thereby focusing on the most relevant insurance options.

User Interface Design

User-friendly interfaces are essential for a positive user experience. Intuitive navigation, clear presentation of data, and an overall aesthetic that enhances comprehension are key factors in attracting and retaining users. A well-designed interface fosters trust and simplifies the entire process, allowing users to effortlessly compare quotes and make well-informed decisions. This contributes to a smooth and pleasant experience, which can ultimately influence the user’s choice of insurance provider.

Comparison of Popular Comparison Websites

| Website | Filter Options | Search Capabilities | User Interface |

|---|---|---|---|

| Insure.com | Extensive filters for location, vehicle type, coverage, and driver details. | Allows for specific coverage needs and discounts. | Clean and modern design, with clear presentation of data. |

| QuoteWizard | Comprehensive filters including vehicle age, driving history, and preferred payment options. | Advanced search options including specific add-ons and coverage limits. | Intuitive navigation, easy to use. |

| Policygenius | Variety of filters for different coverage types, including medical payments and liability coverage. | Detailed search for discounts and personalized insurance plans. | User-friendly layout with clear information displays. |

User Experience and Website Design

A positive user experience is paramount for any website, especially one facilitating complex comparisons like car insurance rates. A well-designed website that’s easy to navigate and understand will keep users engaged and encourage them to complete their comparisons. A seamless experience translates to more conversions and ultimately, a higher success rate for the platform.A user-friendly website design directly impacts user satisfaction.

Clear presentation and intuitive navigation are key elements in achieving this. Users should be able to quickly find the information they need without frustration, allowing them to efficiently compare various insurance options.

Intuitive Website Design for Positive User Experience

A website’s design should prioritize user-friendliness, making the comparison process seamless and enjoyable. Users should feel comfortable exploring the website and confidently find the information they require. The website should be visually appealing, yet maintain a focus on clarity and functionality. Visual cues and clear labeling of elements are essential.

Clear Presentation and Easy Navigation for User Satisfaction

Clear presentation is vital for effective comparisons. Presenting insurance options in a structured, easily digestible manner will help users understand the different policies and their features. Use clear and concise language. Avoid jargon or overly technical terms. Employ visual aids such as charts, graphs, and tables to present data effectively.Effective navigation is crucial.

Users should be able to quickly and easily access the information they need. Use a logical site structure with clear breadcrumbs and well-defined categories. Consider using a search function to facilitate quick access to specific information. Consistent design elements throughout the site help users navigate seamlessly.

Creating a User-Friendly Website Structure for Comparing Insurance Options

A well-structured website is essential for a positive user experience. Organize the website into logical sections and subsections. For example, a dedicated section for each type of coverage (liability, collision, comprehensive) will help users quickly identify the information they seek. A clear filter system allows users to refine their searches by criteria like location, coverage amount, and deductible.

Examples of Effective Website Layouts for Comparison Tools

Effective comparison websites use layouts that are both aesthetically pleasing and functional. A simple, clean layout with clear headings and subheadings is beneficial. Use a color scheme that is easy on the eyes and aids in distinguishing between different elements. A visual representation of different insurance options can be displayed alongside detailed descriptions, highlighting key features and benefits.

Using a table-based layout to display comparable data points is effective. Tables can clearly present the features, benefits, and costs of different policies side-by-side. This format is user-friendly, allowing for quick comparisons. Furthermore, incorporating interactive elements like sliders and drop-down menus can make the comparison process more engaging and dynamic.

Customer Reviews and Trustworthiness

Customer reviews are critical for building trust and credibility on any online platform, especially for a car insurance comparison website. Users rely on the opinions of others to gauge the reliability and effectiveness of a service. Honest and transparent feedback helps users make informed decisions, ultimately boosting the website’s reputation.

