Comparing car insurance rates online is a smart way to find the best deal. It’s easier and faster than traditional methods, and you can often save money. This guide explores the process, the factors affecting premiums, and how to get the most accurate and reliable quotes.

The sheer volume of insurance providers and varying coverage options can feel overwhelming. This comprehensive guide simplifies the process, equipping you with the knowledge and tools to confidently compare car insurance rates online and find the perfect policy for your needs.

Introduction to Online Car Insurance Rate Comparison

Comparing car insurance rates online is a straightforward process that can save you money. It involves using specialized websites or apps to get quotes from multiple insurance providers. This streamlined approach allows you to quickly assess different coverage options and tailor your policy to your specific needs. Instead of contacting each company individually, you can gather numerous quotes in a matter of minutes.Online comparison tools allow you to easily compare prices, benefits, and features from different insurers.

This empowers you to make informed decisions and potentially find a policy that meets your budget and risk profile.

Benefits of Online Comparison

Online car insurance rate comparison offers significant advantages over traditional methods. The efficiency and convenience of online tools make the process significantly faster and more accessible.

- Time-saving: Gathering quotes from multiple insurers can take hours if done manually. Online tools automate this process, allowing you to compare numerous options in a matter of minutes.

- Cost-effectiveness: By comparing quotes, you can identify the most competitive rates available. This often leads to substantial savings, potentially lowering your monthly premiums significantly.

- Convenience: Online comparison tools are accessible 24/7, allowing you to compare rates from the comfort of your home or on the go.

- Transparency: Online comparison sites typically provide detailed information about each policy, including coverage details, exclusions, and pricing breakdowns. This promotes transparency and helps you understand the specific terms of each offer.

- Customization: Many online tools allow you to customize your search criteria. This allows you to filter quotes based on your specific needs and preferences, such as desired coverage levels, deductibles, and vehicle details.

Factors Influencing Car Insurance Premiums

Several factors influence the cost of your car insurance. Understanding these factors helps you understand how your choices affect your premiums.

- Vehicle type and age: Newer, more expensive vehicles tend to have higher insurance premiums due to their higher repair costs. Similarly, older vehicles may also have higher premiums if they are not properly maintained.

- Driving history: A clean driving record, including a history of safe driving practices, often results in lower premiums. Conversely, accidents and traffic violations can significantly increase premiums.

- Location: Areas with higher rates of accidents or theft tend to have higher insurance premiums. This is due to the increased risk associated with these locations.

- Coverage choices: The type and level of coverage selected directly impact the premium. Higher coverage levels typically result in higher premiums, whereas lower levels may offer reduced protection.

- Claims history: Previous claims filed against your policy can increase your insurance premiums. This is a reflection of the insurer’s assessment of your risk.

