Integrating CRM and accounting software is becoming increasingly crucial for businesses seeking efficiency and data-driven decision-making. This approach allows for a seamless flow of information between customer interactions and financial records, enabling real-time insights and automated workflows. From streamlining sales processes to improving financial reporting, the benefits are significant.

This overview explores the key features, integration methods, and cost considerations associated with CRM and accounting software. We’ll delve into how these systems enhance business processes, from automating tasks to improving data accuracy, leading to greater profitability and operational efficiency.

Introduction to CRM and Accounting Software Integration

CRM (Customer Relationship Management) software and accounting software are crucial tools for modern businesses. CRM systems manage interactions with customers, while accounting software handles financial transactions. Integrating these systems provides a unified view of the business, streamlining processes and enhancing efficiency. This integration fosters better data management and decision-making, ultimately leading to improved profitability and growth.

Benefits of Integrating CRM and Accounting Systems

Integrating CRM and accounting systems offers numerous advantages. A unified view of customer data, including purchase history and interactions, empowers businesses to tailor their offerings and services more effectively. This results in improved customer satisfaction and loyalty. Automated data synchronization eliminates manual data entry, reducing errors and saving valuable time. Improved financial insights are achieved through real-time data, enabling more informed business decisions.

The integration also allows for better forecasting and budgeting, as the combined data provides a more comprehensive picture of the business’s performance.

Common Use Cases for Integrated CRM and Accounting Solutions

Integrated CRM and accounting solutions prove invaluable in diverse business scenarios. Sales teams can track customer interactions and sales orders, directly linking them to accounting records for timely invoicing and payment processing. Sales projections and revenue forecasts are facilitated through real-time data analysis. Accurate financial reporting is achievable, which is critical for informed decision-making and regulatory compliance.

Service teams can access customer history to address concerns effectively, while marketing teams can personalize campaigns based on customer purchase behavior. Businesses can use these integrated systems to optimize pricing strategies and improve overall operational efficiency.

Streamlining Business Processes with Integration

Integration of CRM and accounting software significantly streamlines business processes. Automated order processing and invoicing reduce manual tasks, improving efficiency and reducing errors. Real-time data access allows for quick identification of trends and issues, enabling prompt corrective actions. Improved communication between departments (sales, marketing, accounting) reduces delays and fosters better collaboration. Financial forecasting and reporting become more accurate and efficient, enabling better strategic decision-making.

A single source of truth for customer and financial data improves data integrity and reliability.

Different Types of CRM and Accounting Software

This table showcases a variety of CRM and accounting software options, categorized by their features and functionality. Different businesses have different needs and budgets. This provides a basic overview to aid in choosing the right software for your organization.

| Software Type | Description | Examples |

|---|---|---|

| Cloud-Based CRM | CRM software accessible via the internet, typically subscription-based. | Salesforce, HubSpot, Zoho CRM |

| On-Premise CRM | CRM software installed and maintained on the company’s own servers. | Microsoft Dynamics 365, Sage CRM |

| Cloud-Based Accounting | Accounting software accessible via the internet, typically subscription-based. | Xero, QuickBooks Online, Zoho Books |

| On-Premise Accounting | Accounting software installed and maintained on the company’s own servers. | Sage 50, QuickBooks Desktop |

Key Features and Functionality

Integrated CRM and accounting software offer a powerful combination of tools for streamlining business operations. These systems go beyond simple data storage, providing automated workflows and real-time insights that enhance sales, marketing, and financial management. This unified approach significantly improves efficiency and decision-making across the entire organization.