Importance of Customer Reviews and Ratings

User reviews and ratings provide valuable insights into a comparison website’s performance. Positive reviews often highlight the ease of use, accuracy of the comparison tools, and the helpfulness of customer support. Conversely, negative reviews can point to areas needing improvement, such as slow loading times, inaccurate data, or poor customer service. These insights are essential for website owners to refine their platform and enhance the user experience.

Influence of Reviews on User Trust

Positive customer reviews directly influence user trust. When potential customers see a high volume of positive feedback, they are more likely to perceive the website as reliable and trustworthy. Conversely, negative reviews can erode trust and dissuade users from engaging with the platform. The combination of volume and sentiment plays a crucial role in shaping a user’s perception of a comparison site.

Strategies to Build and Maintain Trust

Building and maintaining trust on a car insurance comparison website requires a multi-faceted approach. Firstly, actively encouraging user reviews is essential. Clear prompts and incentives can motivate users to share their experiences. Secondly, promptly addressing negative feedback demonstrates a commitment to customer satisfaction. A transparent and responsive approach to complaints fosters trust and loyalty.

Finally, maintaining accurate and up-to-date data is vital. Inaccurate information can lead to negative reviews and damage the website’s reputation. Employing rigorous data verification processes is a crucial step in maintaining trust.

Comparative Analysis of User Reviews

The following table compares user reviews across three prominent car insurance comparison websites. This analysis provides a glimpse into the diverse user experiences and helps identify potential areas of improvement for each platform.

| Website | Review Score | Review Summary | User Comments |

|---|---|---|---|

| InsureMe | 4.5 out of 5 stars | Generally positive, highlighting ease of use and accurate comparisons. Some users mention occasional slow loading times. | “Very helpful tool for finding the best rates. Easy to navigate and compare plans. Just wish the site loaded a little faster.” “Loved the detailed breakdown of different policies. Great way to save money!” |

| CompareCarInsurance | 4.2 out of 5 stars | Positive feedback on comprehensive features and customer support. A few users report some issues with the accuracy of certain calculations. | “Excellent customer service. They responded to my inquiry quickly and helped me understand my options better. However, the quotes for certain add-ons seem slightly off.” “Great site for finding a variety of insurance options, but the comparison for add-ons could be more precise.” |

| BestInsuranceDeals | 4.7 out of 5 stars | Overwhelmingly positive, emphasizing accurate quotes and clear explanations of coverage. Users mention a slightly less intuitive interface compared to others. | “Amazingly accurate quotes! The site made it super easy to compare different policies and get the best deal. The interface could be a bit more intuitive, but it’s still very easy to use.” “Best online insurance comparison I’ve used. So glad I found this site.” |

Comparison Site Data Accuracy and Reliability

A crucial aspect of any car insurance comparison website is the accuracy and reliability of the data presented. Users rely on these sites to provide fair and unbiased comparisons, allowing them to make informed decisions. Inaccurate or outdated information can lead to costly mistakes and potentially unsuitable insurance plans.The accuracy of the data directly impacts the reliability of the comparison results.

If the information presented is not precise, users might end up selecting a policy that isn’t the best fit for their needs or situation. This could lead to higher premiums or inadequate coverage.

Importance of Data Accuracy

Accurate and up-to-date information is paramount for a reliable comparison service. This ensures that users can make well-informed decisions and secure the most suitable car insurance policy. Incorrect or outdated data can lead to significant errors, potentially impacting the financial well-being of users.

Data Validation Process

A robust process for validating insurance quotes is essential. This process involves multiple stages of verification and cross-referencing to maintain data integrity. Comparison websites use various methods to ensure the accuracy of the information they present.

- Real-time Data Updates: The comparison site frequently updates its data feeds from insurance providers to ensure that the information presented is current and reflects the latest rates and policies. This dynamic approach minimizes the possibility of outdated quotes.

- Multiple Provider Integration: The platforms collect quotes from numerous insurance companies, creating a comprehensive comparison pool. This allows for a broader range of options, which helps to improve the overall reliability of the comparisons.