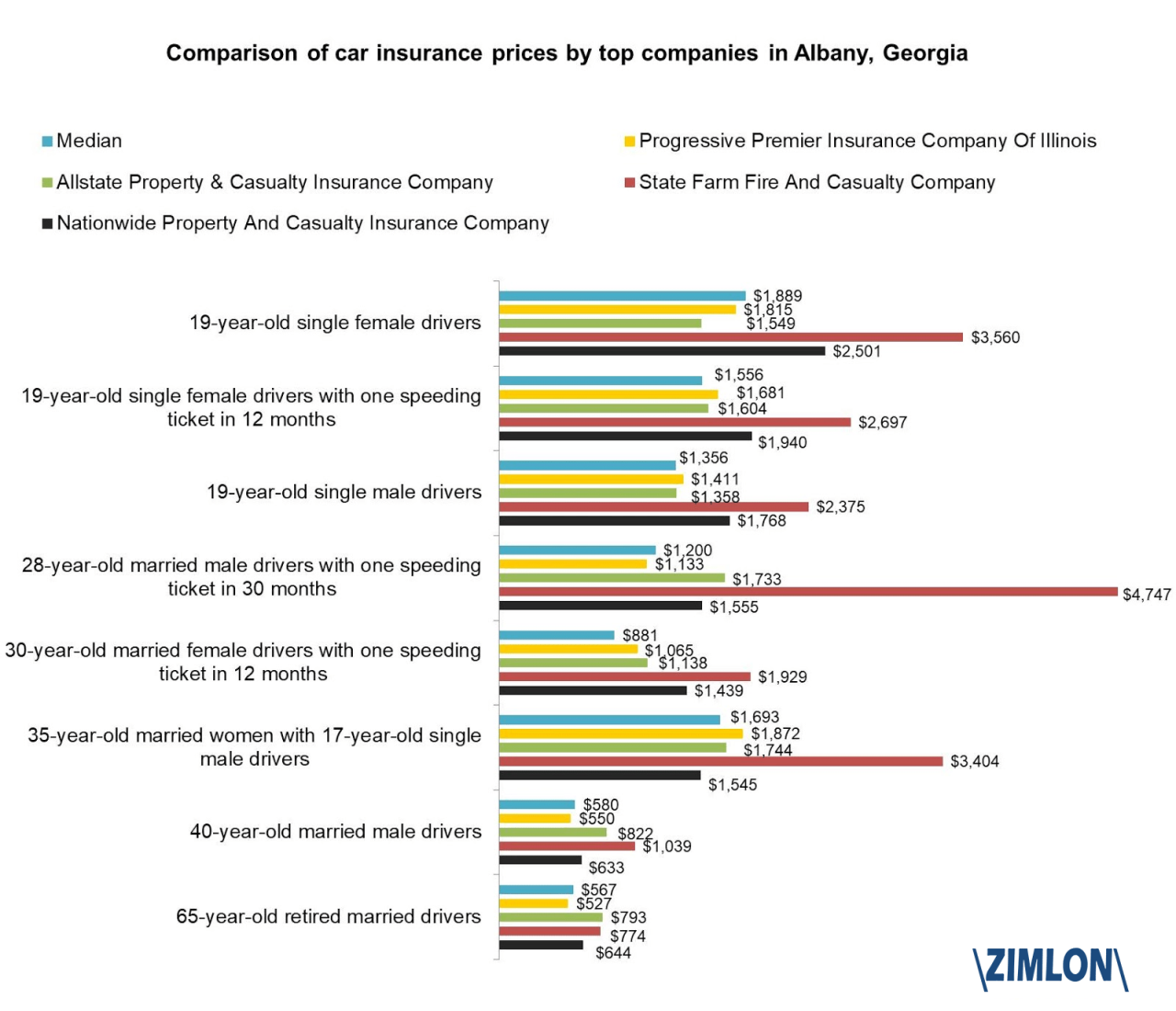

- Age and gender: Insurers often consider the age and gender of the primary driver when determining premiums. Younger drivers and male drivers are sometimes assigned higher risk profiles, which translate to higher premiums.

Impact of Comparison Tools

Online comparison tools significantly simplify the process of finding the best car insurance. These tools are increasingly used by consumers, leading to increased competition among insurers and, ultimately, lower premiums for consumers. This trend reflects a significant shift in the insurance industry toward a more consumer-centric approach.

Platforms for Comparing Car Insurance Rates

Online platforms have revolutionized the process of securing car insurance, allowing drivers to easily compare quotes from various providers. This streamlined approach empowers individuals to find the most cost-effective and suitable coverage options. By utilizing readily available online tools, consumers can make informed decisions based on tailored comparisons.

Popular Comparison Platforms

Numerous online platforms facilitate the comparison of car insurance rates. These platforms act as intermediaries, aggregating quotes from different insurers to present drivers with comprehensive options. By offering a centralized hub, these sites help consumers make informed choices.

Features and Functionalities

These platforms typically offer a range of features to enhance the comparison process. These tools often include interactive questionnaires to collect driver information, such as vehicle details, driving history, and location. This data is then used to generate personalized quotes from participating insurance companies.