Key Features of Integrated Systems

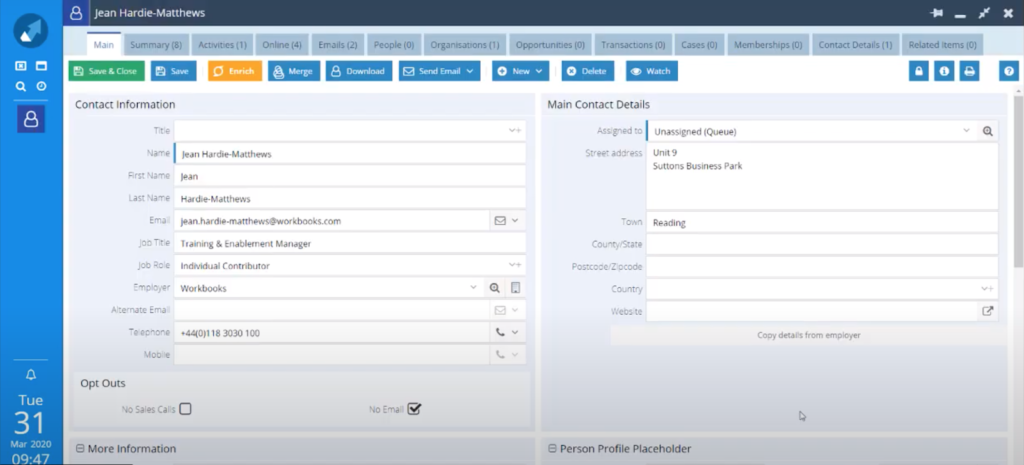

Integrated CRM and accounting software solutions typically feature a comprehensive suite of tools designed to connect sales, marketing, and financial data. This interconnectedness allows for a holistic view of business performance. Crucial features include robust contact management, automated lead nurturing, and seamless order processing.