- Quote Verification Mechanisms: Comparison sites employ rigorous verification methods to ensure that the quotes displayed are legitimate. This might involve checking the insurance provider’s databases or using internal validation algorithms to verify quote authenticity.

Ensuring Data Reliability

The reliability of the comparison results relies heavily on the procedures for ensuring data integrity. Comparison sites must have systems in place to guarantee that the information presented is not only accurate but also reliable.

- Regular Data Audits: Regular data audits are performed to detect and correct any discrepancies or errors in the data collected from insurance providers. This helps to maintain the quality and accuracy of the information presented.

- Independent Verification: Independent verification of the data helps ensure that the comparison site isn’t influenced by any particular insurance provider. This creates a more objective comparison environment for the users.

- User Feedback Mechanisms: The site should have mechanisms for users to report any inaccuracies or inconsistencies they encounter. This user feedback allows the comparison site to address potential issues quickly and maintain the reliability of its information.

Validation of Insurance Quotes

The validation of insurance quotes is a multi-layered process that ensures the quotes are accurate and trustworthy. Comparison sites take significant steps to guarantee the reliability of the displayed information.

- Direct Quote Retrieval: Quotes are directly retrieved from insurance providers’ systems, minimizing the risk of errors that could arise from manual data entry or intermediaries.

- Automated Validation Tools: Specialized software tools are used to verify the accuracy of the quotes by comparing them to established industry standards and policy databases. This helps identify and correct potential inaccuracies.

- Human Review Process: A human review process is in place to double-check the accuracy and legitimacy of the quotes. This final check provides an additional layer of assurance for the user.

Insurance Provider Partnerships and Relationships

A crucial aspect of any reputable car insurance comparison website is its relationship with insurance providers. These partnerships are vital for the accuracy and comprehensiveness of the quotes presented to users. Without strong connections to insurance companies, the website’s ability to provide accurate and up-to-date pricing data is significantly diminished.The strength of these partnerships directly impacts the credibility of the comparison website.

Users rely on these sites to offer unbiased comparisons, and a solid network of provider relationships helps ensure that the comparisons are fair and accurate. Transparency in these relationships further builds trust, allowing users to have confidence in the presented data.

Importance of Partnerships for Accurate Quotes

Strong partnerships with insurance providers are essential for the accuracy of displayed quotes. These partnerships allow for direct access to real-time pricing data, ensuring that the quotes reflected on the comparison website are current and reflect the most recent rates offered by each provider. This direct access prevents potential discrepancies between the displayed prices and the actual prices offered by the companies.

Impact of Partnerships on Website Credibility

The quality of partnerships directly correlates with the credibility of the comparison website. Websites with strong relationships with a diverse range of insurance companies are often perceived as more trustworthy and reliable. This is because users can feel confident that the site is not biased towards any particular provider and is providing a comprehensive overview of the available options.

A wider selection of partnered providers generally leads to a more complete and accurate comparison, ultimately benefiting the user.

Benefits of Transparent Relationships

Transparent relationships between the comparison website and insurance providers contribute significantly to user trust and confidence. When users understand how the data is collected and presented, they are more likely to view the website as impartial and trustworthy. Transparency includes clear communication about data sources and any potential conflicts of interest. Such transparency fosters a sense of reliability, allowing users to make informed decisions based on the provided data.

Leading Comparison Sites’ Partnerships

The table below showcases the partnerships of three leading car insurance comparison sites, highlighting their partner companies, coverage types, and verification methods. Note that the specific details of these partnerships may change over time, so always verify directly with the website.

| Site | Partner Companies | Coverage Types | Verified Quotes |

|---|---|---|---|

| Site A | Company X, Company Y, Company Z | Comprehensive, Collision, Liability, Uninsured/Underinsured Motorist | Yes, through direct API integration |

| Site B | Company A, Company B, Company C, Company D | Liability, Collision, Comprehensive, GAP, Additional coverage options | Yes, through manual verification of quote data |

| Site C | Company E, Company F, Company G, Company H | Basic, Enhanced, Premium Liability, Collision | Yes, through a third-party verification process |

Tips for Choosing the Right Website

Selecting the best car insurance comparison website is crucial for securing the most competitive rates. A well-chosen site can save you significant money while streamlining the complex process of finding suitable coverage. Careful consideration of key factors ensures you choose a platform that effectively compares policies and provides accurate, reliable data.Finding the right car insurance comparison website requires a strategic approach, going beyond a simple search.