Types of Information Available

The platforms provide detailed information on the various insurance policies. This information encompasses the specific coverages offered, policy terms and conditions, and the corresponding premiums. Users can often filter results based on their specific needs and preferences, such as coverage limits or deductibles. Specific details of the insurance products are displayed in an easily understandable manner.

User Interface Examples

Many comparison platforms employ intuitive user interfaces. Typically, the platforms use clear navigation menus, allowing users to quickly input their vehicle information, driving history, and location. The results are usually presented in a tabular format, enabling easy comparison of quotes from different insurers. Visual elements, like color-coding and clear labeling, make it simple to understand the differences between policies.

Comparison Table

| Feature | Platform A | Platform B | Platform C |

|---|---|---|---|

| Ease of Use | Highly intuitive interface, clear navigation. | Simple and straightforward layout, quick access to key information. | Slightly more complex interface, but provides advanced filtering options. |

| Coverage Options | Offers a wide range of coverage options, including add-ons. | Focuses on comprehensive coverage, but may have limited add-on options. | Excellent for specific needs, offering niche coverages, such as vintage car insurance. |

| Quote Speed | Provides instant quotes for most drivers. | Generally faster than other platforms, but may vary slightly depending on user input. | Slightly slower quote generation due to advanced filtering and extensive search criteria. |

| Customer Support | Offers limited customer support via email or chat. | Provides 24/7 customer support through multiple channels. | Offers comprehensive customer support and FAQs. |

Factors Influencing Car Insurance Rates

Car insurance premiums are not a fixed amount; they vary significantly depending on several factors. Understanding these factors is crucial for anyone looking to secure the most affordable car insurance policy. A comprehensive knowledge of these influencing factors enables informed decision-making and helps individuals tailor their coverage to their specific needs and circumstances.Insurance companies use sophisticated algorithms to calculate premiums.

These algorithms weigh various factors, assigning numerical values or weights to each based on historical data and actuarial analysis. The combination of these factors determines the overall risk profile of the insured, which directly impacts the cost of their insurance.

Vehicle Characteristics

Vehicle characteristics are a key determinant in insurance premiums. The type of vehicle, its age, and its safety features directly influence the risk associated with insuring it. Modern, high-safety vehicles with advanced driver-assistance systems often command lower premiums due to their reduced accident potential. Conversely, older, less-safe vehicles are generally more expensive to insure.

- Vehicle Type: Sports cars, SUVs, and trucks often have higher premiums than sedans, due to their potential for more severe accidents. The type of engine (e.g., high-performance) and the vehicle’s overall size can also influence premiums.

- Vehicle Age: Older vehicles are typically more expensive to insure. This is because the parts are more likely to fail, and the vehicle’s overall safety features may be less advanced. However, the condition of the vehicle also plays a role, with well-maintained older vehicles sometimes having lower premiums than newer, neglected ones.

- Safety Features: Vehicles equipped with advanced safety features like airbags, anti-lock brakes (ABS), electronic stability control (ESC), and traction control generally have lower premiums. These features can significantly reduce the likelihood and severity of accidents.

Driver Profile

A driver’s profile, including their driving history and personal characteristics, is a significant factor in determining insurance rates. Companies consider driving experience, location, and potentially even lifestyle choices.

- Driving Experience: Newly licensed drivers and those with a history of accidents or traffic violations face higher premiums. Insurers assess the driver’s experience and driving record to determine their risk level. Extensive experience often results in lower premiums.

- Location: Driving in high-accident areas or areas with a high concentration of traffic incidents may lead to higher premiums. Insurance companies adjust their rates based on the risk associated with specific geographical locations.

- Claims History: Drivers with a history of filing claims have higher premiums. Insurance companies use claims history to gauge a driver’s risk profile, assessing their tendency to be involved in accidents.

- Age: Younger drivers are typically charged higher premiums than older drivers, due to their perceived higher risk profile, although this varies based on the state and insurer.

Coverage and Deductibles

The type and amount of coverage chosen directly impact the premium. Comprehensive coverage and higher liability limits generally result in higher premiums. Adjusting deductibles also affects the price.