Enhanced Sales Management

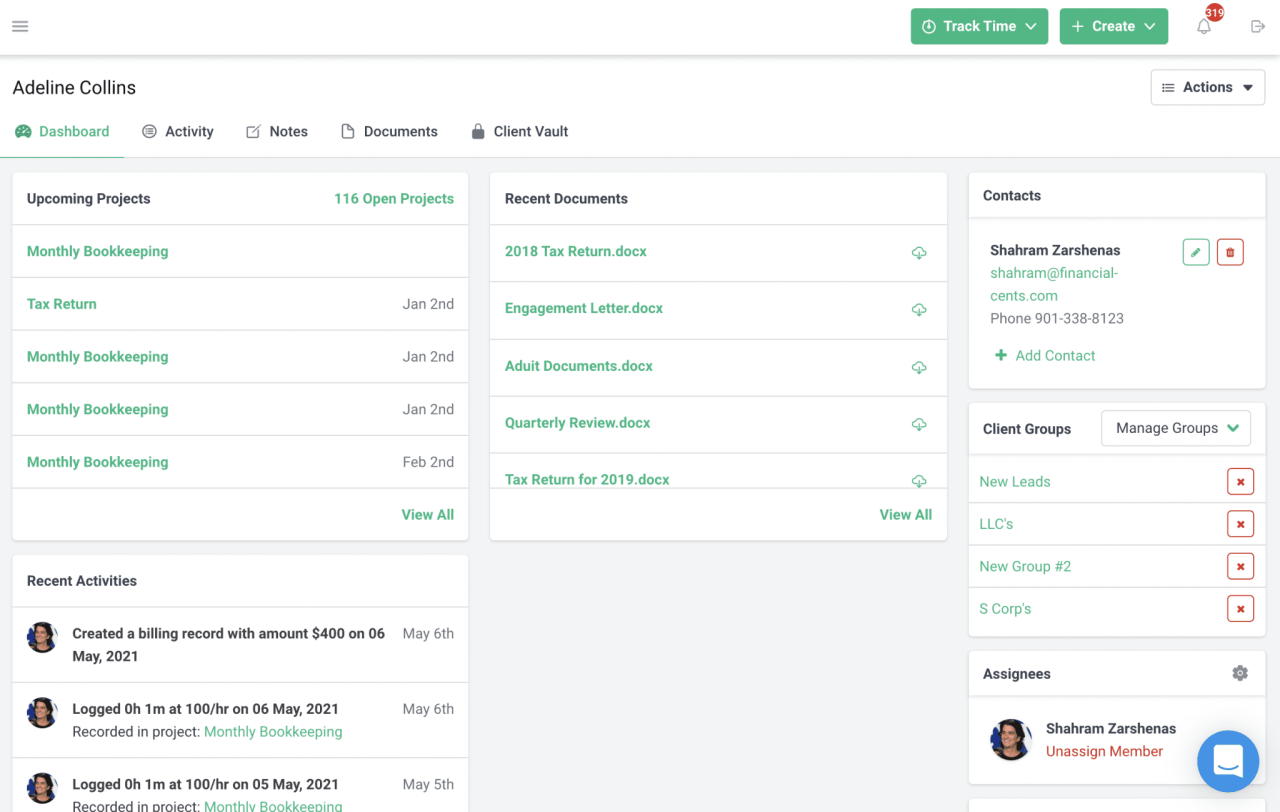

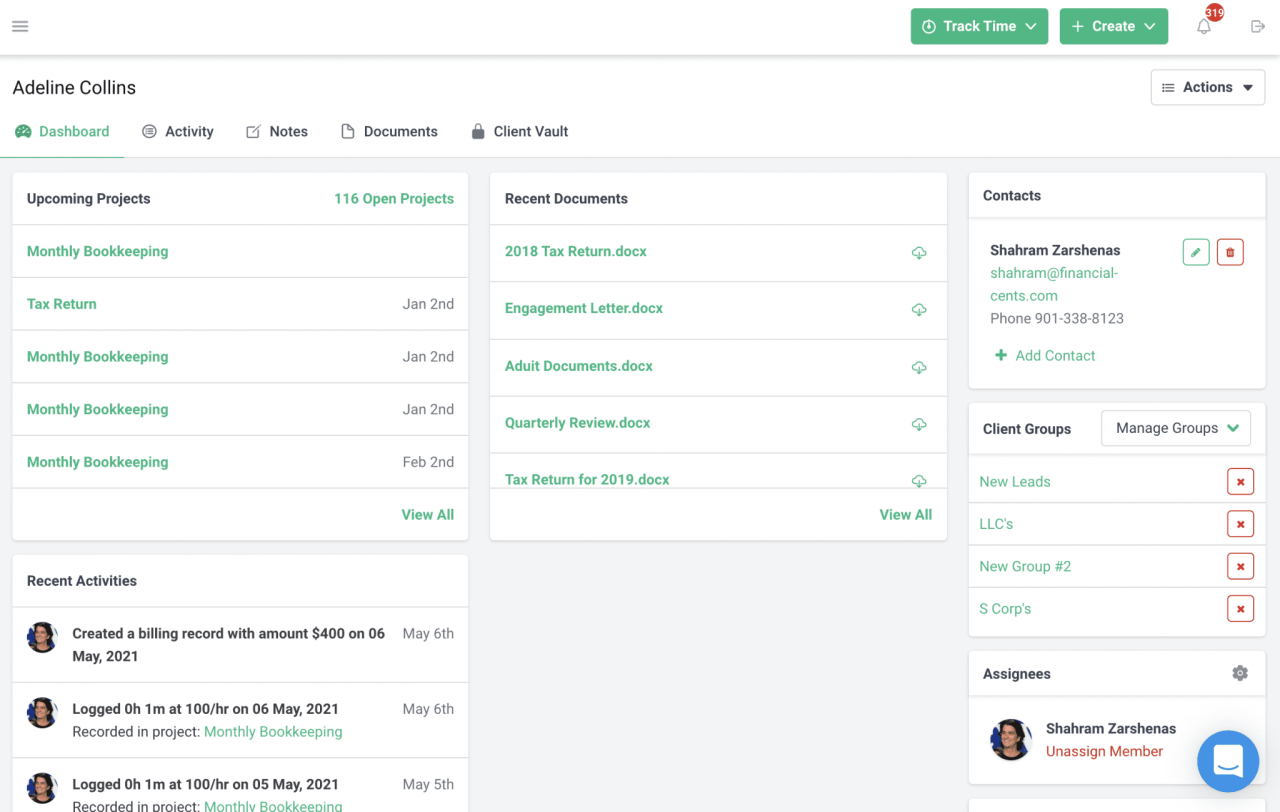

The integration facilitates enhanced sales management by automating tasks and providing real-time data visibility. Sales representatives can access customer information, order history, and financial details within a single platform. This eliminates data silos, allowing for more informed decision-making. Sales teams benefit from a unified view of customer interactions and financial data, enabling them to focus on relationship building and closing deals.

For instance, automated lead scoring and routing functions can help prioritize high-potential leads, leading to increased sales conversion rates.

Improved Marketing Effectiveness

Integrated systems empower marketing teams by enabling targeted campaigns. Data from CRM systems, such as customer preferences and purchase history, can be used to personalize marketing messages and offers. This personalized approach can lead to higher engagement and conversion rates. Automated marketing workflows can nurture leads through the sales funnel, streamlining the entire marketing process. Marketing teams can monitor campaign performance in conjunction with sales and financial data, providing a clearer understanding of return on investment.