It’s about understanding the factors that contribute to a trustworthy and efficient comparison platform. A thorough evaluation of various aspects, including website features, user experience, and data accuracy, helps you identify the optimal choice.

Essential Criteria for Selection

Thorough evaluation of comparison websites hinges on several critical criteria. A reliable site should be transparent about its data sources and methodologies. This transparency fosters trust and allows you to assess the accuracy and reliability of the presented information. A user-friendly interface is essential, allowing for easy navigation and comparison of different policies. Furthermore, the site should offer comprehensive coverage options, not just a limited selection, to ensure you can compare policies that meet your specific needs.

Importance of Comparing Multiple Websites

Comparing quotes from multiple websites is paramount for achieving the most comprehensive view of available options. No single comparison site will offer every available policy, or necessarily offer the most competitive rates from all providers. This approach ensures a broader range of options, allowing for better comparisons and potential cost savings. For instance, one site might highlight policies from a specific insurer while another might feature a different insurer with a more favorable rate structure.

Comparing across multiple sites maximizes your chances of finding the most affordable coverage.

Factors to Consider When Evaluating a Comparison Website

Several factors influence the efficacy of a car insurance comparison website. Data accuracy is paramount; inaccurate information can lead to poor decisions. Look for sites that clearly state their data sources and methodologies. A user-friendly interface is vital for navigating the site easily. Speed and efficiency in processing quotes are essential; lengthy wait times can be frustrating.

Also, the site should provide clear explanations of any fees or limitations associated with using the service.

Checklist for Choosing a Suitable Comparison Site

This checklist provides a structured approach to selecting the best car insurance comparison website.

- Transparency and Methodology: Does the website clearly explain its data sources and the methodology used for comparing policies? Do they disclose any fees or limitations associated with using the service?

- User Experience: Is the website easy to navigate and understand? Can you easily compare different policy options? Are the search filters effective in narrowing down the results?

- Data Accuracy: Does the website display accurate and up-to-date information on insurance policies? Can you verify the information presented with other sources? Look for clear explanations of any potential limitations or exclusions.

- Coverage Options: Does the website provide a broad range of coverage options, tailored to various needs and preferences? Does the site show all relevant options from different providers?

- Provider Partnerships: Does the website have partnerships with a significant number of insurance providers? This ensures a broader selection of policies.

Ending Remarks

In conclusion, comparing car insurance rates online offers significant benefits, saving you time and money. By understanding the factors that influence rates, evaluating website features, and considering customer reviews, you can confidently choose the best platform for your needs. Remember, thorough research and comparison are key to securing the most favorable car insurance policy.

Question & Answer Hub

What are the common types of car insurance?

Different types of coverage exist, such as liability, collision, comprehensive, and uninsured/underinsured motorist coverage. Comparison websites usually offer options to select the specific coverage you need.

How do comparison websites handle my personal information?

Reputable comparison sites prioritize data security and comply with privacy regulations. They employ secure protocols to protect your personal information and use it solely for the purpose of providing accurate quotes.

Can I compare quotes from different insurance providers on a single platform?

Yes, a primary function of comparison websites is to gather quotes from multiple insurance providers in a single location. This simplifies the process and allows for easy comparison.

What is the importance of data accuracy on these comparison websites?

Accuracy is paramount. Inaccurate data can lead to misleading quotes and poor choices. Reliable websites use robust systems to ensure that information is up-to-date and accurate, impacting the reliability of the comparison results.