- Coverage Options: Comprehensive coverage (protecting against damage from non-collision incidents) and collision coverage (protecting against damage from collisions) often increase premiums. Liability coverage, which protects against damages caused to others, varies in cost depending on the coverage limits.

- Deductibles: Higher deductibles result in lower premiums, as the insurer bears less financial responsibility. A higher deductible translates to the insured paying a larger amount in the event of a claim, but they pay less for the insurance policy.

Additional Factors

Other factors can also influence car insurance rates, including the driver’s credit history, vehicle usage, and the specific insurance company.

- Credit History: While not always used, some insurers consider credit scores to assess a driver’s financial responsibility. A better credit score might lead to lower premiums.

- Vehicle Usage: The frequency and purpose of driving can affect premiums. A driver who frequently travels long distances may pay more than one who primarily drives for local commutes.

- Insurance Company: Different insurance companies have different pricing structures and risk assessments, leading to varying premiums for the same coverage.

| Factor | Impact on Premium |

|---|---|

| Vehicle Type (high-performance) | Higher |

| Vehicle Age (old) | Higher |

| Safety Features (lacking) | Higher |

| Driving Experience (new driver) | Higher |

| High-accident area | Higher |

| Claims History (multiple claims) | Higher |

| Higher Coverage Limits | Higher |

| Lower Deductibles | Higher |

Tips for Effectively Comparing Rates

Savvy consumers can significantly reduce their car insurance costs by strategically comparing rates from various providers. Understanding the nuances of online comparison tools and following a methodical approach can lead to substantial savings.Effective comparison requires a systematic approach, meticulously evaluating different policies and providers. By understanding the factors that influence rates and utilizing the right tools, you can find the most suitable insurance option for your needs.

Strategies for Efficient Navigation of Comparison Tools

Online comparison tools can be overwhelming. To efficiently navigate these platforms, focus on providing accurate information and using the platform’s filtering options. Precisely inputting your vehicle details, driving history, and coverage preferences are crucial. Tools often provide advanced filters for narrowing results, enabling you to target insurers offering specific policies or discounts.

Steps Involved in Finding the Best Rate

Finding the ideal rate requires a methodical approach. Start by gathering essential details about your vehicle, driving record, and desired coverage. Using the information gathered, systematically compare quotes from various insurers. Analyzing the coverage details of different policies, considering potential discounts, and carefully reviewing the terms and conditions are essential steps. Thorough research will empower you to select the best option.

Specific Tips for Completing a Rate Comparison

Completing a rate comparison efficiently involves several key strategies. First, gather comprehensive information about your vehicle, including its make, model, year, and mileage. Next, be accurate when inputting your driving history and any discounts you qualify for. Review each quote carefully, comparing coverage options, premiums, and deductibles. Finally, thoroughly examine the fine print to understand the policy’s terms and conditions before making a decision.

Common Mistakes to Avoid During Online Comparisons

Several common mistakes can hinder the process of online comparisons. Avoid hastily selecting the first quote without thoroughly comparing it to other options. Neglecting to check for hidden fees or fine print can lead to unexpected costs. Ignoring discounts or special offers available through certain insurers can significantly affect the final price. A thorough review of all details and terms is paramount.

A Step-by-Step Guide for Comparing Rates

This guide provides a structured approach to comparing car insurance rates:

- Gather Information: Compile details about your vehicle, driving record, and desired coverage options. Be meticulous in collecting these details.

- Utilize Comparison Tools: Employ reputable online comparison platforms to access quotes from multiple insurers. Input the collected information precisely.

- Review Quotes: Carefully examine each quote, comparing premiums, coverage details, and deductibles. Consider any applicable discounts.

- Compare Fine Print: Scrutinize the policy terms and conditions to ensure transparency and avoid hidden fees. Understanding the policy’s specifics is crucial.

- Select the Best Option: Evaluate all the collected information and choose the policy that best suits your needs and budget. Review all aspects thoroughly.