Streamlined Financial Management

Integrated accounting features streamline financial processes, automating tasks like invoice creation, payment processing, and reconciliation. This automation reduces manual errors and frees up staff time for more strategic tasks. Real-time financial data provides a comprehensive overview of business performance, allowing for proactive financial management. Automated reporting tools generate insightful financial reports that can be used to track progress, identify trends, and make informed business decisions.

For example, automated reconciliation processes between CRM and accounting systems can help identify discrepancies and ensure accurate financial records.

Automated Workflows

Automated workflows are a cornerstone of integrated CRM and accounting software. These workflows streamline processes and reduce manual intervention. For instance, a sales order can automatically trigger an invoice creation and update in the accounting system, minimizing delays and errors. Another example is the automatic update of customer records when an order is placed, ensuring accuracy and consistency across systems.

Automated workflows increase efficiency and accuracy by reducing the need for manual data entry and manipulation.

Data Synchronization Methods

Data synchronization between CRM and accounting software is crucial for maintaining data integrity and consistency. Several methods are employed for this purpose. Real-time synchronization ensures both systems have the most up-to-date information. Batch processing synchronizes data at set intervals, providing a balance between speed and data volume. API integrations allow for seamless data exchange between systems, minimizing manual intervention and ensuring accuracy.

Comparison of Integrated CRM and Accounting Software Solutions

| Feature | Solution A | Solution B | Solution C |

|---|---|---|---|

| Contact Management | Excellent, customizable fields | Robust, integrates with email platforms | Simple, focuses on core functionality |

| Lead Management | Automated lead scoring and nurturing | Comprehensive lead tracking and analysis | Basic lead tracking, limited automation |

| Sales Order Processing | Seamless integration with accounting | Real-time order updates in accounting | Manual data entry required for accounting |

| Financial Reporting | Detailed reports, customizable dashboards | Automated financial statements | Basic reporting, limited customization |

| Pricing | Tiered pricing based on features | Fixed pricing for different packages | Affordable basic package, additional features costly |

Note: This table provides a comparative overview of three hypothetical software solutions. Actual features and pricing may vary.

Data Integration and Management

Integrating CRM and accounting software requires careful data management to ensure accurate and consistent information flows between systems. Effective data migration, robust security protocols, and an understanding of data accuracy’s impact on business decisions are crucial for successful integration. This section delves into the methods and implications of this critical process.

Data Migration Methods

Different methods exist for transferring data between CRM and accounting software. These methods vary in complexity and cost, impacting the overall integration timeline. A direct data transfer, where data is copied directly from one system to another, is straightforward but may not handle complex data structures well. A more nuanced approach involves using intermediary tools or custom scripts to map data fields between systems, ensuring compatibility.

Import/export functionalities are also employed for transferring data, though they might require more manual intervention and validation. Choosing the appropriate method depends on the volume and complexity of the data being transferred.

Impact on Financial Reporting

Data integration significantly impacts financial reporting. Accurate sales data from the CRM system, combined with accurate cost and revenue information from the accounting software, leads to more precise financial statements. This results in better insights into profitability, revenue streams, and overall business performance. For instance, tracking sales leads through the CRM system and automatically recording corresponding revenue and expenses in the accounting software allows for real-time analysis of sales performance, enabling more agile decision-making.

This streamlines the process of generating reports, providing a more comprehensive picture of the financial health of the business.

Security Protocols for Integrated Data

Data security is paramount when integrating CRM and accounting software. Robust security protocols are essential to protect sensitive financial information and customer data. These protocols include encryption of data in transit and at rest, access controls based on user roles and permissions, and regular security audits to identify vulnerabilities. Implementing two-factor authentication for all users accessing integrated systems is a key measure to protect against unauthorized access.

Regular security training for employees handling sensitive data further reinforces the security posture.

Impact of Data Accuracy on Business Decisions

Data accuracy directly influences the quality of business decisions. Inaccurate or inconsistent data can lead to flawed analyses and ultimately, poor strategic choices. For example, if sales figures in the CRM system are inaccurate, projections for future revenue will be flawed, leading to suboptimal investment decisions. Similarly, if accounting data is not synchronized with the CRM, the business may miss opportunities to optimize pricing or improve customer service.

Reliable data is essential for making well-informed choices that drive business growth.

Data Security Measures Table

| Integration Type | Data Encryption | Access Controls | Security Audits | User Training |

|---|---|---|---|---|

| Direct Transfer | Full encryption of data in transit and at rest | Role-based access with granular permissions | Monthly security audits and vulnerability scans | Regular security awareness training for all staff |

| Intermediary Tool | Encryption of data handled by the intermediary | User authentication and authorization through the intermediary | Security assessments of the intermediary tool | Training on the intermediary tool and its security features |

| Import/Export | Encryption of data during transfer | User authentication for import/export operations | Validation of import/export data | Training on data import/export procedures and potential risks |

Workflow Automation and Efficiency

Integrating CRM and accounting software automates crucial business processes, enhancing operational efficiency and reducing manual errors. This streamlined workflow leads to faster turnaround times, improved accuracy, and ultimately, increased profitability. The seamless flow of data between systems empowers businesses to react swiftly to changing market conditions and customer needs.

Streamlining Sales Processes

Automation within a CRM and accounting integration significantly streamlines sales processes. By automating tasks like order entry, sales order processing, and customer relationship management, businesses can focus on core activities like sales and marketing, leading to increased sales productivity. For instance, an automated system can instantly update accounting records with sales data, allowing for real-time tracking of revenue and expenses.

Impact on Accounting Tasks and Reporting

Automation significantly impacts accounting tasks by automating data entry, report generation, and invoice processing. This not only reduces the time spent on manual tasks but also enhances the accuracy and reliability of financial reporting. Automated accounting systems can generate insightful reports, providing real-time visibility into financial performance.

Reduction of Manual Errors

Automation dramatically reduces the likelihood of manual errors, which are a significant source of inaccuracies in traditional accounting practices. Automated systems meticulously follow pre-defined rules and procedures, eliminating human error in data entry, calculations, and report generation. This precision translates into more accurate financial statements and better decision-making.

Automated Invoicing and Payment Processing

Automated invoicing and payment processing are critical components of an integrated CRM and accounting system. This automation involves the automatic generation of invoices based on sales orders, facilitating timely billing. Furthermore, automated payment processing allows for the immediate posting of payments to the appropriate accounts, improving cash flow management and reducing late payments. Examples include systems that automatically generate invoices upon order fulfillment, schedule payment reminders, and automatically reconcile payments.

Automated Workflow for a Sales Order

The following flowchart illustrates the automated workflow for a sales order from CRM to accounting:

+-----------------+ +-----------------+ +-----------------+ | CRM System |----->| Order Processing |----->| Accounting System| +-----------------+ +-----------------+ +-----------------+ | Sales Order Entry | | Invoice Generation | | Account Posting | | Customer Data | | Payment Processing | | Reporting | +-----------------+ +-----------------+ +-----------------+

This streamlined process ensures a seamless transition of data, reducing manual intervention and ensuring accuracy.

The automation encompasses the entire sales order cycle, from order placement to payment processing and reporting.

Reporting and Analytics

Integrated CRM and accounting software reporting provides a powerful mechanism for businesses to gain actionable insights from their data. This capability transcends simple data visualization; it enables a deeper understanding of business performance, identifying trends, and pinpointing areas for improvement. By combining CRM and accounting data, businesses can make more informed decisions across all departments.

Comprehensive reporting features are critical to leverage the full potential of integrated systems. These reports, tailored to specific business needs, drive better strategic planning and operational efficiency. Reporting capabilities are not just about generating numbers; they are about translating data into valuable knowledge, fostering a data-driven culture within the organization.

Enhanced Business Insights

Integrating CRM and accounting data allows for a holistic view of business performance. Sales figures are no longer isolated; they are contextualized by associated customer interactions, purchase history, and profitability. This interconnectedness provides a clearer picture of customer behavior and financial health, enabling proactive strategies. For instance, a drop in sales could be linked to a decline in customer satisfaction, as measured by CRM data, leading to a more effective response than simply looking at the bottom line.

Reporting Features Linking CRM and Accounting Data

Integrated reporting features link sales figures from the CRM system with the associated costs and profitability from the accounting system. This connection is crucial for evaluating the true impact of sales efforts on the bottom line. Key features often include drill-down capabilities, enabling users to explore specific transactions or customer interactions in detail. For example, a sales representative’s performance can be analyzed by examining their closed deals, the associated revenue, and the corresponding expenses.