Ensuring Accuracy and Reliability

Getting the most accurate and reliable car insurance quotes is crucial for securing the best possible coverage at the right price. Online comparison tools are convenient, but verifying the information presented is essential to avoid costly mistakes. This section highlights the importance of meticulous accuracy checks and reliable platform selection.

Verifying Quote Accuracy

Online quotes are often generated automatically, making human error a possibility. Carefully reviewing each quote is vital, paying attention to specifics like coverage limits, deductibles, and add-ons. Discrepancies between quoted prices and those from other sources should prompt further investigation. Mismatched details can indicate an error in the quote or a misunderstanding of your needs.

Identifying Potential Inaccuracies

Look for inconsistencies in the information provided. For example, if a quote for comprehensive coverage seems unusually low compared to others, it might indicate a missing or reduced coverage option. Compare the coverage descriptions and details from different providers. Do not accept a quote without thoroughly reviewing the fine print and understanding the terms and conditions.

Validating Information from Different Providers

To ensure accuracy, cross-reference quotes from multiple providers. This practice can highlight potential errors in individual quotes. A consistent price across various providers suggests a more accurate assessment of your risk profile. However, significant discrepancies in quotes from reputable providers may signal a need for a more thorough review of your vehicle and driving history.

Ensuring Reliability of Comparison Sites

Choose reputable online comparison sites. Look for sites with clear privacy policies and security measures. Read customer reviews to gauge the reliability and accuracy of the site’s data. Ensure the comparison site clearly displays its methodology and how it gathers and processes the insurance data. Reputable sites will clearly indicate the affiliations they have with the insurance providers, while avoiding overly aggressive or misleading marketing tactics.

Red Flags in Quotes

| Red Flag | Explanation |

|---|---|

| Unusually Low Quotes | Quotes significantly lower than competitors’ might indicate missing or reduced coverage. Scrutinize the details and confirm coverage limits and exclusions. |

| Missing or Inconsistent Information | Quotes with gaps in the details, such as coverage types, deductibles, or premium breakdowns, may suggest inaccuracies. |

| Conflicting Coverage Descriptions | Discrepancies in coverage descriptions across different quotes should be thoroughly investigated. Contact the insurance provider directly for clarification. |

| Unclear or Incomplete Terms and Conditions | Quotes with vague or confusing terms and conditions require careful attention. Contact the provider to ensure complete understanding. |

| Suspiciously High Premiums with No Apparent Reason | Premiums substantially higher than competitors’ without an evident reason, such as a poor driving record, should be scrutinized. Confirm the accuracy of your information and coverage requirements. |

Understanding Different Coverage Options

Choosing the right car insurance coverage is crucial for protecting your financial well-being and your vehicle. Understanding the various options available and their implications for your premiums is essential in making an informed decision. Different coverage levels cater to varying needs and budgets, so careful consideration is key.

Types of Car Insurance Coverage

Various types of coverage are available, each with its own set of benefits and drawbacks. A comprehensive understanding of these options is vital to selecting the appropriate coverage for your individual circumstances.

- Liability Coverage: This is the most basic type of coverage, primarily protecting you from financial responsibility if you cause an accident and injure someone or damage their property. It typically covers the other party’s medical expenses and property damage, but does not cover your own damages or expenses.

- Collision Coverage: This coverage kicks in if your vehicle is damaged in an accident, regardless of who is at fault. It reimburses you for the repair or replacement of your vehicle, protecting your investment.

- Comprehensive Coverage: This broader coverage extends beyond accidents. It protects your vehicle from non-collision damage, such as vandalism, theft, fire, hail, or weather-related damage. Comprehensive coverage often includes a deductible, meaning you pay a portion of the repair costs before the insurance company steps in.

Differences Between Liability, Collision, and Comprehensive Coverage

Liability insurance, unlike collision or comprehensive coverage, only protects the other party involved in an accident. Collision insurance protects your vehicle irrespective of fault, while comprehensive insurance covers a wider range of incidents, such as vandalism or theft. The fundamental difference lies in the scope of protection and the circumstances triggering coverage.