Examples of Customized Reports for Sales Performance Analysis

Customized reports offer tailored insights for sales teams. One example is a report showing sales performance by region, broken down by sales representative, highlighting top performers and areas needing attention. Another example is a report showcasing the profitability of different product lines or customer segments, helping sales teams focus on high-value opportunities. A third example might include a report comparing sales targets with actual performance, identifying variances and suggesting corrective actions.

These reports empower sales managers to make more strategic decisions based on precise data.

Impact of Reports on Decision-Making

Reports significantly impact decision-making by providing a clear picture of business performance. They identify trends, enabling proactive responses to changing market conditions. For example, a report showing a decline in sales in a specific product category can trigger a marketing campaign focused on that category, while a report showing high customer churn might suggest changes to customer service protocols.

Accurate and timely reporting allows for informed choices, optimizing resource allocation and driving growth. The ability to quickly assess key metrics facilitates faster response times, enabling companies to adapt more effectively to market fluctuations.

Types of Reports Generated by Integrated CRM and Accounting Systems

| Report Type | Description | Application |

|---|---|---|

| Sales Performance by Region | Summarizes sales figures across different regions, highlighting top-performing areas and underperforming regions. | Sales management, regional strategy |

| Customer Lifetime Value (CLTV) | Estimates the total revenue a customer is expected to generate throughout their relationship with the company. | Customer relationship management, sales forecasting |

| Profitability by Product Line | Analyzes the profitability of different product lines, helping identify high-margin and low-margin products. | Product management, pricing strategies |

| Sales Pipeline Analysis | Visualizes the sales pipeline, tracking potential deals, forecasting future revenue, and identifying potential bottlenecks. | Sales forecasting, pipeline management |

| Cash Flow Projection | Predicts future cash flow based on sales forecasts and expenses. | Financial planning, budgeting |

Implementation and Customization

Implementing integrated CRM and accounting software requires a structured approach. This involves careful planning, meticulous configuration, and comprehensive user training to ensure the system aligns with the business’s unique workflows and objectives. Success hinges on a thorough understanding of the system’s capabilities and how to adapt them to specific needs.

Implementation Steps

A phased implementation strategy is crucial for successful integration. This approach allows for gradual adoption, minimizing disruption to existing operations. Key steps include:

- Assessment and Planning: Analyze current processes, identify key areas for improvement, and define specific objectives for the integrated system. This involves mapping out the flow of data between CRM and accounting, outlining user roles and responsibilities, and establishing clear performance metrics. Detailed documentation of existing processes is essential to understanding pain points and opportunities for optimization.

- Data Migration and Preparation: Carefully migrate data from existing systems to the new integrated platform. This includes validating data accuracy and consistency, and mapping data fields to ensure seamless integration. Thorough data cleansing and validation procedures prevent errors and ensure data integrity.

- System Configuration: Configure the software to match the company’s specific requirements. This includes setting up user accounts, defining access permissions, customizing workflows, and integrating with other applications as needed. Proper configuration ensures the system aligns with the company’s unique needs and promotes efficient data flow.

- Testing and Validation: Thoroughly test the integrated system to ensure it functions as expected. This involves testing all workflows, data transfers, and reporting features. Testing should cover all user roles and ensure data integrity across the entire system. Identify and resolve any issues discovered during testing to ensure a smooth launch.

- Deployment and Training: Deploy the integrated system and provide comprehensive training to users. This training should cover the software’s functionality, data entry procedures, and workflow automation capabilities. Providing ongoing support and mentorship ensures users effectively utilize the system.

Customization Options

Integrated CRM and accounting software often offers customization options to tailor the system to specific business needs. These options vary depending on the chosen software platform.

- Workflow Customization: Customize workflows to reflect unique business processes. This might involve creating custom fields, modifying existing ones, and adjusting the order of tasks in various processes. Examples include tailoring sales pipelines, adjusting approval workflows, and optimizing invoicing processes.

- Reporting and Analytics: Customize reports to track specific metrics and KPIs. This includes creating custom dashboards, modifying existing reports, and adding new data points to existing ones. Tailoring reports to specific user roles ensures relevant information is accessible.

- Data Integration Options: Adjust data mapping to accommodate specific data formats and structures. This involves mapping fields, customizing data transformation rules, and potentially creating custom integrations with other third-party applications.