Benefits and Drawbacks of Different Coverage Options

Each coverage option has its own advantages and disadvantages. Weighing these factors is crucial for tailoring your coverage to your needs and budget.

- Liability Coverage: The benefit is its affordability, but the drawback is its limited protection. It only covers the other party’s damages, not your own.

- Collision Coverage: Collision coverage provides peace of mind, covering your vehicle’s repair or replacement regardless of fault. However, it comes at a higher premium than liability coverage.

- Comprehensive Coverage: Comprehensive insurance offers broader protection against various incidents beyond accidents, but comes with a higher premium compared to liability-only policies.

Impact of Coverage Choices on Premiums

The choice of coverage directly affects your insurance premiums. Selecting a broader coverage package, like comprehensive and collision, usually results in a higher premium. A policy limited to liability coverage will be less expensive.

Coverage Options Comparison Table

| Coverage Type | Description | Benefits | Drawbacks | Impact on Premiums |

|---|---|---|---|---|

| Liability | Covers damages to others | Affordable | Limited protection for your vehicle | Lowest |

| Collision | Covers damage to your vehicle in an accident | Protects your investment | Higher premium | Medium |

| Comprehensive | Covers damage to your vehicle from non-collision events | Protects against various incidents | Higher premium | Highest |

Comparing Policies from Different Insurers

Comparing car insurance policies from multiple providers is crucial for securing the best possible coverage at the most competitive price. This process involves a careful evaluation of various factors, including premiums, coverage options, and customer service. Understanding how different insurers approach pricing, and their overall reputation, allows you to make an informed decision.Evaluating policies from diverse insurance companies necessitates a structured approach.

This involves analyzing various aspects of each policy to pinpoint the most advantageous deal. Beyond the financial aspects, a comprehensive comparison considers customer service experiences and the insurer’s reputation.

Different Insurer Pricing Strategies

Different insurance companies employ various strategies to determine premiums. These strategies often hinge on factors like the driver’s demographics, driving record, and the car’s make and model. Some insurers might focus heavily on accident history, while others prioritize factors like location and age. For example, a young driver with a clean driving record might find lower premiums with insurers prioritizing safe driving habits.

Conversely, a driver with a history of accidents or violations could face higher premiums across multiple insurers.

Customer Service and Reputation Assessment

Customer service and reputation play a vital role in selecting an insurer. Insurance claims can be complex and require prompt and efficient handling. Online reviews, ratings, and testimonials can provide valuable insights into an insurer’s responsiveness and helpfulness. Direct interactions with customer service representatives, if possible, offer further clarity. Insurers with consistently positive reviews and a history of handling claims effectively are generally more reliable.

Finding Reliable Insurance Company Reviews

Reliable reviews of insurance companies are essential for informed comparisons. Look for reputable review platforms that gather feedback from a diverse range of customers. Sites dedicated to insurance reviews can offer in-depth analyses and aggregate feedback from many sources. It’s important to consider the overall tone of the reviews and the frequency of positive or negative feedback.

Beware of reviews that appear overly promotional or those from sources with questionable credibility.

Policy Comparison Table Template

A well-structured table facilitates a direct comparison of insurance policies. The table should include key policy features and allow for a side-by-side comparison.

| Insurance Company | Premium (Annual) | Liability Coverage | Collision Coverage | Comprehensive Coverage | Customer Service Rating | Reviews (Summary) |

|---|---|---|---|---|---|---|

| Insurer A | $1,800 | $100,000 | $500 deductible | $500 deductible | 4.5/5 | Generally positive, responsive claims handling. |

| Insurer B | $1,950 | $250,000 | $1,000 deductible | $1,000 deductible | 4.2/5 | Good overall, some reported delays in claim processing. |

| Insurer C | $1,750 | $300,000 | $250 deductible | $250 deductible | 4.7/5 | Excellent customer service, fast claim resolution. |

This template provides a framework for a structured comparison. Remember to adapt the specific coverage details and relevant categories to suit your individual needs. This ensures a comprehensive assessment of available options.