User Training Importance

Effective user training is essential for successful implementation. This involves hands-on sessions, comprehensive documentation, and ongoing support.

- Training Materials: Develop comprehensive training materials, including tutorials, guides, and FAQs, covering all aspects of the software. Clear and concise documentation ensures users can access the information they need when needed.

- Hands-on Sessions: Conduct hands-on training sessions with users, guiding them through practical exercises and demonstrating the system’s features. This ensures users gain practical experience and can apply their knowledge immediately.

- Ongoing Support: Provide ongoing support and mentorship to users after implementation. This ensures users can address issues and optimize their use of the system.

Configuring for Specific Needs

Configuring the software to align with specific business needs is vital for maximizing the system’s effectiveness.

- Defining Roles and Permissions: Define clear roles and permissions for each user, ensuring appropriate access levels. This includes restricting access to sensitive data and controlling specific functionalities based on user roles.

- Customizing Data Entry Forms: Customize data entry forms to streamline data input. This includes adding new fields, adjusting field types, and modifying validation rules to ensure accurate and efficient data capture.

- Setting Up Automated Processes: Establish automated processes to streamline workflows. This includes setting up automated tasks, approvals, and notifications based on specific triggers. Examples include automated invoice generation, email notifications, and task assignments.

Step-by-Step Implementation Guide

- Assess current processes and define objectives.

- Migrate data to the new platform.

- Configure the system for specific needs.

- Test the system thoroughly.

- Deploy the system and provide comprehensive training.

- Provide ongoing support and mentorship.

Cost Considerations and ROI

Integrating CRM and accounting software offers significant advantages, but the financial implications need careful consideration. Understanding pricing models, total cost of ownership (TCO), and return on investment (ROI) is crucial for making informed decisions. A well-planned integration can lead to substantial long-term cost savings and increased profitability.

Pricing Models for Integrated Solutions

Various pricing models exist for integrated CRM and accounting software. These models often vary based on the features included, the number of users, and the level of customization required. Some common models include:

- Subscription-based pricing: This is a popular model where users pay a recurring monthly or annual fee. This fee usually covers access to the software, updates, and support services. The cost often scales with the number of users and features utilized.

- Per-user pricing: This model charges a fixed fee per active user, regardless of the features used. This is suitable for organizations with a clear understanding of their user base and specific needs.

- Tiered pricing: This approach offers different packages with varying feature sets and pricing levels. Organizations can choose the package that best fits their budget and required functionality.

- Custom pricing: Some providers offer custom pricing based on unique business requirements and usage patterns. This can be advantageous for larger organizations with extensive needs or specific integration requirements.

Factors Influencing Total Cost of Ownership (TCO)

The total cost of ownership extends beyond the initial software purchase price. Several factors influence the overall cost:

- Implementation costs: This includes the cost of consultants, training, data migration, and system setup.

- Maintenance and support: Ongoing costs for software updates, technical support, and potential system upgrades.

- Personnel costs: Training staff to use the integrated system and manage data effectively.

- Data migration costs: Moving existing data into the new integrated system can involve significant time and resources.

- Potential for system downtime: Downtime during system upgrades or maintenance can result in lost productivity and revenue.

Calculating Return on Investment (ROI)

Quantifying the ROI of CRM and accounting integration is essential for demonstrating its value. The ROI can be calculated by comparing the benefits derived from the integration with the total costs incurred.

ROI = (Total Benefits – Total Costs) / Total Costs

Methods for estimating benefits include analyzing increased sales, reduced administrative costs, improved customer satisfaction, and enhanced operational efficiency. Accurate cost accounting is critical for a precise ROI calculation.

Long-Term Benefits and Cost Savings

Integrated CRM and accounting software fosters greater efficiency and visibility across the organization, which leads to long-term cost savings.

- Improved data accuracy and consistency: Eliminates manual data entry errors, leading to more reliable reports and decision-making.

- Automation of tasks: Reduces manual effort in data entry, reporting, and other administrative processes, freeing up staff for more strategic tasks.

- Enhanced customer relationships: Provides a holistic view of customer interactions, leading to better customer service and retention.

- Real-time insights: Allows for quicker identification of trends and patterns, enabling data-driven decision-making.

- Streamlined financial processes: Enables faster invoice processing, reconciliation, and reporting, reducing accounting errors and delays.

Comparison of Integration Solutions

A table comparing different CRM and accounting integration solutions is provided below, highlighting the costs and potential benefits.

| Integration Solution | Initial Cost | Ongoing Maintenance | Potential Benefits |

|---|---|---|---|

| Solution A | $10,000 | $2,000/year | Increased sales by 15%, reduced processing time by 20% |

| Solution B | $15,000 | $3,000/year | Improved customer satisfaction by 10%, increased efficiency by 25% |

| Solution C | $20,000 | $4,000/year | Enhanced reporting capabilities, automated workflows, reduced staff time by 30% |

Note: Costs and benefits are illustrative examples and may vary depending on the specific solution and business context.

Security and Compliance

Robust security and compliance are paramount for any CRM and accounting software integration. Protecting sensitive financial and customer data is crucial for maintaining user trust and avoiding potential legal repercussions. This section details the security measures employed in these integrated systems and Artikels their adherence to relevant compliance standards.

Security Measures in Integrated Systems

These systems utilize multi-layered security protocols to safeguard data. Advanced encryption techniques, including AES-256, protect data both in transit and at rest. Access control mechanisms, such as role-based permissions, restrict data visibility based on user roles and responsibilities. Regular security audits and penetration testing are conducted to identify and mitigate potential vulnerabilities. These measures contribute to the overall security posture of the integrated system.

Compliance with Relevant Standards

The systems adhere to various compliance standards, including but not limited to GDPR, CCPA, and SOX. Compliance with these regulations ensures the protection of user data and financial information, fostering trust and maintaining legal standing. Specific provisions within the systems, like data masking and anonymization capabilities, aid in compliance with these standards.

Data Encryption and Access Control

Data encryption plays a vital role in securing sensitive information. Data is encrypted using industry-standard algorithms to prevent unauthorized access during transmission and storage. Access control mechanisms, encompassing user authentication, authorization, and audit trails, restrict data access to authorized personnel. Strong passwords and multi-factor authentication further enhance the security posture.

Data Privacy Considerations

Data privacy is a critical aspect of any CRM and accounting integration. The systems are designed to comply with data privacy regulations, allowing users to control their data and ensuring transparent data handling practices. The systems maintain detailed logs of data access and modifications, offering an audit trail for transparency and accountability.

Security Best Practices for Integrated Systems

Implementing strong security practices is essential for maintaining data integrity and confidentiality. A comprehensive approach includes:

- Regular Security Audits: Conducting regular security audits to identify vulnerabilities and implement appropriate countermeasures.

- Employee Training: Educating employees about security best practices, such as password management and phishing awareness, is crucial.

- Regular Software Updates: Ensuring that all software components are updated with the latest security patches to address vulnerabilities promptly.

- Incident Response Plan: Having a well-defined incident response plan to address security breaches and data breaches swiftly and effectively.

- Data Loss Prevention (DLP) Measures: Implementing DLP measures to prevent sensitive data from leaving the system or being accessed by unauthorized personnel.

Epilogue

In conclusion, CRM and accounting software integration offers a powerful pathway to enhanced business performance. By streamlining workflows, improving data accuracy, and providing insightful reporting, these systems empower businesses to make informed decisions and achieve significant cost savings. The integration’s potential for boosting efficiency and profitability is undeniable.

Clarifying Questions

What are some common challenges in implementing CRM and accounting software integration?

Data migration and ensuring compatibility between different systems can be challenging. Additionally, user adoption and training are crucial for successful integration, requiring careful planning and execution. Addressing these potential roadblocks proactively is key to a smooth implementation.

How does data accuracy affect business decisions?

Accurate data is fundamental to informed decision-making. Inaccurate data can lead to flawed analyses, poor strategic choices, and ultimately, reduced profitability. A robust data management strategy is therefore crucial for successful integration.

What are some examples of automated workflows that can be achieved through integration?

Automated invoicing, payment processing, and order fulfillment are examples of common automated workflows. These integrations can free up valuable employee time and reduce the potential for human error, improving overall efficiency.

How can I calculate the return on investment (ROI) for CRM and accounting software integration?

Calculating ROI involves comparing the costs of the integrated system with the anticipated benefits, such as increased efficiency, reduced errors, and improved revenue. Quantifying these benefits through metrics and benchmarks is crucial for demonstrating the value of integration.