Additional Considerations for Comparing Rates

Beyond the basic factors, several additional considerations can significantly impact your car insurance premiums. Understanding these nuances allows for a more comprehensive comparison and helps you find the most suitable policy.Effective rate comparison goes beyond simply looking at the quoted price. Factors like discounts, vehicle specifics, driving history, and your location all play a crucial role in shaping your insurance costs.

Discounts Impacting Rates

Discounts can substantially lower your insurance premiums. These discounts are often tied to specific behaviors or characteristics, and understanding which ones apply to you is key to finding the best possible rate.

- Safe driving records, such as accident-free years or participation in defensive driving courses, are often rewarded with discounts.

- Security features on your vehicle, such as anti-theft devices or alarm systems, may qualify you for discounts.

- Bundling your insurance with other services, like home insurance, might also result in discounts.

- Insuring multiple vehicles with the same company can sometimes provide a discount, particularly if those vehicles are all in the same household.

- Maintaining a good credit score can also contribute to a lower insurance rate, as it suggests responsible financial habits.

- Discounts for students or senior citizens might be available based on your age and student status.

Vehicle Type, Driving Record, and Location

These factors are often significant determinants of your car insurance premium. Analyzing how they affect your rates is crucial for accurate comparisons.

- Vehicle Type: The type of car you drive significantly impacts your insurance costs. Sports cars, for example, often have higher premiums due to their higher risk profile compared to sedans or compact cars. The make, model, and year of your vehicle can also play a role in determining your premium.

- Driving Record: Your driving history, including any accidents or traffic violations, directly influences your insurance rates. A clean driving record generally leads to lower premiums, while a history of accidents or violations results in higher premiums. The severity of past incidents is also a factor.

- Location: Your location significantly affects your insurance costs. Areas with higher rates of accidents or theft will generally have higher insurance premiums. Factors such as the city, state, and even specific neighborhoods influence insurance rates. Rural areas may have lower premiums than urban areas, but it’s still advisable to check. For example, coastal areas might have higher premiums due to the risk of storm damage.

Potential Discounts

Here’s a comprehensive list of common discounts, noting that availability varies by insurer.

| Discount Category | Description |

|---|---|

| Safe Driving | Discounts for accident-free driving records, defensive driving courses, or participation in programs to improve driving skills. |

| Vehicle Features | Discounts for anti-theft devices, alarm systems, or other safety features installed on your vehicle. |

| Multi-Policy Bundling | Discounts for bundling multiple policies, such as home and auto insurance, with the same insurer. |

| Multiple Vehicles | Discounts for insuring multiple vehicles with the same insurer, especially within the same household. |

| Credit Score | Discounts for maintaining a good credit score, reflecting responsible financial habits. |

| Student/Senior Discounts | Discounts based on age and student status. |

| Other Discounts | Discounts for certain memberships, occupations, or specific insurance options offered by the insurer. |

Closing Notes

In conclusion, comparing car insurance rates online offers significant advantages in terms of convenience, cost savings, and a wider range of options. By understanding the factors influencing premiums, utilizing comparison platforms effectively, and verifying the reliability of quotes, you can confidently secure the best car insurance policy tailored to your specific needs. Remember to consider various coverage options and policies from different insurers for the most comprehensive comparison.

Top FAQs

How long does it typically take to compare car insurance rates online?

The time it takes to compare rates varies, but most online platforms allow you to complete the process in under an hour. Factors such as the number of quotes requested and the complexity of your coverage will influence the duration.

Can I compare rates for different types of coverage (e.g., liability, collision, comprehensive)?

Yes, most online comparison tools allow you to compare different coverage options and tailor them to your needs. This lets you see how the choice of coverage affects the final premium.

What if I find a lower rate online but the provider requires a higher deductible?

Lower rates often come with higher deductibles. Carefully consider whether the lower premium outweighs the potential costs of a higher deductible if a claim arises.

Are there any hidden fees associated with using online car insurance comparison tools?

Reputable comparison sites typically don’t charge hidden fees. Be wary of sites promising “guaranteed savings” or requiring upfront payments.